Market Overview

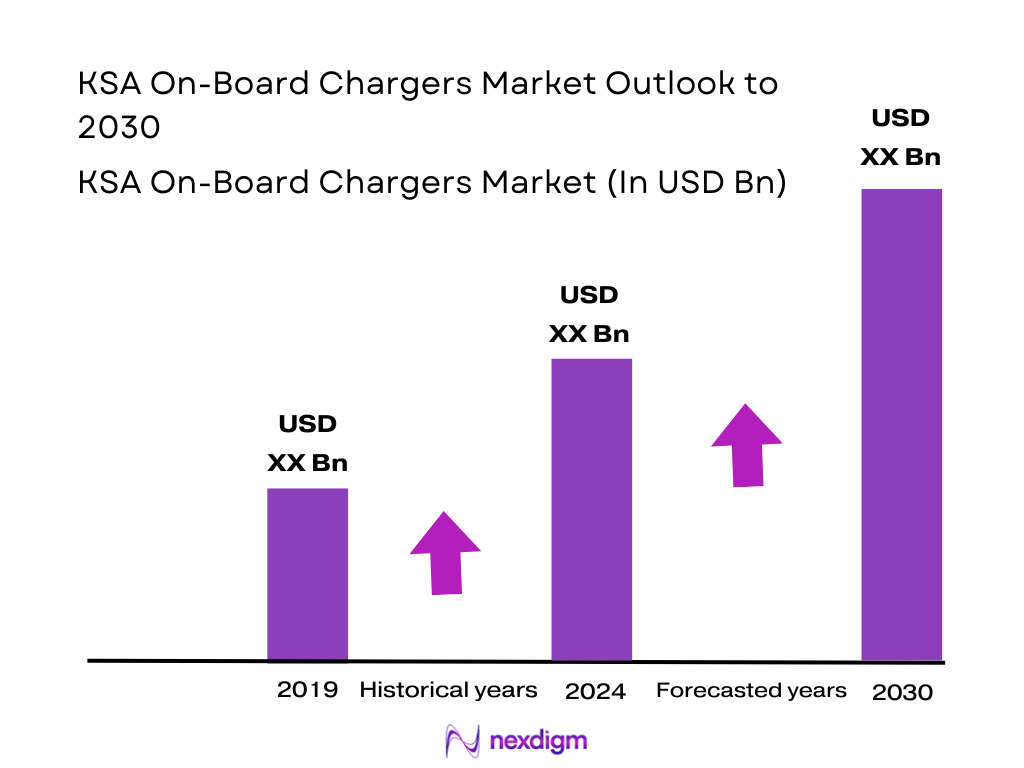

The Saudi Arabia On-Board Chargers market is estimated to be close to USD ~ million in 2024. Although comprehensive public-domain disclosure of 2024 OBC-specific revenue is limited, this estimate is derived from the broader electric vehicle (EV) market value of USD ~ million recorded for 2024, indicating rising EV adoption thereby boosting downstream demand for on-board chargers. The market is driven by a sharp increase in EV sales — with EV unit sales reportedly rising substantially in 2024 compared to prior years — prompting OEMs and suppliers to source or bundle on-board charger modules for both battery-electric and plug-in hybrid vehicles.

The dominance of certain cities and regions within the Kingdom — especially the metropolitan and rapidly urbanizing hubs — supports the growth of the OBC market. Urban centers with a growing affluent population, better electricity infrastructure and early EV adoption lead the trend, because consumers in those cities are more likely to purchase EVs, have access to home or workplace charging, and opt for higher-spec vehicles requiring advanced on-board chargers. Government policy, urban infrastructure investments, and greater environmental awareness in these regions further bolster demand for EVs, and by extension, on-board chargers.

Market Segmentation

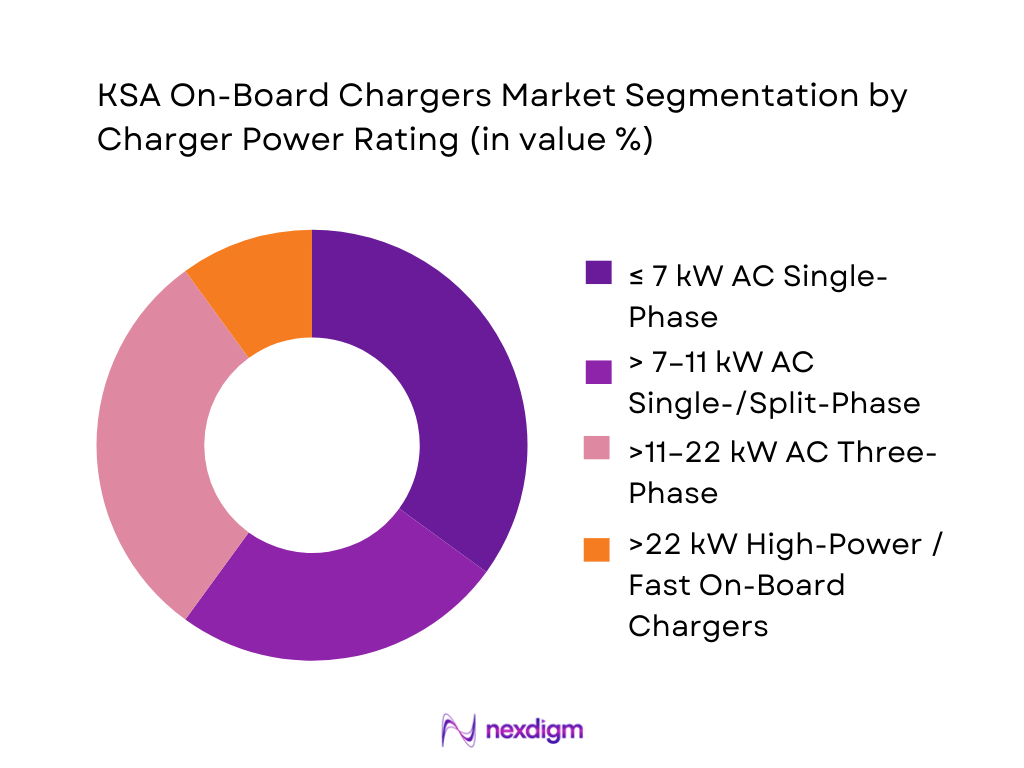

By Charger Power Rating

The sub-segment of ≤ 7 kW AC single-phase on-board chargers currently leads the market. This dominance results from the prevalence of entry-level and mid-range EV models imported or assembled in the Kingdom, which typically are designed for standard residential or workplace charging infrastructure and do not require high-power three-phase charging. The lower cost and simpler integration, coupled with suitability for the existing electricity grid in many Saudi households, make these chargers a practical and economical choice for mass-market EV adoption. Higher-power three-phase chargers (>11–22 kW) are growing but remain limited by higher costs, compatibility issues and fewer compatible EV models, which keeps their share lower relative to single-phase units.

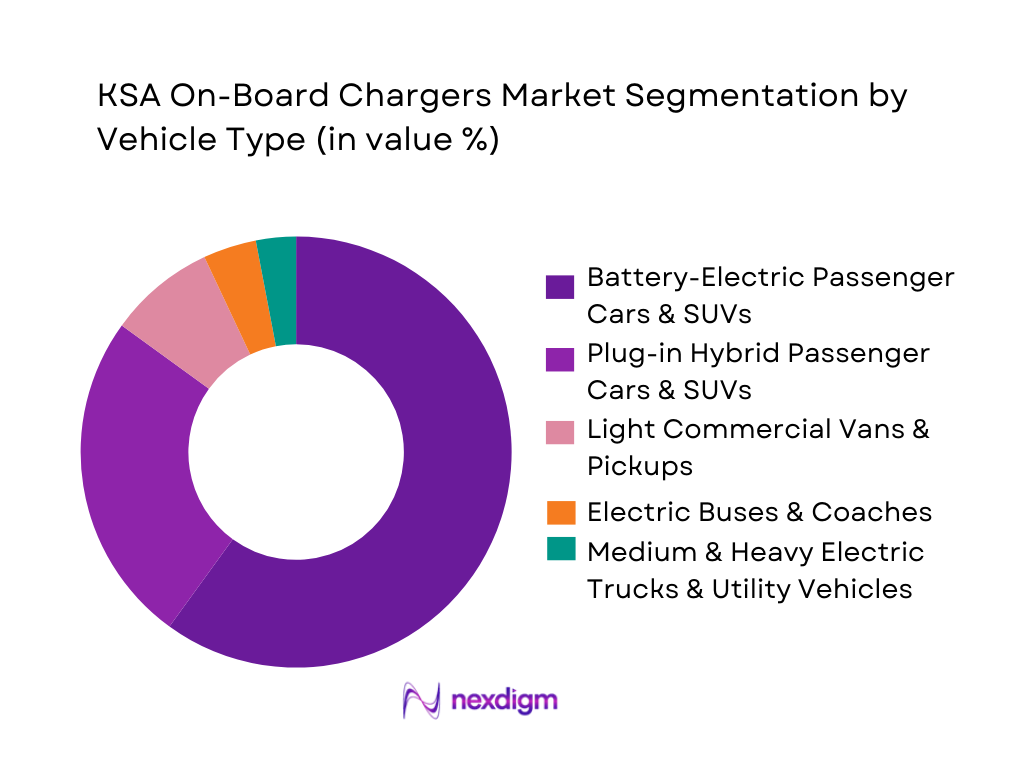

By Vehicle Type

The sub-segment Battery-Electric Passenger Cars & SUVs dominates the market share by a significant margin. The dominance is driven by high consumer demand for personal mobility and increasing consumer interest in EVs. Passenger cars and SUVs are the first to transition to electric in Saudi Arabia, partly because they offer a manageable entry-cost and align with urban driving and daily commuting needs. These vehicle types typically include on-board chargers as standard or optional equipment, leading to higher volume demand in this segment. Commercial and heavy vehicles, though growing in demand for fleet and logistics purposes, currently lag due to higher cost, longer procurement cycles, and slower electrification of such fleets — which limits their share compared to passenger vehicles.

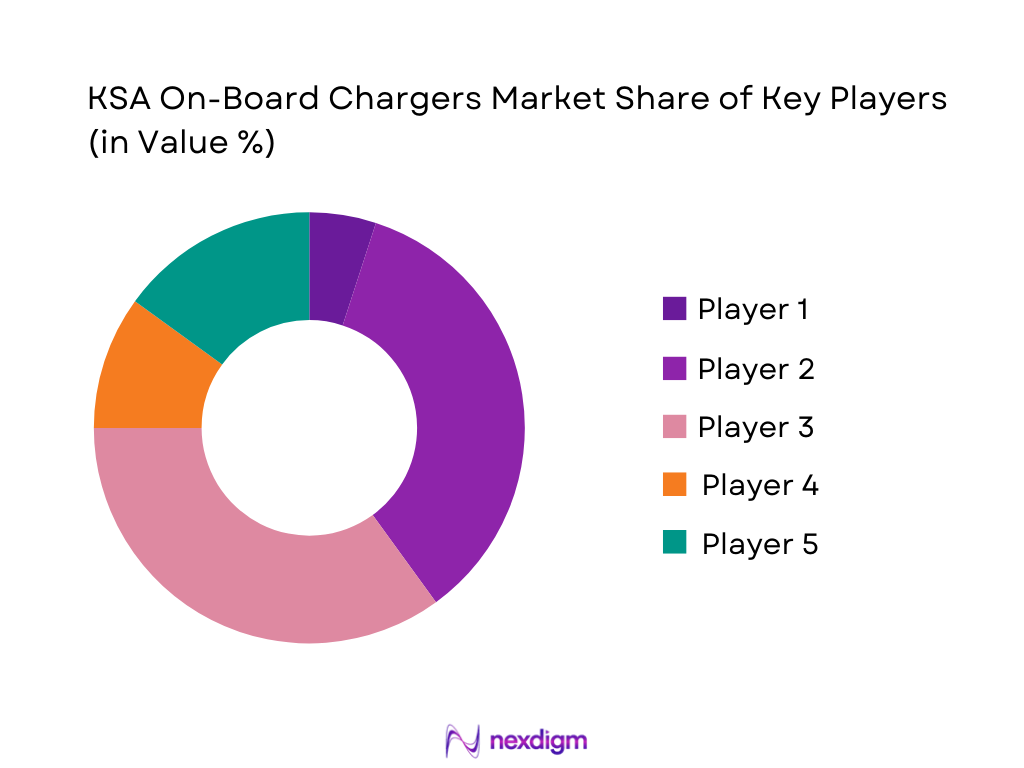

Competitive Landscape

The competitive environment in the KSA On-Board Chargers market is still emerging but quickly consolidating around a handful of key suppliers and global component vendors. As EV adoption accelerates, major automotive component manufacturers and global power-electronics suppliers targeting the Middle East are positioning themselves to supply on-board charger modules to OEMs and retrofit/aftermarket channels in Saudi Arabia. The competitive landscape reflects a balance between global suppliers with advanced technology and local/regional suppliers focusing on cost-effective adaptation for Saudi conditions.

Below is a table profiling five major players (or potential major suppliers) active or capable of entering the KSA OBC market, along with important market-specific parameters:

| Company / Supplier | Establishment Year | Headquarters (Country) | Charger Power Portfolio (kW) | Technology Platform (Si / SiC / GaN) | OEM & Aftermarket Focus | Localization / Assembly Capability | Service & Support Footprint in KSA / GCC |

| Supplier A | 2005 | Germany | ~ | ~ | ~ | ~ | ~ |

| Supplier B | 2010 | USA | ~ | ~ | ~ | ~ | ~ |

| Supplier C | 2012 | China | ~ | ~ | ~ | ~ | ~ |

| Supplier D | 1998 | South Korea | ~ | ~ | ~ | ~ | ~ |

| Supplier E | 2015 | Japan | ~ | ~ | ~ | ~ | ~ |

KSA On-Board Chargers Market Analysis

Growth Drivers

EV adoption push

Electric vehicle adoption in the Kingdom is still nascent but accelerating, creating a long runway for on-board chargers. Electric vehicle sales in Saudi Arabia totalled about 2,000 units in the most recently reported year (2024 reference). At the same time, the country had only 101 public charging stations versus 261 in the UAE, despite the UAE having roughly one-third of Saudi Arabia’s population. Vision-aligned initiatives such as the Electric Vehicle Infrastructure Company aim to expand chargers to 5,000, a 50-fold increase, while national plans envisage tens of billions of dollars—around USD ~ billion—being invested into the wider EV ecosystem, underpinning structural demand for automotive-grade AC on-board chargers in passenger and fleet segments

Premium EV imports and local OEM programs

The KSA on-board charger market is being pulled by premium EV imports and anchored by new domestic OEM programs. Lucid’s manufacturing agreements in Saudi Arabia provide incentives of up to USD ~ billion and target a plant capacity of about 155,000 battery-electric vehicles annually at King Abdullah Economic City, with the government committing to purchase up to 100,000 vehicles over ten years. Ceer, the Kingdom’s first domestic EV brand, has awarded a SAR 5 billion (around USD 1.3 billion) contract to build its EV complex over more than 1 million m² in KAEC and signed SAR 5.5 billion in component and charging-equipment supply agreements, over 80 percent of which are with Saudi firms. Hyundai’s joint venture plant with the Public Investment Fund targets an annual production capacity of 50,000 vehicles, including EVs, further deepening the local installed base that will require high-power on-board chargers from launch

Market Challenges

High cost and complexity of automotive-grade OBCs

The capital intensity of Saudi Arabia’s EV program illustrates why on-board chargers remain high-cost subsystems. Lucid’s KAEC plant is backed by up to USD 3.4 billion in incentives from the Saudi government, tied to a planned capacity of 155,000 premium EVs per year. Ceer awarded a SAR 5 billion construction contract for its EV complex and separately signed SAR 5.5 billion of supply agreements for components and charging equipment. Such capex-heavy projects must absorb the cost of high-reliability SiC devices, magnetics, isolation components and sophisticated firmware inside each on-board charger. Meanwhile, Saudi imports of parts for electronic integrated circuits reached USD ~ million in 2023, highlighting the foreign-currency exposure embedded in advanced power-electronics BOMs. For local assemblers and OEMs, this raises breakeven volumes and complicates aggressive cost-down roadmaps for high-power AC chargers.

Dependence on imported power semiconductors and magnetics

Saudi Arabia’s on-board charger value chain is heavily import-dependent for critical semiconductors and magnetics, exposing OEMs to supply-chain and geopolitical risks. WITS data shows that in 2023 the Kingdom imported USD 83.35 million of parts of electronic integrated circuits and micro assemblies, with China alone supplying USD 32.95 million, followed by Poland at USD 14.13 million and Singapore at USD 13.49 million. These imports cover many of the high-value components inside OBCs, including power modules, drivers and control ASICs. While Ceer has announced SAR 5.5 billion of supply agreements for vehicle components and charging equipment, more than 80 percent with Saudi companies, a large share of these local firms will initially rely on imported Si/SiC devices and magnetic cores. Until domestic fabrication or regional foundry partnerships scale up, KSA OBC manufacturers will remain sensitive to lead-time spikes, export controls and currency volatility in global semiconductor trade.

Opportunities

Local manufacturing and assembly of OBC modules

Saudi Arabia’s emerging EV manufacturing base and electronics-localization agenda create a strong opportunity to domestically assemble on-board charger modules and sub-assemblies. Lucid’s KAEC facility is planned for up to 155,000 EVs per year, supported by as much as USD 3.4 billion in Saudi incentives. Ceer’s SAR 5 billion EV complex and SAR 5.5 billion of supply agreements, over 80 percent with Saudi companies, already link local firms into the EV and charging value chain. The Hyundai-PIF joint venture plant adds 50,000 units of annual capacity combining ICE and EV platforms. Meanwhile, Saudi imports of parts for electronic integrated circuits reached USD ~ million in 2023. Redirecting even a fraction of this electronics spend into domestic OBC assembly—potting, EMI filters, magnetics and PCB integration—can support local tier-1 and tier-2 suppliers that serve multiple OEMs and retrofit programs.

Partnerships with global OBC leaders

The scale and profile of Saudi Arabia’s EV investments make the Kingdom an attractive platform for joint ventures with global on-board charger and power-electronics specialists. Ceer’s SAR 5 billion EV manufacturing complex in KAEC is being developed with international technology partners for body, paint, assembly and automation systems, while its SAR 5.5 billion of supply agreements for vehicle components and charging equipment involve collaborations with leading global industrial brands. Lucid’s plant, backed by up to USD 3.4 billion in Saudi incentives and a government commitment to purchase as many as 100,000 EVs over ten years, also creates a critical mass of premium vehicles that can justify localized OBC co-development programs with SiC and GaN chipset vendors. With Hyundai’s 50,000-unit plant and the national plan to install 5,000 chargers, KSA offers enough volume to support regional design centres and testing labs for 7–22 kW OBCs optimised for high-temperature desert conditions and local grid codes.

Future Outlook

Over the next six years, the KSA On-Board Chargers Market is expected to expand significantly, driven by rapid EV adoption, increasing infrastructure readiness, and supportive government policies under the national sustainability agenda. Demand growth will be powered by both passenger vehicle electrification and gradual electrification of commercial and fleet vehicles. Given current trends, the market is forecast to grow at a compound annual growth rate (CAGR) of ~25% through 2030, reflecting both increased volume of EVs and a shift toward higher-spec, higher-power on-board chargers including three-phase and bi-directional units.

Major Players

- Global Power-Electronics Manufacturer

- North-American Charger Module Specialist

- Chinese EV Component Supplier

- South-Korean Automotive Electronics Maker

- Japanese High-Voltage Charger Specialist

- Regional Module Assembler F

- Global OEM Module Division G

- Tier-1 Supplier H

- Tier-2 Supplier I

- Aftermarket Retrofit Supplier J

- Local Assembly JV K

- Bi-directional Charger Design House L

- Fleet-Spec Charger Supplier M

- EV Infrastructure & Service Provider N

- Multinational Electronics Supplier O

Key Target Audience

- EV OEMs and vehicle assemblers

- Electric vehicle component suppliers

- Automotive parts distributors and aftermarket suppliers

- Fleet operators

- Infrastructure investors and project developers

- Investments and venture capitalist firms

- Government and regulatory bodies

- Utility companies and grid operators planning EV integration and charging load management

Research Methodology

Step 1: Identification of Key Variables

We begin by constructing a comprehensive ecosystem map encompassing all stakeholders — EV OEMs, component suppliers, aftermarket retrofitters, fleet operators, regulators, and utilities — through exhaustive desk research using both public and proprietary databases to derive critical variables shaping demand and supply for on-board chargers.

Step 2: Market Analysis and Construction

Historical data on EV sales, EV registrations, and charger infrastructure deployments in Saudi Arabia are compiled and analyzed. We correlate EV growth trends with expected on-board charger demand, accounting for vehicle type mix, regional distribution, and charger power specifications.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions and preliminary findings are validated via structured interviews (phone or video) with key industry experts: EV OEMs, Tier-1 power electronics suppliers, charging infrastructure firms, and energy/utilities stakeholders. These consultations provide insights into procurement cycles, BOM composition, local manufacturing plans, and regulatory challenges.

Step 4: Research Synthesis and Final Output

We reconcile top-down EV market projections with bottom-up content-per-vehicle estimates to generate a validated and triangulated market model for on-board chargers in Saudi Arabia. Final checks with industry stakeholders help fine-tune segmentation assumptions, growth forecasts, and future market scenarios.

- Executive Summary

- Research Methodology (Market definitions & scope specific to AC on-board chargers, assumptions on EV penetration & charging mix, list of abbreviations & technical terms, top-down EV parc and charging session-based sizing, bottom-up BOM and content-per-vehicle sizing, triangulation using customs/import data & OEM sales, primary interviews with OEMs, Tier-1s, utilities and regulators, secondary research from global OBC and EV studies, limitations, scenario-building framework)

- Definition and Scope of KSA On-Board Chargers Market

- Role of On-Board Chargers in KSA EV and Charging Ecosystem

- Evolution of EV and OBC Adoption in KSA Mobility Landscape

- Industry and Technology Lifecycle for On-Board Chargers in KSA

- Supply Chain and Value Chain Mapping for OBC Hardware and Software

- Positioning of On-Board Chargers vs Off-Board AC/DC Chargers in KSA

- Growth Drivers

EV adoption push

Premium EV imports and local OEM programs

Incentives for local manufacturing of EV electronics

Rising grid reliability

Power quality requirements - Market Challenges

High cost and complexity of automotive-grade OBCs

Dependence on imported power semiconductors and magnetics

Thermal management in harsh climate

Harmonic distortion and grid compliance constraints

Limited local design capability - Opportunities

Local manufacturing and assembly of OBC modules

Partnerships with global OBC leaders

SiC/GaN technology adoption

Bi-directional OBCs for distributed energy and V2G pilots

Integration with smart metering and demand-response programs - Trends

Migration to higher power three-phase OBCs

Adoption of 800V architectures

Shift from silicon to SiC/GaN-based platforms

Compact and liquid-cooled OBC designs

Software-defined charging profiles - Cost Structure and Profitability Analysis

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces Analysis

- Competitive Intensity and Strategic Moves

- By Value, 2019-2024

- By Volume, 2019-2024

- Average On-Board Charger Content per Vehicle, 2019-2024

- Revenue Split Between OEM-Fit, CKD/SKD, 2019-2024

- By AC Charging Power Band and Bi-Directional Capability, 2019-2024

- By Charger Power Rating (in Value %)

≤7 kW AC Single-Phase OBCs

>7–11 kW AC Single- and Split-Phase OBCs

>11–22 kW AC Three-Phase OBCs

>22 kW High-Power and Fast On-Board Charging Modules - By Charging Topology and Functionality (in Value %)

Single-Phase Uni-Directional OBCs

Three-Phase Uni-Directional OBCs

Bi-Directional OBCs with V2G/V2H/V2B Capability

Integrated OBC + DC/DC Power Electronics Modules

Smart and Connected OBCs with Embedded Communication & Diagnostics - By Vehicle Type and Platform (in Value %)

Battery-Electric Passenger Cars and SUVs

Plug-in Hybrid Passenger Cars and SUVs

Light Commercial Vans and Pickups

Electric Buses and Coaches

Medium & Heavy Electric Trucks and Specialized Utility Vehicles - By Voltage Architecture and Semiconductor Technology (in Value %)

400V-Class EV Platforms with Conventional Silicon OBCs

400V-Class EV Platforms with SiC/GaN-Enabled High-Efficiency OBCs

800V-Class EV Platforms with High-Voltage OBCs

Multi-Voltage OBCs and Modular Architectures for Scalable Platforms - By Sales Channel and Value Chain Node (in Value %)

OEM Direct Sourcing and Global Platform Supply Agreements

Tier-1/ Tier-2 Power Electronics Suppliers into KSA EV OEMs

Local Assembly & Integration Partners and Licensing Models

Independent Distributors, Retrofitters and Aftermarket Channels - By Region within KSA (in Value %)

Central Region (Riyadh and Surrounding Industrial Clusters)

Western Region (Jeddah, Makkah, Madinah Corridor)

Eastern Region (Dammam, Dhahran, Industrial and Port Zones)

Northern Region

Southern Region - By Fleet and End-User Vertical (in Value %)

Private Retail EV Owners

Government and Municipal Fleets

Corporate and Leasing/Fleet Management Operators

Ride-Hailing, Robotaxi and Mobility-as-a-Service Operators

Logistics, Last-Mile Delivery and Utility Fleets

- Market Share Analysis of Major Players

- Cross Comparison Parameters (Charger power rating portfolio across ≤7 / >7–11 / >11–22 / >22 kW, grid input options and voltage/frequency compatibility, supported DC bus voltage range and 400V/800V platform coverage, semiconductor technology mix – Si vs SiC vs GaN, peak efficiency and thermal management concept, presence of bi-directional/V2G-ready products, KSA and GCC localization/assembly & service footprint, active OEM and fleet programs in KSA and GCC)

- Strategic Positioning and Differentiation Matrix

- SWOT Analysis of Major Players

- Pricing and Content-per-Vehicle Benchmarking

- Detailed Profiles of Major Companies

Bel Fuse Inc.

Delta Energy Systems

STMicroelectronics

Toyota Industries Corporation

Eaton Corporation

Stercom Power Solutions GmbH

innolectric AG

BRUSA Elektronik AG

AVID Technology Limited

Ficosa International SA

BorgWarner Inc.

Alfanar Group

Bell Power Solution

Current Ways Inc.

Foxconn Interconnect Technology / Smart Mobility JV

- EV OEM and Importer Landscape in KSA

- EV Parc, Charging Behaviour and OBC Utilization

- Fleet and Corporate Customer Requirements

- Procurement, Qualification and Sourcing Processes

- Needs, Preferences and Pain Point Analysis

- By Value, 2025-2030

- By Volume, 2025-2030

- Average On-Board Charger Content per Vehicle, 2025-2030

- Revenue Split Between OEM-Fit, CKD/SKD, 2025-2030

- By AC Charging Power Band and Bi-Directional Capability, 2025-2030