Market Overview

The KSA Nuclear Missile and Bomb Market is valued based on a recent historical assessment of defense spending and technological advancements within the region. As of the latest evaluation, the market is valued at approximately USD ~ billion, reflecting substantial investment in advanced nuclear technologies and missile defense systems. Key drivers include the government’s ongoing initiatives to bolster national security capabilities amid regional tensions. Growth is influenced by the demand for more sophisticated systems in both missile defense and nuclear propulsion technology, where strategic alliances and defense procurements play significant roles in market expansion.

The dominant regions within the KSA Nuclear Missile and Bomb Market include Riyadh and Jeddah, where major military and defense infrastructure is concentrated. Riyadh, the capital, leads in defense-related investments due to its central role in national security policy and governmental decision-making. Jeddah follows closely as a logistical hub with significant naval and defense-related facilities, supporting the country’s strategic objectives in missile defense and nuclear weapons development. The strength of these cities lies in their proximity to critical military operations and access to international defense markets, ensuring sustained demand for advanced missile systems and nuclear capabilities.

Market Segmentation

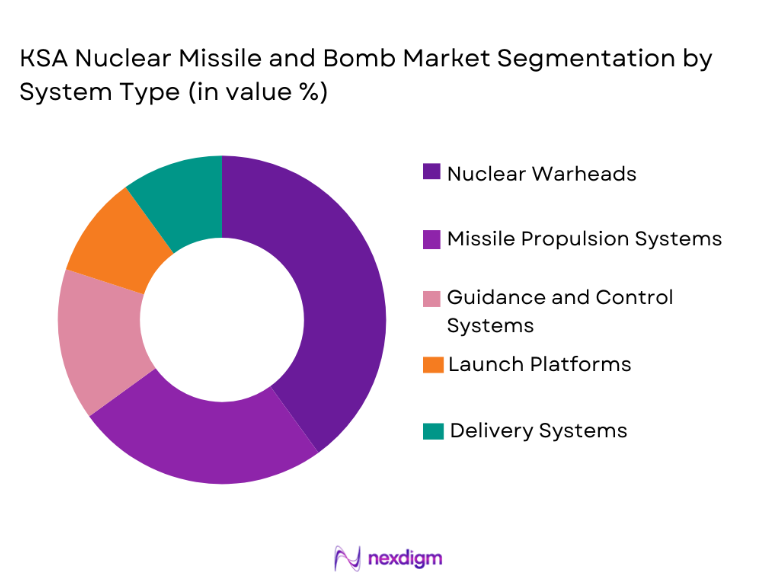

By System Type

The KSA Nuclear Missile and Bomb Market is segmented by system type into nuclear warheads, missile propulsion systems, guidance and control systems, launch platforms, and delivery systems. Recently, nuclear warheads have captured the largest share of the market due to factors such as regional defense strategies prioritizing nuclear deterrence and the growing tension in the Middle East. The demand for nuclear warheads is amplified by national security policies that emphasize enhancing deterrent capabilities and strengthening defense mechanisms against potential threats. These systems are essential in meeting both strategic defense requirements and fulfilling military objectives for national protection.

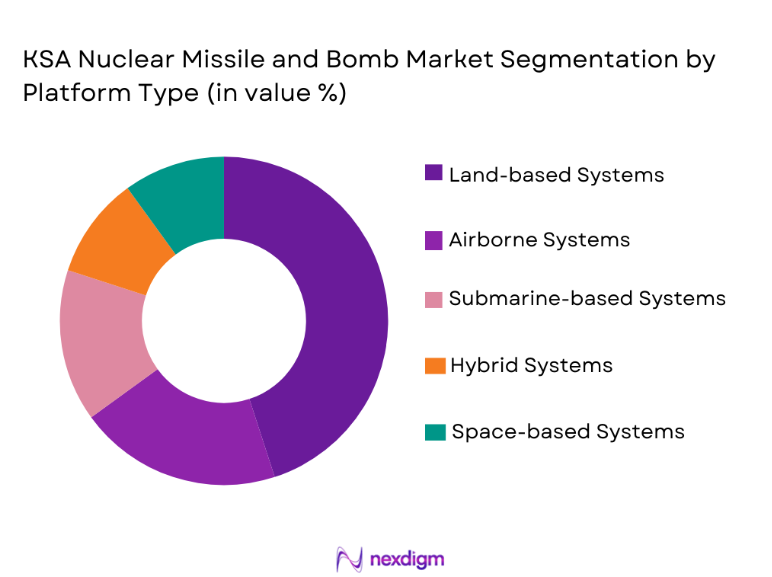

By Platform Type

The KSA Nuclear Missile and Bomb Market is segmented by platform type into land-based systems, airborne systems, submarine-based systems, hybrid systems, and space-based systems. Among these, land-based systems dominate the market due to their strategic value in ensuring readiness and rapid deployment. Land-based systems are vital for the country’s defense posture, allowing for more control over missile launches and better coordination with ground forces. Their proven reliability and ease of integration with existing defense infrastructure have made them a preferred choice for missile deployment, especially for long-range deterrence and strategic operations.

Competitive Landscape

The competitive landscape of the KSA Nuclear Missile and Bomb Market is marked by significant consolidation, with a few large players dominating the market. Major companies involved in the development of nuclear missile and bomb systems continue to shape the market through strategic partnerships, technological innovations, and defense contracts. Players in this market influence both the supply and demand sides, leveraging advancements in missile technology, nuclear propulsion, and advanced defense systems to cater to the KSA government’s defense needs.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | R&D Investment |

| Lockheed Martin | 1995 | USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1997 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

KSA Nuclear Missile and Bomb Market Analysis

Growth Drivers

Defense Budget Expansion

The primary growth driver for the KSA Nuclear Missile and Bomb Market is the continual expansion of the country’s defense budget, which aims to modernize its military forces. This increase in spending supports the acquisition of advanced nuclear systems, missile technologies, and strategic defense infrastructure. The Saudi government recognizes the importance of enhancing national security to defend against external threats, particularly from regional powers. The heightened defense budget also includes significant investments in R&D, ensuring the development of cutting-edge nuclear technologies. This funding is intended not only for acquiring systems but also for developing indigenous capabilities, which aligns with the country’s long-term strategic defense goals. The government has made it clear that boosting military capabilities, especially nuclear deterrence, is a critical aspect of maintaining sovereignty and regional influence. With the ongoing regional instability and evolving geopolitical dynamics, the defense budget will likely continue to grow, further accelerating the demand for advanced missile and nuclear systems. This investment is key to ensuring that KSA remains a leading player in the Middle East’s military capabilities.

Technological Advancements in Missile Systems

Technological advancements in missile systems, particularly in propulsion and guidance systems, are driving the KSA Nuclear Missile and Bomb Market. The rapid development of more accurate and efficient missile systems, including advanced guidance technologies and longer-range capabilities, allows KSA to maintain its strategic edge. These advancements are not only boosting the effectiveness of the country’s missile defense capabilities but also enhancing its deterrent power in the region. The integration of artificial intelligence (AI) and machine learning in missile guidance systems is a significant leap forward, enabling greater precision and faster decision-making processes in missile launches. As the KSA continues to invest in such technologies, these systems become more sophisticated and capable of countering a broader range of threats. The ongoing development of hybrid systems, combining land-based and airborne technologies, is also contributing to the expansion of the market. These technological improvements are expected to lead to more cost-effective solutions in the long run, ensuring that KSA’s defense capabilities remain at the forefront of global standards.

Market Challenges

International Regulatory Pressures

A significant challenge in the KSA Nuclear Missile and Bomb Market is the increasing international pressure related to nuclear non-proliferation. As the country continues to enhance its nuclear capabilities, global regulatory bodies such as the United Nations and the International Atomic Energy Agency (IAEA) have imposed stricter regulations on the development, testing, and deployment of nuclear systems. These regulations can delay development timelines, increase costs, and create obstacles for the country in terms of international trade and partnerships. Furthermore, the possibility of sanctions from countries opposed to nuclear proliferation may hinder KSA’s ability to access critical technologies and resources necessary for missile system development. The KSA must navigate these complex political and diplomatic landscapes while continuing to modernize its defense capabilities.

High Development and Operational Costs

The development and operational costs associated with nuclear missile systems are another major challenge facing the KSA Nuclear Missile and Bomb Market. These systems are incredibly expensive to design, test, manufacture, and maintain. The advanced technology required for missile guidance, propulsion, and warhead delivery significantly drives up the cost, making it difficult for emerging economies to compete with well-established players in the market. In addition to the high costs, there are also ongoing maintenance and operational expenses to ensure that these systems remain functional and effective. As the KSA looks to expand its nuclear and missile capabilities, the financial burden of these systems can strain national resources. This economic challenge is compounded by the need to prioritize spending on other areas of national security and infrastructure development.

Opportunities

Advancement of Autonomous Missile Systems

One of the key opportunities in the KSA Nuclear Missile and Bomb Market lies in the development and deployment of autonomous missile systems. As the global defense landscape evolves, there is an increasing emphasis on autonomous technologies that can operate with minimal human intervention. These systems are designed to offer greater speed, accuracy, and operational efficiency, particularly in response to evolving threats. The KSA has a unique opportunity to invest in these systems to strengthen its defense capabilities while reducing human error and improving mission effectiveness. Autonomous missile systems can significantly reduce the risks associated with human involvement in high-stakes defense operations, particularly in nuclear deterrence scenarios. Additionally, the integration of AI and machine learning into these systems allows for faster decision-making and more precise targeting, further enhancing their effectiveness.

Strategic International Partnerships

Another significant opportunity for the KSA Nuclear Missile and Bomb Market lies in forming strategic international partnerships. Collaborations with countries like the United States, Russia, and China, which possess advanced nuclear technologies, offer the KSA a unique opportunity to access cutting-edge technology and expertise in missile defense systems. These partnerships can result in technology transfers, joint ventures, and defense procurement agreements, helping KSA rapidly enhance its missile and nuclear capabilities. Furthermore, such partnerships can open up new opportunities for defense exports, positioning KSA as a leader in the regional defense industry. By leveraging these partnerships, KSA can secure its position as a global player in nuclear missile technology while ensuring that its defense systems meet international standards.

Future Outlook

The KSA Nuclear Missile and Bomb Market is poised for steady growth in the next five years, driven by increasing defense spending, technological advancements, and strategic partnerships. As the demand for advanced missile systems and nuclear deterrence capabilities continues to rise, KSA is expected to enhance its infrastructure and technological base. The country’s military strategy will likely focus on integrating autonomous systems, expanding its missile defense capabilities, and navigating the regulatory landscape of nuclear proliferation. Expected regulatory support and continued international collaborations will further propel the market forward.

Major Players

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies

- BAE Systems

- Thales Group

- Boeing

- General Dynamics

- L3 Technologies

- Saab Group

- Leonardo

- Tata Advanced Systems

- Kongsberg Gruppen

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Embraer

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- National defense contractors

- Military procurement agencies

- Missile defense system integrators

- Research and development institutions

- International defense alliances

- Strategic defense policy experts

Research Methodology

Step 1: Identification of Key Variables

In this step, key market variables are identified, such as market size, technological trends, regional dynamics, and regulatory factors that impact the nuclear missile and bomb sector.

Step 2: Market Analysis and Construction

Data is collected from credible sources, including government reports, defense agencies, and market research to build a comprehensive analysis of the KSA Nuclear Missile and Bomb Market.

Step 3: Hypothesis Validation and Expert Consultation

Key assumptions regarding market dynamics, technology adoption, and defense strategies are validated through consultations with industry experts and stakeholders to ensure accurate market projections.

Step 4: Research Synthesis and Final Output

The research findings are synthesized into actionable insights, forming the foundation for the final market report. This output provides a detailed analysis of the current and future state of the market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Advancements in nuclear missile technology

Increased defense budgets in the Middle East

Strategic military alliances and defense agreements

Rising regional security threats and geopolitical tensions

Government funding for defense innovation - Market Challenges

High development and maintenance costs

International pressure and regulations on nuclear proliferation

Technological complexity and integration hurdles

Dependence on global supply chains for critical components

Political and economic instability in the region - Market Opportunities

Expansion of military partnerships and defense sales

Growth of autonomous and unmanned missile systems

Advancements in green propulsion technologies for missiles - Trends

Miniaturization of nuclear warheads

Integration of artificial intelligence in missile guidance

Deployment of next-generation nuclear submarines

Shift towards hybrid missile defense systems

Increased focus on missile defense systems in regional conflicts - Government Regulations & Defense Policy

International nuclear non-proliferation agreements

Defense collaborations with allied nations

National policies on the development and use of nuclear weapons

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Nuclear Warheads

Missile Propulsion Systems

Guidance and Control Systems

Launch Platforms

Delivery Systems - By Platform Type (In Value%)

Land-based Systems

Airborne Systems

Submarine-based Systems

Hybrid Systems

Space-based Systems - By Fitment Type (In Value%)

Standalone Systems

Integrated Systems

Modular Systems

Custom-fit Solutions

Pre-fitted Systems - By EndUser Segment (In Value%)

National Defense Agencies

Military Contractors

Research & Development Institutions

Private Security Firms

International Defense Partners - By Procurement Channel (In Value%)

Government Procurement

Direct Sales to Defense Contractors

International Defense Agreements

Private Sector Sales

Joint Ventures and Partnerships - By Material / Technology (in Value%)

Uranium-based Technology

Plutonium-based Technology

High-performance Alloys

Missile Propulsion Technology

Advanced Radar and Guidance Systems

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Technological Innovation, Market Reach, Strategic Alliances, Price Competitiveness, Brand Strength, Operational Efficiency, Regulatory Compliance, Product Portfolio, Financial Performance, R&D Capabilities)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Northrop Grumman

Raytheon Technologies

Boeing

General Dynamics

Thales Group

BAE Systems

L3 Technologies

Saab Group

Leonardo

Tata Advanced Systems

Kongsberg Gruppen

Israel Aerospace Industries

Rafael Advanced Defense Systems

Embraer

- National defense agencies investing in advanced missile systems

- Regional defense contractors involved in missile manufacturing

- Research institutions focused on nuclear propulsion systems

- Private security firms providing missile defense solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035