Market Overview

The KSA mine warfare market size is influenced by the country’s significant defense budget allocation and the ongoing modernization of its military infrastructure. Based on recent assessments, the market for mine warfare technology in Saudi Arabia is valued at approximately USD ~ billion. The demand is primarily driven by the need for advanced mine detection, clearance, and neutralization systems to enhance the security of its defense forces and critical infrastructure. The increasing adoption of sophisticated technologies, such as unmanned vehicles and robotic systems, further supports the market’s growth.

The dominant players in the KSA mine warfare market are primarily concentrated in regions with advanced military capabilities. Saudi Arabia, as a key player in the Middle East, continues to dominate due to its strategic location and ongoing military collaborations with global defense contractors. The country’s substantial investments in defense technology, supported by its Vision 2030 plan, create a favorable environment for mine warfare technology adoption. Moreover, geopolitical tensions in the region contribute to the demand for advanced mine clearance systems.

Market Segmentation

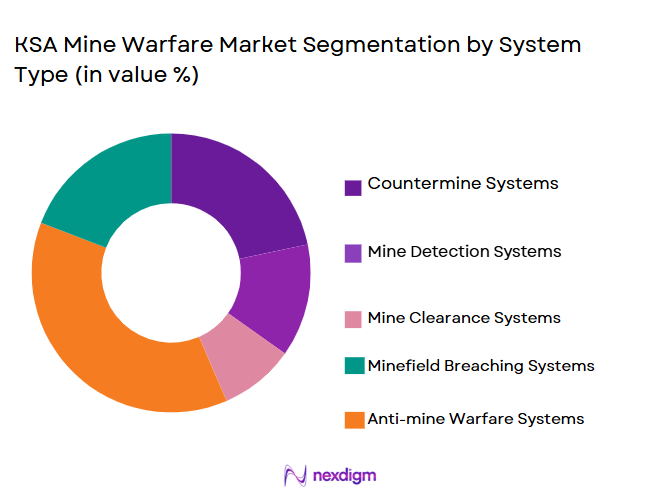

By System Type

The KSA mine warfare market is segmented by product type into mine detection systems, explosive ordnance disposal (EOD) systems, mine clearance systems, countermeasure systems, and robotic systems. Recently, mine detection systems have a dominant market share due to their critical role in early identification and neutralization of mines, especially in areas with active conflict zones. The increasing deployment of unmanned systems and advancements in detection technologies, such as ground-penetrating radar and acoustic sensors, has further bolstered the demand for these systems. As military operations in Saudi Arabia require increased security measures, the reliance on these technologies is expected to continue growing, positioning mine detection systems as a dominant segment in the market.

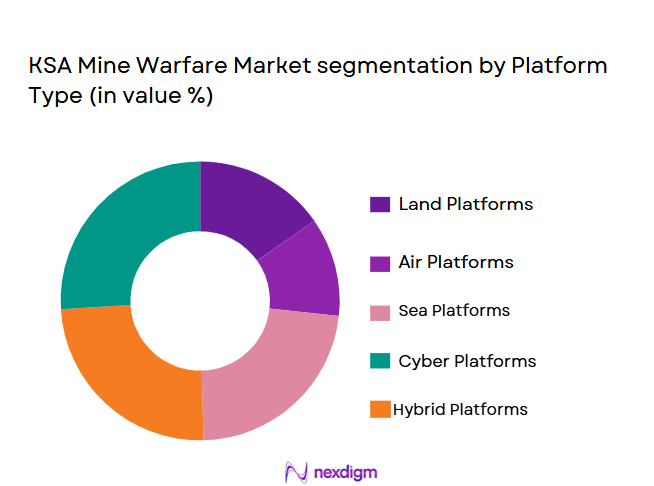

By Platform Type

The market for KSA mine warfare is further segmented by platform type, including land-based platforms, naval platforms, aerial platforms, unmanned platforms, and hybrid platforms. Among these, land-based platforms dominate the market share due to the extensive use of ground vehicles in mine clearance and detection operations. The growing deployment of armored vehicles and unmanned ground vehicles in mine-clearance operations, supported by increasing military investments, contributes to this dominance. These platforms are particularly critical in areas where mines pose significant threats to ground forces, making land-based systems essential for Saudi Arabia’s defense strategy.

Competitive Landscape

The KSA mine warfare market is highly competitive, with several large defense contractors dominating the landscape. The industry is experiencing consolidation, with major global players establishing partnerships and joint ventures to expand their market presence. The influence of these players is marked by their strong technological capabilities, extensive experience, and ability to meet the specific demands of Saudi Arabia’s military. Key players are investing in research and development to enhance their product offerings, contributing to a highly dynamic competitive environment.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-Specific Parameter |

| Lockheed Martin | 1912 | United States | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | United States | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Israel | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

KSA mine warfare Market Analysis

Growth Drivers

Increased Defense Spending

Increased defense spending is a key growth driver in the KSA mine warfare market, driven by the country’s commitment to enhancing its military capabilities. Saudi Arabia allocates a significant portion of its GDP to defense, supporting the purchase and development of advanced mine warfare technologies. The Kingdom’s defense budget for the current fiscal year is estimated at USD ~ billion, reflecting a steady rise in military expenditure. This substantial funding enables the procurement of state-of-the-art mine detection, clearance, and neutralization systems, ensuring the safety and security of military personnel and infrastructure. As the security challenges in the Middle East continue to evolve, the demand for advanced technologies, such as unmanned systems and robotic solutions, is expected to rise in response to evolving threats.

Geopolitical Tensions

Geopolitical tensions in the region have significantly impacted the KSA mine warfare market. Saudi Arabia, as a key player in the Middle East, faces increasing threats from landmines, particularly in areas with active conflict zones. The necessity for advanced mine warfare solutions has become even more critical as regional instability persists, driving demand for sophisticated detection and neutralization systems. With conflicts in neighboring countries such as Yemen and Syria, the Saudi military has intensified its focus on counter-mine capabilities to protect its forces and infrastructure. The increasing reliance on military technology to maintain national security is contributing to the growth of the mine warfare market.

Market Challenges

High Development Costs

One of the significant challenges facing the KSA mine warfare market is the high cost of developing and deploying advanced systems. The design, manufacturing, and deployment of mine detection, clearance, and neutralization systems require significant capital investment. Moreover, the integration of cutting-edge technologies, such as unmanned vehicles and AI-powered systems, adds to the overall expense. The high upfront costs can limit the ability of smaller defense contractors to enter the market, potentially leading to market consolidation among larger players. Furthermore, the continuous need for system upgrades and maintenance contributes to ongoing financial pressures for stakeholders in the sector.

Regulatory and Compliance Barriers

Regulatory challenges also pose a barrier to the growth of the KSA mine warfare market. Saudi Arabia’s defense industry is heavily regulated, with strict certification requirements for military-grade products. Compliance with international standards, coupled with the need for various certifications and approvals, can delay the procurement process and increase costs. These regulatory hurdles often slow the speed at which advanced mine warfare technologies can be deployed, limiting their effectiveness in responding to emerging threats. Additionally, complex export restrictions and international trade regulations can further complicate the procurement process.

Opportunities

Technological Advancements in Robotics

The continuous advancements in robotics and autonomous systems present significant opportunities for growth in the KSA mine warfare market. Robotic systems, such as unmanned ground vehicles (UGVs) and aerial drones, are increasingly being deployed for mine detection and clearance operations. These systems enhance safety by reducing the need for human intervention in hazardous environments, which is particularly crucial in conflict zones. With Saudi Arabia’s ongoing investment in technological innovation and its focus on developing autonomous systems, there is a substantial opportunity for the adoption of robotic mine clearance technologies. The future of mine warfare in Saudi Arabia will likely involve the integration of AI-driven robotic systems capable of performing complex tasks with minimal human supervision.

Public-Private Partnerships

Public-private partnerships (PPPs) represent another opportunity in the KSA mine warfare market. The Saudi government is actively seeking to collaborate with international defense contractors to develop advanced mine warfare solutions. These partnerships enable the transfer of technology and expertise, which benefits the local defense industry. Moreover, they provide an opportunity for defense contractors to gain access to government contracts, which are typically large-scale and long-term. By leveraging PPPs, Saudi Arabia can accelerate the development and deployment of advanced mine warfare technologies, positioning itself as a regional leader in mine clearance and detection capabilities.

Future Outlook

The future of the KSA mine warfare market over the next five years is expected to see continued growth driven by advancements in technology and increasing defense investments. The development of autonomous systems, such as unmanned ground vehicles and robotic mine clearance units, will play a crucial role in the modernization of Saudi Arabia’s defense infrastructure. Additionally, regulatory support for defense modernization programs will ensure a steady demand for mine warfare solutions. As geopolitical tensions persist, the demand for effective mine clearance and detection systems will remain high, providing a robust growth trajectory for the market.

Major Players

• Northrop Grumman

• Thales Group

• Rafael Advanced Defense Systems

• BAE Systems

• Elbit Systems

• Leonardo

• L3Harris Technologies

• Saab

• QinetiQ

• General Dynamics

• ST Engineering

• Dynetics

• Honeywell Aerospace

• Israel Aerospace Industries

Key Target Audience

• Ministry of Defense (KSA)

• Saudi Arabian National Guard

• Royal Saudi Air Force

• Royal Saudi Navy

• Ministry of Interior (KSA)

• General Authority for Military Industries (GAMI)

• Saudi Arabian Military Industries (SAMI)

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the most relevant factors influencing the KSA mine warfare market, such as defense spending, technological trends, and geopolitical factors.

Step 2: Market Analysis and Construction

The collected data is analyzed to develop a comprehensive market model, assessing current trends and forecasting future demand for mine warfare solutions.

Step 3: Hypothesis Validation and Expert Consultation

This stage includes consultations with industry experts and key stakeholders to validate assumptions and refine the market model based on real-world insights.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the findings from various research phases and producing a comprehensive market report, highlighting trends, challenges, and opportunities in the KSA mine warfare market.

- Executive Summary

- KSA Mine Warfare Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense budgets and military modernization

Heightened geopolitical tensions in the Middle East

Rising demand for advanced military technology - Market Challenges

High costs of mine detection and disposal systems

Limited local manufacturing capacity

Complex regulatory requirements and compliance issues - Market Opportunities

Technological advancements in robotic systems for mine clearance

Expansion of military collaborations and joint defense initiatives

Growing focus on training and capacity building for mine warfare operations - Trends

Integration of AI and machine learning in mine detection systems

Shift toward autonomous and remotely operated systems

Growing adoption of hybrid platforms for land and naval mine warfare

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Mine Detection Systems

Explosive Ordnance Disposal Systems

Mine Clearance Systems

Countermeasure Systems

Robotic Systems - By Platform Type (In Value%)

Land-based Platforms

Naval Platforms

Aerial Platforms

Unmanned Platforms

Hybrid Platforms - By Fitment Type (In Value%)

Ground Fitment

Naval Fitment

Aerial Fitment

Modular Fitment

Portable Fitment - By EndUser Segment (In Value%)

Military Forces

Government Defense Agencies

Private Contractors

International Peacekeeping Forces

Security Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Public-Private Partnerships

Defense Alliances

Private Sector Investments

- Market Share Analysis

- Cross Comparison Parameters

(Technology adoption, Pricing trends, Government regulations, Market entry barriers, R&D capabilities) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Northrop Grumman

Thales Group

BAE Systems

General Dynamics

Leonardo

Rafael Advanced Defense Systems

BAE Systems

QinetiQ

ST Engineering

Dynetics

L3Harris Technologies

Cubic Corporation

Israel Aerospace Industries

Kongsberg Gruppen

- Military forces focusing on enhanced protection

- Government defense agencies prioritizing advanced mine warfare technology

- Private contractors seeking partnerships for system development

- International peacekeeping forces involved in mine clearance operations

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035