Market Overview

The KSA passive radar market is valued at USD ~ billion, based on recent historical data and trends within the region. The market growth is driven by a strong focus on national defense, increasing investments in surveillance technologies, and the expansion of security infrastructure across the kingdom. With Saudi Arabia’s ongoing Vision 2030 initiative to modernize its defense systems and increase military capabilities, passive radar systems have become a key component of the country’s strategy to enhance security without emitting detectable signals. The market size is supported by rising government expenditure on advanced defense technologies, which includes passive radar systems for military surveillance and border security.

Source: Saudi Arabian Ministry of Defense

Saudi Arabia is the dominant player in the Middle East for passive radar systems, primarily due to its strategic location and defense needs. Riyadh, as the capital and center for military operations, plays a critical role in the market’s development, attracting investments in advanced radar systems. The Kingdom’s significant defense budget, coupled with its commitment to upgrading its military infrastructure, drives the demand for high-tech surveillance systems. Additionally, Saudi Arabia’s role in regional security and geopolitical stability makes it a key adopter of passive radar for military and civilian applications.

Market Segmentation

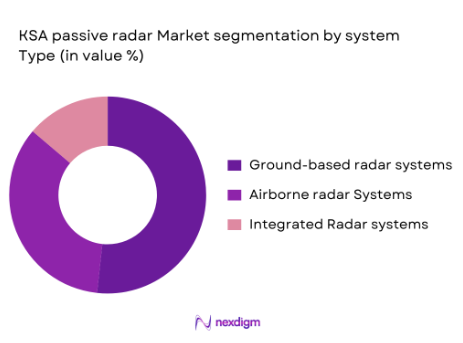

By System Type

The KSA passive radar market is segmented into various system types, including airborne radar systems, ground-based radar systems, and integrated radar systems. Among these, ground-based radar systems dominate the market. This is primarily due to their widespread use in border surveillance, anti-aircraft defense, and monitoring critical infrastructure. Ground-based systems are favored because they offer stable and reliable performance for extended periods without requiring significant mobility. The ability to detect threats in real-time while remaining undetected is particularly valuable for the kingdom’s defense and security operations.

By Platform Type

The KSA passive radar market is also segmented by platform type, which includes military platforms, commercial platforms, and surveillance platforms. Military platforms dominate this segment, driven by the kingdom’s focus on enhancing defense capabilities. The rising geopolitical tensions and security concerns in the region have significantly increased the demand for military-grade radar systems. Passive radar technology is critical in modern military strategies for detecting threats while maintaining stealth, making it a key component in defense applications, especially in areas like air defense and border protection.

Competitive Landscape

The KSA passive radar market is competitive, with several key players who lead the development and deployment of advanced radar systems. Companies like Elbit Systems, Rafael Advanced Defense Systems, and Israel Aerospace Industries dominate the sector. These companies leverage cutting-edge technology in radar systems and contribute to various military and commercial applications. The market is further enhanced by government initiatives to modernize defense systems in line with Vision 2030, which focuses on adopting advanced surveillance technologies, including passive radar.

| Company Name | Establishment Year | Headquarters | R&D Investment | Product Innovation | Market Focus | Revenue (USD) | Global Presence |

| Elbit Systems | 1966 | Haifa, Israel | – | – | – | – | – |

| Rafael Advanced Defense Systems | 1980 | Haifa, Israel | – | – | – | – | – |

| Israel Aerospace Industries | 1953 | Tel Aviv, Israel | – | – | – | – | – |

| Lockheed Martin | 1912 | Bethesda, USA | – | – | – | – | – |

| Raytheon Technologies | 2020 | Waltham, USA |

KSA Passive Radar Market Dynamics

Growth Drivers

Increasing Defense Expenditure in North America

North America, especially the United States, has been increasing its defense budget significantly in recent years. In 2023, the U.S. defense budget was valued at USD 816 billion, up from USD 778 billion in 2022, with a continued trend expected into 2024. This high level of expenditure supports the development and deployment of advanced radar systems, including passive radar, to enhance national security. The U.S. Department of Defense (DoD) continues to invest in advanced surveillance technologies, which has a ripple effect on global defense markets, particularly in the Middle East, where countries like Saudi Arabia aim to modernize their defense infrastructure using cutting-edge technologies like passive radar systems.

Rising Demand for Surveillance and Border Protection

The increasing focus on national security, particularly border protection, has driven the demand for advanced surveillance systems, including passive radar, globally. For example, in 2023, the U.S. allocated USD 24 billion to improve border security technology, including surveillance radar systems. Saudi Arabia, located in a geopolitically sensitive region, is particularly focused on enhancing its security infrastructure. As part of this strategy, border security measures, such as radar systems, are a key component of ensuring the safety of its borders and critical infrastructure. The kingdom has recognized the importance of passive radar systems in reducing vulnerability to threats without compromising operational secrecy.

Market Challenges

High Cost of Passive Radar System Installation

The installation of passive radar systems comes with significant upfront costs, particularly in regions like the Middle East, where the infrastructure requirements are complex. For example, the installation of a high-end passive radar system can cost over USD 150 million, depending on the scope and scale. These costs include infrastructure, system integration, and long-term operational expenses. In Saudi Arabia, which has a growing demand for such systems, these high costs present a challenge to widespread adoption, particularly for smaller municipalities or defense sectors that may face budget constraints despite high levels of national defense expenditure

Regulatory Hurdles in Defense Equipment Procurement

Regulatory compliance and international defense export laws are significant hurdles for countries looking to acquire advanced technologies such as passive radar systems. For instance, Saudi Arabia, like many nations, must navigate through international regulatory frameworks such as the International Traffic in Arms Regulations (ITAR), which govern the export of military technology from the U.S. These regulations impose stringent restrictions on the transfer of passive radar systems and related technology, causing delays in procurement processes. Additionally, Saudi Arabia’s defense procurement processes require extensive approval from regulatory bodies, which can slow the deployment of new technologies and affect market growth.

Market Opportunities

Growth of Smart Cities and Urban Surveillance Networks

The rise of smart cities globally, including within Saudi Arabia, presents significant growth opportunities for passive radar systems. For example, Riyadh, the capital city, is undergoing rapid urbanization with substantial investments in smart city technologies to optimize urban living, security, and monitoring. In 2023, over USD 10 billion was allocated by the Saudi government for developing urban surveillance networks and upgrading infrastructure, with a focus on using advanced surveillance systems such as passive radar. These systems can provide real-time data for managing traffic, ensuring public safety, and monitoring critical urban infrastructures without emitting signals, offering a stealthy yet effective solution.

Source: Saudi Smart Cities Initiative

Expansion of Defense Budgets in North America

North America’s increasing defense budgets create opportunities for passive radar market growth in regions like the Middle East, including Saudi Arabia. The U.S. Department of Defense’s 2023 budget allocation of over USD 816 billion will continue supporting advanced defense systems, including radar technology. The rise in defense spending allows for investments in technologies that enhance border security and military capabilities, areas where passive radar systems are crucial. Saudi Arabia’s own defense modernization initiatives, such as Vision 2030, aim to develop a more advanced and secure defense infrastructure, driving demand for passive radar technology.

Future Outlook

Over the next decade, the KSA passive radar market is expected to experience substantial growth driven by a combination of technological advancements, increasing defense budgets, and expanding applications in smart city and defense sectors. The growing demand for non-intrusive surveillance systems and the integration of AI and machine learning to enhance radar system capabilities will be key drivers of market growth. Moreover, the kingdom’s Vision 2030 initiative is expected to further propel the demand for passive radar solutions to improve security, border control, and defense infrastructure.

Major Players

- Elbit Systems

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Lockheed Martin

- Raytheon Technologies

- Northrop Grumman

- Thales Group

- BAE Systems

- L3 Technologies

- Leonardo S.p.A

- Saab AB

- General Dynamics

- IMI Systems

- Aeronautics Ltd

- Rockwell Collins

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aerospace and Defense Manufacturers

- Telecommunications and Surveillance Service Providers

- Border Security Agencies

- Urban Development Agencies

- Military Contractors

- Technology Integrators for Defense Systems

Research Methodology

Step 1: Identification of Key Variables

The first phase involves creating a map of key stakeholders in the KSA passive radar market. This process combines secondary research and proprietary databases to understand the market dynamics, stakeholders, and key drivers.

Step 2: Market Analysis and Construction

We will compile historical data regarding the market’s value and adoption rate, focusing on regional defense expenditure, platform demand, and technology integration. This analysis will assess various radar systems, particularly their application in military and civilian sectors.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be tested through consultations with industry experts, military officials, and defense contractors. This expert feedback will refine the market insights and verify the assumptions made during the research phase.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from various sources and experts, offering a comprehensive overview of the market. This data will be cross-validated with bottom-up and top-down market estimates, ensuring the accuracy and reliability of the final report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense expenditure in North America

Rising demand for surveillance and border protection

Technological advancements in radar system integration - Market Challenges

High cost of passive radar system installation

Regulatory hurdles in defense equipment procurement

Integration complexities with existing military systems - Market Opportunities

Growth of smart cities and urban surveillance networks

Expansion of defense budgets in North America

Technological innovations in radar signal processing - Trends

Shift toward low-maintenance radar systems

Growing use of radar systems in civil applications

Integration of AI and machine learning for enhanced radar performance

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Ground-based Radar Systems

Airborne Radar Systems

Maritime Radar Systems

Integrated Passive Radar Systems

Mobile Radar Systems - By Platform Type (In Value%)

Military Platforms

Commercial Platforms

Surveillance Platforms

Defense Communication Platforms

Smart City Platforms - By Fitment Type (In Value%)

Fixed Systems

Mobile Systems

Portable Systems

Integrated Systems

Modular Systems - By End User Segment (In Value%)

Military & Defense

Aerospace & Aviation

Homeland Security

Public Safety & Emergency Services

Private Sector (Telecommunications, Weather Forecasting) - By Procurement Channel (In Value%)

Direct Procurement

Public Tenders

Private Procurement

Integrated Procurement

Online Platforms

- Market Share Analysis

- Cross Comparison Parameters (Market Share, System Complexity, Installation Cost, Technology Integration, Platform Compatibility)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Detailed Company Profiles

Elbit Systems

Rafael Advanced Defense Systems

Israel Aerospace Industries

IMI Systems

Aeronautics Ltd

Thales Group

Lockheed Martin

Northrop Grumman

Raytheon Technologies

Saab AB

General Dynamics

BAE Systems

Leonardo S.p.A

L3 Technologies

Rockwell Collins

- Government agencies’ growing reliance on passive radar

- Military organizations enhancing border surveillance

- Aerospace companies adopting radar for air traffic control

- Telecommunications industry seeking radar for spectrum management

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035