Market Overview

The KSA Missiles and Missile Defense Systems market is expected to experience significant growth driven by substantial investments in national defense and an increasing demand for advanced military technologies. As of the most recent assessment, the market size for missiles and defense systems is estimated to reach approximately USD ~ billion, with key drivers including the growing geopolitical tensions in the Middle East and the country’s strategic military initiatives. Saudi Arabia’s national defense budget has seen consistent growth, with a forecast of USD ~ billion allocated in the coming years for military expenditures, including missile defense systems. These developments are further fueled by Saudi Arabia’s increasing emphasis on enhancing its domestic defense capabilities and strengthening international defense collaborations.

The market is primarily dominated by key players from countries with robust defense industries, including the United States, the United Kingdom, and France. Saudi Arabia’s positioning as a significant purchaser of defense equipment, particularly in the context of the Gulf region, allows it to maintain a competitive edge. Cities like Riyadh and Dhahran are central hubs for defense contracts, military coordination, and research in missile technologies. The Kingdom’s long-term defense strategy also involves creating strategic alliances with other global military powers to procure advanced missile defense systems. This dominance is supported by the Kingdom’s large-scale military modernization efforts and a heavy focus on technological upgrades in missile defense systems.

Market Segmentation

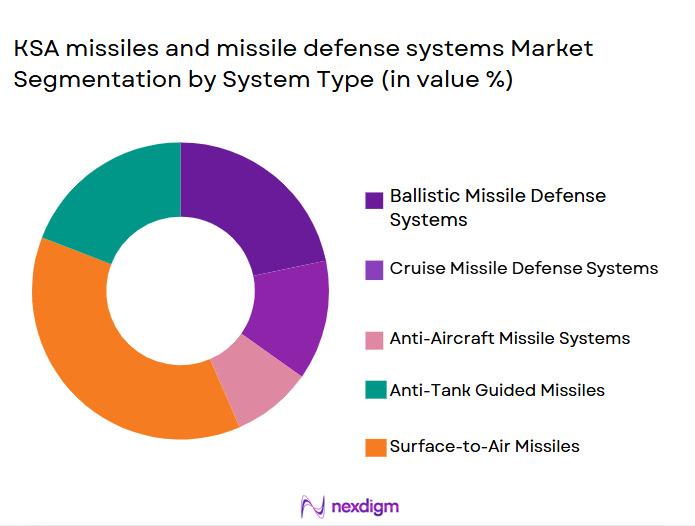

By System Type

The KSA Missiles and Missile Defense Systems market is segmented by product type into surface-to-air missiles, anti-ship missiles, anti-tank missiles, ballistic missiles, and cruise missiles. Recently, surface-to-air missiles have dominated the market due to factors such as the demand for more comprehensive air defense systems, technological advancements in radar and targeting systems, and regional security concerns. This product type has benefitted from the increasing need for enhanced defense against aerial threats, and the expanding presence of air defense systems in Saudi Arabia’s military strategies.

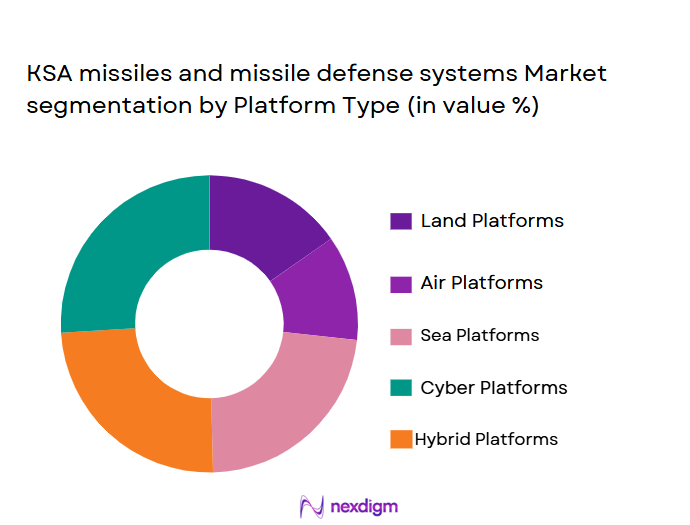

By Platform Type

The KSA Missiles and Missile Defense Systems market is segmented by platform type into land-based platforms, airborne platforms, naval platforms, space-based platforms, and mobile platforms. Recently, land-based platforms have had the dominant market share, driven by the increasing need for ground defense systems that can effectively protect critical infrastructure and military installations. These platforms are particularly preferred for their cost-effectiveness and ability to be rapidly deployed in defense of large areas against missile threats.

Competitive Landscape

The KSA Missiles and Missile Defense Systems market is characterized by a competitive landscape with major international defense players, both state and private entities, playing a significant role in providing cutting-edge missile defense technologies. Saudi Arabia has fostered strategic partnerships with global defense contractors, leading to a consolidation of resources and expertise in defense systems. These collaborations have greatly influenced the Kingdom’s ability to modernize its defense capabilities and enhance its strategic military initiatives. The market is primarily driven by technological advancements, with key players continuously innovating and upgrading their defense systems to meet the evolving security demands of the region.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Market-Specific Parameter |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

KSA missiles and missile defense systems Market Analysis

Growth Drivers

Increasing Defense Budgets

Increasing defense budgets in Saudi Arabia are a key growth driver for the missiles and missile defense systems market. Saudi Arabia has consistently increased its defense spending, aiming to modernize its military forces and enhance its missile defense capabilities. In recent years, the Kingdom allocated a significant portion of its budget towards acquiring advanced missile defense systems and technologies. As a result, the defense industry has been experiencing accelerated growth, particularly in the procurement of advanced surface-to-air missiles and ballistic missile defense systems. The growing geopolitical tensions in the Middle East have also played a major role in driving the demand for stronger defense capabilities. This rise in defense spending is expected to continue, as Saudi Arabia remains committed to maintaining a robust defense posture against potential regional threats.

Technological Advancements in Missile Defense Systems

Technological advancements in missile defense systems have spurred the growth of the market. Innovations in radar, detection systems, and missile interception technologies have made it possible to defend against increasingly sophisticated aerial threats. Saudi Arabia’s military strategy includes a significant push for integrating cutting-edge technologies into its defense arsenal, such as the development of hypersonic missile defense and AI-powered systems for faster response times. These technologies have improved the effectiveness of missile defense systems and are driving demand from defense agencies, leading to the expansion of both domestic and international defense collaborations. The focus on system integration and interoperability has also enhanced the demand for highly advanced and capable missile defense solutions.

Market Challenges

High Development and Maintenance Costs

High development and maintenance costs represent a significant challenge for the KSA Missiles and Missile Defense Systems market. The advanced technology and manufacturing processes involved in developing state-of-the-art missile defense systems contribute to high initial investment costs. Additionally, these systems require sophisticated maintenance and upgrades to remain operational and effective over time, further increasing costs for defense agencies. This issue is particularly challenging for defense budgets, which must allocate substantial resources to maintain and expand missile defense capabilities. While the market demand is high, the costs associated with these systems pose a challenge for long-term sustainability, especially during periods of financial constraints.

Dependency on Foreign Suppliers for Advanced Technologies

Saudi Arabia’s dependency on foreign suppliers for advanced missile defense technologies poses a challenge in terms of self-sufficiency and defense independence. While international collaborations have played a significant role in securing advanced defense systems, reliance on foreign suppliers for critical technology can leave the Kingdom vulnerable to changes in international relations or trade policies. The ongoing need for complex technologies, such as radar systems and precision-guided missiles, has led to an increasing reliance on foreign defense contractors. This dependency could limit Saudi Arabia’s ability to rapidly respond to emerging defense threats and undermine the country’s long-term defense autonomy.

Opportunities

Expansion of Collaborative Defense Alliances

One significant opportunity for the KSA Missiles and Missile Defense Systems market is the expansion of collaborative defense alliances with regional and international military powers. By strengthening its alliances with countries like the United States, the United Kingdom, and France, Saudi Arabia can gain access to more advanced defense technologies and participate in joint military operations. Collaborative efforts in missile defense are mutually beneficial, allowing Saudi Arabia to modernize its defense systems while promoting regional stability. This opportunity also includes engaging in joint research and development efforts to create next-generation defense solutions tailored to the specific needs of the Middle East region.

Integration of Artificial Intelligence (AI) and Autonomous Systems

The integration of artificial intelligence (AI) and autonomous systems in missile defense systems represents a tremendous opportunity for the market. AI-powered systems can significantly enhance the precision, speed, and efficiency of missile defense, allowing for real-time analysis and decision-making in countering missile threats. Saudi Arabia has already made progress in incorporating AI into its defense systems, and continued investment in autonomous technologies will lead to the development of more advanced and automated defense mechanisms. This opportunity will not only bolster the Kingdom’s defense capabilities but also attract international collaborations to further advance the technology, making Saudi Arabia a leader in AI-driven missile defense.

Future Outlook

The KSA Missiles and Missile Defense Systems market is poised for strong growth in the coming years, driven by technological advancements and continued defense spending. With a focus on modernization, the market is expected to witness the integration of advanced systems, such as hypersonic missile defense, AI-powered technologies, and more robust radar systems. Additionally, the Kingdom’s ongoing efforts to strengthen regional defense collaborations will further fuel market demand. Regulatory support and the growing geopolitical tensions in the Middle East will continue to drive investment in advanced defense solutions, contributing to the market’s expansion and long-term growth.

Major Players

• Raytheon Technologies

• Northrop Grumman

• BAE Systems

• Thales Group

• Rafael Advanced Defense Systems

• Elbit Systems

• Leonardo

• MBDA

• Kongsberg Gruppen

• Saab Group

• L3Harris Technologies

• Harris Corporation

• Honeywell Aerospace

• General Dynamics

Key Target Audience

• Government and regulatory bodies

• National defense agencies

• International defense contractors

• Military technology developers

• Aerospace and defense manufacturing companies

• Strategic defense organizations

• Military equipment procurement departments

Research Methodology

Step 1: Identification of Key Variables

Identifying critical market variables such as key technologies, growth factors, and procurement trends.

Step 2: Market Analysis and Construction

Analyzing historical data, market trends, and consumer preferences to build market models.

Step 3: Hypothesis Validation and Expert Consultation

Validating market models with expert insights and consultations from industry leaders.

Step 4: Research Synthesis and Final Output

Synthesizing collected data and analysis to provide final comprehensive market insights.

- Executive Summary

- KSA Missiles and Missile Defense Systems Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in National Defense Budgets

Escalating Geopolitical Tensions in the Region

Technological Advancements in Missile Defense Systems - Market Challenges

High Development and Maintenance Costs

Limited Domestic Production Capabilities

Regulatory Hurdles and Export Restrictions - Market Opportunities

Expansion of Collaborative Defense Alliances

Growing Demand for Advanced Defense Technologies

Increased Focus on Regional Security Enhancements - Trends

Integration of AI in Missile Defense Systems

Shift Toward Autonomous Weaponry

Rise in Military-Industrial Complex Collaborations

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Surface-to-Air Missiles

Anti-Ship Missiles

Anti-Tank Missiles

Ballistic Missiles

Cruise Missiles - By Platform Type (In Value%)

Land-based Platforms

Airborne Platforms

Naval Platforms

Space-based Platforms

Mobile Platforms - By Fitment Type (In Value%)

Original Equipment Manufacturer (OEM)

Aftermarket

Refurbished Systems

Upgraded Systems

Custom Fitments - By EndUser Segment (In Value%)

Military Defense Forces

Government Defense Agencies

Defense Contractors

Private Security Companies

International Partners - By Procurement Channel (In Value%)

Direct Procurement by Government

Private Sector Procurement

International Defense Deals

Public-Private Partnerships

Defense Industry Alliances

- Market Share Analysis

- Cross Comparison Parameters

(Product Innovation, Pricing Strategy, Geographic Reach, Regulatory Compliance, Technology Adoption) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Raytheon Technologies

Lockheed Martin

Boeing Defense

Northrop Grumman

General Dynamics

BAE Systems

Thales Group

Rafael Advanced Defense Systems

Elbit Systems

Leonardo

MBDA

Kongsberg Gruppen

Saab Group

L3Harris Technologies

Harris Corporation

- National Defense Forces’ Demand for Advanced Systems

- Rising Role of Defense Contractors in the Region

- Increased Government Investments in High-Tech Defense

- Collaborations with International Missile Defense Providers

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035