Market Overview

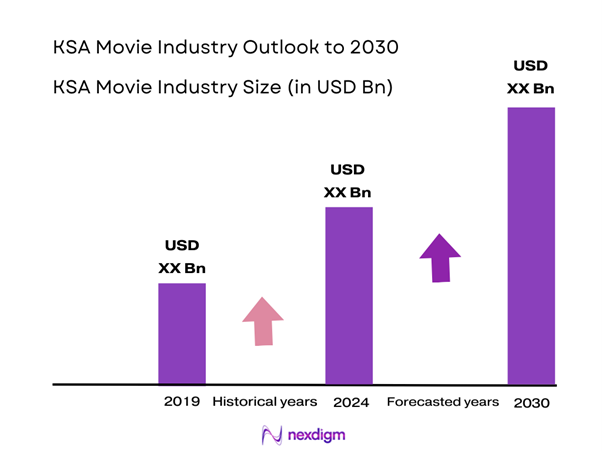

The KSA Movie Industry is valued at USD ~ million in 2024 with an approximated compound annual growth rate (CAGR) of 8.5% from 2024-2030, based on a five-year historical analysis, and has been propelled by significant investments in cinema infrastructure and content production. Rising consumer demand for diverse cinematic experiences and the introduction of various global brands in the market have contributed to this growth.

Cities such as Riyadh, Jeddah, and Dammam dominate the KSA Movie Industry, driven by their large populations and robust economic dynamics. Riyadh, as the capital and largest city, has seen a surge in cinema openings and film-related events, establishing it as a cultural hub. Jeddah, known for its cultural significance and coastal attractions, complements this by attracting both local and international filmmakers, while Dammam caters to the Eastern Province’s active consumer base, thereby reinforcing the overall growth of the industry.

The licensing requirements in the KSA Movie Industry are designed to safeguard cultural integrity while facilitating the growth of cinema. As part of the regulatory framework, film producers must undergo a rigorous approval process, which can include reviews by the General Commission for Audiovisual Media. In 2023, approximately 300 films submitted for approval faced scrutiny, reflecting the regulatory body’s commitment to ensuring quality and cultural relevance. While these requirements aim to protect national values, the licensing process can also lead to delays, impacting the timely release of films. However, adherence to these regulations demonstrates a commitment to maintaining industry standards.

Market Segmentation

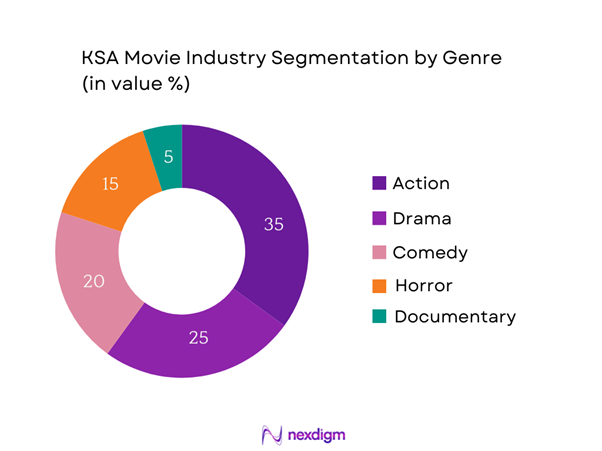

By Genre

The KSA Movie Industry is segmented by genre into action, drama, comedy, horror, and documentary. Recently, the action genre has dominated the market share, accounting for 35% of the total market in 2024. This dominance can be attributed to the widespread appeal of action films, often characterized by high budgets, special effects, and international collaborations. These films tend to attract larger audiences, driving ticket sales and revenue. Additionally, action films have a strong presence in marketing campaigns and promotional activities, further enhancing their visibility among moviegoers.

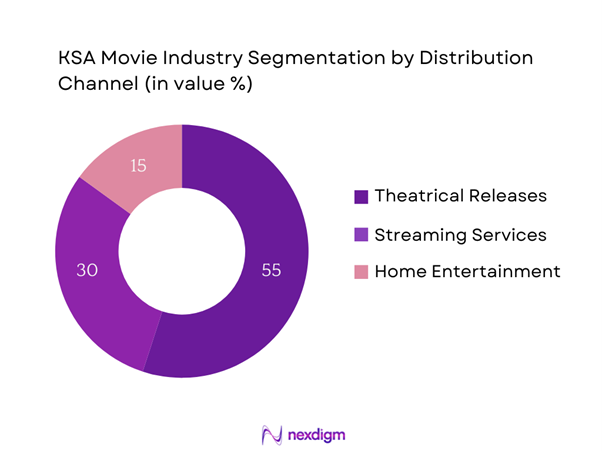

By Distribution Channel

The KSA Movie Industry is also segmented by distribution channel into theatrical releases, streaming services, and home entertainment. The theatrical releases segment is the market leader, holding a 55% share in 2024, driven by the cultural significance of cinema-going experiences in Saudi Arabia. The expansion of cinema chains and the successful launch of blockbuster movies have amplified the appeal of cinema as a social activity. While streaming services have gained traction, the unique experience of watching films on the big screen continues to resonate strongly with audiences, ensuring that theatrical releases remain a cornerstone of the industry.

Competitive Landscape

The KSA Movie Industry is characterized by a few major players, including local cinema chains and international film distributors. The competition is solidified around companies that possess robust distribution networks and significant market influence.

| Company | Establishment Year | Headquarters | Number of Theaters | Major Genres Offered | Notable Collaborations | Revenue (Est.) |

| AMC Cinemas | 1920 | Riyadh | – | – | – | – |

| VOX Cinemas | 2015 | Dubai | – | – | – | – |

| MUVI Cinemas | 2019 | Riyadh | – | – | – | – |

| Saudi Film Council | 2018 | Riyadh | – | – | – | – |

| National Film Corporation | 2020 | Jeddah | – | – | – | – |

KSA Movie Industry Analysis

Growth Drivers

Increasing Box Office Revenues

The KSA Movie Industry has seen a significant rise in box office revenues, with total admissions reaching 10 million in 2023, highlighting the growing consumer engagement with cinema. Furthermore, the government’s initiatives to promote the entertainment sector, including the lifting of bans on cinemas in previous years, have led to a more vibrant box office environment. This positive trend is supported by the overall economic growth in Saudi Arabia, projected to be around 2.8% in 2024, which suggests an increasing disposable income for the population, thereby boosting entertainment spending.

Growth in Cinema Infrastructure

Over the past few years, significant investments have been made in the cinema infrastructure within the Kingdom. As of 2023, the number of cinema screens doubled to 600 from just a few hundred a couple of years earlier, indicating aggressive expansion within the industry. This growth aligns with the Saudi Vision 2030 initiative that aims to diversify the economy, with potential investments in infrastructure projected to exceed USD 64 billion. Such enhancements in cinema infrastructure create better viewing experiences and attract a larger audience base.

Market Challenges

Piracy Issues

Piracy remains a substantial challenge for the KSA Movie Industry, with around 48% of the population engaging in some form of content piracy according to reports from the Ministry of Culture. This poses a significant threat to revenues and stifles the growth of legitimate content distribution channels. Furthermore, the enforcement of copyright protections is still developing, leading to an estimated loss of over USD 500 million annually due to piracy. Such issues hinder the potential return on investment for filmmakers and negatively affect the overall industry growth trajectory.

Regulatory Compliance

Navigating the regulatory landscape in the KSA Movie Industry can be challenging for local and international filmmakers. Various compliance requirements, including licensing and censorship, can often lead to delays and increased costs in film production. In 2023 alone, there were over 50 films that faced stricter scrutiny under the General Commission for Audiovisual Media. The industry’s regulatory requirements aim to maintain cultural integrity; however, the stringent controls may stifle creativity and deter foreign investments, with compliance costs for new entrants averaging around USD 150,000.

Opportunities

Expansion of International Collaborations

The potential for international collaborations in the KSA Movie Industry is substantial, with recent partnerships showcasing Saudi talent on global platforms. In 2023, Saudi Arabia co-produced over 10 films with international studios, reflecting an openness to integrating global cinematic standards. This push for collaborations is further supported by the country’s desire to host film festivals and invite international talent, with around 1.2 million tourists expected to attend film-related events in the coming years. Such collaborations can help develop local skill sets while enhancing the reputation of the Saudi film industry globally.

Adoption of Advanced Technology in Filmmaking

The shift towards advanced technology in filmmaking opens up new avenues for the KSA Movie Industry. With large investments in digital filming techniques and post-production processes, the industry is moving towards industry-standard technologies. By utilizing state-of-the-art technology, including CGI and VR, local films are becoming competitive internationally. The growing demand for high-quality films is essential; in 2023, more than 40% of film productions employed advanced filmmaking technologies, reflecting the transition towards modern production methods that improve the viewer experience

Future Outlook

Over the next five years, the KSA Movie Industry is anticipated to show significant growth driven by continuous government support for the entertainment sector, advancements in cinema technology, and the increasing popularity of diverse content among consumers. The combination of new cinema openings and burgeoning streaming platforms is expected to enhance access to films while promoting local cinematic talent. Additionally, support for international collaborations is likely to attract foreign investments, further enriching the cultural landscape of the KSA movie industry.

Major Players

- AMC Cinemas

- VOX Cinemas

- MUVI Cinemas

- Saudi Film Council

- National Film Corporation

- Falcon Films

- Red Sea Film Festival

- Telfaz11

- Empire Cinemas

- Cinema 70

- Saudi Arabia Film Festival

- MBC Group

- O3 Productions

- Alturki Group

- Rotana Media Group

Key Target Audience

- Government and Regulatory Bodies (General Commission for Audiovisual Media)

- Film Production Companies

- Entertainment and Media Investors

- Advertising Agencies

- Cinemas and Theater Chains

- Streaming Platforms

- Licensing and Distribution Companies

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA Movie Industry. Extensive desk research is conducted using a combination of secondary sources and proprietary databases to gather comprehensive industry-level information. This step is focused on identifying and defining the critical market variables, including audience demographics, film genres, and distribution channels that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the KSA Movie Industry is compiled and analyzed. This includes assessing market penetration rates among various genres, the ratio of cinemas to populations in key cities, and the resultant revenue generation from ticket sales. Additionally, an evaluation of the audience’s preferences is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts across various sectors, including cinema operations, film distribution, and content production. These consultations provide insights into financial performance and operational trends directly from practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple film production companies, distributors, and cinema operators to get detailed insights into product segments, sales performance, audience engagement, and emerging trends. This interaction helps verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the KSA Movie Industry.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Box Office Revenues

Growth in Cinema Infrastructure

Rise of Local Content Production - Market Challenges

Piracy Issues

Regulatory Compliance - Opportunities

Expansion of International Collaborations

Adoption of Advanced Technology in Filmmaking - Trends

Emergence of Film Festivals

Shift toward Digital Marketing - Government Regulation

Licensing Requirements

Content Censorship Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Revenue, 2019-2024

- By Number of Screens, 2019-2024

- By Average Ticket Price, 2019-2024

- By Genre (In Revenue %)

Action

Drama

Comedy

Horror

Documentary - By Distribution Channel (In Revenue %)

Theatrical Releases

Streaming Services

Home Entertainment - By Audience Demographics (In Revenue %)

Age Groups

Gender

Socioeconomic Status - By Region (In Revenue %)

Central Region

Eastern Region

Western Region

Southern Region - By Language (In Revenue %)

Arabic

English

Other

- Market Share of Major Players on the Basis of Revenue, 2024

Market Share of Major Players by Genre, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Genre, Number of Screens, Number of Theaters, Distribution Channels, Margins, Unique Value Offering, and others)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Releases

- Detailed Profiles of Major Companies

AMC Cinemas

VOX Cinemas

MUVI Cinemas

Saudi Film Council

National Film Corporation

Red Sea Film Festival

Falcon Films

Empire Cinemas

Telfaz11

Al Fozan Group

Saiidia Films

Saudi Arabia Film Festival

Zain KSA

MBC Group

Rotana Media Group

- Market Demand and Ticket Purchases

- Audience Engagement Strategies

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Revenue, 2025-2030

- By Number of Screens, 2025-2030

- By Average Ticket Price, 2025-2030