Market Overview

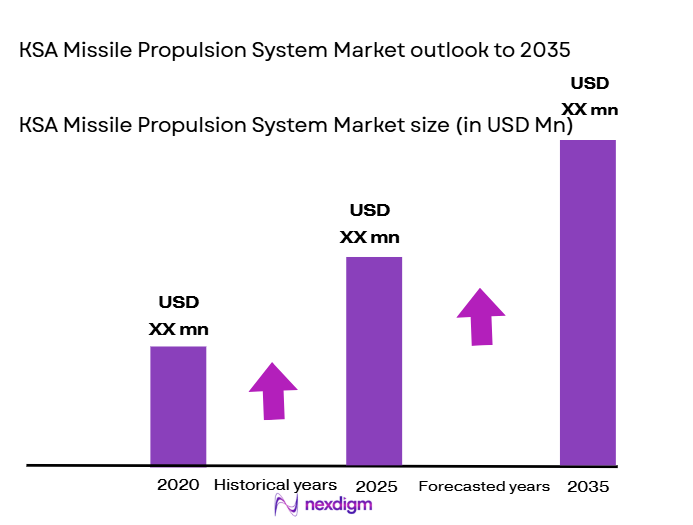

The KSA missile propulsion system market is experiencing significant growth, with the market size driven by increasing defense budgets and rising investments in advanced missile technologies. The total market value in USD ~ is expected to see substantial growth in the coming years, with government investments being a key driver. The continuous demand for missile systems is mainly supported by geopolitical factors and security concerns within the region. Based on a recent historical assessment, the market is poised for steady expansion, underpinned by the modernization of defense infrastructure.

Saudi Arabia’s dominance in the missile propulsion system market is driven by its strategic location, advanced defense initiatives, and the government’s focus on enhancing its military capabilities. The country has also been increasing its defense procurement, with a special focus on strengthening air and ground-based missile systems. Several military and defense organizations, such as the Ministry of Defense and Royal Saudi Air Force, play a significant role in shaping the market, while collaborations with global defense contractors boost technological advancements and capabilities in missile propulsion systems.

Market Segmentation

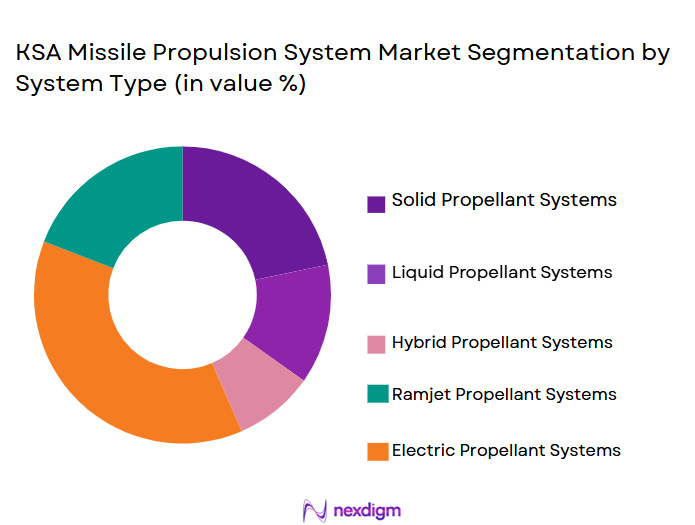

By System Type

The KSA missile propulsion system market is segmented by product type into solid propellant systems, liquid propellant systems, hybrid propellant systems, electric propulsion systems, and nuclear propulsion systems. Among these, solid propellant systems have a dominant market share due to their robustness, reliability, and cost-effectiveness. The solid propellant systems are extensively used in both air and ground-based missile systems, making them highly favorable in KSA’s defense strategy. The higher demand for solid propulsion systems in military applications is attributed to the greater precision, faster deployment times, and reduced maintenance needs, which align with the strategic defense requirements of the region.

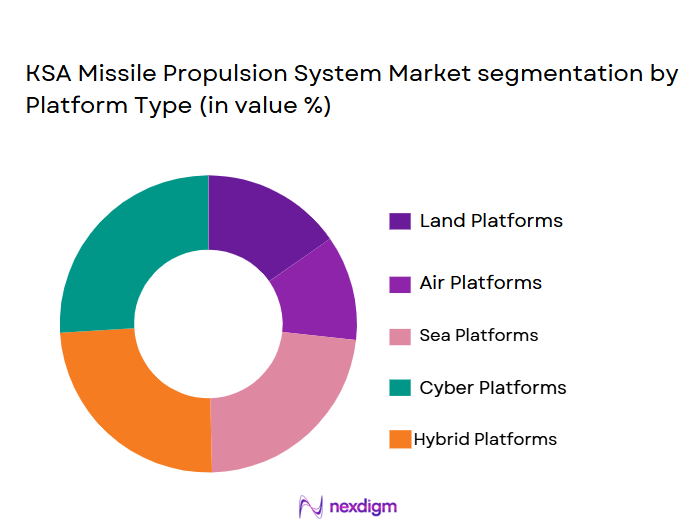

By Platform Type

The KSA missile propulsion system market is segmented by platform type into ground-based launchers, air-based systems, sea-based systems, submarine-based launchers, and space-based platforms. Air-based systems are expected to dominate the market share, driven by Saudi Arabia’s focus on enhancing its aerial defense capabilities. Air-launched missile systems provide flexibility and rapid response in combat situations, making them essential for defense strategies. The adoption of air-launched systems is increasing due to technological advancements in aircraft and missile integration, which are well-supported by both the government and defense contractors within the kingdom.

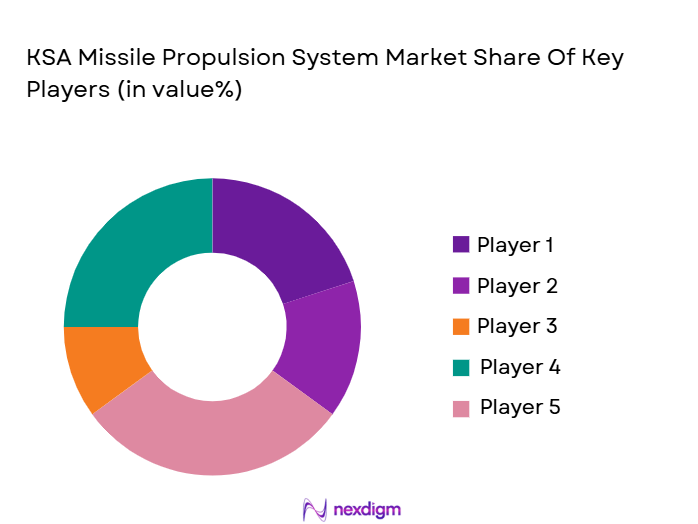

Competitive Landscape

The KSA missile propulsion system market is competitive, with several global and local players vying for dominance. The market is witnessing increasing consolidation as major defense contractors collaborate with the government and local manufacturers to meet the rising demand for advanced propulsion systems. Companies in this market are focusing on technology innovation, cost-efficiency, and strong partnerships with Saudi military authorities to expand their market share and enhance their influence in the region.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market-Specific Parameter |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | Reston, USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

| MBDA | 2001 | Le Plessis-Robinson, France | ~ | ~ | ~ | ~ | ~ |

KSA missile propulsion system Market Analysis

Growth Drivers

Increase in Defense Spending

Increasing defense budgets across the Middle East, particularly in Saudi Arabia, has driven the demand for missile propulsion systems. As geopolitical tensions continue to rise, the Saudi government has prioritized enhancing its military capabilities. This investment in defense infrastructure leads to heightened procurement activities and long-term strategic planning. The Saudi government’s ongoing defense modernization programs ensure a steady demand for advanced missile propulsion systems, which are crucial for air, ground, and naval defense platforms. These programs reflect Saudi Arabia’s commitment to securing its borders and strengthening its military deterrence capabilities. In line with these efforts, the country has also established defense procurement policies favoring local manufacturing, creating opportunities for domestic suppliers to contribute to missile systems development. As a result, increased defense spending is expected to continue fueling market growth in the years to come.

Technological Advancements

The development and integration of next-generation propulsion technologies, such as hybrid and electric propulsion, are expected to be key growth drivers for the KSA missile propulsion system market. The Saudi military is increasingly focusing on modernizing its defense technology, which includes upgrading propulsion systems in missile defense applications. These technological advancements not only enhance the performance and accuracy of missile systems but also help reduce operational costs, making them more cost-effective and efficient for long-term use. Moreover, collaborations between Saudi defense manufacturers and global missile technology providers are fostering innovation in propulsion systems. As the defense sector becomes more technologically sophisticated, the integration of artificial intelligence (AI) and automation with missile propulsion systems is expected to bring about significant advancements, further boosting the market’s expansion.

Market Challenges

High R&D and Manufacturing Costs

A major challenge for the KSA missile propulsion system market is the high cost of research and development (R&D) and manufacturing of advanced propulsion technologies. The defense industry in Saudi Arabia has been striving to modernize its missile defense systems, but these efforts come with significant financial burdens. Developing advanced missile propulsion systems requires substantial investments in R&D, testing, and manufacturing capabilities. These costs, along with the necessary compliance with stringent defense standards, make it challenging for smaller local suppliers to compete with large multinational companies that have more substantial financial resources. Additionally, the prolonged timelines for developing and testing these technologies further increase the overall cost burden, limiting the pace of innovation and slowing the rate at which new systems are deployed.

Geopolitical Instability

The geopolitical instability in the Middle East is a persistent challenge for the KSA missile propulsion system market. While the region’s defense budgets are expanding, political tensions, ongoing conflicts, and security concerns are major roadblocks to consistent market growth. Saudi Arabia faces potential threats from neighboring countries and non-state actors, making it necessary for the kingdom to continuously invest in defense systems to safeguard its national interests. However, the political climate can result in fluctuating defense policies and procurement plans, which may lead to unpredictable shifts in demand for missile propulsion systems. This instability can hinder long-term strategic planning and cause delays in contract awards, slowing market development.

Opportunities

Integration of AI and Automation

The integration of artificial intelligence (AI) and automation in missile propulsion systems offers a significant growth opportunity for the KSA market. AI-driven missile systems are expected to enhance the accuracy and efficiency of missile guidance, while automation will streamline manufacturing and reduce costs. The development of AI-powered propulsion systems is a priority for the Saudi military, as it allows for faster response times, more precise targeting, and reduced operational risks. These technologies are expected to revolutionize the defense sector by improving system performance and operational flexibility. Moreover, Saudi Arabia’s push to enhance its technological capabilities, coupled with its investments in innovation, positions the country to become a leader in AI and automated missile defense systems in the region.

Strategic Defense Collaborations

Strategic collaborations with global defense companies and research institutions present a key opportunity for the growth of the KSA missile propulsion system market. Saudi Arabia has been actively forming partnerships with international missile defense manufacturers to gain access to advanced technologies and expand its domestic defense capabilities. These collaborations enable Saudi companies to acquire the technical expertise required for developing cutting-edge missile propulsion systems while fostering economic growth through knowledge transfer and joint ventures. Additionally, such partnerships increase the country’s position in the global defense supply chain, allowing it to become an exporter of high-tech missile systems. As the demand for advanced missile systems increases globally, these strategic collaborations provide a pathway for KSA to strengthen its defense sector and improve regional security.

Future Outlook

The future outlook for the KSA missile propulsion system market is promising, with projected growth driven by technological advancements and increased defense spending. The Saudi government’s commitment to modernizing its defense infrastructure and expanding missile capabilities ensures a continued demand for high-performance propulsion systems. Emerging technologies like AI, automation, and hybrid propulsion are expected to revolutionize the market, offering more efficient, cost-effective, and powerful missile systems. Additionally, collaborations with global defense contractors will help Saudi Arabia stay at the forefront of missile propulsion innovation, positioning the country as a leader in regional defense.

Major Players

• General Dynamics

• Lockheed Martin

• Northrop Grumman

• MBDA

• BAE Systems

• Thales Group

• L3Harris Technologies

• Rafael Advanced Defense Systems

• Honeywell Aerospace

• Leonardo

• Elbit Systems

• Saab Group

• Kongsberg Gruppen

• Mitsubishi Heavy Industries

Key Target Audience

• Ministry of Defense (KSA)

• Saudi Arabian Armed Forces

• Saudi Arabian National Guard

• Royal Saudi Air Force

• Royal Saudi Navy

• General Authority for Military Industries (GAMI)

• Saudi Arabian Military Industries (SAMI)

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying critical variables that influence the market, such as technological trends, government policies, and defense spending.

Step 2: Market Analysis and Construction

Comprehensive market analysis is conducted through primary and secondary research to build a foundational understanding of market dynamics, including demand, supply, and competitor analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert consultations, ensuring accurate interpretation of data and aligning findings with industry standards and expectations.

Step 4: Research Synthesis and Final Output

The final market report is synthesized, ensuring clarity in market projections, competitive analysis, and strategic recommendations, followed by thorough quality assurance.

- Executive Summary

- KSA Missile Propulsion System Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Defense Budget Allocations

Focus on Technological Advancements in Missile Propulsion

Strategic Military Alliances with Global Powers - Market Challenges

High R&D and Manufacturing Costs

Regulatory and Compliance Hurdles

Geopolitical Instability and Security Concerns - Market Opportunities

Integration of AI and Automation in Propulsion Systems

Growing Demand for Precision Weapons

Expansion of Saudi Military Capabilities - Trends

Shift Towards Green Propulsion Technologies

Development of Multi-Stage Propulsion Systems

Advancement in Hypersonic Propulsion

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Solid Propellant Systems

Liquid Propellant Systems

Hybrid Propellant Systems

Electric Propulsion Systems

Nuclear Propulsion Systems - By Platform Type (In Value%)

Ground-Based Launchers

Air-Based Systems

Sea-Based Systems

Submarine-Based Launchers

Space-Based Platforms - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket Systems

Upgrades & Modifications

Integrated Propulsion Systems

Standalone Propulsion Units - By End-user Segment (In Value%)

Ministry of Defense (KSA)

Saudi Armed Forces

Royal Saudi Air Force

Royal Saudi Navy

Military Contractors - By Procurement Channel (In Value%)

Direct Purchases

Government Tenders

Defense Contractors

Private Sector Procurement

International Partnerships

- Market Share Analysis

- Cross Comparison Parameters

(Technology Innovation, Manufacturing Capacity, Geopolitical Influence, Military Collaboration, Cost Efficiency) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Raytheon Technologies

General Dynamics

Thales Group

BAE Systems

L3Harris Technologies

Lockheed Martin

Rafael Advanced Defense Systems

Northrop Grumman

Saab Group

MBDA

Airbus Defense and Space

Elbit Systems

Kongsberg Gruppen

Leonardo

Hanwha Defense KSA Missile Propulsion System Competitive Landscape

Market Share Analysis

Cross Comparison Parameters

(Technology Innovation, Manufacturing Capacity, Geopolitical Influence, Military Collaboration, Cost Efficiency)

SWOT Analysis of Key Competitors

Pricing & Procurement Analysis

Key Players

Raytheon Technologies

General Dynamics

Thales Group

BAE Systems

L3Harris Technologies

Lockheed Martin

Rafael Advanced Defense Systems

Northrop Grumman

Saab Group

MBDA

Airbus Defense and Space

Elbit Systems

Kongsberg Gruppen

Leonardo

Hanwha Defense

- Adoption of Propulsion Systems in Military Strategy

- Role of Domestic Defense Contractors

- Integration with Advanced Weapon Systems

- Collaborations with International Defense Forces

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035