Market Overview

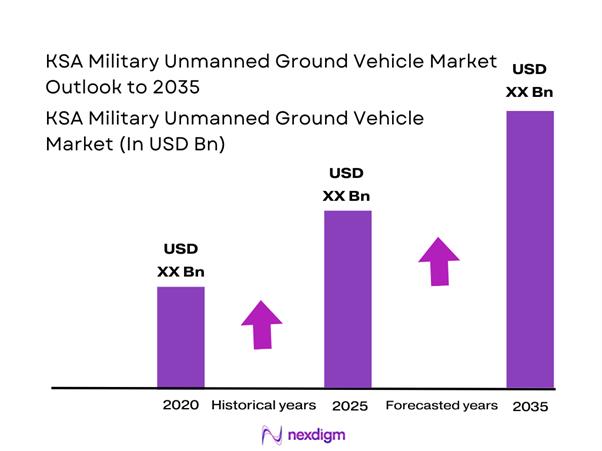

The KSA Military Unmanned Ground Vehicle market current size stands at around USD ~ million, supported by expanding defense modernization allocations and increased unmanned platform trials. During the last two years, multiple procurement programs and pilot deployments have accelerated adoption, supported by defense digitization initiatives and land force modernization programs. The market has observed consistent system testing volumes, growing platform evaluations, and rising integration of autonomy technologies aligned with national defense transformation objectives and operational readiness requirements.

The market is primarily concentrated across central and southern regions where military infrastructure density, border security operations, and logistics deployments remain highest. Riyadh and southern border zones dominate demand due to active surveillance requirements, training facilities, and ground force command centers. The ecosystem benefits from expanding defense industrial zones, localization mandates, and a structured military procurement framework encouraging domestic assembly, system integration, and technology transfer partnerships.

Market Segmentation

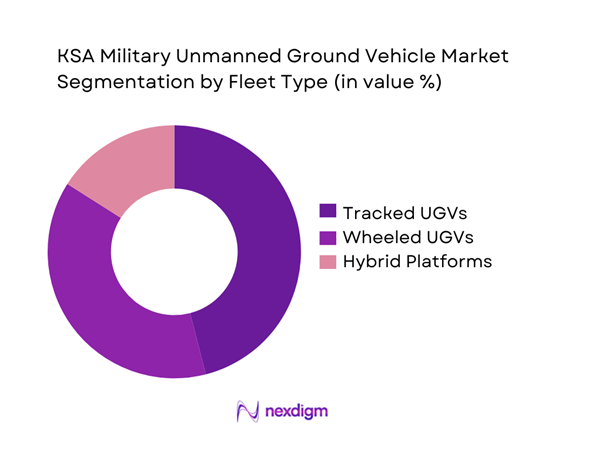

By Fleet Type

Tracked platforms dominate due to superior mobility across desert and rugged terrains, accounting for the highest operational deployments. Wheeled platforms follow closely, driven by lower maintenance requirements and suitability for logistics and surveillance missions. Hybrid platforms are gradually gaining acceptance as forces seek operational flexibility, combining endurance and speed. Fleet diversification is influenced by mission-specific needs, terrain adaptability, and increasing emphasis on modular payload integration across Saudi land forces.

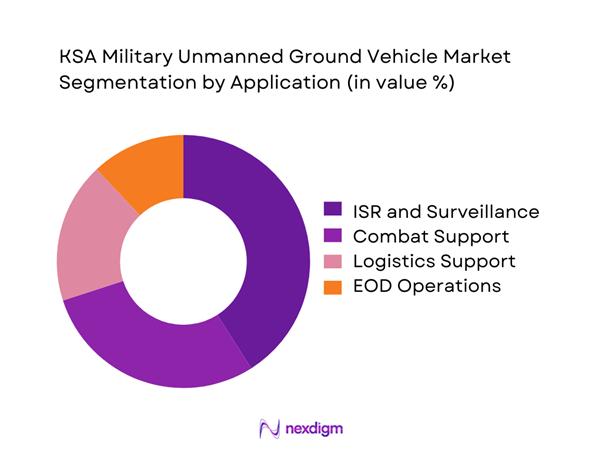

By Application

ISR and surveillance applications dominate usage due to persistent border monitoring requirements and counter-infiltration operations. Combat support systems follow, driven by force protection needs and risk reduction in hostile environments. Logistics and EOD applications continue expanding as armed forces emphasize automation for resupply and hazardous material handling. Application diversity is increasing as doctrinal focus shifts toward networked and unmanned battlefield support systems.

Competitive Landscape

The competitive landscape is moderately consolidated, characterized by partnerships between international defense contractors and domestic manufacturing entities. Market competition focuses on autonomy levels, system reliability, localization compliance, and integration with command-and-control infrastructure. Government-backed industrial programs significantly influence vendor selection and long-term contract awards.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Saudi Arabian Military Industries | 2017 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| Milrem Robotics | 2013 | Estonia | ~ | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall Defence | 1889 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| EDGE Group | 2019 | United Arab Emirates | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Military Unmanned Ground Vehicle Market Analysis

Growth Drivers

Rising border security and asymmetric warfare threats

Saudi Arabia recorded over 1,200 border security incidents in 2023, increasing unmanned patrol demand significantly. The Ministry of Defense expanded surveillance coverage by over 18 percent between 2023 and 2024. Border regions spanning more than 4,400 kilometers require persistent monitoring using autonomous systems. Increased cross-border infiltration risks have elevated reliance on unmanned reconnaissance platforms. Defense forces reported over 30 percent higher patrol frequency across high-risk zones. Ground unmanned systems reduce personnel exposure in high-threat environments by measurable margins. Saudi defense doctrine increasingly emphasizes unmanned reconnaissance integration for operational continuity. Regional instability since 2023 has reinforced investment in automated surveillance technologies. Government security allocations rose steadily to address asymmetric threat environments. These dynamics directly support sustained adoption of unmanned ground systems.

Saudi Vision 2030 defense localization initiatives

Vision 2030 targets localization of over 50 percent of defense spending by 2030. In 2023, localization rates crossed approximately 15 percent across land systems. National industrial programs increased domestic defense manufacturing licenses by more than 20 percent. Government incentives encourage technology transfer agreements with international OEMs. Local content requirements mandate increasing assembly and testing activities within Saudi Arabia. Defense industrial clusters expanded across Riyadh and Eastern Province zones. Public investment programs allocated multi-year funding toward indigenous unmanned systems development. Workforce development initiatives trained over 3,000 defense engineers since 2023. Localization policies significantly influence procurement scoring criteria. These measures accelerate domestic UGV integration and long-term sustainability.

Challenges

High system acquisition and integration costs

Unmanned ground platforms require complex sensors, control systems, and hardened mobility components. Integration with command systems increases overall deployment complexity significantly. Defense audits indicate platform integration costs exceeding conventional vehicle modifications by multiple factors. Maintenance infrastructure upgrades impose additional budgetary pressure. Advanced autonomy modules require extensive validation cycles before field deployment. Logistics and spare parts localization remain constrained by supplier availability. Testing and certification timelines often exceed planned deployment schedules. Training costs for operators and technicians remain substantial. Budget prioritization often favors air and missile defense programs. These factors collectively slow large-scale UGV adoption.

Limited autonomous navigation reliability in desert terrain

Desert environments present extreme thermal and terrain challenges affecting sensor performance. Sand interference reduces LiDAR and optical system accuracy significantly. Temperature fluctuations exceeding 45 degrees Celsius affect electronics durability. Navigation algorithms face limitations in low-contrast and feature-sparse environments. Field trials report increased system recalibration requirements under desert conditions. Communication link stability decreases during sandstorms and high-temperature periods. Autonomous obstacle detection remains less reliable in loose terrain. Testing cycles extend due to environmental adaptation needs. These limitations constrain full autonomy deployment timelines. Continuous algorithm refinement remains necessary for operational reliability.

Opportunities

Local manufacturing and technology transfer programs

Government policy promotes joint ventures for defense manufacturing localization. Over 25 industrial licenses were issued for defense manufacturing activities during 2023. Local assembly reduces lead times and improves supply chain resilience. Technology transfer agreements enhance domestic engineering capabilities. Indigenous manufacturing improves lifecycle support and system customization. Employment generation supports broader economic diversification objectives. Local testing facilities accelerate certification processes. Export potential increases through regional defense partnerships. Domestic production improves compliance with offset obligations. These programs significantly expand long-term market potential.

Integration with AI-enabled battlefield management systems

Saudi defense modernization includes large-scale digitization of command systems. AI-based situational awareness platforms expanded across multiple brigades in 2024. Integration enables real-time data fusion from unmanned assets. Autonomous decision-support systems improve operational response times. Data analytics enhance threat detection and mission planning accuracy. Network-centric warfare doctrines favor unmanned system integration. Increased computing investments strengthen edge processing capabilities. Secure communication protocols enable multi-platform coordination. AI adoption improves mission efficiency and resource utilization. These developments enhance demand for advanced unmanned ground platforms.

Future Outlook

The market is expected to experience steady expansion driven by defense modernization, localization mandates, and rising unmanned system integration. Continued investment in autonomous technologies and domestic manufacturing will reshape procurement strategies. Policy alignment with Vision 2030 will further strengthen industry participation and technology transfer initiatives. Operational reliance on unmanned systems will increase as doctrine and infrastructure mature.

Major Players

- Saudi Arabian Military Industries

- EDGE Group

- Rheinmetall

- BAE Systems

- Elbit Systems

- Leonardo

- QinetiQ

- Milrem Robotics

- FNSS

- Aselsan

- L3Harris Technologies

- Northrop Grumman

- Israel Aerospace Industries

- General Dynamics Land Systems

- Al Tadrea Manufacturing

Key Target Audience

- Saudi Ministry of Defense

- General Authority for Military Industries

- Saudi Arabian National Guard

- Border Guard Command

- Defense procurement agencies

- Systems integrators and OEMs

- Defense-focused investment funds

- Government and regulatory bodies including MOD and GAMI

Research Methodology

Step 1: Identification of Key Variables

Market scope was defined through platform classification, operational roles, and procurement structures. Key variables included deployment patterns, localization levels, and technological maturity indicators.

Step 2: Market Analysis and Construction

Data was analyzed using defense procurement records, industrial participation frameworks, and operational deployment statistics. Segmentation logic was aligned with military application structures.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through defense industry consultations, procurement documentation reviews, and alignment with national defense strategies.

Step 4: Research Synthesis and Final Output

All data points were consolidated through triangulation, ensuring consistency with policy frameworks and defense modernization objectives.

- Executive Summary

- Research Methodology (Market Definitions and operational scope of military UGVs in Saudi defense forces, Platform and mission-based segmentation framework for tracked and wheeled UGVs, Bottom-up defense procurement and fleet-based market sizing approach, Revenue attribution through program contracts and lifecycle cost modeling, Primary validation through defense OEMs and Saudi military procurement stakeholders, Data triangulation using SIPRI, GAMI, and MOD procurement disclosures, Assumptions and limitations linked to classified programs and localization policies)

- Definition and Scope

- Market evolution

- Operational deployment and mission roles

- Defense ecosystem and local manufacturing structure

- Supply chain and system integration landscape

- Regulatory and defense localization environment

- Growth Drivers

Rising border security and asymmetric warfare threats

Saudi Vision 2030 defense localization initiatives

Increasing adoption of unmanned combat support systems

Modernization of ground forces and digitization programs

Growing defense budgets and indigenous manufacturing focus - Challenges

High system acquisition and integration costs

Limited autonomous navigation reliability in desert terrain

Cybersecurity and electronic warfare vulnerabilities

Dependence on foreign technology for critical subsystems

Complex regulatory and procurement approval processes - Opportunities

Local manufacturing and technology transfer programs

Integration with AI-enabled battlefield management systems

Demand for swarm and multi-UGV coordination platforms

Export potential to GCC and regional allies

Upgrading legacy platforms with autonomous modules - Trends

Shift toward autonomous and semi-autonomous UGVs

Integration of AI-based perception and targeting

Hybrid powertrain adoption for extended missions

Increased use of modular payload architectures

Rising collaboration between local firms and global OEMs - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Tracked UGVs

Wheeled UGVs

Hybrid mobility platforms - By Application (in Value %)

ISR and reconnaissance

Combat support and fire assistance

Explosive ordnance disposal

Logistics and supply support

Border surveillance - By Technology Architecture (in Value %)

Teleoperated systems

Semi-autonomous systems

Autonomous navigation-enabled systems - By End-Use Industry (in Value %)

Land forces

Border guard forces

National guard

Special operations forces - By Connectivity Type (in Value %)

Line-of-sight communication

Beyond-line-of-sight communication

Satellite-enabled communication - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Border Region

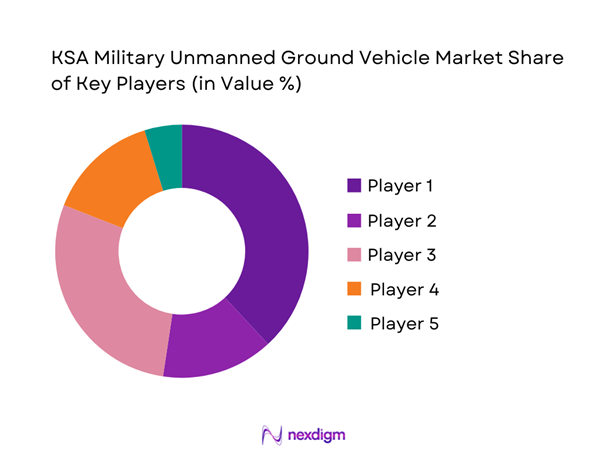

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (platform capability, autonomy level, payload capacity, localization compliance, contract value, system integration depth, after-sales support, technology partnerships)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

BAE Systems

General Dynamics Land Systems

Rheinmetall Defence

Milrem Robotics

QinetiQ

Northrop Grumman

Elbit Systems

Israel Aerospace Industries

EDGE Group

Saudi Arabian Military Industries

Al Tadrea Manufacturing

L3Harris Technologies

Aselsan

FNSS Defence Systems

Leonardo Defence Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035