Market Overview

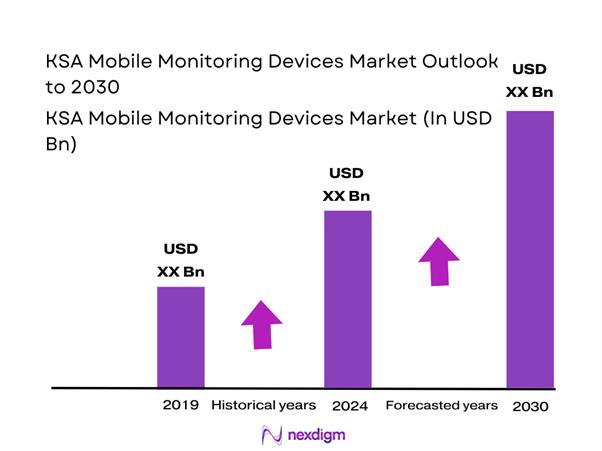

The KSA mobile monitoring devices market is valued at USD ~ million, derived from hospital procurement data, home-healthcare device shipments, and consumer wearables with clinical monitoring capabilities. The market expansion is driven by high chronic disease incidence, rising hospital admission volumes, and national healthcare digitization investments exceeding USD ~ billion. Device demand is increasingly shifting toward continuous monitoring models to reduce inpatient burden while maintaining clinical oversight.

Riyadh and Jeddah dominate adoption due to concentration of tertiary hospitals, private healthcare chains, and large insured populations. These cities host the majority of digital health pilots, remote patient monitoring programs, and advanced homecare providers, supported by high smartphone penetration, robust broadband infrastructure, and stronger reimbursement experimentation compared to secondary cities.

Market Segmentation

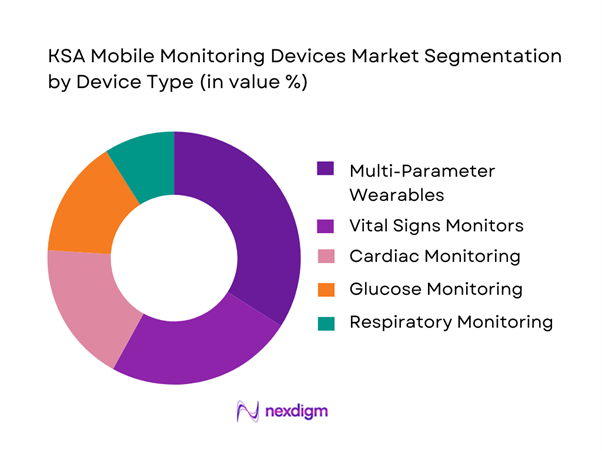

By Device Type

The market is segmented into vital signs monitors, cardiac monitoring devices, glucose monitoring devices, respiratory monitoring devices, and multi-parameter wearable monitors. Multi-parameter wearable monitors dominate, accounting for ~ market share, due to their ability to capture heart rate, oxygen saturation, temperature, and activity data in a single platform. Hospitals and homecare providers increasingly prefer consolidated devices to reduce equipment complexity, improve clinician dashboards, and enable early warning systems across multiple conditions without deploying multiple standalone devices.

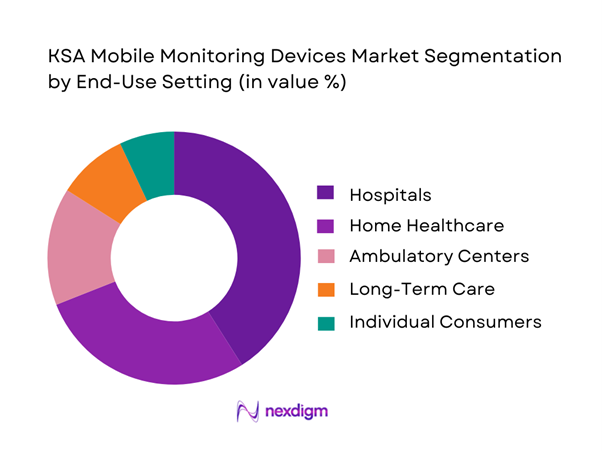

By End-Use Setting

End-use segmentation includes hospitals, home healthcare, ambulatory care centers, long-term care facilities, and individual consumers. Hospitals lead with ~ share, driven by ICU overflow management, post-discharge monitoring mandates, and nurse workload optimization. Large hospital systems increasingly deploy mobile monitoring kits for step-down patients and early discharge programs, reducing average length of stay while maintaining clinical vigilance through centralized command centers.

Competitive Landscape

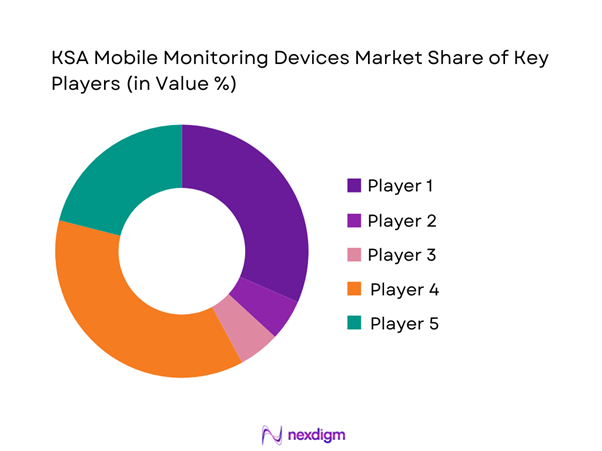

The market is moderately consolidated, led by global medical device manufacturers with strong regulatory approvals and enterprise-grade platforms, alongside consumer electronics brands expanding into clinical-grade monitoring.

| Company | Est. Year | HQ | Device Breadth | Clinical Validation | Connectivity Depth | Enterprise Dashboard | KSA Presence |

| Philips Healthcare | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ |

| GE HealthCare | 1892 | USA | ~ | ~ | ~ | ~ | ~ |

| Medtronic | 1949 | USA | ~ | ~ | ~ | ~ | ~ |

| Masimo | 1989 | USA | ~ | ~ | ~ | ~ | ~ |

| Abbott | 1888 | USA | ~ | ~ | ~ | ~ | ~ |

KSA Mobile Monitoring Devices Market Analysis

Growth Drivers

Hospital Bed Optimization Pressure

Saudi Arabia’s inpatient capacity pressure is structural: the Kingdom had ~ hospitals and ~ hospital beds in the latest system-wide count, translating to ~ beds per ~ people—a ratio that tightens quickly when high-acuity admissions spike and length-of-stay is not actively managed through step-down monitoring. With the national population at ~ and GDP at USD ~ trillion, the operating imperative is to preserve scarce bed-days for cases that truly need on-site escalation while shifting stable follow-ups to monitored pathways. This is exactly where mobile monitoring devices become bed-capacity levers: they allow earlier discharge with continuity of vitals capture, enable virtual rounding, and reduce avoidable readmissions from unrecognized deterioration. National virtual-care infrastructure is already sized for this logic, creating remote escalation capacity that pairs naturally with device-driven monitoring for post-discharge cohorts and high-risk outpatients.

Rising Chronic Disease Burden

The demand base for mobile monitoring in KSA is anchored in chronic-care volumes that require frequent biomarker checks, not episodic visits. One concrete signal is the expansion of digital clinical registries, reflecting the scale at which providers are already digitizing longitudinal disease management and, by extension, creating demand for device-fed home readings that can populate records without repeated facility visits. Renal care adds a second high-intensity use case, with the Kingdom hosting more than ~ peritoneal dialysis patients, and a significant portion already on a remote patient monitoring setup—proof that device-enabled monitoring is being operationalized in real clinical workflows for chronic populations. When this chronic load sits within a macro context of a population at ~ and an economy at USD ~ trillion, the health system’s cost of manual follow-up rises, making connected devices a practical necessity for continuity rather than a pilot concept. These numeric markers translate into a credible installed-base runway for broader mobile monitoring adoption in cardiometabolic, respiratory, and post-acute segments.

Challenges

Device Integration with Hospital IT Systems

Integration complexity is a primary bottleneck because KSA is simultaneously scaling national digital exchange and standardization expectations. The Council for Health Insurance ecosystem alone spans ~ provider organizations, ~ insurers, and ~ TPAs, collectively servicing ~ beneficiaries—a multi-entity environment where device data must map cleanly into clinical documentation, claims workflows, and national interoperability rules rather than remain siloed in vendor dashboards. That scale turns integration into an operational risk, requiring alignment with structured data requirements and integration across heterogeneous hospital information systems. In practice, hospital IT teams must reconcile data flows from wearables, home devices, and apps into EHRs and care management systems while maintaining clinical-grade data quality, time-stamping, and traceability. This challenge is amplified by system load, as the health system employs ~ doctors and ~ nurses, and any integration that increases clicks or alert fatigue will face pushback. Successful device adoption therefore depends less on hardware and more on deep integration within a national ecosystem operating at multi-million beneficiary scale.

Data Localization & Cybersecurity Constraints

Mobile monitoring depends on continuous health data transmission, but KSA’s regulatory and security environment requires tight control over where sensitive data is stored and how it is protected. The Personal Data Protection Law sets formal obligations around personal data handling, forcing RPM providers and device-cloud vendors to operationalize lawful bases, consent, retention controls, and regulated cross-border transfer decisions as immediate requirements rather than later-stage enhancements. Cybersecurity expectations are also rising in parallel, with the Kingdom’s cybersecurity market reaching SAR ~ billion, supported by ~ registered providers and ~ cybersecurity professionals—evidence of both heightened threat awareness and expanding compliance oversight capacity. For mobile monitoring devices, these conditions translate into practical constraints including local hosting, encryption key management, incident response readiness, vendor risk assessments, and audit trails for data access. In hospital settings, where device data may feed clinical decisions, any breach or downtime is treated as patient safety risk, increasing procurement scrutiny and slowing deployment unless vendors demonstrate security-by-design and compliant data residency architecture.

Opportunities

Hospital-at-Home Programs

KSA’s current infrastructure strongly supports hospital-at-home growth anchored in monitored care without relying on speculative future numbers. The strongest enabling asset is national virtual hospital infrastructure that already supports ~ hospitals, offers ~ specialized services plus ~ sub-specialties, employs ~ physicians, and is designed to serve ~ patients annually. These are the operational ingredients needed for hospital-at-home triage, escalation, and specialist cover while patients remain at home. When combined with the scale of digital patient journeys, with ~ users and more than ~ consultations and appointments, KSA has a large population already accustomed to remote interactions, which lowers behavioral barriers to monitored home recovery. The opportunity for mobile monitoring devices is to formalize these pathways around high-volume case mixes that directly reduce avoidable bed occupancy. Macro fundamentals support sustained investment, with population at ~ and GDP per capita at USD ~ indicating capacity to expand reimbursed care models and home health services. The immediate commercial upside for device players lies in enterprise programs aligned with national virtual hospital capacity and provider operational priorities.

AI-Based Clinical Decision Support

AI-driven decision support becomes commercially realistic in KSA because the Kingdom already has high digital encounter volumes and strong governance pressure for secure, compliant data handling. On the demand side, more than ~ digital consultations and appointments and national-scale virtual hospital operations imply an environment where triage prioritization, risk scoring, and alert management can materially reduce clinician burden when combined with continuous streams from mobile monitoring devices. On the supply and compliance side, a cybersecurity ecosystem valued at SAR ~ billion and staffed by ~ professionals indicates growing capacity to secure AI pipelines, APIs, and connected device environments. Meanwhile, data protection obligations require AI solutions to be privacy-aware and governance-ready, pushing vendors toward transparent model documentation, access control, and auditable decision logic. The near-term opportunity for mobile monitoring vendors is to pair devices with clinically useful AI that reduces noise so clinicians see fewer but higher-value alerts. This positioning aligns with KSA’s operational constraints, including workforce scale, chronic disease follow-up needs, and the national drive to make virtual care clinically robust.

Future Outlook

Over the next five years, the KSA mobile monitoring devices market will transition from device-led sales to platform-centric care models. Growth will be driven by hospital-at-home expansion, payer-supported remote monitoring programs, AI-driven alert systems, and tighter integration with national electronic health records. Devices offering predictive analytics, multilingual interfaces, and compliance-ready data hosting will gain disproportionate traction.

Major Players

- Philips Healthcare

- GE HealthCare

- Medtronic

- Masimo

- Abbott

- Omron Healthcare

- iRhythm Technologies

- Withings

- Biotronik

- Nihon Kohden

- Mindray

- Xiaomi Health

- Garmin Health

- Dräger

Key Target Audience

- Hospital Groups & Health Systems

- Home Healthcare Providers

- Digital Health Platform Operators

- Medical Device Distributors

- Insurance & Payer Organizations

- Government & Regulatory Bodies

- Investment & Venture Capital Firms

- Corporate Healthcare Buyers

Research Methodology

Step 1: Identification of Key Variables

An ecosystem map was developed covering hospitals, homecare providers, regulators, distributors, and device OEMs, supported by extensive secondary research.

Step 2: Market Construction

Historical shipment volumes, procurement values, and installed base data were analyzed to construct bottom-up revenue estimates.

Step 3: Hypothesis Validation

CATI interviews were conducted with clinicians, procurement heads, and distributors to validate usage patterns and pricing logic.

Step 4: Final Synthesis

Primary insights were triangulated with institutional data to finalize market sizing and competitive positioning.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Device Scope Boundaries, Abbreviations, Top-Down & Bottom-Up Market Sizing Logic, Demand-Side Validation Through Hospital & Homecare Interviews, Primary Research Framework, Data Triangulation, Forecasting Assumptions, Limitations & Forward-Looking Considerations)

- Definition and Clinical–Consumer Scope

- Market Evolution within KSA Digital Health Ecosystem

- Device Adoption Timeline across Care Settings

- Healthcare Digitalization Business Cycle

- Medical Device Supply Chain & Value Chain Mapping

- Growth Drivers

Hospital Bed Optimization Pressure

Rising Chronic Disease Burden

National Digital Health Investments

Remote Patient Monitoring Adoption - Challenges

Device Integration with Hospital IT Systems

Data Localization & Cybersecurity Constraints

Clinical Workflow Resistance

High Device Validation Requirements - Opportunities

Hospital-at-Home Programs

AI-Based Clinical Decision Support

Payer-Supported Remote Monitoring Models - Trends

Sensor Miniaturization

Cloud-Based Monitoring Dashboards

Predictive Analytics Integration - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- Installed Base, 2019–2024

- Average Selling Price Dynamics, 2019–2024

- By Fleet Type (in Value %)

Hospital-Deployed Monitoring Devices

Home-Based Monitoring Devices

Consumer-Grade Mobile Monitoring Devices - By Application (in Value %)

Chronic Disease Monitoring

Post-Acute & Discharge Monitoring

Preventive Health Monitoring

Emergency & Critical Care Monitoring - By Technology Architecture (in Value %)

Single-Parameter Devices

Multi-Parameter Monitoring Platforms

AI-Enabled Predictive Monitoring Systems - By Connectivity Type (in Value %)

Bluetooth-Enabled Devices

Cellular-Enabled Devices

Wi-Fi Enabled Devices

Hybrid Connectivity Devices - By End-Use Industry (in Value %)

Hospitals

Home Healthcare Providers

Ambulatory Care Centers

Long-Term Care Facilities

Individual Consumers - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market Share Snapshot by Device Category

- Cross Comparison Parameters (installed device base, clinical accuracy certification depth, interoperability score, data hosting compliance, battery life cycle, remote alert latency, enterprise dashboard maturity, post-sales service SLA)

- SWOT Benchmarking of Major Players

- Pricing and ASP Benchmarking

- Detailed Company Profiles

Philips Healthcare

GE HealthCare

Medtronic

Masimo

Abbott

Omron Healthcare

iRhythm Technologies

Withings

Biotronik

Nihon Kohden

Mindray

Xiaomi Health

Garmin Health

Dräger

- Utilization Patterns

- Budget Allocation Logic

- Procurement & Tendering Process

- Clinical and Operational Pain Points

- Decision-Making Hierarchy

- By Value, 2025–2030

- Installed Base, 2025–2030

- Average Selling Price Dynamics, 2025–2030