Market Overview

The Saudi Arabia moisturizing dermatology creams market sits within the broader skincare category which was valued at USD ~ million in the Kingdom, according to one analysis using the 2024 base year. Using a separate source, the skincare market is valued at USD 325.83 million in 2024. Within this context, the moisturizing dermatology creams segment is being driven by desert climate conditions that create persistent skin-barrier damage and dryness, increased dermatologist visits, higher disposable income and greater adoption of premium, halal-certified and clinically-tested formulations. The heavy import dependency of the KSA market also means brands are investing in localized manufacturing and distribution to capture the growth.

In Saudi Arabia the largest share of demand for moisturising dermatology creams comes from the Riyadh metropolitan area and the surrounding Central region because of the high urban concentration, elevated incomes, an affluent and brand-aware population, and a greater presence of specialty dermatology clinics and premium retail. Similarly, the Western region (Jeddah and Makkah) plays a major role due to high expat population, tourism and luxury retail infrastructure drawing in premium skincare spend. The Eastern region (Dammam/Al Khobar) is also significant owing to its industrial wealth, high disposable incomes and established pharmacy & hospital networks stocking dermatology-moisturiser formulations.

Market Segmentation

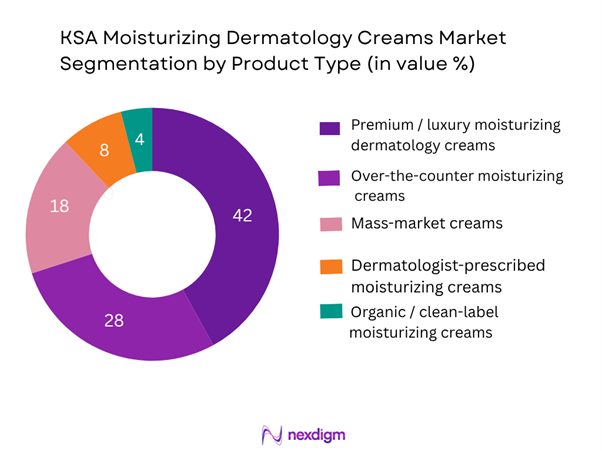

By Product Type

The market for moisturizing dermatology creams in Saudi Arabia is segmented by product type into: (i) Dermatologist-prescribed moisturizing creams; (ii) Over-the-counter (OTC) moisturizing creams; (iii) Premium / luxury moisturizing dermatology creams; (iv) Mass-market/value moisturizing creams; (v) Organic/clean-label moisturizing dermatology creams. Among these, the Premium / luxury segment dominates share at present. This dominance is primarily due to the high spending power of affluent KSA consumers, the attractiveness of clinical-derm-backed brands, and the climate-induced need for higher-performance formulations (barrier repair, ceramides, hyaluronic acid). Brands offering dermatologist endorsement and halal certification have captured affluent consumers in Riyadh, Jeddah and Eastern region, driving premium pricing and higher unit values. Meanwhile, OTC and mass-market segments are growing but still trail in value due to lower price points and less brand differentiation in the dermo-moisturiser category.

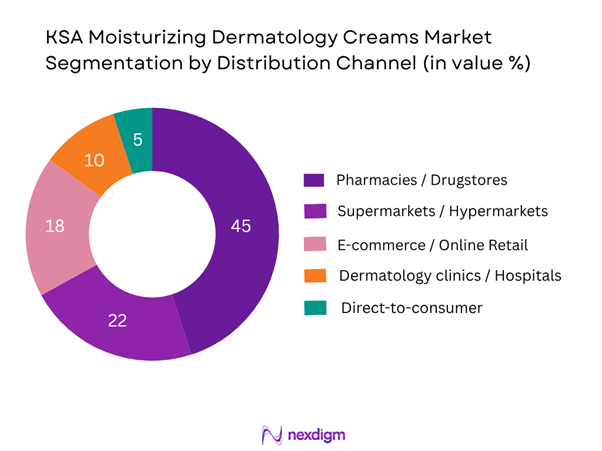

By Distribution Channel

The market is further segmented by distribution channel into: (i) Pharmacies / Drugstores; (ii) Dermatology clinics / Hospitals; (iii) Supermarkets / Hypermarkets & Beauty Specialty Retail; (iv) E-commerce / Online Retail; (v) Direct-to-consumer & Subscription Models. Among these, the Pharmacies / Drugstores channel currently holds the dominant market share. This is due to the high consumer trust in pharmacists and derm-product recommendations, wide penetration of pharmacy chains in urban centres, and the fact that many moisturizing dermatology creams straddle the cosmetic-therapeutic divide and thus are stocked in pharmacy outlets rather than purely in supermarket aisles. Further, dermatology clinics/hospitals also contribute but less in volume compared to pharmacies. E-commerce is the fastest growing channel but still smaller in overall share.

Competitive Landscape

The KSA moisturizing dermatology creams market is characterised by the presence of global dermo-cosmetic brands, regional distributors, and local private-label manufacturers. A moderate number of major players dominate value share, emphasising premium positioning, halal certification, dermatologist endorsements and e-commerce distribution. The consolidation among key players allows for strong brand equity, broad distribution networks and formulation innovation, which raises entry barriers for smaller players.

| Company | Establishment Year | Headquarters | Portfolio Depth | Saudi Local Manufacturing/Presence | Distribution Reach KSA | Dermatologist Endorsement Strategy | Pricing Tier (Mass / Premium) |

| L’Oréal Saudi Arabia | 1909 (global) | Clichy, France | – | – | – | – | – |

| Beiersdorf AG (Eucerin/NIVEA) | 1882 | Hamburg, Germany | – | – | – | – | – |

| Johnson & Johnson Consumer KSA | 1946 (global) | New Brunswick, USA | – | – | – | – | – |

| Galderma Arabia | 1981 (global) | Lausanne, Switzerland | – | – | – | – | – |

| Unilever Arabia | 1929 (global) | London/Rotterdam | – | – | – | – | – |

KSA Moisturizing Dermatology Creams Market Analysis

Growth Drivers

Rising skin dryness due to desert climate + air-conditioning

Saudi Arabia’s climate is extremely arid: the annual average relative humidity across the Kingdom stands at about 32 per cent, with inland desert temperatures regularly reaching 40 °C or more. Such hot, dry conditions damage the skin barrier and elevate consumer need for high-performance moisturising/dermatology creams. Additionally, widespread air-conditioning in urban homes and offices further lowers indoor humidity, intensifying skin dehydration. These combined environmental stressors lead to increased demand for barrier-repair and dermatology-grade moisturisers in Saudi Arabia.

Increasing dermatologist visits

Dermatology-related presentations remain significant in Saudi hospitals: a study of a tertiary-care centre in Riyadh in 2024 recorded 11,443 dermatology-related emergency department visits within the year. While many of these relate to acute conditions, the high volume underscores a broad base of dermatological disease burden, clinic visits, and awareness of skin health. As consumers consult dermatologists more frequently, prescriptions or recommendations of specialised moisturising dermatology creams rise, supporting the adoption of premium dermo-moisturiser products in the Saudi market.

Market Challenges

High penetration of imported brands

Saudi Arabia’s cosmetics ecosystem relies heavily on imported skincare and dermo-cosmetic brands. As of 2023, imports of halal-related products (including cosmetics) amounted to SAR 124.4 billion (USD 33.2 billion) in the Kingdom. The dominance of global brands creates a competitive environment making it difficult for local manufacturers or newer brands to secure shelf space, establish distribution or offer differentiating value. This reliance on imports also means high competition on pricing, brand recognition and consumer loyalty, limiting margin expansion for domestic entrants in the moisturising dermatology creams segment.

Regulatory compliance

The regulatory regime for cosmetics in Saudi Arabia is stringent: for example, the Saudi Food & Drug Authority (SFDA) requires each imported or locally-manufactured cosmetic product to undergo a detailed notification process under the “eCosma” system, including Arabic-labelling, certificate of origin, conformity certification, and authorised local agent registration. These compliance requirements raise time-to-market, incur additional cost and create entry-barriers for smaller players. For moisturising dermatology-creams—often sitting between cosmetics and therapeutic categories—the regulatory burden is higher still, restraining agility and innovation.

Opportunities

Localisation of manufacturing

Saudi Arabia is actively pursuing localisation of manufacturing under the Saudi Vision 2030 agenda, which includes building domestic manufacturing capacity in personal care and cosmetics. With consumer spending on halal lifestyle products reaching SAR 623.7 billion (USD 166.3 billion) in 2023, there is government support and investment for local production of beauty and skin-care goods. For moisturising dermatology creams this presents an opportunity: local manufacturing enables shorter lead times, lower import duties, faster regulatory approval and KSA-specific formulation adaptation (for climate, halal/Arabic labelling). Brands investing locally can gain cost, supply-chain and regulatory advantage over import-only competitors.

Halal/clean-label positioning

The Saudi Arabia halal cosmetics market segment—covering skincare, face and body care—already reached USD 3.57 billion in 2024. Consumer demand is shifting toward ethically-sourced, halal-certified and “clean” formulations free of harsh chemicals. For the moisturising dermatology creams category, positioning products as halal-certified, fragrance-free, hypoallergenic and locally compliant offers differentiation in a crowded market. Brands that emphasise such credentials can tap both the ethical beauty trend and the strong religious-cultural alignment in KSA, thereby securing price premium and loyalty.

Future Outlook

Over the next six years the KSA moisturizing dermatology creams market is projected to witness steady growth driven by factors such as further penetration of premium dermo-moisturiser formulations, expansion of e-commerce and omnichannel retail, and increasing localisation of manufacturing in alignment with Saudi Vision 2030. Innovations such as halal-certified barrier-repair creams, male grooming moisturisers, and post-procedure skin care will open white-space opportunities. Additionally, rising consumer awareness of dermatological skin health, aided by social media and influencer engagement, will further support volume and value growth.

Assuming a CAGR of approximately 4.5% for the market period 2024-2030 (guided by related skincare and cosmetics growth studies in KSA), the market value is forecast to increase meaningfully by 2030. Tailored strategies for premium vs mass segments, channel shifts toward online, and regulatory alignment will determine winners in this evolving market landscape.

Major Players

- L’Oréal Saudi Arabia

- Beiersdorf AG (Eucerin / NIVEA)

- Johnson & Johnson Consumer Saudi Arabia

- Galderma Arabia

- Unilever Arabia

- Ego Pharmaceuticals (Middle East region)

- CeraVe (by L’Oréal, dermo-moisturiser brand)

- Bioderma Middle East

- Arab Chemists Company for Cosmetic & Medical Industries Ltd (Saudi local)

- Glow Pro International (Saudi distributor/brand)

- Labothécaire (Saudi luxury skincare brand)

- Salil Limited Company (KSA skincare manufacturer)

- Neutrogena (Johnson & Johnson)

- La Roche-Posay (L’Oréal dermo brand)

- QV Skincare (Dermatology‐moisturiser brand active in KSA)

Key Target Audience

- Brand managers and product‐development leads at dermo-cosmetic companies

- Senior sales & distribution executives in beauty & dermatology retail chains

- Investors and venture capital firms focusing on personal care / beauty start-ups

- Local manufacturing & contract‐manufacturing firms considering KSA skin‐care expansion

- Government and regulatory bodies (e.g., Saudi Food & Drug Authority (SFDA), Saudi Small & Medium Enterprises Authority)

- E-commerce platform operators and digital beauty-retail strategy leaders

- Dermatology clinics and hospital procurement teams specialising in skincare portfolios

- Importers & regional distributors serving KSA and Gulf-Cooperation-Council (GCC) markets

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of all major stakeholders in the KSA moisturizing dermatology creams market: manufacturers (global & local), dermatologists, pharmacies & drugstores, e-commerce platforms, distribution networks, regulatory bodies. Extensive desk research utilising secondary and proprietary databases was used to gather industry-level information such as market size, pricing, and channel structure.

Step 2: Market Analysis and Construction

This phase compiled and analysed historical data for the KSA market (skincare & dermo-moisturiser segments). This included assessing product penetration, value and volume growth, distribution channel mixes, and consumer-demographic adoption patterns. The revenue generation by segment and channel was evaluated to build the baseline market size.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses (e.g., premium segment growth, e-commerce channel acceleration, local manufacturing push) were developed and validated through CATI (computer-assisted telephone interviews) and email interviews with dermatologists, brand-managers, retail chain procurement leads and distribution executives operating in Saudi Arabia. Their insight helped to refine data assumptions, validate growth drivers and adjust competitive benchmarks.

Step 4: Research Synthesis and Final Output

In the final phase, direct engagement with multiple skincare manufacturers, regional distributors and retail chains provided detailed insights into product segmentation, sales performance, consumer preferences and distribution dynamics specific to KSA. The bottom-up revenue estimates were cross-checked with top-down data and adjusted for local market idiosyncrasies (e.g., climate-driven demand, halal certification, expatriate population). The end result is a validated, comprehensive analysis of the KSA moisturizing dermatology creams market.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Abbreviations & Terminology, Market Sizing Approach, Consolidated Research Approach, Primary Research Approach (expert interviews, retailer surveys, distribution channel audits in Riyadh/Jeddah/Dammam), Limitations, Data Reliability & Future Conclusions)

- Definition and Scope of the Market

- Genesis & Evolution of the Category in KSA

- Timeline of Major Product and Brand Launches

- Business Cycle & Market Maturity – adoption, penetration, growth phase

- Supply Chain & Value Chain Analysis

- Regulatory & Reimbursement Environment

- Market Ecosystem – stakeholders

- Growth Drivers

Rising skin dryness due to desert climate + air-conditioning

Increasing dermatologist visits

Social media skincare awareness - Market Challenges

High penetration of imported brands

Regulatory compliance

Counterfeit/parallel imports - Opportunities

Localisation of manufacturing

Halal/clean-label positioning

Male grooming segment - Trends

Personalised dermatology skincare

E-commerce growth

Subscription models

Influencer/derm-blogger driven - Regulatory & Reimbursement Framework

SFDA

Halal certification

Import tariffs

Labelling in Arabic

Cosmetic/therapeutic border issues - SWOT Analysis

- Stakeholder Ecosystem (Dermatologists, Dermatology Clinics, Retailers, E-commerce Platforms)

- Porter’s Five Forces Analysis

- By Value (SAR/USD), 2019- 2024

- By Volume (Units or litres/kg), 2019- 2024

- By Average Unit Price (SAR per SKU), 2019- 2024

- By Product Type (In Value %)

Dermatologist-prescribed moisturizing creams

Over-the-counter (OTC) moisturizing creams

Premium / luxury moisturizing dermatology creams

Mass market / value range moisturizing creams

Organic/clean-label moisturizing dermatology creams - By End-User Skin Condition/Application (In Value %)

Dry / very dry skin

Sensitive / irritation-prone skin

Post-dermatology (post-procedure/hyperpigmentation) use

Hijab-related skin conditions (friction / occlusion)

Men’s moisturizing dermatology creams - By Distribution Channel (In Value %)

Pharmacies / Drugstores

Dermatology clinics / hospitals

Supermarkets / Hypermarkets & Beauty Specialty Retail

E-commerce / Online retail

Direct-to-consumer & subscription models - By Ingredient / Formulation Type (In Value %)

Ceramide-rich / barrier-repair creams

Hyaluronic acid / humectant-based moisturizers

Natural / botanical actives (e.g., date-palm extract)

Fragrance-free / hypoallergenic dermatology creams

Halal-certified / wudhu-friendly formulations - By Region (In Value %)

Central Region (Riyadh & environs)

Western Region (Jeddah & Makkah)

Eastern Region (Dammam/Al Khobar)

Northern & Central smaller provinces

Southern Region (Asir, Jizan)

- Market Share of Major Players (value & volume basis, by product-type)

- Cross-Comparison Parameters (Company Overview, Business Strategy, Recent Developments & Product Launches, Strengths, Weaknesses, Distribution Network / Channel Reach, Portfolio Coverage, Manufacturing / Local Production Capacity in KSA, Pricing Strategy / Unit Price Positioning, Market Share Trend, Unique Value Proposition)

- Detailed Profiles of Major Companies

Galderma Arabia

Cetaphil

La Roche‑Posay

Ego Pharmaceuticals

QV Skincare

Arab Chemists Company for Cosmetic & Medical Industries Ltd

Glow Pro International

Labothécaire

Vince Beauty

Salil Limited Company

Eucerin

Bioderma

Neutrogena

CeraVe

2Care Medical Center

- Demand & Utilisation Patterns

- Purchasing Power & Budget Allocations

- Influencing Factors / Buying Triggers

- Needs, desires & pain-point analysis

- Customer Decision-Making Process

- Customer Cohort Profiles

- Post-purchase Behaviour & Repeat-Purchase Rates

- By Value (SAR/USD), 2025-2030

- By Volume (Units or litres/kg), 2025-2030

- By Average Unit Price (SAR per SKU), 2025-2030