Market Overview

The KSA NATO Military Aircraft Modernization and Retrofit market is valued at USD ~ billion, as seen in recent years. The market is primarily driven by the modernization needs of the Saudi Arabian Armed Forces, alongside growing defense budgets across the Middle East region. Increased demand for advanced avionics, system upgrades, and air combat capabilities drives the modernization efforts, ensuring military platforms remain technologically relevant and operationally superior. Government-driven defense policies, coupled with NATO agreements, ensure continuous demand for aircraft retrofit and modernization services in the region.Saudi Arabia leads the KSA NATO Military Aircraft Modernization and Retrofit market, owing to its strategic position within the Middle East and robust military expenditure. The country has positioned itself as the dominant player due to its significant investments in military defense, including aircraft modernization programs. Additionally, other nations within the Gulf Cooperation Council (GCC) such as the UAE and Qatar also contribute to the market’s dominance due to their significant military capabilities and partnerships with NATO countries. The region’s ongoing geopolitical concerns further bolster the demand for aircraft modernization, ensuring military superiority and advanced defense technology.

Market Segmentation

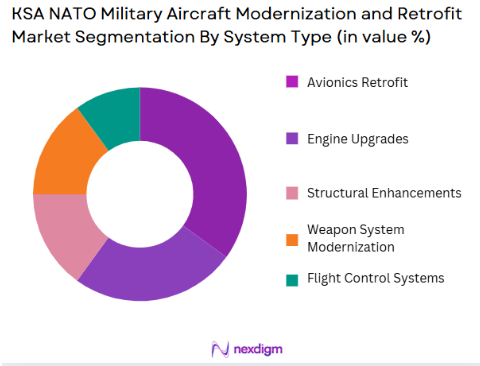

By System Type:

The KSA NATO Military Aircraft Modernization and Retrofit market is segmented into avionics retrofit, engine upgrades, structural enhancements, weapon system modernization, and flight control systems.Avionics retrofitting dominates this segment due to the increasing need for advanced navigation, communication, and electronic warfare systems in military aircraft. The growing complexity of modern warfare has necessitated the integration of state-of-the-art avionics into legacy aircraft to ensure they meet NATO standards. With increasing threats in the region, countries like Saudi Arabia are keen on upgrading their aircraft with the latest electronic and navigation systems to enhance operational capabilities.

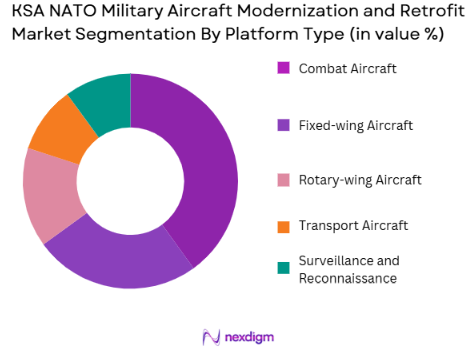

By Platform Type:

The market is segmented by platform type into fixed-wing aircraft, rotary-wing aircraft, combat aircraft, transport aircraft, and surveillance and reconnaissance aircraft.Combat aircraft take the lead in this market segment due to the ever-present demand for upgraded fighter jets in response to regional security challenges. Nations like Saudi Arabia prioritize the modernization of combat aircraft to maintain air superiority. The need for advanced weaponry, enhanced targeting systems, and combat avionics make this segment the dominant contributor. Furthermore, regional alliances with NATO and the evolving nature of aerial combat heighten the necessity for keeping combat aircraft at the forefront of military technology.

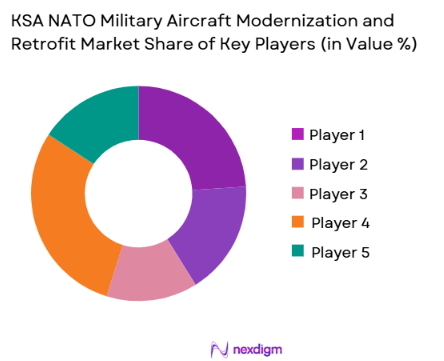

Competitive Landscape

The KSA NATO Military Aircraft Modernization and Retrofit market is dominated by both international defense contractors and local aerospace manufacturers. Key players in the market include Boeing, Lockheed Martin, Northrop Grumman, and regional entities such as Saudi Arabian Military Industries (SAMI). These companies are responsible for providing cutting-edge military aircraft upgrades, leveraging technology transfer agreements with NATO partners.

| Company | Year of Establishment | Headquarters | Market Experience | Product Portfolio | Regional Market Penetration | Innovation Focus |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ |

| Saudi Arabian Military Industries | 2017 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ |

KSA NATO Military Aircraft Modernization and Retrofit Market Analysis

Growth Drivers

Urbanization

Urbanization, while traditionally associated with the development of civilian sectors, indirectly influences the KSA NATO Military Aircraft Modernization and Retrofit market. As urbanization increases in Saudi Arabia and the broader Middle East region, there is a corresponding growth in defense spending to ensure national security amidst rising population densities and growing geopolitical challenges. Urban centers, with their advanced infrastructure, demand enhanced security systems, including air surveillance and defense capabilities. This urban growth boosts demand for modernized military aircraft, ensuring better monitoring, defense readiness, and efficient response systems. The need for highly efficient, versatile aircraft is becoming more important as urban environments evolve, necessitating advanced technologies in both civilian and military airspace management. Thus, the rising trend of urbanization drives the demand for more sophisticated military capabilities, leading to a push for aircraft modernization and retrofitting projects.

Industrialization

The industrialization process in Saudi Arabia and surrounding regions is significantly contributing to the KSA NATO Military Aircraft Modernization and Retrofit market. As industries expand, particularly in sectors related to defense, technology, and aerospace manufacturing, there is a marked shift towards modernizing existing military equipment. Industrialization leads to the establishment of state-of-the-art facilities capable of supporting the development and maintenance of advanced military aircraft. This development also enhances local production capabilities, reducing dependence on foreign suppliers for aircraft parts and retrofitting services. The growing industrial infrastructure makes aircraft retrofitting not only a necessity for maintaining competitive defense capabilities but also an opportunity for economic growth and technological innovation within the region.

Restraints

High Initial Costs

One of the significant challenges faced by countries investing in military aircraft modernization and retrofit, particularly in the KSA NATO Military Aircraft Modernization and Retrofit market, is the high initial costs. Retrofitting existing aircraft with state-of-the-art systems such as advanced avionics, new engines, and enhanced weaponry systems involves substantial financial outlays. The cost of procurement, installation, and system integration can be prohibitive for some countries or defense budgets, especially when factoring in the need for ongoing maintenance and operational costs. The high initial capital investment required for military aircraft modernization may delay the decision-making process, particularly in times of economic uncertainty or shifting political priorities. This restraint significantly affects the pace of modernization programs and the long-term sustainability of retrofitting projects.

Technical Challenges

Technical challenges also pose a significant restraint in the KSA NATO Military Aircraft Modernization and Retrofit market. The complexity of modernizing older aircraft platforms with new technology involves intricate design modifications, software upgrades, and integration challenges. Ensuring that retrofitted systems function seamlessly with existing platforms often requires overcoming compatibility issues between older airframes and newer, cutting-edge avionics, engines, and weapon systems. The technical challenges are compounded by the need to train personnel in the operation and maintenance of these advanced systems, and to manage the risks associated with system failures or malfunctions. These complexities can delay project timelines and increase the risk of cost overruns, making it harder for countries to fully realize the benefits of aircraft modernization.

Opportunities

Technological Advancements

Technological advancements present a significant opportunity for growth in the KSA NATO Military Aircraft Modernization and Retrofit market. The continuous evolution of military technology, including improvements in avionics, engines, materials, and weapons systems, offers the potential to enhance the performance, capability, and longevity of older aircraft. As new technologies become available, they create opportunities for retrofitting legacy aircraft with cutting-edge systems that significantly boost their operational effectiveness. The introduction of advanced technologies such as autonomous flight systems, next-generation radar, and AI-driven combat capabilities are reshaping the future of military aircraft. As these innovations become more accessible, they can be integrated into existing platforms, ensuring that military forces remain technologically superior, agile, and capable of responding to evolving threats.

International Collaborations

International collaborations present a valuable opportunity for the KSA NATO Military Aircraft Modernization and Retrofit market. Collaborative defense agreements between Saudi Arabia and NATO countries enable the sharing of knowledge, technologies, and resources, accelerating the modernization process. These partnerships facilitate the transfer of advanced technologies and ensure that aircraft modernization programs adhere to international standards, increasing the interoperability of military forces. Additionally, joint ventures and collaborations with global defense contractors allow for cost-sharing and access to cutting-edge aerospace technologies that would otherwise be unavailable to local manufacturers. Such collaborations not only enhance the modernization capabilities of Saudi Arabia’s military fleet but also position the country as a key player in the international defense landscape, creating opportunities for expanded trade, military alliances, and regional security.

Future Outlook

Over the next decade, the KSA NATO Military Aircraft Modernization and Retrofit market is poised for substantial growth. As the geopolitical situation in the Middle East remains complex, nations like Saudi Arabia are expected to continue investing heavily in military aircraft modernization to enhance their operational readiness and defense capabilities. Technological advancements in avionics, engine upgrades, and weapon systems will be key growth drivers. Additionally, the increasing demand for multi-role, highly adaptable aircraft will further fuel the market’s expansion, making it a pivotal segment of the Middle East defense sector.

Major Players

- Boeing

- Lockheed Martin

- Northrop Grumman

- Saudi Arabian Military Industries

- Airbus

- Raytheon Technologies

- Leonardo

- General Electric

- BAE Systems

- Collins Aerospace

- Rolls-Royce

- Thales

- L3 Harris Technologies

- Sikorsky Aircraft

- Honeywell Aerospace

Key Target Audience

- Government Defense Agencies

- Military Contractors

- Aerospace Manufacturers

- Aviation Technology Suppliers

- Private Military Contractors

- Defense Sector Investors

- Aerospace Defense Investment Funds

- Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

This initial phase focuses on identifying all major stakeholders and key variables within the KSA NATO Military Aircraft Modernization and Retrofit market. Comprehensive desk research is conducted to gather data on industry dynamics, market trends, and technological advancements, using both secondary and proprietary data sources.

Step 2: Market Analysis and Construction

We analyze historical data to assess market penetration and the ratio of modernization programs to military aircraft in service. Data on growth patterns, service demand, and regional alliances with NATO are examined to evaluate the future potential of the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding demand drivers, technological shifts, and regional security concerns will be validated through expert consultations. These consultations are conducted with aerospace engineers, defense contractors, and military experts to ensure a clear understanding of market forces.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all gathered data and collaborating with key industry players to verify product segments, sales performance, and technological developments. This ensures the delivery of accurate and actionable market insights for the KSA NATO Military Aircraft Modernization and Retrofit market

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Defense Budgets in the Middle East

Demand for Improved Operational Readiness

Technological Advancements in Avionics and Weaponry - Market Challenges

High Costs of Modernization Programs

Complexity of Integration into Legacy Platforms

Regulatory Hurdles in Export Controls - Trends

Shift Towards Digital and Electronic Modernization Solutions

Increased Focus on Cybersecurity in Aircraft Systems

Move Towards Multirole Aircraft in Modernization

- Market Opportunities

Growing Demand for Combat and Surveillance Aircraft Retrofits

Expansion of NATO Partnerships in the Region

Introduction of Advanced Autonomous Systems in Military Aircraft - Government regulations

Stringent Export Control Regulations

Aviation Safety Standards for NATO-compliant Aircraft

Environmental Impact Reduction Regulations for Aircraft Retrofits - SWOT analysis

Strength: Strong Government Spending in Defense

Weakness: High Maintenance Costs for Older Aircraft

Opportunity: Rising Demand for Upgraded Military Platforms

Threat: Geopolitical Tensions in the Middle East Affecting Defense Budgets

- Porters 5 forces

High Bargaining Power of Suppliers in Aerospace Components

Moderate Threat of New Entrants Due to High Capital Investment

Moderate Bargaining Power of Buyers due to Limited Competition in Military Aircraft Retrofit

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Avionics Retrofit

Engine Upgrades

Structural Enhancements

Weapon System Modernization

Flight Control Systems - By Platform Type (In Value%)

Fixed-wing Aircraft

Rotary-wing Aircraft

Combat Aircraft

Transport Aircraft

Surveillance and Reconnaissance Aircraft - By Fitment Type (In Value%)

Line Replaceable Units (LRUs)

Full-system Retrofits

Modular Fitments

Upgraded Components

Integrated Systems - By EndUser Segment (In Value%)

Military Air Forces

Defense Contractors

Government Defense Agencies

OEMs (Original Equipment Manufacturers)

Private Military Contractors - By Procurement Channel (In Value%)

Direct Sales to Governments

Defense Expos and Bidding

Private Sector Procurement

Multi-national Procurement Agreements

Government to Government Deals

- Market Share Analysis

- CrossComparison Parameters(Market Share by Company, Price Trends, Technological Differentiation, Customer Satisfaction, Regional Market Penetration)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Boeing

Lockheed Martin

Northrop Grumman

Airbus

Leonardo

Raytheon Technologies

General Electric

BAE Systems

Thales

Saab

Sikorsky Aircraft

L3 Harris Technologies

Honeywell Aerospace

Collins Aerospace

Rolls-Royce

- Demand for Advanced Weaponry and Communication Systems in Modernized Aircraft

- Shift towards Multi-role Aircraft Across Different Military Branches

- Rising Demand for Customizable Solutions from NATO Allies

- Government and Private Military Contractors’ Increasing Role in Aircraft Modernization

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035