Market Overview

The global nasal drug delivery technology space has expanded from about USD ~ billion to roughly USD ~ billion over the most recent two reporting points, reflecting rising preference for needle-free and self-administered therapies. Within this context, Saudi Arabia’s inhalation & nasal spray generic segment – a core proxy for the KSA nasal drug delivery solutions market – generated USD ~ million in revenue in the latest base year and accounts for about 0.8% of the global generic inhalation & nasal spray market. Demand is underpinned by a high burden of allergic rhinitis, chronic rhinosinusitis, and asthma, supported by large and growing healthcare outlays.

The market is geographically concentrated around Riyadh, the Jeddah–Makkah corridor, and the Eastern Province (Dammam–Khobar–Dhahran), which host the largest tertiary hospitals, specialized ENT clinics, and high-income populations. Saudi Arabia accounts for about 60% of GCC healthcare expenditure, with government spending on healthcare and social development exceeding USD ~ billion in the most recent budget cycle, reinforcing advanced access to intranasal therapies. Urban regions also report higher allergic rhinitis prevalence (meta-analysis around 21.2% of the population), driving consistent prescription volumes for intranasal corticosteroids, decongestant sprays, and saline solutions.

Market Segmentation

By Therapeutic Indication

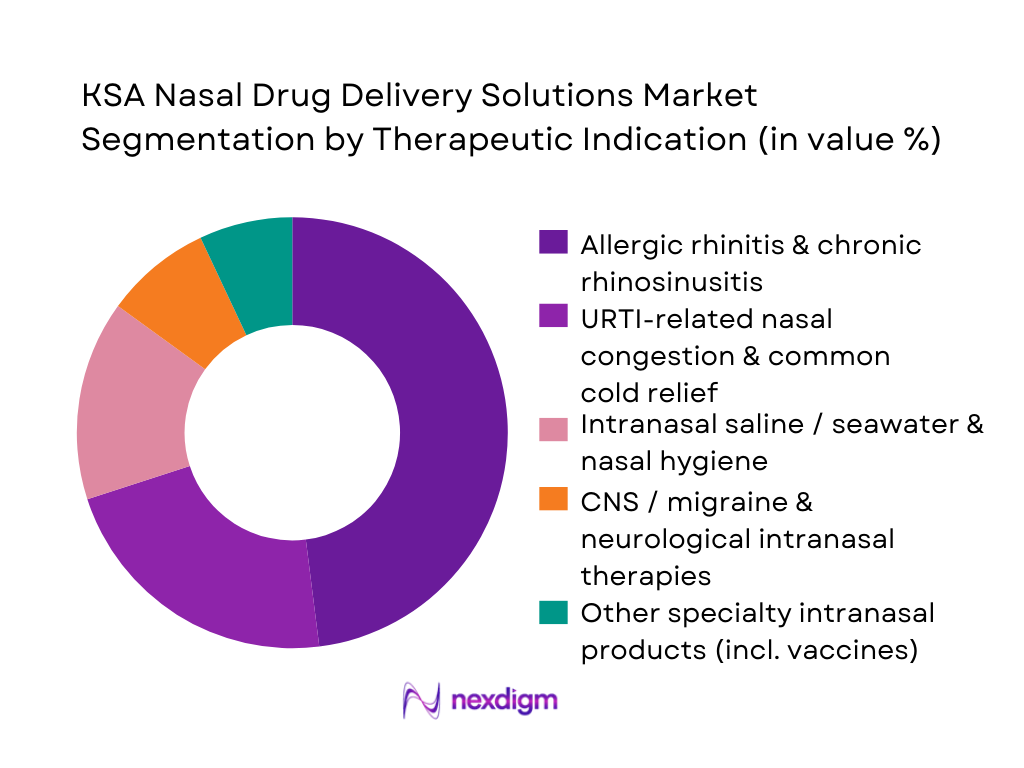

The KSA Nasal Drug Delivery Solutions Market is segmented by therapeutic indication into allergic rhinitis & chronic rhinosinusitis, upper respiratory infection–related congestion, intranasal saline & hygiene, CNS / migraine & neurological uses, and other specialty intranasal therapies (e.g., intranasal vaccines, opioid overdose rescue). Allergic rhinitis and chronic rhinosinusitis solutions dominate this segmentation. A national meta-analysis estimates allergic rhinitis in Saudi Arabia at roughly one in five residents, with urban prevalence higher than rural. Studies also show chronic rhinosinusitis prevalence around 22–23% in some Saudi cohorts, particularly in western and eastern regions exposed to dust, sandstorms, and industrial pollution. These conditions drive sustained use of intranasal corticosteroids, antihistamine–steroid combinations, and decongestant sprays, making allergic rhinitis & CRS–oriented therapies the largest revenue-generating indication in the market.

By Dosage Form

By Dosage Form

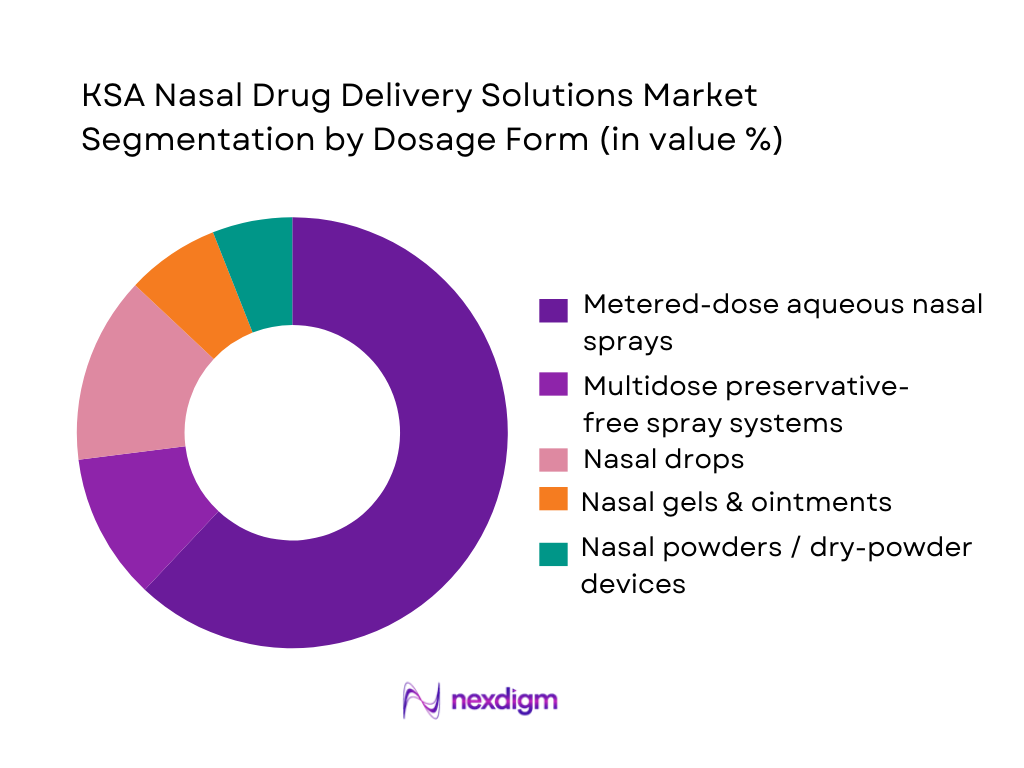

The KSA Nasal Drug Delivery Solutions Market is segmented into metered-dose aqueous nasal sprays, multidose preservative-free sprays, nasal drops, gels & ointments, and nasal powders / dry-powder devices. Metered-dose aqueous sprays command the dominant share. Saudi generics and branded generics portfolios in inhalation & nasal spray generics are heavily skewed toward aqueous metered sprays across bronchodilators, combination antihistamine–steroid products and decongestants, reflecting physician familiarity, standardized dosing and ease of patient self-administration. Hospital and homecare end-use data in the regional dataset show strong preference for spray formats over drops or gels for chronic allergic rhinitis and CRS, reinforcing the leadership of metered-dose aqueous sprays within the KSA market.

Competitive Landscape

Competitive Landscape

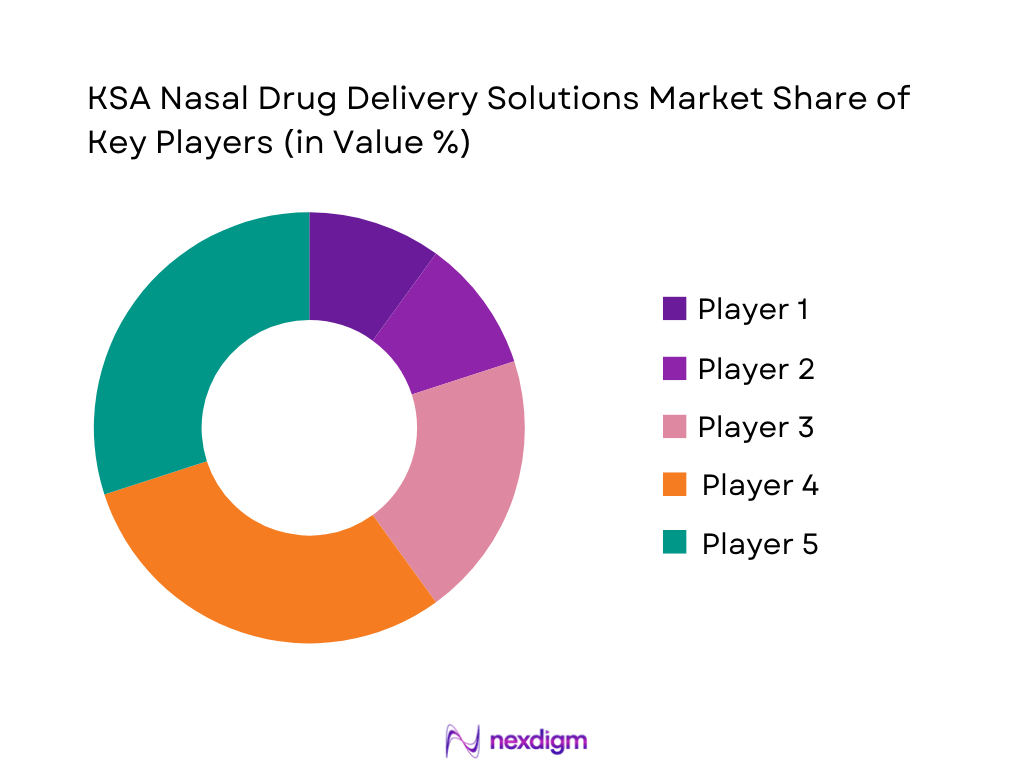

The KSA Nasal Drug Delivery Solutions Market is characterized by a blend of global originator brands in allergic rhinitis and decongestant sprays, strong regional generics players, and leading domestic manufacturers with ENT and respiratory franchises. Global nasal innovators such as GSK (intranasal corticosteroids), Novartis and Bayer (decongestants), and Teva (complex generics) coexist with regional and Saudi companies like Hikma, SPIMACO and Tabuk, which leverage local manufacturing, under-licensing and tender participation. Market power is reinforced through hospital and NUPCO tenders, private insurance coverage, and retail pharmacy networks.

| Company | Establishment Year | Global HQ (Country) | KSA Nasal / Respiratory Focus | KSA Presence Model | Core Nasal Delivery Capabilities | Primary KSA Channels | Differentiating Edge in KSA Nasal Space |

| GSK plc | 1715 | UK (London) | ~ | ~ | ~ | ~ | ~ |

| Novartis AG | 1996 | Switzerland (Basel) | ~ | ~ | ~ | ~ | ~ |

| Teva Pharmaceutical Industries | 1901 | Israel (Tel Aviv area) | ~ | ~ | ~ | ~ | ~ |

| Hikma Pharmaceuticals plc | 1978 | UK (London; founded in Jordan) | ~ | ~ | ~ | ~ | ~ |

| SPIMACO (Saudi Pharmaceutical Industries & Medical Appliances Corp.) | 1986 | Saudi Arabia (Al-Qassim) | ~ | ~ | ~ | ~ | ~ |

KSA Nasal Drug Delivery Solutions Market: Analysis

Growth Drivers

Rising prevalence of allergic rhinitis and sinusitis

Saudi Arabia shows a high burden of nasal-mucosa conditions. A pooled meta-analysis indicates that allergic rhinitis (AR) affects about 21.2% of the Saudi population, with higher rates in adults and in urban areas. Chronic rhinosinusitis (CRS) is also widely prevalent — one epidemiological study estimates roughly 25% prevalence among the national population, corresponding to nearly 9 million individuals in a population base of 36 million. These high absolute numbers of affected individuals create sustained demand for nasal drug delivery solutions such as sprays, saline rinses and corticosteroid therapies, making nasal delivery a mainstay of ENT and allergy care in the Kingdom.

Growing CNS and mental-health intranasal indications

Recent clinical research in Saudi Arabia shows that among patients with chronic rhinosinusitis with nasal polyps (CRSwNP), nearly 99.7% exhibit type-2 inflammation, which correlates with comorbidities like asthma and allergic rhinitis. This high inflammation burden signals potential for broader use of advanced intranasal therapeutics — not only for ENT but also for CNS and neuro-inflammatory conditions, where nose-to-brain delivery or targeted intranasal anti-inflammatory or biologic therapies may offer benefits. As awareness of these comorbidities grows among physicians and patients, nasal delivery becomes an attractive non-invasive route for emerging CNS, neuropsychiatric or pain-related applications previously dominated by oral or injectable routes.

Challenges

Stringent SFDA quality and bioequivalence requirements

Regulation in Saudi Arabia is rigorous. New nasal drug products must meet the standards set by the Saudi Food and Drug Authority (SFDA), including bioequivalence for generics and compliance for device-plus-drug systems. Given the high prevalence of chronic rhinosinusitis (around 25% in some studies) and frequent co-morbidities such as asthma or allergic rhinitis, regulators are especially cautious to ensure safety and efficacy. This regulatory burden slows down market entry, especially for complex intranasal formulations or novel device-based therapies such as preservative-free multidose systems or nose-to-brain delivery platforms.

Complexity of device-plus-drug registrations

Nasal drug delivery solutions often combine a drug formulation with a specific delivery device (pump spray, preservative-free system, etc.). Registration of such combination products under SFDA requires demonstration of both pharmaceutical quality and device performance, which involves additional validation, testing, and regulatory scrutiny. The prevalence of CRS and allergic rhinitis in Saudi Arabia (21.2% AR, ~25% CRS) means there is demand for advanced delivery systems — yet regulatory and logistical complexity may disincentivize smaller or regional players from launching specialized nasal devices, limiting product variety and slowing innovation adoption.

Opportunities

Nose-to-brain therapeutics for CNS and psychiatric care

Given the high burden of chronic rhinosinusitis with type-2 inflammation among nasal-polyp patients — nearly 99.7% in a recent Saudi cohort — there is a strong clinical rationale for exploring intranasal delivery of CNS-acting therapeutics (e.g., neuroinflammatory modulators, antidepressants, migraine treatments) via nose-to-brain pathways. Increasing recognition of comorbid asthma, allergic rhinitis, and sinusitis in such patients offers a ready patient base already familiar with nasal administration. Nasal delivery could bypass first-pass metabolism, reduce systemic side-effects, and improve adherence compared with oral or injectable CNS treatments — creating a compelling future growth vector for intranasal biologics, neuro-therapies, or novel small molecules in the Saudi market.

Intranasal migraine and acute pain therapies

The combination of high overall population (approx. 35.3 million), significant prevalence of chronic rhinosinusitis and nasal inflammatory conditions, and increasing urbanization suggests a sizable potential pool of patients for acute symptom relief. Nasal delivery is particularly well-suited for rapid-onset therapies such as migraine rescue, acute sinus-related pain or allergic flare-ups. Given limited domestic high-end device manufacturing, there is a strategic opening for companies to introduce ready-to-use intranasal formulations for pain or migraine — particularly using imported devices or partnership-based fill/final packaging — thereby expanding the nasal therapy category beyond chronic allergic and sinus diseases into acute and episodic care

Future Outlook

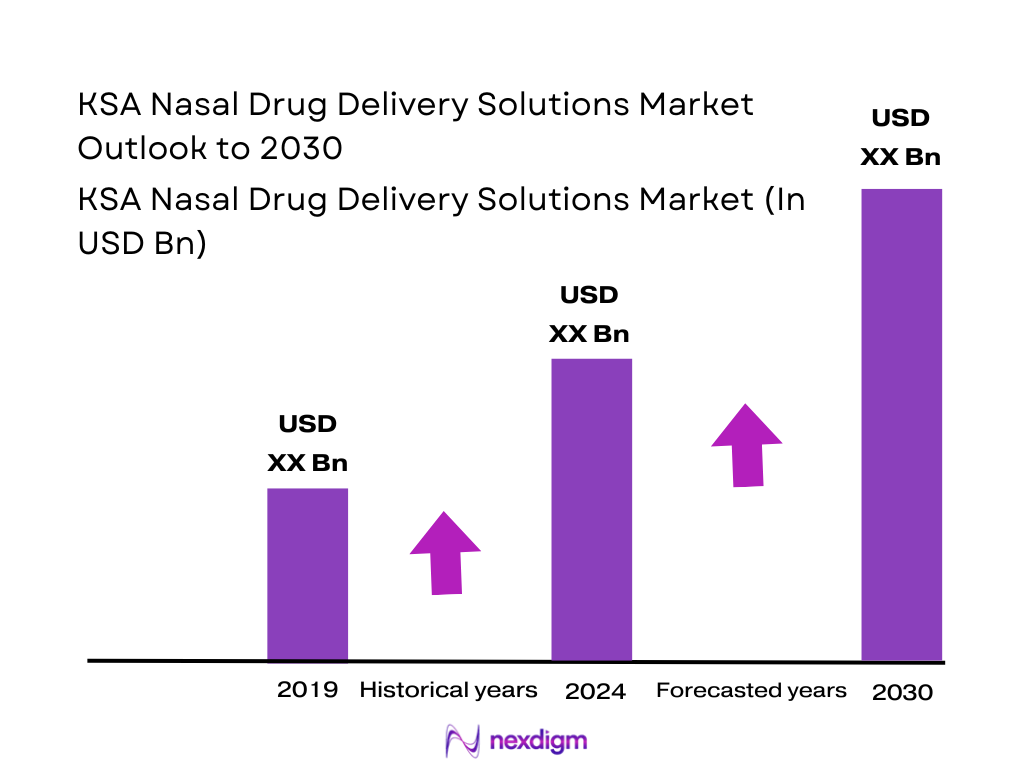

Over the next six years, the KSA Nasal Drug Delivery Solutions Market is expected to expand in line with the broader inhalation & nasal spray generics segment, which is projected to rise from USD ~ million in 2024 to USD ~ million by 2030, implying an annual growth rate of about 8.7%. Structural drivers include high and persistent prevalence of allergic rhinitis and chronic rhinosinusitis, rising asthma burden, and continued prioritization of healthcare within Saudi budgets and Vision 2030 reforms.

Government policy favors generic uptake and local manufacturing, supported by strong pharmaceutical spending (estimated national drug market around USD ~ billion), which will encourage expansion of local nasal spray production and under-licensed brands. The pipeline of intranasal biologics (for migraine, CNS, and rare diseases), vaccine-like intranasal platforms, and emergency products (such as naloxone sprays) is expected to gradually enter the market, with regional players like Hikma building manufacturing partnerships. Digital health, e-pharmacies, and OTC self-care trends will further shift volumes from clinic-dispensed products toward retail and online channels, particularly in urban centers.

Major Players

- GSK plc

- Novartis AG

- Sanofi S.A.

- Bayer AG

- Teva Pharmaceutical Industries Ltd

- Hikma Pharmaceuticals plc

- Saudi Pharmaceutical Industries & Medical Appliances Corp.

- Tabuk Pharmaceuticals Manufacturing Company

- Jamjoom Pharma

- Julphar

- Cipla Ltd

- Sun Pharmaceutical Industries Ltd

- Mylan / Viatris Inc.

- Dr. Reddy’s Laboratories Ltd

Key Target Audience

- Global nasal spray and intranasal biologics manufacturers

- Regional and domestic pharmaceutical manufacturers

- Contract development and manufacturing organizations

- Hospital groups and integrated health systems

- Retail pharmacy and e-pharmacy chains

- API, excipient, and packaging suppliers

- Investment and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The research begins with mapping the full ecosystem of the KSA Nasal Drug Delivery Solutions Market, covering originator pharma, generic manufacturers, CDMOs, distributors, hospital groups, retail pharmacies, regulators (SFDA, NUPCO), and patients. Extensive desk research is conducted using syndicated databases, clinical literature on allergic rhinitis and CRS in Saudi Arabia, and policy documents on healthcare spending and localization. Critical variables such as indication mix, dosage forms, channel structures, and pricing tiers are defined at this stage.

Step 2: Market Analysis and Construction

Historical trends for the global nasal drug delivery market and the Saudi inhalation & nasal spray generic segment are compiled, focusing on revenue curves, growth rates, and share of Saudi Arabia within global and MEA markets. This is integrated with national indicators such as pharmaceutical market size, healthcare expenditure, disease prevalence (AR, CRS, asthma) and generic utilization dynamics. A bottom-up view is built using drug-class segmentation (e.g., bronchodilators, combination sprays, corticosteroids), end-use (homecare vs hospital), and distribution channels, leading to a structured market model for KSA nasal drug delivery solutions.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary hypotheses on indication dominance (allergic rhinitis & CRS), format preference (aqueous metered sprays), and channel dynamics (hospital vs retail vs online) are validated through structured interviews and CATI-style consultations with ENT specialists, allergists, hospital pharmacists, retail pharmacy buyers, and KSA-based pharma executives. These interactions test assumptions on prescribing behavior, generic substitution, tender dynamics, and brand loyalty, and refine segment splits and growth narratives to reflect on-ground realities.

Step 4: Research Synthesis and Final Output

The final stage triangulates quantitative market models with qualitative feedback and cross-checks against multiple syndicated sources (e.g., inhalation & nasal spray generic drugs, global nasal spray and nasal drug delivery technology markets). Special focus is placed on aligning KSA forecasts with regional MEA nasal spray market outlooks and Vision 2030 healthcare reforms. The result is a consolidated, validated view of the KSA Nasal Drug Delivery Solutions Market – including indication-wise and dosage-form splits, competitive positioning, and a robust growth outlook to 2030 – suitable for investment, market-entry, and strategic planning decisions.

- Executive Summary

- Research Methodology (Nasal dosage-form taxonomy, intranasal route definition, KSA Rx vs OTC classification, SFDA registration universe, hospital-tender vs retail-panel sampling, bottom-up SKU and dose-count modelling, top-down therapeutic-prevalence triangulation, payer-mix calibration, data validation and sensitivity checks)

- Definition, Scope and Boundaries

- Evolution of Intranasal Therapies in KSA

- Role of Nasal Route in KSA Treatment Algorithms

- Supply Chain and Value Chain Mapping

- Stakeholder Ecosystem and Decision-Making Hierarchy

- Growth Drivers

Rising prevalence of allergic rhinitis and sinusitis

Growing CNS and mental-health intranasal indications

Patient preference for non-invasive self-administered therapies

Expansion of modern trade and e-pharmacy

Vision healthcare access initiatives - Challenges

Stringent SFDA quality and bioequivalence requirements

Complexity of device-plus-drug registrations

Price controls in hospital tenders

Pharmacist substitution behaviour

Limited local high-end device manufacturing - Opportunities

Nose-to-brain therapeutics for CNS and psychiatric care

Intranasal migraine and acute pain therapies

Anti-pollution and environmental-protection nasal sprays

Pediatric-focused formulations and devices

Scope for KSA-based fill-finish and packaging - Trends

Shift toward preservative-free multidose systems

Adoption of advanced pump and nozzle geometries

Data-enabled adherence tracking

Preference for natural and seawater-based formulations

Growth in combination intranasal therapies - Regulatory and Policy Landscape

SFDA product classification and borderline guidance

Pharmacovigilance and risk-management obligations

Labelling and Arabic-language requirements

Promotional code and digital-communication rules

Stability and packaging norms for nasal products in KSA climate - Pricing, Tendering and Reimbursement Dynamics

- Stakeholder and Ecosystem Mapping

- Porter’s Five Forces Analysis

- SWOT Analysis – KSA Nasal Drug Delivery Solutions Market

- Competition Ecosystem and Strategic Grouping

- By Value, 2019-2024

- By Volume, 2019-2024

- By Treated Patients and DDD Consumption, 2019-2024

- By Product Lifecycle Stage, 2019-2024

- By Dosage Form (in Value %)

Metered-dose nasal sprays

Multi-dose preservative-free sprays

Nasal drops

Nasal powders/dry-powder systems

Nasal gels/ointments - By Therapeutic Indication Cluster (in Value %)

Allergic rhinitis and seasonal allergies

Chronic rhinosinusitis and nasal polyposis

Decongestion and upper-respiratory infection symptom relief

Migraine and CNS/neuropsychiatric indications

Pain management and post-operative care - By Molecule Class and Active Ingredient Type (in Value %)

Intranasal corticosteroids

Antihistamines

Sympathomimetic decongestants

Saline and seawater formulations

Anticholinergic agents - By Device and Delivery Technology (in Value %)

Conventional pump sprays

Breath-actuated nasal sprays

Soft-mist and fine-particle devices

Unit-dose and disposable nasal applicators

Multidose preservative-free pump systems - By Patient Cohort (in Value %)

Pediatric patients

Adolescent patients

Adult working-age population

Geriatric population

Patients with co-morbid respiratory conditions - By Distribution and Access Channel (in Value %)

Hospital pharmacies and institutional procurement

Polyclinic and ENT clinic pharmacies

Community and chain pharmacies

Online and e-pharmacy platforms

Direct-to-hospital and specialty-clinic supply models - By Payer and Reimbursement Type (in Value %)

Public sector coverage and MOH schemes

NUPCO and governmental procurement pathways

Cooperative and private health insurance payers

Out-of-pocket self-pay segment

Employer-based and institutional payers - By Region and City Tier (in Value %)

Central region and Riyadh cluster

Western region including Makkah and Madinah

Eastern region including Dammam and Khobar

Northern and Southern regions

Tier-1 metropolitan vs tier-2/3 cities

- Market Share of Major Players

- Cross-Comparison Parameters (KSA nasal-portfolio breadth by indication cluster, number of SFDA-registered nasal SKUs, balance of Rx vs OTC and switch brands, depth in advanced device platforms and preservative-free systems, participation and success rate in NUPCO and major hospital tenders, local manufacturing/repackaging or fill-finish presence, average actuations-per-pack and pack-size strategy in KSA, patient- and HCP-support programs including digital adherence tools)

- Strategic Positioning and Business Models

- SWOT Analysis of Major Players

- Pricing and Pack Architecture Analysis

- Device and Formulation Technology Benchmarking

- Detailed Profiles of Major Companies

GlaxoSmithKline plc

Pfizer Inc.

Novartis AG

Sanofi

Bayer AG

AstraZeneca

Johnson & Johnson

Merck & Co., Inc.

Teva Pharmaceutical Industries Ltd.

Hikma Pharmaceuticals plc

Julphar

Tabuk Pharmaceuticals

Jamjoom Pharma

Saudi Pharmaceutical Industries & Medical Appliances Corp

- Hospital and Institutional End-Users

- ENT Specialists, Allergists and Primary-Care Physicians

- Community and Chain Pharmacies

- Patient Behaviour, Adherence and Preference Analysis

- Budget Allocations and Procurement Practices

- By Value, 2025-2030

- By Volume, 2025-2030

- By Treated Patients and DDD Consumption, 2025-2030

- By Product Lifecycle Stage, 2025-2030