Market Overview

The KSA NATO Ammunition market is influenced by the growth in defense spending and the expansion of military modernization programs across the region. The market size has shown steady growth in recent years, driven by strategic defense procurements and increasing collaborations with NATO. This growth is supported by Saudi Arabia’s significant investment in defense and security sectors, as the country continues to modernize its military capabilities to maintain its geopolitical influence in the Middle East. The value of the market for KSA NATO Ammunition is currently positioned at USD ~ billion..The KSA NATO Ammunition market is heavily dominated by countries such as Saudi Arabia, the UAE, and Qatar. Saudi Arabia leads the market, thanks to its large defense budget, ongoing modernization programs, and active engagement in regional military operations. The country’s strategic alliance with NATO member states further bolsters the demand for NATO-standard ammunition. Additionally, the demand from the UAE and Qatar also contributes to the market dynamics as they continue to enhance their military readiness, with a particular focus on procuring NATO-compatible ammunition.

Market Segmentation

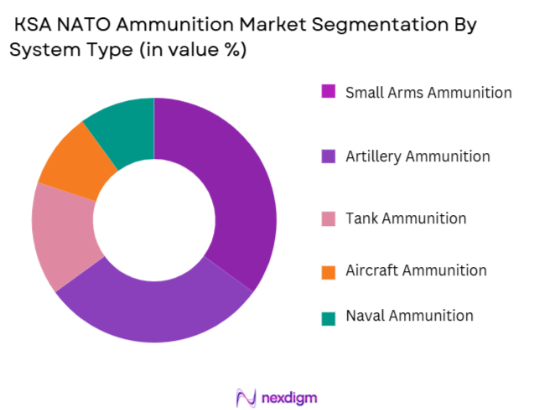

By System Type

The KSA NATO Ammunition market is segmented by system type into small arms ammunition, artillery ammunition, tank ammunition, aircraft ammunition, and naval ammunition. Among these, small arms ammunition holds the dominant market share. This is due to the extensive use of small arms in both military and law enforcement agencies, with a focus on tactical and operational needs. Small arms ammunition continues to see a robust demand in Saudi Arabia, which maintains one of the largest armed forces in the region. The demand for NATO-compatible small arms ammunition is driven by ongoing military operations and the need for standardization across defense forces. Furthermore, international defense collaborations have led to an increased focus on ensuring compatibility with NATO standards for small arms ammunition.

By Platform Type

The KSA NATO Ammunition market is also segmented by platform type into land platforms, airborne platforms, naval platforms, mobile systems, and fixed defense systems. Land platforms, including tanks and infantry fighting vehicles, dominate the market share. This is because land-based military systems are central to Saudi Arabia’s defense strategy, especially given its role in regional military alliances. The need for ammunition that is compatible with NATO-standard land platforms continues to grow as part of the broader strategy to modernize the armed forces. In addition, the importance of land-based operations in Saudi Arabia’s defense posture ensures that land platforms drive a substantial portion of ammunition demand.

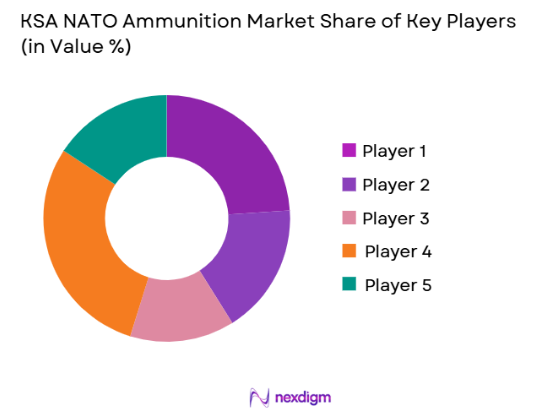

Competitive Landscape

The KSA NATO Ammunition market is dominated by a few major players who have established strong presences in the region. These include global defense giants such as Lockheed Martin, BAE Systems, and Rheinmetall AG, alongside key regional players with strong ties to local defense contractors. The consolidation of the market reflects the growing importance of NATO-standard ammunition systems, as countries like Saudi Arabia continue to invest heavily in modernizing their armed forces. These companies benefit from long-standing relationships with the KSA defense sector, as well as their ability to meet NATO’s rigorous standards for ammunition.

| Company | Establishment Year | Headquarters | Product Type | Technological Advancement | Market Penetration | Key Collaborations | Growth Strategy |

| Lockheed Martin | 1995 | United States | Ammunition Systems | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | United Kingdom | Defense Ammunition | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Germany | Tank Ammunition | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | United States | Small Arms Ammunition | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | Airborne Ammunition | ~ | ~ | ~ | ~ |

KSA NATO Ammunition Market Analysis

Growth Drivers

Increased Defense Spending and Modernization Programs

The Kingdom of Saudi Arabia (KSA) has been significantly increasing its defense budget to maintain and enhance its military capabilities. This trend is expected to continue through the coming years, driven by the need to modernize the defense infrastructure and bolster its national security in response to regional threats. The modernization programs include the procurement of NATO-compatible ammunition, aiming for interoperability with allied forces. With these investments, KSA will continue to procure advanced, high-tech ammunition systems, which will drive the growth of the NATO ammunition market. Additionally, Saudi Arabia’s strategic importance in the Middle East amplifies the need for top-tier ammunition systems to secure the country’s geopolitical influence. The push for more sophisticated artillery, tank, and aircraft ammunition, as well as enhanced small arms systems, contributes to the increasing demand for NATO-standard munitions.

Strategic Defense Partnerships with NATO

Saudi Arabia’s close ties with NATO members, particularly in defense and security collaboration, are a key growth driver for the NATO ammunition market. These strategic alliances ensure that the Kingdom’s armed forces are equipped with ammunition that meets NATO’s high standards. Furthermore, NATO standardization ensures that the Saudi military can seamlessly integrate with allied forces in joint operations, enhancing operational effectiveness. These relationships have resulted in increasing defense contracts for NATO-compliant systems, including ammunition. The continued expansion of these partnerships and collaborative defense efforts solidifies the demand for NATO-standard ammunition in the region, which further strengthens market growth.

Market Challenges

High Cost of Procurement and Maintenance

A significant challenge to the KSA NATO ammunition market is the high cost associated with procuring and maintaining NATO-compliant ammunition systems. While these systems offer enhanced compatibility and performance, they often come with a premium price tag. This impacts defense budgets, especially in a region where geopolitical instability and fluctuating oil prices can affect economic conditions. For Saudi Arabia, managing these high procurement and maintenance costs while expanding its ammunition stockpile poses a continuous challenge. Additionally, the costs associated with ensuring that ammunition is regularly tested, upgraded, and compatible with new military platforms add to the financial burden, creating a barrier to rapid procurement of required systems.

Dependence on Foreign Suppliers

Another challenge for the KSA NATO ammunition market is the reliance on foreign suppliers for specialized ammunition. While Saudi Arabia has a robust defense industry, it still depends on foreign manufacturers for the production of some NATO-standard ammunition, which introduces vulnerabilities in the supply chain. This dependence on external suppliers can lead to delays, fluctuations in pricing, and issues with timely delivery of critical ammunition, particularly during geopolitical crises or conflicts. Moreover, there are ongoing concerns regarding the strategic risk of relying on foreign sources for ammunition, especially when dealing with sensitive defense procurements. To mitigate this, Saudi Arabia may need to invest in local production capabilities, which could take years to develop fully.

Opportunities

Technological Advancements in Smart Ammunition

One of the most promising opportunities for the KSA NATO ammunition market lies in the growing demand for smart ammunition. Advances in technology have enabled the development of precision-guided munitions (PGMs) that are more effective, reducing collateral damage and improving target accuracy. These systems are particularly advantageous in modern warfare, where precision and reduced casualties are paramount. Saudi Arabia, with its substantial defense budget, is in a prime position to integrate these advanced ammunition technologies into its military arsenal. As NATO continues to develop and standardize these advanced systems, the KSA market can benefit by modernizing its ammunition stockpile and acquiring the latest smart ammunition technologies.

Expansion of Regional Defense Collaborations

Saudi Arabia’s role as a leader in the Gulf Cooperation Council (GCC) and its close relationships with neighboring countries presents a significant opportunity for the NATO ammunition market. There is a growing trend of regional defense collaborations, particularly in light of shared security concerns such as threats from Iran and other non-state actors in the region. As part of these collaborations, Saudi Arabia is likely to procure ammunition that is compatible with NATO standards to ensure interoperability across various military forces in the GCC. This will increase the demand for NATO-standard ammunition not only in Saudi Arabia but across the region. The expansion of these alliances and mutual defense agreements will further drive the demand for specialized ammunition in the coming years.

Future Outlook

Over the next 5 years, the KSA NATO Ammunition market is expected to show significant growth, fueled by an increasing defense budget and ongoing military collaborations with NATO members. Continuous modernization of military platforms, along with the development of more advanced and specialized ammunition types, will contribute to the growth. Additionally, the demand for NATO-standard ammunition will continue to rise as Saudi Arabia seeks to enhance its defense capabilities to address evolving security challenges in the Middle East.

Major Players

- Lockheed Martin

- BAE Systems

- Rheinmetall AG

- General Dynamics

- Thales Group

- Northrop Grumman

- Leonardo S.p.A.

- FN Herstal

- Elbit Systems

- Textron Systems

- Saab AB

- L3Harris Technologies

- Denel SOC Ltd

- AeroVironment, Inc.

- Raytheon Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (

- Defense procurement agencies

- Global defense contractors

- Private security contractors

- Large military supply chain companies

- Regional defense ministries

- International NATO and defense cooperation agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the major stakeholders and variables impacting the KSA NATO Ammunition market. Extensive desk research is conducted, utilizing secondary and proprietary data sources, such as defense reports and military procurement data. Key variables include market value, growth drivers, and dominant countries in the market.

Step 2: Market Analysis and Construction

In this phase, we gather and analyze historical market data, focusing on factors such as market size, growth trends, and key industry dynamics. This includes reviewing reports, financial filings, and defense-related government publications to ensure accuracy and relevance.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are refined through consultations with industry experts via surveys and interviews. These experts provide insights into operational and financial trends within the KSA NATO Ammunition market, validating the assumptions made and further enhancing the robustness of the analysis.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all collected data and cross-referencing insights from various industry players and government reports. This ensures a holistic view of the KSA NATO Ammunition market, providing a validated, comprehensive analysis.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing regional defense budgets

Rising geopolitical tensions in the Middle East

Enhanced defense cooperation with NATO member states - Market Challenges

High production and operational costs

Complex regulatory environments

Dependence on foreign technology and components - Trends

Shift towards advanced ammunition for multi-role platforms

Integration of smart technology in ammunition systems

Increased focus on ammunition sustainability

- Market Opportunities

Technological advancements in ammunition systems

Growing demand for NATO-standard equipment

Expansion of defense collaborations within the GCC region - Government regulations

Compliance with NATO standards and certifications

National defense regulations governing ammunition imports

Environmental regulations on ammunition production and disposal - SWOT analysis

Strength: Strong defense ties with NATO

Weakness: Limited domestic manufacturing capabilities

Opportunity: Investment in local ammunition production

Threat: Volatility in raw material prices - Porters 5 forces

Threat of new entrants: Low due to high entry barriers

Bargaining power of suppliers: Moderate, given reliance on foreign suppliers

Bargaining power of buyers: High in government procurement

Threat of substitute products: Low due to specificity of military ammunition

Industry rivalry: Moderate, with a few key players dominating the market

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Ammunition for Small Arms

Ammunition for Artillery Systems

Ammunition for Tanks

Ammunition for Aircraft

Ammunition for Naval Platforms - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Mobile Systems

Fixed Defense Systems - By Fitment Type (In Value%)

Standardized Fitment

Custom Fitment

Universal Fitment

Modular Fitment

Interchangeable Fitment - By EndUser Segment (In Value%)

Military Forces

Law Enforcement Agencies

Private Security Contractors

Defense Contractors

Government Defense Ministries - By Procurement Channel (In Value%)

Direct Procurement

Government Tender Systems

Defense Contractors

Private Purchases

International Partnerships

- Market Share Analysis

- Cross Comparison Parameters(Market value, Regional demand, System complexity, Technological advancement, Key players)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

General Dynamics Ordnance and Tactical Systems

Lockheed Martin

BAE Systems

Northrop Grumman

Raytheon Technologies

Leonardo S.p.A.

Rheinmetall AG

FN Herstal

Thales Group

Elbit Systems

Textron Systems

Saab AB

L3Harris Technologies

Denel SOC Ltd

AeroVironment, Inc.

- Increase in defense spending by Saudi Arabia

- Growing requirement for advanced military-grade ammunition

- Rise in demand for specialized ammunition for naval platforms

- High demand from private security firms for tactical ammunition

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035