Market Overview

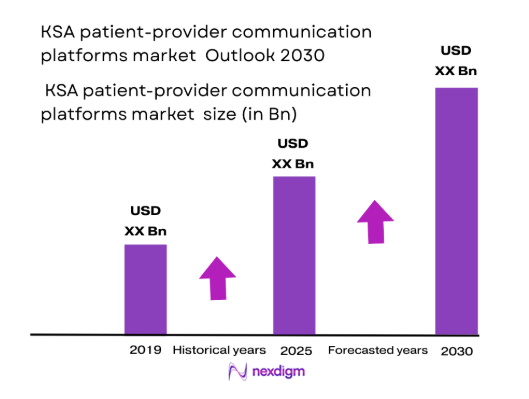

The KSA patient-provider communication platforms market is valued at USD~ million, and it is primarily driven by the rising demand for efficient and effective healthcare communication solutions. Factors such as increased smartphone penetration, government healthcare initiatives, and a growing focus on patient-centered care fuel the demand for such platforms. Government programs like the Saudi Vision 2030 initiative emphasize digital transformation within healthcare, aiming to modernize the delivery of medical services, including communication channels between patients and healthcare providers.

The Kingdom of Saudi Arabia (KSA) is witnessing significant growth in the patient-provider communication platforms market, with cities like Riyadh, Jeddah, and Dammam playing a key role in market dominance. Riyadh, being the capital and the economic hub, is home to several leading healthcare institutions and tech companies, driving the adoption of digital health solutions. Jeddah, with its thriving healthcare sector and proximity to Mecca, also fosters the expansion of these platforms due to its large population and high healthcare expenditure. These cities are at the forefront of healthcare innovation and digital health integration.

Market Segmentation

By Platform Type

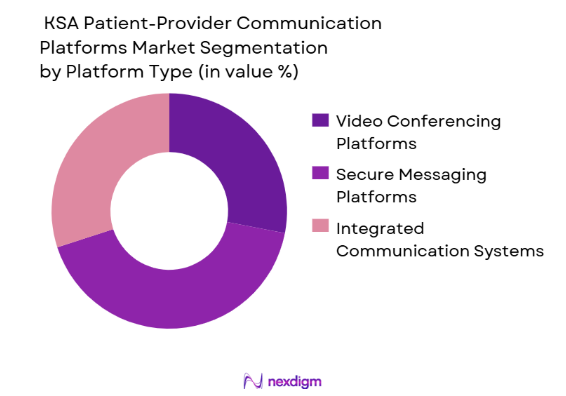

The KSA patient-provider communication platforms market is segmented by platform type into video conferencing platforms, secure messaging platforms, and integrated communication systems. Recently, secure messaging platforms have seen rapid growth due to their ability to offer real-time, secure communication, which is essential for patient confidentiality and privacy in accordance with regulatory requirements such as HIPAA. Additionally, healthcare providers are increasingly using these platforms to offer continuous care, which supports a more personalized patient experience.

By secure messaging platforms, the adoption is largely driven by the ease of use and immediate response capabilities, which reduce wait times and improve overall patient satisfaction. This trend is further supported by the shift toward telemedicine, where communication privacy and speed are critical.

By End User

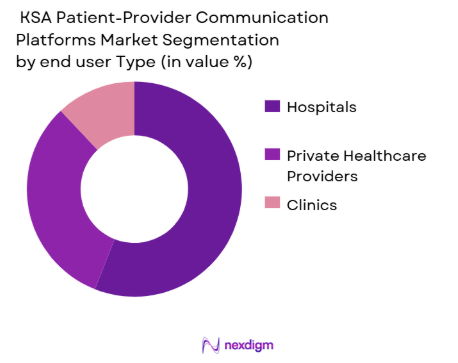

The market is also segmented by end users, including hospitals, private healthcare providers, and clinics. Hospitals dominate this segment due to their large-scale infrastructure and the need for complex communication systems for different departments and specialists. These institutions are increasingly adopting platforms to streamline patient management, improve patient care, and comply with healthcare regulations. The private healthcare providers’ segment is expanding as well, driven by rising healthcare expenditures and the need for efficient communication with patients to offer personalized services. Hospitals lead in platform adoption, as they require advanced systems to manage a high volume of patient-provider interactions across multiple departments, ensuring quality patient care and better operational efficiency.

Competitive Landscape

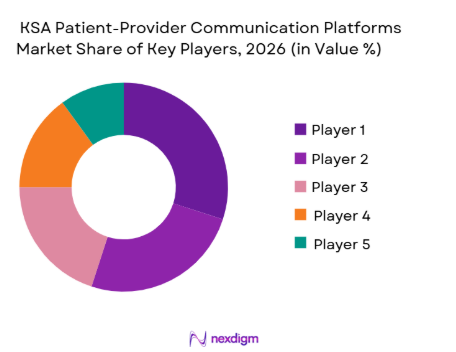

The patient-provider communication platforms market in KSA is growing rapidly, and several key players dominate the market. The market is characterized by a combination of global giants and local companies providing secure and efficient solutions. Companies like Cerner Corporation, Philips Healthcare, and local tech-driven startups like Healthigo are leading the market. The competition is intense, with an increasing focus on enhancing security features, ease of integration with existing healthcare systems, and a seamless user experience for both patients and providers.

| Company | Establishment Year | Headquarters | Key Offerings | Technology | Target Market |

| Cerner Corporation | 1979 | USA | ~ | ~ | ~ |

| Philips Healthcare | 1891 | Netherlands | ~ | ~ | ~ |

| Healthigo | 2017 | KSA | ~ | ~ | ~ |

| Medtronic | 1949 | USA | ~ | ~ | ~ |

| Siemens Healthineers | 1847 | Germany | ~ | ~ | ~ |

KSA Patient-Provider Communication Platforms Market Analysis

Growth Drivers

Urbanization

Urbanization is a key factor driving the growth of the patient-provider communication platforms market in Saudi Arabia. As of 2024, over 84% of the population in Saudi Arabia lives in urban areas, with cities like Riyadh, Jeddah, and Mecca leading in healthcare infrastructure development. This rapid urbanization has increased the demand for digital health solutions to cater to the growing urban population’s healthcare needs. Additionally, urban centers are hubs for technological advancements, fostering innovation in communication technologies that improve healthcare delivery. The increased need for efficient patient-provider communication in densely populated cities further fuels the adoption of these platforms.

Industrialization

Industrialization in Saudi Arabia has played a significant role in the demand for patient-provider communication platforms. With the government’s Vision 2030 aiming to diversify the economy, the growth in industrial sectors such as oil, gas, and manufacturing has led to urban workforce expansion. This shift necessitates more accessible and efficient healthcare solutions for industrial workers, especially in remote areas. The rise in private and public sector partnerships is pushing healthcare providers to adopt advanced communication tools to ensure the timely delivery of health services, improving overall worker productivity and health outcomes.

Restraints

High Initial Costs

One of the significant barriers to the widespread adoption of patient-provider communication platforms in Saudi Arabia is the high initial investment required. The integration of advanced technologies, such as secure messaging, video conferencing, and AI-powered diagnostic tools, requires substantial capital investment, particularly for smaller healthcare facilities. Many healthcare providers in the country face budget constraints, limiting their ability to implement such technologies across the board. The cost of ensuring compliance with data protection regulations further escalates initial deployment costs, making it a challenge for some healthcare providers to fully embrace digital solutions.

Technical Challenges

The technical challenges of integrating patient-provider communication platforms into existing healthcare systems represent a significant restraint. The complexity of linking these platforms with Electronic Health Records (EHRs) and other hospital management systems often leads to compatibility issues. Furthermore, maintaining the interoperability of systems, especially in a rapidly evolving technological landscape, presents ongoing challenges for healthcare providers. Healthcare professionals also face difficulties in training their staff to use these systems efficiently, leading to delays in implementation and underutilization of the platforms.

Opportunities

Technological Advancements

Technological advancements in AI, machine learning, and mobile health (mHealth) solutions present significant opportunities for the KSA patient-provider communication platforms market. AI-powered chatbots and virtual assistants are increasingly being integrated into communication platforms to provide automated assistance to patients, reducing the load on healthcare staff and improving patient engagement. Moreover, the development of 5G networks in Saudi Arabia is expected to further enhance the capabilities of telemedicine and communication platforms, facilitating real-time video consultations and improving the overall user experience.

International Collaborations

International collaborations present an opportunity for the growth of patient-provider communication platforms in Saudi Arabia. Partnerships between Saudi Arabian healthcare providers and global tech companies can facilitate the adoption of best-in-class platforms and technologies. These collaborations are also helping to bring in advanced telemedicine solutions, including virtual care platforms, and ensure seamless integration with global health data networks. The government’s Vision 2030 emphasizes international partnerships in healthcare, creating opportunities for technology transfer and expertise sharing between international companies and Saudi healthcare institutions.

Future Outlook

The future of KSA’s patient-provider communication platforms market is promising, with significant investments expected in healthcare IT and telemedicine. Over the next few years, the market will likely see continued growth, driven by the government’s focus on improving healthcare delivery through technology. The rapid adoption of mobile apps, integration of AI in health diagnostics, and seamless patient-provider communication solutions are expected to be the major trends. Government initiatives promoting digital healthcare transformation under Vision 2030 will support the growth of the market, with increasing acceptance of telemedicine and remote monitoring solutions.

Major Players

- Cerner Corporation

- Philips Healthcare

- Epic Systems Corporation

- Allscripts Healthcare Solutions

- IBM Watson Health

- eClinicalWorks

- Oracle Corporation

- Microsoft Corporation

- Cisco Systems Inc.

- Tiger Connect Inc.

- Vocera Communications

- Spok Inc.

- PerfectServe Inc.

- Halo Health

- Doctify

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Healthcare Providers

- Healthcare Technology Providers

- Telemedicine Companies

- Insurance Providers

- Healthcare Consultants

- Private Health Networks

Research Methodology

Step 1: Identification of Key Variables

The first phase involves constructing a detailed ecosystem map of the KSA healthcare and communication sector. Extensive desk research and data collection from industry reports, public records, and official Saudi healthcare sources will ensure a comprehensive understanding of all key players and their contributions to the market.

Step 2: Market Analysis and Construction

This phase involves the compilation and analysis of historical data regarding the adoption of communication platforms in the KSA healthcare system. The data will be segmented by region, platform type, and end user to build an accurate picture of market demand and supply.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through expert consultations, including interviews with healthcare providers, government officials, and technology experts. These consultations will help fine-tune the market predictions and ensure they align with real-time market behavior and evolving trends.

Step 4: Research Synthesis and Final Output

In this phase, the final report will be developed based on the insights gathered through primary and secondary research. The data and trends will be analyzed in relation to KSA’s Vision 2030 to forecast the future trajectory of the market and provide strategic recommendations.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Healthcare Ecosystem & Value Chain Analysis

- Growth Drivers

Government Digital Health Initiatives & Vision 2030 Alignment

High Smartphone & Internet Penetration Supporting Digital Consultations

Rising Chronic Disease Burden & Need for Efficient Care Communication

Pandemic‑Driven Acceleration of Remote Communication Platforms - Market Challenges

Regulatory & Data Privacy Compliance Requirements

Integration Complexity with Hospital Information Systems - Opportunities

AI & Machine‑Learning Integration for Personalized Patient Engagement

Expansion into Underserved Rural Regions

Cross‑Platform Interoperability with National EHR Initiatives

Chronic Care Management Communication Workflows - Trends

AI‑Powered Chatbots & Symptom Checkers

Wearables & Mobile Integration for Ongoing Patient Feedback

Enhanced Bi‑Directional Patient Messaging Systems

Localization of Platforms for Arab‑Language Patient Engagement

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price, 2019-2025

- By Technology Type (In Value %)

Video Communication Platforms

Patient Portal System

E‑Prescription & Follow‑Up Platforms

AI‑Enabled Symptom Check & Triage Tools

Secure Messaging & Chat Platforms - By Interaction Mode (In Value %)

Synchronous (Real‑Time Communication)

Asynchronous Messaging & Follow‑Up Tools

Hybrid Interaction Platforms - By End‑User Type, 2024 (In Value %)

Hospitals

Clinics & Specialty Centers

Home Care Providers & Remote Care Services

Patients - By Deployment Model (In Value %)

Cloud‑Based Platforms

On‑Premises Solutions

Hybrid Deployment Models - By Service Type, (In Value %)

Virtual Consultations & Telemedicine

Remote Monitoring & Alerts

Care Coordination & Discharge Planning Tool

Appointment Booking & Patient Engagement Services

Electronic Health Records Integrated Messaging

- Market Share (Value/Volume)

- Cross Comparison Parameters:(Business Strategies & Roadmaps, Recent Developments & Partnerships, Strength and Weaknesses, Organizational Structure & Team Expertise, Annual Revenues & Revenue Growth, Product Portfolio Breadth (Telemedicine, Messaging, mHealth, AI), Number of Active Users / Providers, Customer Acquisition & Retention Metrics, Average Revenue per User (ARPU), Integration with National Health Systems, Interoperability & EHR Connectivity, Geographic Penetration & Distribution Network)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Porter’s Five Forces

- Detailed Profiles

Virtual Hospital

Mawid Sehhaty

Altibbi

Vezeeta

Cura

Meddy

Okadoc

DabaDoc

TAJ Digital Health

CloudPita

MedIQ Solutions

GlobCare Medical

Smart Health Medical Company

IMC Telemedicine Magna International

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2026-2030

- By Volume, 2026-2030

- By Average Price, 2026-2030