Market Overview

The oral drug solutions market in the Kingdom of Saudi Arabia (KSA) is valued at approximately USD ~million in 2024. Its size has been driven by a steep rise in non-communicable diseases (diabetes, cardiovascular disorders), elevated patient access via expanded hospital and retail pharmacy infrastructure, and a strong national push under Vision 2030 to boost pharmaceutical consumption and local production.

The market’s dominance by major metropolitan hubs such as Riyadh, Jeddah and Dammam stems from their concentration of tertiary hospitals, established pharmacy chains, integrated logistics and a large base of both expatriate and domestic patients. Riyadh serves as the corporate and regulatory centre; Jeddah benefits from western-region medical tourism; and Dammam/Eastern Region supports proximity to Gulf supply chains and import hubs.

Market Segmentation

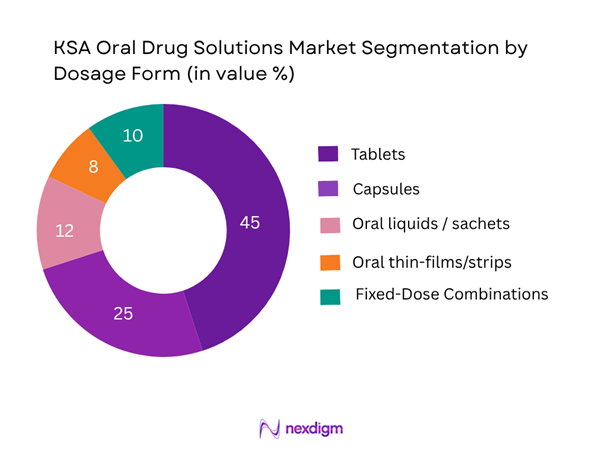

By Dosage Form

The KSA oral drug solutions market is segmented into tablets, capsules, oral liquids/sachets, thin-films/strips and fixed-dose combinations (FDCs). Tablets are dominating with ~45% share in value terms, because they are the established standard for chronic therapies in the Kingdom, benefit from high physician familiarity and broad hospital/retail channel availability. Their production is localised increasingly and supply is steady, making them the preferred format. Capsules follow at ~25% as they offer improved bioavailability for certain APIs. Oral liquids/sachets (~12%) address paediatric and geriatric needs; thin-films/strips (~8%) are emerging for compliance-driven therapies; and FDCs (~10%) are gaining traction in chronic NCD management (e.g., diabetes + hypertension therapies).

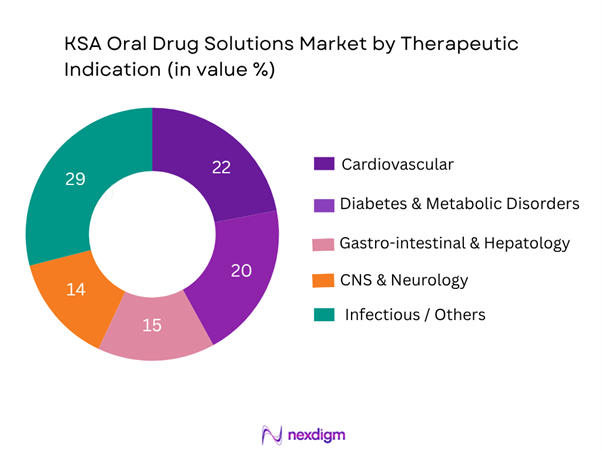

By Therapeutic Indication

Among oral drug solutions in KSA, the infectious/others segment leads (~29%) driven by high antibiotic and anti-infective consumption, plus OTC self-care medications. Cardiovascular (~22%) and diabetes/metabolic (~20%) segments are strong due to high prevalence of hypertension, obesity and diabetes in Saudi Arabia and chronic therapy requirements. GI/hepatology (~15%) and CNS/neurology (~14%) follow, reflecting growth in brain-health, neuro-therapies and gastrointestinal disorders associated with lifestyle. The dominance of infectious/others underscores broad demand across acute conditions and general wellness, where oral dosage forms are convenient and accessible.

Competitive Landscape

The KSA oral drug solutions market is moderately consolidated at the branded-originator end and increasingly competitive in the generics space. Major global players partner with local manufacturers or distributors, while domestic firms are scaling production under the “Made in Saudi” push and competing on cost, localisation and regulatory familiarity.

Below is a snapshot of five major players in the oral solutions segment:

| Company | Establishment Year | Headquarters | Oral-Dosage Portfolio Focus | Localisation/Manufacturing in KSA | R&D Investment (Oral) | Regulatory Approvals (Oral) | Distribution Reach (Oral) |

| Hikma Pharmaceuticals | 1978 | Amman, Jordan | – | – | – | – | – |

| SPIMACO | 1986 | Riyadh, KSA | – | – | – | – | – |

| Tabuk Pharmaceuticals | 1995 | Jeddah, KSA | – | – | – | – | – |

| Pfizer Saudi Limited | 1951 (global) | New York / Riyadh | – | – | – | – | – |

| Sanofi Saudi Arabia | 1933 (global) | Paris / Riyadh | – | – | – | – | – |

KSA Oral Drug Solutions Market Analysis

Key Growth Drivers

Rising NCD burden in KSA

In the Kingdom of Saudi Arabia, non-communicable diseases (NCDs) are the leading cause of mortality, accounting for approximately 73% of all deaths. A recent study found that 18.5% of adults have diabetes and 13.0% have hypertension. The ageing population contributes significantly: the ratio of people aged over 65 per 100 aged 20-64 is projected to almost double from 5.3 to 9.5 by 2030. These large absolute numbers of chronic disease patients drive sustained demand for oral drug solutions, especially tablets and capsules, which are standard for long-term management of conditions like diabetes, cardiovascular disorders and hypertension.

Oral-route dominance (~54% of pharmaceuticals)

In 2024, the oral route of administration represented around 54.0% of the total pharmaceuticals market in Saudi Arabia. This dominance reflects strong patient preference for non-invasive treatment modalities and the well-developed infrastructure for manufacturing and distributing oral dosage forms in the country. The accessibility of retail pharmacies and widespread outpatient treatment models further reinforce oral solutions as the preferred route for chronic and acute therapies. As a result, manufacturers and distributors in the oral-drug segment can leverage this high-volume route to scale and deepen market penetration.

Key Market Challenges

Import-reliance

Saudi Arabia’s pharmaceutical sector remains heavily import-dependent: medicinal and pharmaceutical product imports were valued at USD 2,727.93 million in December 2023. Additionally, local drug production covered only about 36% of total consumption as of 2021. This high level of reliance on imported finished dosage forms and APIs exposes the oral drug solutions market to external supply-chain risks, currency fluctuations and regulatory dependencies—significant hurdles for domestic manufacturers seeking to scale operations.

API supply chain

The supply of active pharmaceutical ingredients (APIs) is also a pressure point: in 2024 the Saudi Arabia API market generated USD 1,882.8 million in revenue, illustrating both the scale and dependence on specialized raw materials. Since many suppliers are offshore, disruptions or delays upstream can impact oral formulation availability, creating inventory risk for manufacturers and distributors of oral drug solutions in the Kingdom.

Emerging Opportunities

Local manufacturing under Vision 2030

Under the Kingdom’s Vision 2030 and associated Healthcare Sector Transformation Programme, Saudi Arabia aims to localise at least 40% of its pharmaceutical manufacturing. With huge volumes of oral drug demand and 54% of the market being oral route, scaling domestic production of oral dosage forms presents a major opportunity: producers who establish local manufacturing or contract-manufacturing capability for tablets, capsules and oral FDCs stand to capture value from supply-chain localisation, government incentives and import-substitution mandates.

Generics/generic oral expansion

The generics segment is gaining policy favour: the oral route in the generic pharmaceutical products market accounted for approximately 45.62% share in 2023. Since generics typically leverage oral delivery formats and benefit from cost-effective manufacturing, there is a strong opportunity for companies focusing on oral generics to grow in Saudi Arabia. Given the large chronic-disease burden and budget pressures on healthcare financing, generics in oral dosage form are strategically well-positioned to expand usage and market share.

Future Outlook

Over the next several years the KSA oral drug solutions market is expected to show meaningful growth driven by the Kingdom’s structural shift toward localised pharmaceutical manufacturing, expanding chronic disease treatment needs, evolving patient adherence technologies (e.g., thin-films, digital packaging) and strengthening retail/online pharmacy penetration. As the government pursues supply-chain security and import substitution under Vision 2030, production of oral dosage forms locally is likely to accelerate, enabling cost efficiencies, faster approvals and improved access. Growth will also be supported by generics uptake, fixed-dose combinations for treatment simplification and expansion of e-pharmacy channels, which enhance reach of oral therapies across urban and semi-urban geographies.

Major Players

- Hikma Pharmaceuticals

- Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO)

- Tabuk Pharmaceuticals

- Jamjoom Pharmaceuticals

- Pfizer Saudi Limited

- Sanofi Saudi Arabia

- AstraZeneca Saudi Arabia

- Novartis Saudi Arabia

- GlaxoSmithKline Saudi Arabia

- Riyadh Pharma

- TheraSaudi Pharmaceuticals

- Ameco Pharmaceutical Company

- Glenmark Saudi Arabia

- Novo Nordisk Saudi Arabia

- Sun Pharma Saudi Arabia

Key Target Audience

- Pharmaceutical manufacturers (local and multinational)

- Distribution and retail pharmacy chains

- Hospitals and hospital pharmacy procurement teams

- Investments and venture-capital firms (pharma/healthcare focussed)

- Government and regulatory bodies (e.g., Saudi Food & Drug Authority (SFDA))

- Contract manufacturing/outsourcing organisations (CMOs/CDMOs)

- Health insurance & reimbursement payers

- API and excipient suppliers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the ecosystem of all major stakeholders within the KSA oral drug solutions market, including oral-dosage manufacturers, importers, distributors, hospital and retail pharmacies. Desk research was conducted using secondary and proprietary databases to gather industry-level information on market size, segmentation, regulatory frameworks and local manufacturing initiatives.

Step 2: Market Analysis and Construction

In this phase historical data and current market information were compiled pertaining to oral drug solutions—such as unit shipments (tablets, capsules), average unit pricing, generics vs branded split, and distribution channel volumes. In addition, we evaluated supply-chain parameters (local vs imported oral dosage forms) and pricing trends to derive revenue estimates and validate underlying logic.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding growth drivers (e.g., chronic disease burden, localisation push), constraints (e.g., regulatory delays, API import dependency) and future trends were validated through structured phone interviews with industry experts from manufacturing, regulatory, distribution and hospital pharmacy segments. These insights supplemented and refined the quantitative data models.

Step 4: Research Synthesis and Final Output

The final phase involved synthesising all gathered data into our bottom-up model for the oral drug solutions market in KSA—adjusting for local manufacturing growth, generics substitution trends, retail/online channel expansion and regulatory impacts. The model was triangulated with publicly-available market forecasts and competitor data to ensure consistency and robustness.

- Executive Summary

- Research Methodology (Definitions & Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, In-depth Industry Interviews, Primary Research Approach, Limitations, Definition and scope, Data sources, Sizing methodology, Forecasting assumptions, Limitations & future conclusions)

- Definition & scope of “oral drug solutions”

- Market origin & evolution in KSA

- Timeline of major regulatory/manufacturing milestones

- Business cycle in the oral drug segment

- Supply chain & value-chain analysis

- Growth drivers

Rising NCD burden in KSA

Oral route dominance ~54% of pharmaceuticals - Market Challenges

Import-reliance

API supply chain

Regulatory approval time - Market opportunities

Local manufacturing under Vision 2030

Generics/generic oral expansion - Key trends

Shift toward generics in oral forms

Oral thin-films for compliance

Digital prescription/tele-medicine impact - Regulatory & policy landscape

- SWOT analysis (for the KSA oral drug solutions market)

- Stakeholder ecosystem (API suppliers, formulators, contract manufacturers, wholesalers, pharmacies)

- Porter’s Five Forces

- By value (K SAR / USD), 2019-2024

- By volume, 2019-2024

- By average unit price, 2019-2024

- By Dosage Form (In-value %)

Tablets

Capsulesoral Liquids

Oral Thin-Films

Fixed-Dose Combinations (FDCs) - By therapeutic indication (In-value %)

Cardiovascular

Diabetes & Metabolic

CNS/Neurology

Gastro-Intestinal/hepatology

Infectious/others - By product category (In-value %)

Branded originator oral drug generic

Oral drugs

OTC oral solutions - By distribution channel (In-value %)

Hospital pharmacies

Retail/community pharmacies

E-pharmacy/online channels - By region (In-value %)

Central

Eastern

Western

Southern

Northern

- Market share of major players (value/volume) in the KSA oral drug solutions market

- Cross-comparison parameters: (Company Overview, Strategic Focus, Product Portfolio, Revenues from oral segment, R&D spend, Local Manufacturing capacity, Regulatory Approvals, Distribution & sales reach)

- SWOT profiles of major players

- Pricing analysis

- Detailed profiles of Major companies:

Hikma Pharmaceuticals

Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO)

Tabuk Pharmaceuticals

Jamjoom Pharmaceuticals

Pfizer Saudi Limited

Sanofi Saudi Arabia

AstraZeneca Saudi Arabia

Novartis Saudi Arabia

GlaxoSmithKline Saudi Arabia

Riyadh Pharma

TheraSaudi Pharmaceuticals

Ameco Pharmaceutical Company

Glenmark Saudi Arabia

Novo Nordisk Saudi Arabia

Sun Pharma Saudi Arabia

- Demand & utilisation patterns

- Patient demographics & behavioural segments

- Budget allocations & reimbursement landscape

- Key unmet needs & pain-points

- Decision-making process & procurement pathway

- By value (K SAR / USD), 2025-2030

- By volume (million units / DDD), 2025-2030

- By average unit price (K SAR per unit), 2025-2030

- Forecast by segmentation, 2025-2030