Market Overview

The KSA NATO C4ISR market is a critical component of military and defense infrastructure, driven by advancements in communication, surveillance, and intelligence systems. The market’s growth is mainly propelled by the increasing defense budgets of NATO countries and the rising security concerns in the Middle East. In 2024, the market is valued at USD~billion, supported by strong investments in military technology and strategic defense partnerships. Additionally, the growing need for interoperability between NATO member states and their allies enhances the demand for robust C4ISR solutions. The market’s growth trajectory reflects ongoing investments in the modernization of defense systems and the integration of advanced technologies like artificial intelligence (AI) and cybersecurity.The dominant players in the KSA NATO C4ISR market are concentrated in countries with strong military infrastructures and defense budgets. Key regions such as the United States, Saudi Arabia, and several NATO member countries lead the market. These regions are dominant due to their continuous investment in military technologies and defense modernization programs. Saudi Arabia, in particular, has become a strategic defense partner in the Middle East, driving the demand for sophisticated C4ISR systems to support regional stability and defense alliances. The advanced technological infrastructure and high demand for military communication and surveillance systems in these countries further solidify their position in the global market.

Market Segmentation

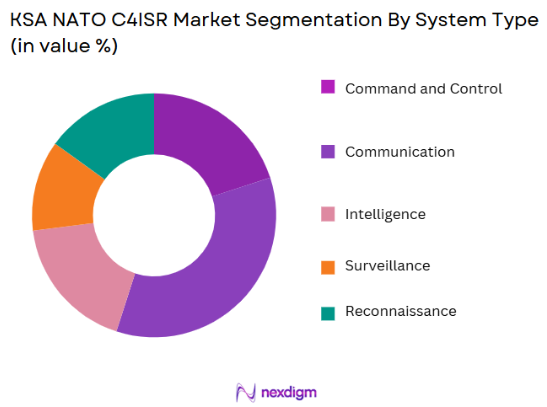

By System Type:

The KSA NATO C4ISR market is segmented by system type into command and control systems, communication systems, intelligence systems, surveillance systems, and reconnaissance systems. Currently, communication systems dominate the market. The rising need for real-time data transfer and secure communications within military operations, both regionally and globally, drives the demand for communication systems. As countries seek to enhance their military capabilities, investment in robust and secure communication infrastructure remains paramount. Additionally, advancements in satellite and cloud-based communication technologies are further boosting the demand for communication systems. Key players are heavily focusing on providing integrated, high-performance solutions to meet these growing needs.

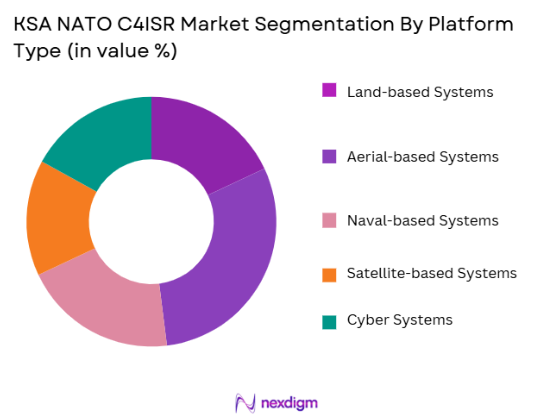

By Platform Type:

The KSA NATO C4ISR market is also segmented by platform type, which includes land-based systems, aerial-based systems, naval-based systems, satellite-based systems, and cyber systems. Aerial-based systems have a dominant share in the market. The increasing deployment of drones and UAVs (Unmanned Aerial Vehicles) for surveillance, reconnaissance, and intelligence-gathering activities has contributed to the growth of aerial platforms. Additionally, the advancement of autonomous flight technologies and the ability to integrate these systems with command and control networks make aerial systems a preferred choice in defense strategies. With the focus shifting toward more agile and flexible systems, aerial-based platforms continue to gain traction among military and defense forces.

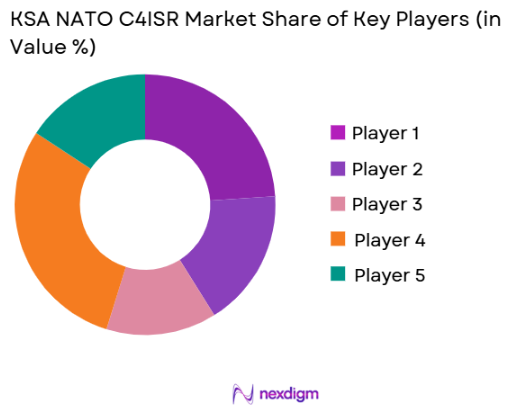

Competitive Landscape

The KSA NATO C4ISR market is primarily driven by a few key players that dominate the industry with their advanced technology offerings and extensive market presence. The market is led by global defense contractors and technology providers like Lockheed Martin, Northrop Grumman, and Thales Group, who have established a strong foothold in the region. These players are actively involved in the development and deployment of C4ISR systems that cater to the defense needs of NATO member countries and their partners. The consolidation of these companies highlights the market’s competitive nature, as these players continuously innovate to provide cutting-edge, integrated defense solutions that meet the growing demands of military operations.

| Company Name | Establishment Year | Headquarters | Market Focus | Technology | Client Base | Product Portfolio | Strategic Initiatives | Revenue |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ | ~ |

KSA NATO C4ISR Market Analysis

Growth Drivers

Urbanization:

Urbanization plays a pivotal role in the growth of the KSA NATO C4ISR market. As cities expand and population density increases, there is a heightened need for sophisticated security, communication, and surveillance systems to ensure public safety and national security. Urban environments, especially in regions like Saudi Arabia, are increasingly becoming central hubs for strategic military operations, necessitating advanced command and control systems, which are integral to C4ISR systems. Moreover, the rising demand for smart city initiatives across the Middle East, including advanced traffic monitoring, infrastructure management, and urban security, directly contributes to the market’s expansion. This trend drives the need for integrated C4ISR solutions to enhance communication and coordination in these high-density areas, thereby facilitating timely decision-making and operational efficiency. The need for urban infrastructure protection and effective defense mechanisms in rapidly growing cities makes urbanization a key driver in the development and deployment of advanced C4ISR systems.

Industrialization:

The continued industrialization in Saudi Arabia and other key NATO-aligned countries accelerates the demand for advanced C4ISR technologies. As industries grow, the importance of maintaining secure communication networks and reliable surveillance systems increases. Industrial sectors, including defense manufacturing, energy, and petrochemicals, rely on C4ISR systems to ensure operational continuity, manage assets, and protect critical infrastructure. The Kingdom’s Vision 2030 aims to diversify its economy, which increases reliance on cutting-edge technologies like C4ISR systems to safeguard new industrial developments and secure strategic economic zones. Moreover, industrial growth fuels military modernization initiatives, with countries investing in systems that enhance operational efficiency and command control across vast industrial landscapes. This convergence of defense and industrial growth propels the market for C4ISR systems, as they are integral to managing security risks and ensuring smooth operation in rapidly evolving industries.

Restraints

High Initial Costs:

One of the significant barriers in the KSA NATO C4ISR market is the high initial cost associated with the procurement and implementation of C4ISR systems. These systems are highly sophisticated and require considerable investment in technology infrastructure, including sensors, communication platforms, and command and control systems. For defense forces and governments, the upfront costs for acquiring, integrating, and maintaining these systems can be prohibitive. In the case of Saudi Arabia, as part of the larger Middle Eastern region, defense budgets are often allocated to multiple priority areas, and large-scale investments in C4ISR systems can strain financial resources. Additionally, the systems require ongoing maintenance and periodic upgrades to stay relevant with technological advancements, further adding to the total lifecycle costs. High initial expenditures, therefore, pose a challenge for market adoption, especially for nations with limited defense spending or competing demands.

Technical Challenges:

Another key challenge is the technical complexity of integrating and maintaining C4ISR systems. These systems often involve a wide array of components, including sensors, communication networks, and intelligence platforms that must work seamlessly together. Ensuring interoperability between different platforms, particularly across various NATO member states and allied nations, can be difficult due to different technological standards and protocols. Furthermore, the rapid pace of technological innovation means that systems can quickly become outdated, requiring continuous updates and upgrades to maintain their effectiveness. This results in not only technical challenges but also logistical and training issues for military personnel tasked with operating and maintaining the systems. The technical complexity of C4ISR systems can lead to delays in deployment, higher costs, and potential security vulnerabilities if not managed properly.

Opportunities

Technological Advancements:

The ongoing advancements in technology offer significant growth opportunities for the KSA NATO C4ISR market. The integration of emerging technologies such as artificial intelligence (AI), machine learning, big data analytics, and the Internet of Things (IoT) can greatly enhance the effectiveness and efficiency of C4ISR systems. AI can improve real-time decision-making by analyzing vast amounts of data from various sources, enabling commanders to respond more quickly to dynamic situations. Additionally, advancements in satellite communication and cloud computing can provide more reliable and scalable systems for military operations, reducing dependency on traditional communication infrastructures. The convergence of cyber defense with C4ISR systems also presents opportunities to secure sensitive data against evolving cyber threats. As the defense sector continues to prioritize modernization, the deployment of these cutting-edge technologies will be crucial for maintaining a competitive edge in the rapidly evolving global security landscape.

International Collaborations:

International collaborations provide an excellent opportunity for the expansion of the KSA NATO C4ISR market. NATO countries and allied nations can pool resources and expertise to enhance the development, deployment, and maintenance of C4ISR systems. Collaborations allow for the sharing of advanced technologies, best practices, and operational strategies, enabling countries to enhance the interoperability and effectiveness of their defense systems. Additionally, partnerships with global defense contractors and technology providers facilitate access to the latest innovations in C4ISR technology. Such collaborations are crucial in the Middle East, where regional security concerns drive cooperation between neighboring nations and NATO allies. For instance, joint exercises and shared defense initiatives between Saudi Arabia and NATO member states foster the integration of advanced C4ISR systems into regional defense strategies, improving both national and collective security. The ability to leverage international collaborations enhances technological capabilities and accelerates the adoption of C4ISR systems across different defense forces.

Future Outlook

Over the next 5 years, the KSA NATO C4ISR market is expected to witness significant growth driven by increasing defense budgets, advancements in military communication technologies, and a rising demand for secure and efficient surveillance and reconnaissance systems. The market will also benefit from ongoing modernization initiatives within NATO member states and their strategic partners, including Saudi Arabia and other Middle Eastern nations. The ongoing development of autonomous systems, satellite communication, and cyber defense will play a crucial role in shaping the market’s future. Additionally, geopolitical tensions in the Middle East are expected to fuel the demand for advanced C4ISR systems, thereby driving growth in the region.

Major Players in the Market

- Lockheed Martin

- Northrop Grumman

- Thales Group

- Raytheon Technologies

- BAE Systems

- General Dynamics

- Elbit Systems

- Leonardo

- L3 Harris Technologies

- Saab

- Indra Sistemas

- Rockwell Collins

- Rheinmetall

- Harris Corporation

- Cobham Aerospace Communications

Key Target Audience

- Military and Defense Organizations

- Government and Regulatory Bodies

- Defense Contractors

- Aerospace and Defense Equipment Manufacturers

- Intelligence and Surveillance Agencies

- Investments and Venture Capitalist Firms

- Security Agencies

- Armed Forces of Allied Nations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves defining the key variables influencing the KSA NATO C4ISR market, including system types, platform types, and procurement channels. This step utilizes secondary research and proprietary databases to establish the scope and boundaries of the market.

Step 2: Market Analysis and Construction

This phase involves compiling historical data related to market penetration and system deployments. Analyzing defense budgets, military modernization trends, and technological investments helps determine current market trends and growth drivers.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through consultations with industry experts and defense contractors via surveys and interviews. These insights validate the findings and ensure alignment with real-world developments in defense strategies.

Step 4: Research Synthesis and Final Output

The final stage synthesizes data from both primary and secondary sources, including direct consultations with key players and defense ministries. This comprehensive analysis results in a validated and well-supported market forecast for KSA NATO C4ISR systems

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing geopolitical tensions in the Middle East

Rising defense budgets of NATO and allied nations

Advancement of military communication technologies - Market Challenges

High system integration costs

Complexity of interoperability across different military systems

Geopolitical instability impacting defense investment - Trends

Emerging cyber defense and cybersecurity technologies

Development of autonomous military systems

Increased focus on advanced data analytics in defense

- Market Opportunities

Growing demand for secure communication systems

Innovation in AI-powered surveillance systems

Expansion of cloud-based military platforms

- Government regulations

Strict export controls and regulations on defense technology

Adoption of NATO standards for military interoperability

Increased investment in national security technologies - SWOT analysis

Strengths: Strong demand from defense sector

Weaknesses: High dependency on foreign suppliers

Opportunities: Expansion of regional defense cooperation - Porters 5 forces

Threat of new entrants: Moderate due to high barriers to entry

Bargaining power of suppliers: High due to specialized components

Bargaining power of buyers: Moderate due to limited alternatives

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command and Control Systems

Communication Systems

Intelligence Systems

Surveillance Systems

Reconnaissance Systems - By Platform Type (In Value%)

Land-based Systems

Aerial-based Systems

Naval-based Systems

Satellite-based Systems

Cyber Systems - By Fitment Type (In Value%)

Standalone Systems

Integrated Systems

Mobile Systems

Modular Systems

Cloud-based Systems - By End-User Segment (In Value%)

Defense Forces

Military Contractors

Government Organizations

Security Agencies

International Alliances - By Procurement Channel (In Value%)

Direct Procurement

Third-party Procurement

Online Procurement

Government Auctions

Contracted Procurement

- Market Share Analysis

- CrossComparison Parameters(System Type, Platform Type, Fitment Type, End-User Segment, Procurement Channel)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Northrop Grumman

Raytheon Technologies

BAE Systems

General Dynamics

Thales Group

Leonardo

Elbit Systems

L3 Harris Technologies

SAAB

Indra Sistemas

Rockwell Collins

Rheinmetall

Harris Corporation

Cobham Aerospace Communications

- Demand from Middle Eastern defense ministries

- Adoption by NATO member states and allies

- Expansion of military contractors and private defense firms

- Increased reliance on intelligence agencies for C4ISR systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035