Market Overview

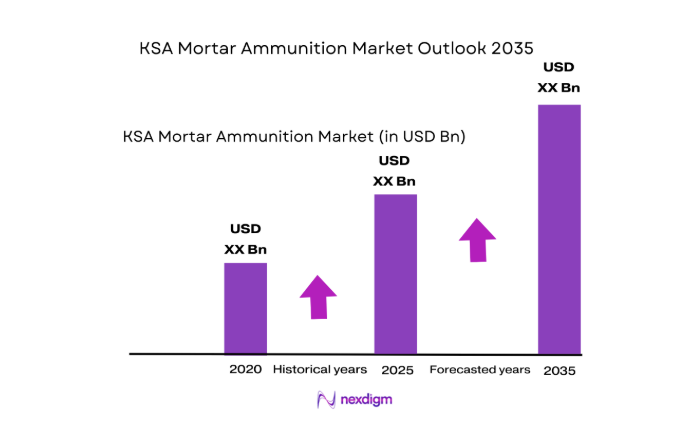

The KSA Mortar Ammunition market is valued at approximately USD ~, driven primarily by the country’s increasing defense spending and modernization of military capabilities. Saudi Arabia is investing heavily in enhancing its defense infrastructure and artillery systems, aligning with the broader regional goal of strengthening defense readiness. This is further supported by high demand for advanced mortar systems that offer superior targeting and range capabilities, especially in light of regional security concerns.

The dominant players in the KSA Mortar Ammunition market are Saudi Arabia and the surrounding GCC countries, particularly those with strong defense forces such as the UAE and Qatar. The region’s strategic position in the Middle East, coupled with the continued military collaborations between Saudi Arabia and key international defense contractors, has bolstered its position as a dominant player in the market. Additionally, the region’s high defense expenditure is contributing to the strong demand for advanced mortar systems.

Market Segmentation

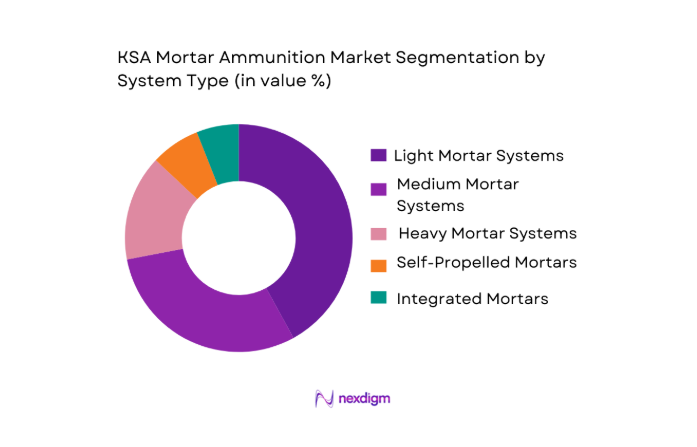

By System Type

The KSA Mortar Ammunition market is segmented by system type into light mortars, medium mortars, heavy mortars, self-propelled mortars, and integrated mortars. Among these, the light mortar systems dominate the market share. This dominance can be attributed to their versatility and ease of deployment in various military operations. Light mortars are widely used by both regular military units and special forces, providing a balance between firepower and mobility. Their cost-effectiveness compared to heavier systems also makes them the preferred choice in many scenarios. Furthermore, light mortars are being increasingly integrated into modern artillery networks, further cementing their position in the market.

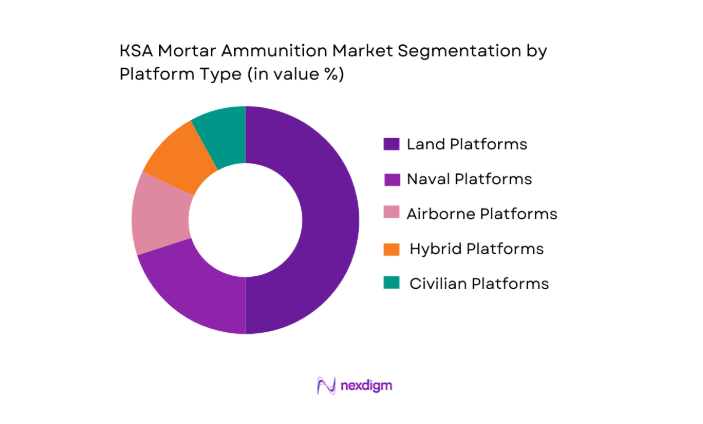

By Platform Type

The KSA Mortar Ammunition market is also segmented by platform type into land-based platforms, naval platforms, airborne platforms, hybrid platforms, and civilian platforms. The land-based platforms segment holds the dominant market share, largely due to the ongoing military operations and the need for ground-based artillery in defense strategies. Mortars deployed on land platforms are crucial for providing support during ground-based combat operations. Additionally, land-based mortars can be quickly mobilized and deployed in various terrains, making them an essential part of the military’s artillery arsenal. The increasing investment in land-based military platforms, such as armored vehicles and mobile artillery, is contributing to the dominance of this segment.

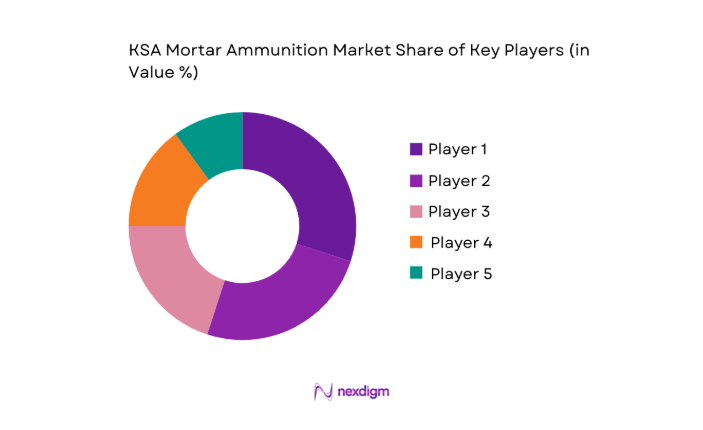

Competitive Landscape

The KSA Mortar Ammunition market is dominated by a few major players who provide advanced and reliable mortar systems. Companies like Lockheed Martin, BAE Systems, and Rheinmetall are at the forefront due to their established global presence, extensive research and development in artillery technology, and strong defense contracts with Saudi Arabia. These companies have the technological capabilities to meet the rigorous demands of modern military operations, ensuring that they remain leaders in the market. Additionally, the increasing defense budget of Saudi Arabia and strategic defense partnerships continue to create opportunities for these global defense giants.

| Company | Establishment Year | Headquarters | Defense Contracts | R&D Investment | Product Innovation | Strategic Partnerships |

| Lockheed Martin | 1995 | USA | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ |

| Rheinmetall | 1980 | Germany | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ |

| General Dynamics | 1948 | USA | ~ | ~ | ~ | ~ |

KSA Mortar Ammunition Market Dynamics

Growth Drivers

Increasing Military Spending in Saudi Arabia

Saudi Arabia has been consistently increasing its defense spending to strengthen its military capabilities. In 2024, Saudi Arabia’s military expenditure is projected to reach approximately USD ~, maintaining its position as the largest defense spender in the Middle East. This rise in defense budget is driven by the need to modernize the military and prepare for potential regional conflicts. The government is emphasizing the enhancement of the defense sector, focusing on high-tech systems, including advanced mortars. This is in line with Saudi Arabia’s Vision 2030, which highlights defense sector modernization as a key objective to boost national security.

Strategic Defense Partnerships in the Middle East

Saudi Arabia’s strategic defense partnerships in the Middle East have been crucial in strengthening its military and defense capabilities. The Kingdom continues to collaborate with major global defense contractors such as the U.S., the U.K., and France, contributing significantly to its mortar systems and artillery modernization programs. As of 2024, Saudi Arabia remains one of the largest recipients of foreign military sales from the U.S., which includes advanced mortar systems and artillery technology. These partnerships not only help improve the operational readiness of Saudi forces but also enhance the country’s defense technology.

Market Challenges

High Maintenance Costs

One of the major challenges facing the KSA Mortar Ammunition market is the high maintenance costs associated with advanced mortar systems. Saudi Arabia’s procurement of high-tech mortar systems from global suppliers often involves complex maintenance contracts, requiring significant investments for parts replacement, repairs, and system upgrades. The operational cost for mortar systems in the Kingdom is estimated to increase by over 10% annually due to these maintenance requirements. This is a substantial burden on the defense budget, which limits the number of systems that can be deployed and maintained effectively.

Limited Local Manufacturing Capabilities

Saudi Arabia’s reliance on foreign suppliers for mortar systems is another key challenge in the market. The Kingdom’s local manufacturing capabilities for advanced artillery systems, including mortars, are currently limited. While there have been efforts to establish defense manufacturing in the country, local production of high-tech systems still lags behind global standards. The lack of advanced manufacturing infrastructure forces Saudi Arabia to depend heavily on imports for cutting-edge mortar technology, which increases overall procurement costs and leads to potential delays in supply.

Market Opportunities

Technological Advancements in Mortar Ammunition

Technological advancements in mortar ammunition present significant opportunities for growth in the KSA Mortar Ammunition market. The Kingdom is heavily investing in the research and development of next-generation mortar systems, focusing on integrating smart technologies such as automated targeting, increased precision, and advanced guidance systems. In 2024, the global military R&D expenditure is projected to reach USD ~, with a significant portion allocated to advancements in mortar technologies. As the demand for precision-guided munitions rises, Saudi Arabia’s investment in advanced mortar systems will position it to lead in this technological shift.

Growing Demand from International Defense Collaborations

International defense collaborations present a growing opportunity for Saudi Arabia to expand its mortar ammunition capabilities. Through strategic alliances with other Gulf Cooperation Council (GCC) nations and global powers, Saudi Arabia is poised to increase its access to innovative mortar systems and technologies. Collaborative projects, such as joint military exercises and defense procurement programs, are expected to boost demand for sophisticated mortar systems, especially with the rising security threats in the region. Additionally, these collaborations offer access to global expertise and cutting-edge innovations that will enhance the operational effectiveness of Saudi Arabia’s defense forces.

Future Outlook

Over the next decade, the KSA Mortar Ammunition market is expected to experience steady growth, fueled by continued military modernization and the expanding defense budget of Saudi Arabia. The ongoing regional security challenges and the increasing emphasis on enhancing military capabilities will further drive demand for advanced mortar systems. Additionally, the adoption of next-generation mortar technology, including autonomous and smart systems, will significantly contribute to the evolution of the market.

Major Players

- Lockheed Martin

- BAE Systems

- Rheinmetall

- Elbit Systems

- General Dynamics

- Thales

- L3Harris Technologies

- Saab

- Leonardo

- Northrop Grumman

- Oshkosh Defense

- Hanwha Defense

- Indra Sistemas

- Denel Dynamics

- Rosoboronexport

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military and defense contractors

- Government defense procurement agencies

- International defense alliances

- Military logistics and equipment suppliers

- Defense technology research institutions

- Private defense sector investors

Research Methodology

Step 1: Identification of Key Variables

The first step in this study involves identifying the key variables that affect the KSA Mortar Ammunition market, such as defense spending, military procurement patterns, and technological advancements in mortar systems. We rely heavily on secondary research and proprietary industry reports to identify these variables and define their impact on market trends.

Step 2: Market Analysis and Construction

Historical data on defense spending, military contracts, and mortar system adoption will be analyzed to build the market model. This step will also involve assessing the penetration of mortar systems across various military platforms in Saudi Arabia and the broader GCC region.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses formed in the earlier stages will be validated through consultations with military experts and defense industry professionals. These interviews will help refine the understanding of market dynamics and validate the assumptions related to product adoption, military strategies, and procurement patterns.

Step 4: Research Synthesis and Final Output

Finally, data from various primary and secondary sources will be synthesized to provide a comprehensive view of the KSA Mortar Ammunition market. The research will culminate in detailed insights about market size, segmentation, dynamics, and competitive landscape.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Military Spending in Saudi Arabia

Strategic Defense Partnerships in the Middle East

Modernization of Mortar Systems for Enhanced Accuracy - Market Challenges

High Maintenance Costs

Limited Local Manufacturing Capabilities

Stringent International Regulations - Market Opportunities

Technological Advancements in Mortar Ammunition

Growing Demand from International Defense Collaborations

Increased Focus on Self-Defense and Security Systems - Trends

Adoption of Smart Mortar Systems

Integration of Automation & AI in Ammunition Systems

Surge in Private Sector Investment in Defense - Swot Analysis

- Porters Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Light Mortar Systems

Medium Mortar Systems

Heavy Mortar Systems

Self-Propelled Mortar Systems - By Platform Type (In Value%)

Land-Based Platforms

Naval Platforms

Airborne Platforms

Hybrid Platforms

Civilian Platforms - By Fitment Type (In Value%)

OEM

Aftermarket

Refurbished Systems

Retrofit Kits - By EndUser Segment (In Value%)

Military

Defense Contractors

Government & Law Enforcement

Private Sector

International Alliances - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Vendors

Government & Defense Procurement

Online Platforms

- Market Share Analysis

- Cross Comparison Parameters (Price per unit, system performance, geographic distribution, innovation rate, market accessibility)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Boeing

Rheinmetall

Elbit Systems

Northrop Grumman

BAE Systems

General Dynamics

Saab

Thales

L3Harris Technologies

Oshkosh Defense

Leonardo

Hanwha Defense

Indra Sistemas

Denel Dynamics

- Increasing Military Modernization Programs

- Demand from Tactical Operations Units

- Growing Focus on Homeland Security

- Shift Towards Domestic Manufacturing Partnerships

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035