Market Overview

The KSA mobile health solutions market generated USD ~ million and subsequently reached USD ~ billion, reflecting rapid scale-up of app-based care access, teleconsultation workflows, and remote monitoring adoption enabled by improving connectivity and smartphone-led engagement. The growth trajectory is anchored in expanding digital-health service delivery across the Kingdom and sustained uptake of mHealth apps as a primary revenue contributor, supported by broader platformization of care and on-demand access expectations among consumers and employers.

Within KSA, Riyadh dominates due to the concentration of national-level regulators, payer headquarters, enterprise buyers, and large hospital groups that accelerate contracting and integration-led deployments; Jeddah follows through private provider density and retail-pharmacy ecosystems supporting medication-adherence journeys; and Dammam/Khobar benefit from corporate/employer health programs and insurer-linked access pathways. On the ecosystem side, solution influence is also shaped by UAE-based regional digital-health operators and MENA platforms, which leverage cross-market product maturity, Arabic-first UX, and multi-country provider networks to scale faster in KSA through partnerships rather than greenfield builds.

Market Segmentation

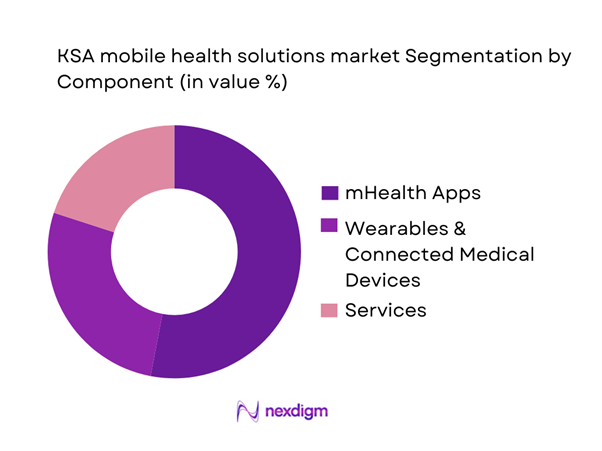

By Component

KSA mobile health solutions are segmented by component into mHealth Apps, Wearables & Connected Medical Devices, and Services (monitoring services, chronic/post-acute programs, and system-strengthening services). Recently, mHealth apps have been the dominant sub-segment because they sit at the “digital front door” of care—driving discovery, triage, booking, teleconsultation, and follow-ups in one workflow while keeping user acquisition friction low through app-store distribution and payer/employer enrollment. They also scale faster than device-led models because they do not require hardware procurement cycles and can be embedded into provider and payer journeys (booking + eRx + care plans). As a result, apps capture a disproportionate share of engagement minutes and repeat usage loops, which drives recurring monetization via memberships, pay-per-consult, and bundled programs.

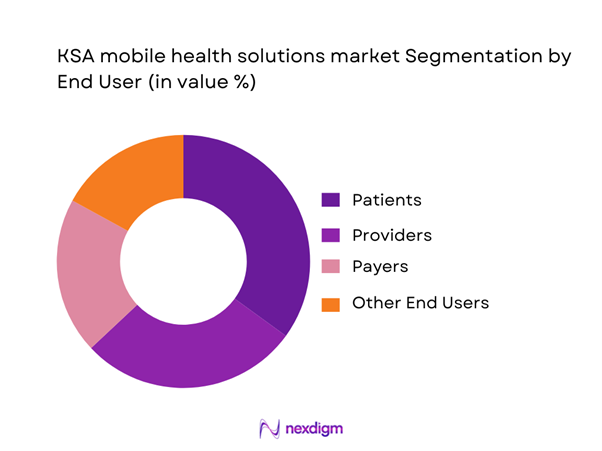

By End User

KSA mobile health solutions are segmented by end user into Patients (B2C), Providers (Hospitals/Clinics), Payers (Insurers/TPAs), and Other End Users (Employers, Pharmacies, Home-care operators). Recently, patients tend to dominate day-to-day demand volume because consumer-led entry points (symptom-first consults, follow-up chats, bookings, prescription refills, wellness and chronic management routines) generate the highest frequency of interactions and app sessions. However, the commercial power center often sits with payers and large employers, since panel inclusion, benefits design, and PMPM contracting determine scale access and retention. Providers increasingly drive adoption where virtual care is tightly coupled with EMR workflows, eRx, referral loops, and clinical governance—reducing operational friction and improving continuity of care. In practice, patient-led usage dominates engagement, while payer/employer-led distribution increasingly determines who wins scaled cohorts.

Competitive Landscape

The KSA mobile health solutions market is increasingly shaped by a mix of government-backed platforms, Saudi-native telehealth operators, and regional MENA digital-health platforms that compete on Arabic-first experience, provider network depth, integration maturity (booking/eRx/EMR), and enterprise distribution through insurers, TPAs, and employers. Competitive advantage is built less on “app presence” and more on the ability to embed into regulated healthcare workflows while maintaining clinical governance and data protection requirements.

| Company | Est. Year | HQ | KSA Coverage Model | Core Modalities | Integration Depth (Booking / eRx / EMR / Claims) | Primary Buyer Channel | Provider Network Depth | Differentiation Lever |

| Cura | 2016 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ | ~ |

| Altibbi | 2008 | Amman, Jordan (regional HQ) | ~ | ~ | ~ | ~ | ~ | ~ |

| Vezeeta | 2012 | Egypt (regional) | ~ | ~ | ~ | ~ | ~ | ~ |

| Nahdi Medical (NahdiCare ecosystem) | 1986 | Jeddah, KSA | ~ | ~ | ~ | ~ | ~ | ~ |

| Okadoc | 2018 | Dubai, UAE | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Mobile Health Solutions Market

Growth Drivers

MOH Digital Platforms Pull

Saudi Arabia’s macro capacity to scale app-led healthcare is underpinned by a large, digitally addressable population and strong national spending power, with population of ~ million and GDP of USD ~ trillion, with GDP per capita of USD ~. Against this base, the Ministry of Health’s platform-led model has created a high-throughput “digital front door” for access and continuity, converting appointment, consultation, and prescription workflows into mobile journeys rather than facility-first touchpoints. A clear signal of system-level pull is the scale of virtual interactions routed through the national app ecosystem, with Sehhaty supporting ~ million users, offering ~ healthcare services, and facilitating more than ~ million consultations and appointments, with ~ million online prescriptions cited as part of the same digital transformation narrative. In a market where primary care access, refills, and follow-ups generate repeat demand, these numbers indicate that MOH platforms are not niche pilots but mass-use infrastructure.

Chronic Disease Management Demand

Saudi Arabia’s chronic-disease management load is structurally linked to the size of its population and the scale of ongoing medicine utilization, which are both within the “mHealth solutions” operating envelope (monitoring, adherence, refill loops, follow-ups). The Kingdom’s population stands at ~ million, creating a large base for repeat-care pathways that are typically chronic-heavy (hypertension, diabetes, cardiovascular, respiratory, and mental health follow-up routines). On the demand expression side, the digital health transformation has made medication access and adherence a measurable, system-wide workflow, with ~ million online prescriptions and more than ~ million consultations and appointments, alongside ~ million users on the national app. Even without using market-size or CAGR figures, these prescription and consultation volumes strongly support the chronic-care narrative because chronic management is inherently prescription- and follow-up-intensive. In practical terms, the chronic driver for mHealth in KSA is not just “digital access,” but the conversion of high-frequency tasks—refills, adherence reminders, symptom tracking, and post-visit follow-up—into app-native journeys that reduce leakage.

Challenges

Clinical Governance and Liability

Saudi Arabia’s clinical governance challenge in mHealth is fundamentally a scale-and-consistency problem, as virtual care volumes increase and the system must ensure standardized protocols, credentialing, and escalation pathways across a large and regionally distributed provider base. The country has ~ hospitals and ~ primary healthcare centers and medical complexes, supported by ~ physicians and ~ nurses, highlighting how many facilities and clinicians can potentially touch an app-mediated journey. When mobile health expands beyond simple booking into diagnosis, follow-up, and remote monitoring, clinical liability rises because care becomes distributed across digital interfaces, call centers, and multiple provider entities. A volume indicator of why governance is hard is the scale of digital interactions, with more than ~ million consultations and appointments facilitated through the national app ecosystem and ~ million users. These counts imply that even a small fraction of edge cases can become significant in absolute terms, increasing the need for consistent triage rules, documentation, and auditability.

Data Privacy and Consent Compliance

In KSA, privacy and consent compliance becomes a scaling constraint as mHealth shifts from appointment tools into clinically sensitive pathways such as teleconsult notes, eRx histories, chronic disease tracking, and remote monitoring. The magnitude of the compliance surface is reinforced by adoption scale, with ~ million users supported by the national app ecosystem, ~ million online prescriptions, and more than ~ million consultations and appointments. These are high-volume data events involving identity, health records, and medication histories, where consent, purpose limitation, access controls, and audit logging must be enforced consistently. The healthcare footprint is also large, with ~ primary healthcare centers and medical complexes and ~ hospitals, implying many institutional endpoints that may integrate with apps and exchange data. GDP of USD ~ trillion and GDP per capita of USD ~ support continued digitization investment, but also raise expectations for enterprise-grade controls. In practical terms, the compliance challenge affects time-to-contract, integration timelines, vendor due diligence, and ongoing audit readiness, making privacy and consent a gating factor for sustained growth.

Opportunities

Hospital-at-Home Enablement

Hospital-at-home growth in KSA can be supported by the combination of a sizable, distributed healthcare infrastructure that creates capacity pressure and mass adoption of digital access pathways that can orchestrate home-based follow-up. The country has ~ hospitals and ~ hospital beds per ~ population, alongside ~ primary healthcare centers and medical complexes that can act as referral and follow-up anchors. Workforce scale also supports operationalization, with ~ nurses and ~ pharmacists forming the staffing base needed for home-based monitoring, medication counseling, and escalation protocols when supported by mobile workflows. Digital adoption is already proven at scale, with more than ~ million consultations and appointments, ~ million users, and ~ million online prescriptions indicating that citizens are using mobile channels for clinically meaningful actions. GDP of USD ~ trillion and GDP per capita of USD ~ support ongoing investment in home-care enablement infrastructure. The opportunity is that vendors who can operationalize hospital-at-home can convert existing digital engagement volume into a higher-value, continuity-driven care model.

Post-Acute and Remote Monitoring Programs

Post-acute care and remote monitoring programs can scale in KSA because the system already exhibits large volumes of digital touchpoints and a sizeable pharmacy network, both essential for discharge follow-up, medication adherence, and early escalation. There are ~ private sector pharmacies enabling broad fulfilment coverage for post-discharge medication plans, alongside ~ primary healthcare centers and medical complexes that can serve as continuity nodes for follow-ups and referrals. Clinical staffing scale supports monitoring operations, with ~ physicians and ~ nurses providing the workforce base for protocolized monitoring. Digital behavior already reflects high engagement, with more than ~ million consultations and appointments and ~ million online prescriptions, suggesting that medication and follow-up interactions are happening digitally at high volume. Population of ~ million provides scale for payer- or employer-funded monitoring cohorts. The opportunity is therefore a conversion play, turning today’s digital consult and prescription volume into structured post-acute pathways delivered through mobile-first workflows and supported by dense pharmacy coverage and a large primary care footprint.

Future Outlook

Over the next phase of market development, KSA mobile health solutions are expected to expand through deeper payer embedding, more integrated care pathways (booking → consult → eRx → follow-up), and wider adoption of remote monitoring programs for chronic disease and post-acute care. Scale will increasingly be driven by enterprise distribution and by platforms that can prove clinical governance, interoperability readiness, and compliance-by-design. Competitive intensity will rise as consumer acquisition costs increase and procurement shifts toward outcomes-oriented programs.

Major Players

- Sehhaty

- Seha

- Mawid

- Tawakkalna Services

- Cura

- Altibbi

- Nahdi Medical / NahdiCare

- Vezeeta

- Okadoc

- Doctor Anywhere

- Meddy

- DabaDoc

- Healthigo

- Careem Health

Key Target Audience

- Health insurers & payer strategy teams

- Third-Party Administrators (TPAs) & claims operations leadership

- Hospital groups & integrated provider networks

- Large pharmacy chains & e-pharmacy operators

- Employer benefits buyers

- Digital-health platform operators & telehealth providers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We construct a KSA digital health ecosystem map covering regulators, providers, payers/TPAs, employers, pharmacies, and platform operators. Desk research consolidates the core demand variables (care journeys, channel access, and monetization models) and defines scope boundaries for mobile health solutions.

Step 2: Market Analysis and Construction

We compile historical market signals across app-led usage, virtual-care service volumes, and enterprise contracting patterns. The analysis models how value is created across booking, consult, eRx, and RPM pathways and how procurement differs between B2C, B2B2C, and payer panels.

Step 3: Hypothesis Validation and Expert Consultation

We validate assumptions via expert interviews with insurers/TPAs, provider digital leaders, pharmacy operators, and platform executives. This step refines adoption bottlenecks (clinical governance, integration, compliance) and verifies channel dynamics and buying criteria.

Step 4: Research Synthesis and Final Output

We synthesize findings into a triangulated view of market structure, segmentation logic, and competitive positioning. The output is finalized through cross-checks with disclosed market figures and consistency tests against platform model economics and contracting pathways.

- Executive Summary

- Research Methodology (Market Definitions and Scope Boundaries, KSA-Specific Assumptions, Abbreviations, Market Engineering Framework, Top-Down Sizing and Bottom-Up Sizing, Primary Research Approach, Expert Validation Approach, Data Triangulation and Consistency Checks, Bias Controls, Limitations and Forward-Looking Considerations)

- Definition and Scope

- Market Evolution and Digital-Health Inflection Points

- KSA Digital-Health Service Stack

- Patient Journeys Addressed by Mobile Health

- KSA Healthcare Digital Operating Model Snapshot

- Growth Drivers

MOH Digital Platforms Pull

Chronic Disease Management Demand

Provider Capacity Optimization

Insurance Workflow Digitization

Pharmacy and Homecare Integration

Arabic-First UX Adoption - Challenges

Clinical Governance and Liability

Data Privacy and Consent Compliance

Interoperability Constraints

Provider Workflow Adoption Barriers

Fraud and Misuse Risks - Opportunities

Hospital-at-Home Enablement

Post-Acute and Remote Monitoring Programs

Employer-Led Preventive Health Programs

Women’s Health and Family Care Platforms

Rural and Peripheral Region Access - Trends

AI-Based Symptom Triage

Integrated Booking-to-eRx Journeys

Connected Medical Device Integration

Payer-Embedded Digital Front Doors

Virtual Specialty Clinics - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Active User Base, 2019–2024

- By Transaction Volume, 2019–2024

- Service Revenue Mix, 2019–2024

- By Application (in Value %)

Teleconsult

e-Booking

Remote Patient Monitoring

e-Prescription and Medication Adherence

Chronic Care Programs - By End-Use Industry (in Value %)

Patients and Consumers

Hospitals and Clinics

Pharmacies

Payers and TPAs

Employers and Occupational Health - By Technology Architecture (in Value %)

Marketplace-Led Platforms

Network-Integrated Platforms

Hybrid Care Platforms

Fully Virtual Care Platforms - By Connectivity Type (in Value %)

Standalone Mobile Apps

EMR-Integrated Platforms

Claims and Payer-Integrated Platforms

Device and IoT-Integrated Platforms - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market Concentration and Positioning

Market Share Assessment Framework - Cross Comparison Parameters (NPHIES and insurance workflow readiness, PDPL health-data governance maturity, SFDA digital health classification exposure, Arabic-first clinical UX depth, provider network breadth, integration depth across scheduling and eRx, care pathway performance tooling, cybersecurity and NCA ECC compliance)

- SWOT Analysis of Key Players

- Pricing and Content Benchmarking

- Detailed Profiles of Major Companies

Sehhaty

Mawid

Seha

Tawakkalna Services

Cura

Altibbi

NahdiCare Clinics

Vezeeta

Okadoc

Doctor Anywhere

Meddy

DabaDoc

Healthigo

Careem Health

- Utilization and Demand Mapping

- Purchasing and Budget Ownership

- Decision-Making Process

- Patient Experience and Trust Factors

- Enterprise Rollout Frameworks

- By Value, 2025–2030

- By Active User Base, 2025–2030

- By Transaction Volume, 2025–2030

- Service Revenue Mix, 2025–2030