Market Overview

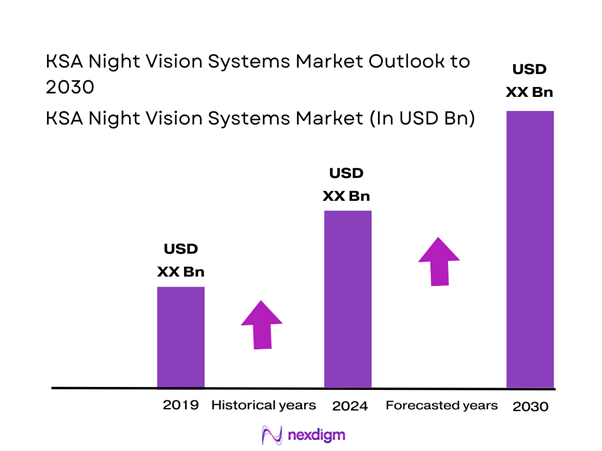

The KSA Night Vision Systems market is valued at USD ~ million, reflecting its role as a strategic enabler of nighttime operational effectiveness across defense, security, and critical infrastructure environments. Demand is structurally anchored in national security priorities, where visibility superiority directly influences mission success, force protection, and situational awareness. The market’s importance is reinforced by sustained procurement cycles, long equipment lifespans, and ongoing upgrades tied to evolving threat environments. Night vision systems are treated as mission-critical assets rather than discretionary equipment, creating stable baseline demand even during broader budget realignments.

Within the Kingdom, procurement and operational concentration is strongest around major military and security hubs in the central and eastern regions, where command centers, bases, and strategic assets are clustered. These regions dominate due to proximity to defense decision-makers, training facilities, and critical energy infrastructure requiring persistent surveillance. From a supply and technology perspective, global influence is driven by countries with advanced electro-optics and thermal imaging capabilities, which dominate core component innovation and system-level integration. Their leadership stems from long-term defense R&D investment, battlefield validation, and established export-grade manufacturing ecosystems.

Market Segmentation

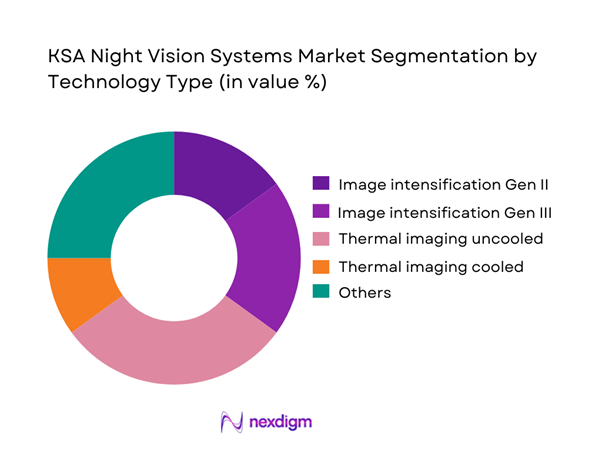

By Technology Type

Thermal imaging systems dominate the KSA night vision systems market due to their superior performance in harsh desert environments and complete darkness. Unlike image intensification devices, thermal systems detect heat signatures rather than relying on ambient light, making them highly effective during sandstorms, smoke, and night-time operations common across the Kingdom. This reliability is critical for border surveillance, infrastructure protection, and military patrols operating across vast and exposed terrains. Thermal imaging also supports longer detection ranges and easier target acquisition, reducing operator fatigue and training complexity. As operational doctrines increasingly prioritize all-weather and all-condition visibility, procurement preferences have shifted toward thermal and hybrid fusion platforms, reinforcing their dominant position across defense and security deployments.

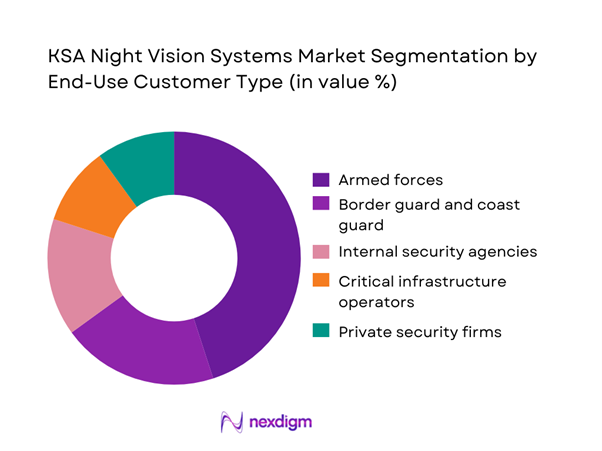

By End-Use Customer Type

Armed forces represent the largest end-use segment within the KSA night vision systems market, driven by comprehensive modernization programs and expanding night-time operational doctrines. Military demand spans infantry units, armored platforms, aviation support, and special operations, each requiring specialized night vision capabilities. Continuous readiness requirements necessitate not only initial system procurement but also sustained upgrades, spares, and training support. Compared to civilian or commercial users, armed forces procure higher-specification systems with enhanced durability, extended detection ranges, and integration with other battlefield technologies. This creates higher average system values and long-term service revenues, reinforcing the segment’s dominance across total market value.

Competitive Landscape

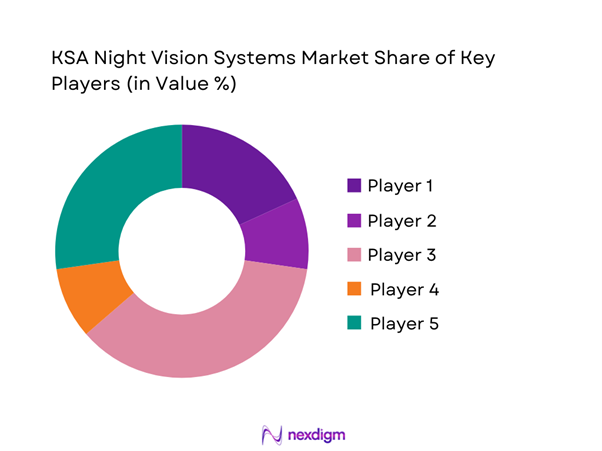

The KSA Night Vision Systems market is dominated by a few major players, including L3Harris Technologies and global or regional brands like Thales Group, Elbit Systems, and Safran Electronics & Defense. This consolidation highlights the significant influence of these key companies.

| Company | Est. Year | Headquarters | Technology Strength | Local Presence | Key Market Focus |

| L3Harris Technologies | 1890s | USA | ~ | ~ | ~ |

| Teledyne FLIR | 1978 | USA | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ |

| Thales Group | 1890s | France | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ |

KSA Night Vision Systems Market Analysis

Growth Drivers

Defense modernization programs

Sustained defense modernization initiatives remain a fundamental growth driver for the KSA night vision systems market. The armed forces’ shift toward technology-centric warfare doctrines prioritizes round-the-clock operational effectiveness, situational awareness, and force survivability. Night vision systems are increasingly embedded within integrated soldier systems, armored vehicles, and command-and-control architectures rather than being procured as standalone devices. As operational concepts evolve, specifications for resolution, weight, power efficiency, and interoperability are regularly updated. This results in continuous replacement, retrofit, and upgrade demand, creating a structurally stable procurement pipeline supported by long-term capability planning rather than sporadic acquisitions.

Border security reinforcement

Border security reinforcement across vast desert and remote terrains strongly drives demand for advanced night vision systems. Continuous night-time monitoring is essential for detecting unauthorized crossings, smuggling activity, and security threats in low-visibility environments. Night vision technologies reduce reliance on manpower by enabling persistent surveillance through fixed installations, mobile patrols, and vehicle-mounted systems. As coverage requirements expand, security agencies increasingly prioritize ruggedized systems with extended detection range and thermal performance suited to harsh climatic conditions. This results in diversified deployment across checkpoints, patrol units, and observation towers, strengthening overall market demand.

Challenges

High acquisition and maintenance costs

Night vision systems rely on sophisticated optical assemblies, sensors, and precision electronics, making acquisition costs inherently high. Beyond initial procurement, ongoing expenses related to calibration, repairs, spare parts, and periodic upgrades significantly increase total cost of ownership. These financial considerations influence procurement planning, particularly for internal security, border units, and infrastructure protection agencies operating within defined budget allocations. Cost sensitivity can lead to phased deployments or prioritization of critical units only, slowing broader adoption. Additionally, specialized maintenance requirements increase dependence on authorized service providers, further elevating lifecycle expenditures.

Export controls and supplier dependency

Export control regulations governing advanced electro-optical and thermal technologies present a persistent challenge for the market. Many high-performance components are subject to licensing restrictions, which can extend lead times and complicate procurement schedules. Heavy reliance on foreign suppliers for image intensifier tubes, thermal sensors, and fusion modules also exposes buyers to geopolitical risks and supply disruptions. These dependencies limit sourcing flexibility and complicate long-term sustainment planning, particularly for mission-critical systems requiring guaranteed availability. Compliance requirements further increase administrative overhead and can delay system upgrades or replacements.

Opportunities

Local manufacturing and localization initiatives

National localization policies create strong opportunities for establishing in-Kingdom assembly, integration, and sustainment capabilities for night vision systems. Local manufacturing initiatives reduce reliance on foreign supply chains while improving delivery timelines and system availability. These programs also support joint ventures, licensed production, and technology transfer arrangements aligned with national industrial development goals. Developing domestic calibration, repair, and overhaul capabilities enhances lifecycle efficiency and reduces operational downtime. Over time, localization initiatives can evolve from assembly-focused operations toward higher-value activities such as testing, customization, and limited component manufacturing.

Integration with unmanned platforms

The expanding deployment of unmanned aerial and ground platforms presents a significant opportunity for night vision system integration. These platforms require compact, lightweight, and energy-efficient electro-optical payloads capable of operating in low-light and no-light environments. Integration with unmanned systems drives innovation in sensor miniaturization, thermal efficiency, and multi-sensor fusion. Successful adaptation broadens addressable applications beyond soldier-mounted and vehicle-based use cases to include reconnaissance, perimeter monitoring, and autonomous patrol operations. This diversification enhances long-term demand and encourages development of platform-specific night vision solutions.

Future Outlook

The KSA night vision systems market is expected to remain strategically resilient, supported by sustained defense and security priorities. Future demand will increasingly favor thermal and fusion technologies, deeper system integration, and localized support capabilities. Procurement will emphasize reliability, lifecycle value, and interoperability, shaping a market oriented toward long-term partnerships rather than transactional sales.

Major Players

- L3Harris Technologies

- Elbit Systems

- Thales Group

- Safran Electronics & Defense

- Leonardo

- BAE Systems

- Raytheon Technologies

- Rheinmetall Electronics

- FLIR Systems

- Hensoldt

- Aselsan

- Optix

- Harder Digital

- Newcon Optik

Key Target Audience

- Defense procurement authorities

- Internal security agencies

- Border and coast guard units

- Critical infrastructure operators

- Private security companies

- System integrators and contractors

- Investments and venture capitalist firms

- Government and regulatory bodies (Saudi Arabia)

Research Methodology

Step 1: Identification of Key Variables

Core demand drivers, application areas, technology categories, and procurement mechanisms were defined to establish market boundaries and relevance.

Step 2: Market Analysis and Construction

Historical deployment patterns, procurement behavior, and technology adoption trends were analyzed to construct the market structure and segmentation.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through consultations with industry participants, system integrators, and procurement experts to refine assumptions.

Step 4: Research Synthesis and Final Output

All findings were synthesized into a coherent framework aligned with client decision-making needs and strategic planning requirements.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Night Vision Usage and Value-Chain Mapping

- Business Cycle and Demand Seasonality

- KSA Defense, Security, and Industrial Delivery Architecture

- Growth Drivers

Defense modernization programs

Border security reinforcement

Critical infrastructure protection needs

Technological upgrades and lifecycle replacement

Night-time operational readiness requirements - Challenges

High acquisition and maintenance costs

Export controls and supplier dependency

Training and operational complexity

Environmental performance limitations

Procurement cycle rigidity - Opportunities

Local manufacturing and localization initiatives

Thermal imaging adoption beyond defense

Integration with unmanned platforms

Dual-use industrial and infrastructure monitoring

Technology transfer partnerships - Trends

Shift toward thermal and fusion systems

Increased emphasis on ruggedization

Digital and network-enabled vision systems

Modular and scalable platform demand

Lifecycle service and sustainment focus - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- Installed Base / Active Usage Metric, 2019–2024

- Service / Revenue Mix, 2019–2024

- By Device Category (in Value %)

Goggles

Monoculars

Binoculars

Weapon-mounted sights

Clip-on night vision devices

Vehicle-mounted systems - By Application (in Value %)

Military and defense operations

Border security and surveillance

Critical infrastructure protection

Law enforcement tactical use

Hunting and outdoor recreation

Industrial and utility inspection - By Technology Type (in Value %)

Image intensification Gen II

Image intensification Gen III

Thermal imaging uncooled

Thermal imaging cooled

Digital night vision

Hybrid fusion systems - By Distribution Model (in Value %)

Direct government procurement

Defense system integrators

Authorized distributors

OEM direct sales - By End-Use Customer Type (in Value %)

Armed forces

Border guard and coast guard

Internal security agencies

Critical infrastructure operators

Private security firms - By Region (in Value %)

Central Region

Western Region

Eastern Region

Northern Region

Southern Region

- Competition ecosystem overview

- Cross Comparison Parameters (detection range, resolution clarity, environmental tolerance, system weight, power consumption, lifecycle support, localization readiness, integration compatibility)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

L3Harris Technologies

Elbit Systems

Thales Group

Leonardo

Safran Electronics & Defense

Rheinmetall Electronics

BAE Systems

Raytheon Technologies

FLIR Systems

Hensoldt

Aselsan

Optix

Harder Digital

Newcon Optik

Wilco Precision

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- Installed Base / Active Usage Metric, 2025–2030

- Service / Revenue Mix, 2025–2030