Market Overview

The KSA military wearables market is driven by the increasing demand for advanced wearable technologies in defense applications. Market size being USD ~ with a growing emphasis on enhancing soldier performance, situational awareness, and safety, the market is expected to reach a significant value in the near future. Key drivers include the adoption of smart wearables for real-time data collection, communication, and health monitoring. The market is propelled by both government investments in defense technologies and advancements in wearable tech integration.

The market is primarily dominated by key defense hubs such as Riyadh and Jeddah, where military research, development, and procurement activities are concentrated. The strategic focus on modernizing military capabilities and improving operational efficiency has led to high demand for military wearables. Additionally, the centralization of military technology procurement and infrastructure development in these regions has made them critical drivers of market growth.

Market Segmentation

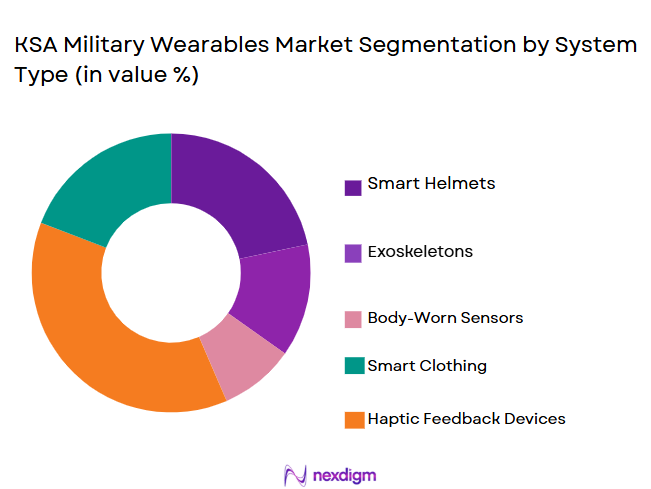

By System Type

The KSA military wearables market is segmented by system type into various sub-segments such as body-worn sensors, headgear devices, wearable cameras, and augmented reality systems. The dominant sub-segment is body-worn sensors, driven by the increasing need for health monitoring and real-time performance tracking of soldiers. These devices are critical in enhancing soldier well-being, providing vital statistics on their physical condition, and ensuring mission readiness. Demand for wearable health monitoring systems is expected to grow significantly as the military focuses more on soldier health and safety.

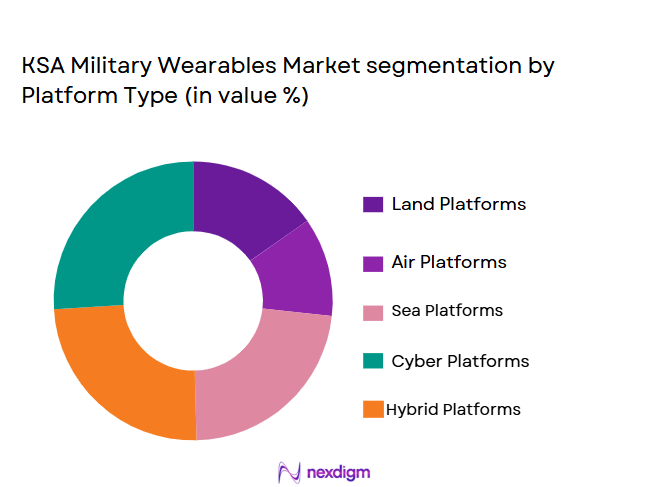

By Platform Type

The KSA military wearables market is segmented by platform type into land-based platforms, air-based platforms, and maritime platforms. Land-based platforms, particularly those used in infantry operations, dominate the market due to the high demand for wearable technologies in enhancing battlefield effectiveness. The integration of wearables in land-based military operations enables soldiers to improve communication, navigation, and overall operational efficiency. This sub-segment is driven by the need for enhanced situational awareness in complex combat environments.

Competitive Landscape

The KSA military wearables market is highly competitive, with several key players driving innovation and technological advancements. Major players in the market focus on integrating wearable devices with other military technologies to offer complete solutions that improve operational effectiveness. There has been a trend of consolidation, with large defense contractors acquiring smaller wearable tech firms to expand their portfolios and capabilities.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| Company A | 1990 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ |

| Company B | 2005 | Jeddah, KSA | ~ | ~ | ~ | ~ | ~ |

| Company C | 2010 | Abu Dhabi, UAE | ~ | ~ | ~ | ~ | ~ |

| Company D | 1998 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ |

| Company E | 2015 | London, UK | ~ | ~ | ~ | ~ | ~ |

KSA military wearables Market Analysis

Growth Drivers

Technological advancements

The integration of cutting-edge technologies such as IoT, AI, and data analytics into wearable devices is a key driver of growth in the KSA military wearables market. These technologies enable real-time monitoring and provide soldiers with actionable insights, significantly enhancing their operational capabilities. Furthermore, the increasing focus on soldier health and safety is pushing the demand for advanced wearable solutions that monitor vital signs and provide feedback on overall well-being. Additionally, the adoption of augmented reality (AR) wearables enhances situational awareness, allowing soldiers to interact with the environment and receive real-time data to improve decision-making processes in combat scenarios.

Military modernization programs

The KSA military has heavily invested in modernization programs, prioritizing the development and integration of advanced technologies to increase defense capabilities. This includes the procurement of high-tech wearable systems designed to improve soldier effectiveness and enhance communication in complex operational environments. The government’s commitment to strengthening defense infrastructure, including technological innovations in military wearables, drives the market forward. This also reflects a growing demand for integrated solutions that combine wearable devices with other defense technologies such as drones, AI-based systems, and advanced weaponry.

Market Challenges

High costs of integration

One of the major challenges facing the KSA military wearables market is the high cost of integrating advanced wearable technologies into existing military systems. These devices require significant investment in infrastructure, technology development, and training, which can strain defense budgets. Additionally, military wearables often need to meet stringent performance and durability standards, further driving up development and procurement costs. This presents a barrier for widespread adoption, particularly for smaller defense units and regional forces that may face budget constraints.

Regulatory challenges

The regulatory environment for military technologies, including wearables, can be complex and may vary across regions. In KSA, compliance with national security regulations and international export controls (such as ITAR) can limit the speed at which wearable technologies can be deployed. The need for stringent testing and certifications to ensure reliability in critical operations adds further complexity to the market. As the military seeks to expand its adoption of wearable tech, navigating these regulatory challenges while maintaining compliance remains a significant obstacle.

Opportunities

Focus on soldier health and performance

The growing focus on soldier health, performance, and well-being presents a major opportunity for the KSA military wearables market. Wearable health monitoring devices, such as those tracking heart rate, body temperature, and fatigue levels, are in increasing demand as they offer critical insights that can prevent injuries and enhance operational readiness. As the military prioritizes the health of its personnel, especially in extreme environments, there is significant potential for the adoption of wearables that ensure soldiers’ physical and mental wellness.

Increased defense spending

The continued rise in defense spending in KSA, coupled with a strong focus on technological advancements, creates a fertile ground for the growth of the military wearables market. As the country seeks to modernize its defense forces, wearables offer a valuable solution to enhance combat capabilities, provide real-time feedback, and improve soldier safety. With increased investments in military technology, including wearables, the market is poised to expand further, especially with a focus on enhancing situational awareness and performance efficiency in complex military operations.

Future Outlook

The future outlook for the KSA military wearables market remains optimistic, with continued growth expected over the next five years. Technological advancements such as AI-powered wearables, improved sensor technologies, and enhanced communication systems are expected to drive market growth. The KSA military’s ongoing commitment to modernizing its forces and enhancing soldier safety and performance will further contribute to the increasing demand for wearable devices. Additionally, favorable government regulations and growing defense budgets provide a stable foundation for continued investment in military wearables. Overall, the market will likely see substantial growth driven by these trends, with a focus on real-time data, health monitoring, and advanced soldier equipment integration.

Major Players in the KSA Military Wearables Market

- Raytheon Technologies

- General Dynamics

- Thales Group

- BAE Systems

- L3Harris Technologies

- Textron Systems

- Elbit Systems

- Northrop Grumman

- Lockheed Martin

- Honeywell Aerospace

- Leonardo

- SAAB

- QinetiQ

- Cubic Corporation

- Harris Corporation

Key Target Audience

- Investments and venture capitalist firms

- Ministry of Defense (KSA)

- Royal Saudi Air Force

- Royal Saudi Navy

- Ministry of Interior (KSA)

- Saudi Arabian National Guard

- General Authority for Military Industries (GAMI)

- Saudi Arabian Military Industries (SAMI)

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the primary market drivers, constraints, and trends that shape the KSA Military Wearables Market. This is achieved by a mix of secondary data collection and expert interviews. We aim to identify the key variables that will inform our analysis, including technological advancements, regulatory impacts, and defense strategies.

Step 2: Market Analysis and Construction

This phase focuses on collecting historical and current market data. We analyze key metrics such as market size, growth patterns, and technological adoption rates. The analysis is based on reports from credible sources such as industry publications and government agencies, ensuring the robustness of the market projections.

Step 3: Hypothesis Validation and Expert Consultation

After formulating initial market hypotheses, we validate them through discussions with industry professionals, including defense contractors, technology providers, and government officials. These interviews, including structured surveys, provide in-depth insights and practical validation of our data, ensuring the accuracy of our findings.

Step 4: Research Synthesis and Final Output

In the final step, we consolidate and synthesize the gathered data to create a detailed market report. This includes cross-referencing insights from primary and secondary research and applying advanced modeling techniques to generate forecasts. This comprehensive approach ensures that the final output is both reliable and actionable.

- Executive Summary

- KSA Military Wearables Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing need for situational awareness and data collection

Advancements in wearable technology integration for enhanced performance

Growing defense budget and military modernization efforts - Market Challenges

High cost of deployment and maintenance

Technological integration complexities across various platforms

Regulatory and standardization barriers - Market Opportunities

Rising demand for augmented reality-based wearable systems

Technological advancements in lightweight and durable materials

Expansion of military contracts in Middle Eastern regions - Trends

Adoption of AI and machine learning for enhanced decision-making

Shift towards autonomous systems and wearable robotics

Increase in demand for remote health monitoring solutions

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Smart Helmets

Smart Vests

Smart Footwear

Smart Eyewear

Exoskeletons - By Platform Type (In Value%)

Ground Platforms

Aerial Platforms

Marine Platforms

Wearable Robotics

Communication Platforms - By Fitment Type (In Value%)

Body-Worn

Head-Worn

Foot-Worn

Chest-Worn

Gloves - By EndUser Segment (In Value%)

Army

Air Force

Navy

Special Forces

Law Enforcement - By Procurement Channel (In Value%)

Direct Procurement

Distributors

Online Procurement

Government Contracts

Private Sector

- Market Share Analysis

- Cross Comparison Parameters

(Technology adoption rate, procurement cost, system integration capability, market presence, R&D investment) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Raytheon Technologies

General Dynamics

Thales Group

BAE Systems

L3Harris Technologies

Textron Systems

Elbit Systems

Northrop Grumman

Lockheed Martin

Honeywell Aerospace

Leonardo

SAAB

QinetiQ

Cubic Corporation

Harris Corporation

- Demand from defense forces for real-time data exchange

- Law enforcement agencies adopting advanced wearable systems

- Integration of military wearables in battlefield support systems

- Growing interest from private sector security and surveillance companies

- Forecast Market Value ,2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform ,2026-2035