Market Overview

The KSA NATO Defense market is primarily driven by the Kingdom of Saudi Arabia’s heavy investments in military capabilities. In 2023, the market value stood at approximately USD~billion, largely fueled by defense spending and strategic alliances, particularly with NATO members. The country’s defense budget, which exceeds USD ~ billion, plays a critical role in this growth. The demand for advanced defense systems is further bolstered by regional security concerns, technological advancements, and increasing geopolitical instability.Saudi Arabia is the dominant player in the KSA NATO Defense market, with a focus on strengthening its defense ties with NATO. The country has made substantial investments in advanced defense systems, contributing to its leadership in the market. Additionally, cities like Riyadh and Dhahran are central hubs for military operations and procurements due to their proximity to key defense installations and government agencies. Saudi Arabia’s geopolitical significance in the Middle East further enhances its dominance in the defense sector.

Market Segmentation

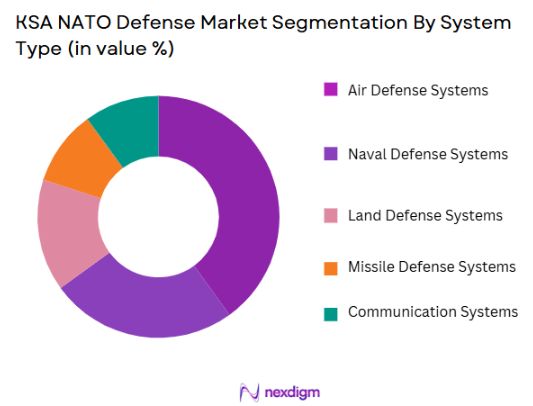

By System Type

The KSA NATO Defense market is segmented by system types into Air Defense Systems, Naval Defense Systems, Land Defense Systems, Missile Defense Systems, and Communication Systems. Among these, Air Defense Systems hold a dominant market share due to Saudi Arabia’s strategic focus on bolstering its air defense capabilities. The country’s need to secure its airspace, especially against regional threats, has driven a heavy investment in systems like the Patriot missile system and other advanced radar technologies. The continuous modernization of air defense systems, coupled with high-end procurement from NATO allies, ensures the continued dominance of this segment.

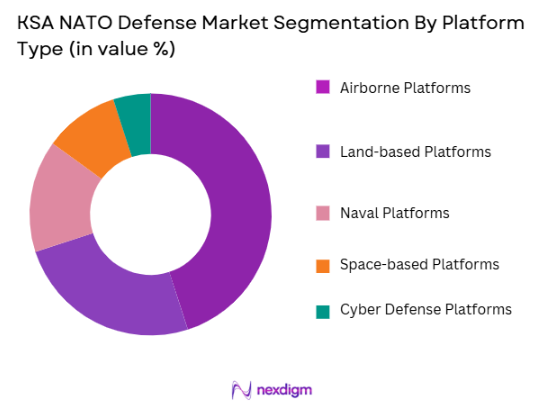

By Platform Type

The market is also segmented by platform type, including Land-based Platforms, Airborne Platforms, Naval Platforms, Space-based Platforms, and Cyber Defense Platforms. Airborne Platforms dominate the segment due to Saudi Arabia’s strategic reliance on air power for both defense and deterrence. With a focus on acquiring advanced fighter jets and surveillance aircraft from NATO, airborne platforms play a crucial role in enhancing national defense capabilities. Saudi Arabia’s significant investment in military aviation technology supports the continued dominance of this sub-segment.

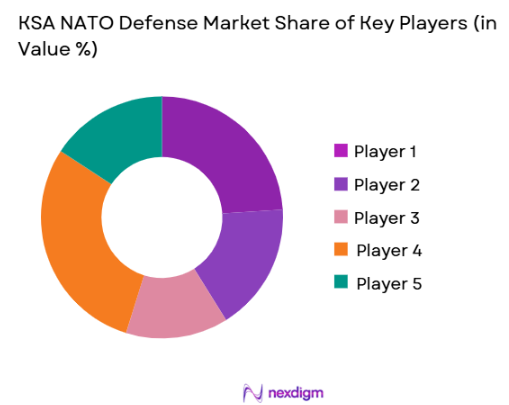

Competitive Landscape

The KSA NATO Defense market is dominated by several key players globally, including Lockheed Martin, Northrop Grumman, and BAE Systems. These companies have established strong presences in the region due to their advanced technologies and strategic partnerships with the Saudi government. The competition in this market is characterized by high entry barriers, substantial capital investment, and the need for technology integration with existing military systems.

| Company | Establishment Year | Headquarters | Technology Leadership | Regional Presence | R&D Investment | Government Contracts | Product Range |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

KSA NATO Defense Market Analysis

Growth Drivers

Urbanization

Urbanization plays a significant role in driving the growth of the KSA NATO Defense market. As Saudi Arabia continues its urbanization efforts, particularly in cities like Riyadh, Jeddah, and Dammam, the demand for robust defense infrastructures and security systems has surged. Urban areas, with their growing populations and industrial developments, require sophisticated defense systems to ensure safety and protect critical infrastructure. The urbanization process includes the expansion of smart cities and the construction of advanced infrastructure, which necessitates the integration of cutting-edge defense technologies, including surveillance systems, air defense solutions, and cybersecurity measures. Furthermore, urban centers often become key targets in regional conflicts, thus prompting the Saudi government to invest in NATO-aligned technologies and defense systems to secure urban spaces. This growing need for defense technology integration in urban settings directly contributes to the expansion of the KSA NATO Defense market.

Industrialization

Saudi Arabia’s ongoing industrialization efforts have significantly contributed to the expansion of the defense market. The country’s Vision 2030 initiative emphasizes diversification away from oil dependency and the development of sectors like manufacturing, high-tech industries, and defense. With the establishment of industrial hubs such as King Salman Energy Park and the expansion of military industries, Saudi Arabia is increasingly focused on developing self-sustaining defense capabilities. This trend has led to rising investments in defense systems, including missile defense, communication systems, and naval technologies. As industrialization progresses, the demand for more sophisticated defense infrastructure increases to protect these growing sectors. In turn, industrialization strengthens Saudi Arabia’s relationships with NATO members, ensuring continued access to state-of-the-art defense technologies and strengthening the market’s growth.

Restraints

High Initial Costs

A major restraint in the growth of the KSA NATO Defense market is the high initial cost associated with acquiring and deploying advanced defense systems. The cutting-edge technologies required for effective defense, such as air defense systems, missile systems, and cyber security infrastructure, come with hefty price tags. Additionally, integrating these systems into existing military infrastructure involves not only high capital expenditures but also substantial training and maintenance costs. The high cost of procurement limits the purchasing capacity of the Saudi government and may slow down the pace of defense upgrades. While Saudi Arabia has a significant defense budget, these expenses can divert funds from other critical sectors, such as healthcare and education. The financial burden associated with these systems is often mitigated through international collaborations and defense contracts with NATO members, but the high initial investment remains a significant constraint in the market.

Technical Challenges

The integration of advanced NATO-grade defense systems in Saudi Arabia presents significant technical challenges. The complex nature of these systems often leads to compatibility issues with existing infrastructure, requiring expensive upgrades or replacements of legacy systems. Additionally, advanced technologies such as cyber defense, air defense radar systems, and missile defense technologies need to be continuously updated to address evolving threats. There are also challenges in ensuring that local defense personnel are trained to operate these highly sophisticated systems efficiently. Moreover, the dependency on foreign expertise and technologies further complicates the process, as geopolitical tensions and export controls may limit access to essential components. These technical hurdles, coupled with the need for constant upgrades and training, are significant constraints on the KSA NATO Defense market.

Opportunities

Technological Advancements

Technological advancements represent one of the most promising opportunities for the KSA NATO Defense market. With rapid innovations in artificial intelligence, cybersecurity, automation, and unmanned systems, Saudi Arabia has the chance to leapfrog traditional defense systems and implement next-generation technologies. NATO members are at the forefront of these innovations, which include advanced missile defense, AI-powered surveillance systems, and next-gen fighter jets. By collaborating with NATO countries, Saudi Arabia can access these technologies to enhance its military capabilities and strengthen its defense infrastructure. Additionally, these advancements improve the efficiency and effectiveness of defense operations, allowing for more cost-effective solutions in the long term. Saudi Arabia’s Vision 2030 initiative places a strong emphasis on technological growth, and defense technologies are no exception. This growing emphasis on tech advancements offers vast opportunities for market expansion and modernization of the country’s defense sector.

International Collaborations

International collaborations, particularly with NATO allies, offer a significant opportunity for growth in the KSA NATO Defense market. Saudi Arabia has been actively seeking partnerships with NATO countries to enhance its defense capabilities, focusing on acquiring advanced military technologies, conducting joint exercises, and collaborating on research and development. These collaborations enable the transfer of cutting-edge defense technologies such as missile defense systems, cybersecurity frameworks, and unmanned aerial vehicles (UAVs), which are critical for modernizing the Saudi military. Moreover, partnerships with NATO countries can open up avenues for joint defense manufacturing and technology sharing, reducing dependency on foreign suppliers and fostering domestic innovation. These collaborations not only strengthen Saudi Arabia’s defense sector but also bolster its geopolitical position in the Middle East, making international collaborations a key driver for long-term market growth. The growing focus on strategic defense alliances will continue to shape the KSA NATO Defense market for years to come.

Future Outlook

Over the next decade, the KSA NATO Defense market is expected to see significant growth, driven by the Kingdom’s ongoing modernization of its defense systems, the increased reliance on advanced technologies, and its strategic partnerships with NATO. The Kingdom’s focus on upgrading its air and missile defense capabilities, coupled with a shift towards cybersecurity and space-based defense systems, will continue to shape the market dynamics. As tensions in the Middle East persist, Saudi Arabia’s defense investments will likely expand, with a strong emphasis on high-tech defense solutions and integration of NATO-standard technologies.

Major Players

- Lockheed Martin

- Northrop Grumman

- BAE Systems

- Raytheon Technologies

- General Dynamics

- Leonardo S.p.A.

- Rafael Advanced Defense Systems

- Thales Group

- Saab AB

- Hensoldt

- Kongsberg Gruppen

- Airbus Defence and Space

- Navantia

- Embraer Defense & Security

- Israel Aerospace Industries

Key Target Audience

- Investments and Venture Capitalist Firms

- Saudi Ministry of Defense

- NATO Defense Agencies

- Saudi National Guard

- International Defense Contractors

- Regional Defense Analysts and Strategists

- Military Equipment Procurement Officers

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key market drivers, including defense budgets, technological advancements, and geopolitical influences in the KSA NATO Defense market. It also includes gathering comprehensive industry data through secondary research, consulting proprietary databases, and analyzing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on defense spending, procurement patterns, and market penetration will be assessed. This analysis will focus on understanding how military procurement decisions are made and their impact on the market growth and technological integration.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on the future trends of the KSA NATO Defense market will be validated through interviews with industry experts, including defense analysts, military officials, and executives from key defense contractors. These consultations will help verify assumptions and provide insights into market forecasts.

Step 4: Research Synthesis and Final Output

The final output will synthesize data from multiple sources, including market analysis, expert opinions, and case studies, to provide a comprehensive and reliable overview of the market. This phase will ensure the accuracy and credibility of the final report.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growing defense budgets in KSA

Increase in security threats from regional instability

Advancements in defense technologies - Market Challenges

High cost of defense procurement

Complexity of integrating new technologies

Geopolitical tensions affecting defense contracts - Trends

Shift towards unmanned defense systems

Focus on AI and machine learning in defense tech

Development of multi-domain defense strategies

- Market Opportunities

Increased collaboration with NATO allies

Expansion of KSA defense exports

Rising demand for cybersecurity solutions - Government regulations

Tighter compliance with international arms agreements

Local content regulations in defense procurement

Increased scrutiny of defense exports

- SWOT analysis

Strength: Strong government investment in defense

Weakness: Dependence on foreign technology

Opportunity: Expansion of local defense manufacturing

Threat: Geopolitical instability in the Middle East - Porters 5 forces

Bargaining power of suppliers: High

Bargaining power of buyers: Medium

Threat of substitutes: Low

Threat of new entrants: Medium

Industry rivalry: High

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Air Defense Systems

Naval Defense Systems

Land Defense Systems

Missile Defense Systems

Communication Systems - By Platform Type (In Value%)

Land-based Platforms

Airborne Platforms

Naval Platforms

Space-based Platforms

Cyber Defense Platforms - By Fitment Type (In Value%)

Retrofit

New Installation

Upgrades

Replacements

Custom Fitments - By EndUser Segment (In Value%)

Military & Defense Forces

Government Agencies

Private Defense Contractors

Civil Aviation

International Defense Organizations - By Procurement Channel (In Value%)

Direct Procurement

Indirect Procurement

Public Sector Tenders

Private Sector Contracts

Third-party Resellers

- Market Share Analysis

- CrossComparison Parameters(Market Share, Product Portfolio, Technological Innovations, Regional Presence, Contract History)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Northrop Grumman

Raytheon Technologies

General Dynamics

BAE Systems

L3 Technologies

Leonardo S.p.A.

Rafael Advanced Defense Systems

Thales Group

Saab AB

Hensoldt

Kongsberg Gruppen

Airbus Defence and Space

Navantia

Embraer Defense & Security

- Military and defense forces are driving demand for advanced defense systems

- Government agencies are expanding their procurement of high-tech defense equipment

- Private contractors are seeking innovative solutions for defense integration

- International defense organizations are exploring multi-country defense collaboration

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035