Market Overview

The KSA Pedestrian Detection Systems Market is valued at USD ~ million, reflecting the growing structural importance of advanced vehicle safety technologies within the country’s mobility ecosystem. Demand for pedestrian detection systems is driven by increasing urbanization, higher pedestrian traffic density, and a national focus on reducing road fatalities through technology-led interventions. These systems play a critical role in enhancing situational awareness for drivers by identifying pedestrians in real time and triggering warnings or autonomous braking responses. Their integration into modern vehicles aligns with broader intelligent transportation and road safety objectives, making them a foundational component of next-generation automotive safety architectures in the Kingdom.

Within the country, Riyadh and Makkah regions dominate deployment due to higher vehicle density, complex urban road networks, and elevated pedestrian movement linked to commercial activity and religious tourism. These regions experience greater safety risk exposure, accelerating adoption by both private consumers and fleet operators. On the supply and technology side, global automotive safety technology leaders influence system architectures, sensor design, and software algorithms through OEM partnerships. Their dominance stems from advanced R&D capabilities, proven safety certifications, and the ability to integrate pedestrian detection into broader ADAS platforms aligned with evolving vehicle platforms in the Kingdom.

Market Segmentation

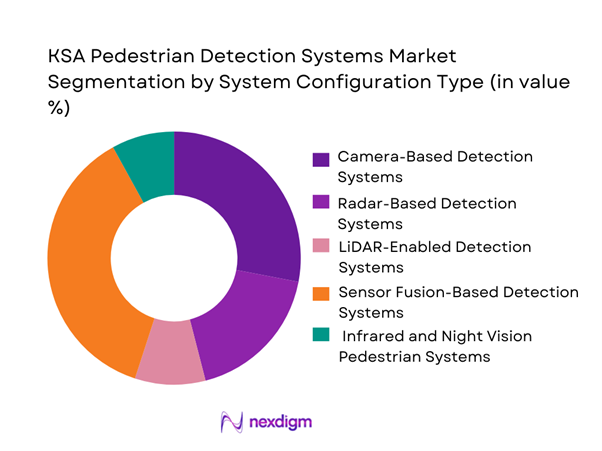

By System Configuration Type

Sensor fusion-based detection systems dominate the KSA Pedestrian Detection Systems Market as they combine data from cameras, radar, and in some cases infrared sensors to deliver higher detection accuracy across diverse driving conditions. The Kingdom’s operating environment, characterized by intense sunlight, dust, and night-time visibility challenges, limits the effectiveness of single-sensor systems. Sensor fusion architectures overcome these constraints by cross-validating inputs, reducing false positives, and improving reliability in urban and highway scenarios. OEMs increasingly prioritize these configurations to meet stringent safety performance requirements while ensuring system robustness. Additionally, sensor fusion systems provide scalability for future software upgrades, making them a preferred choice for manufacturers aiming to align with long-term vehicle safety roadmaps.

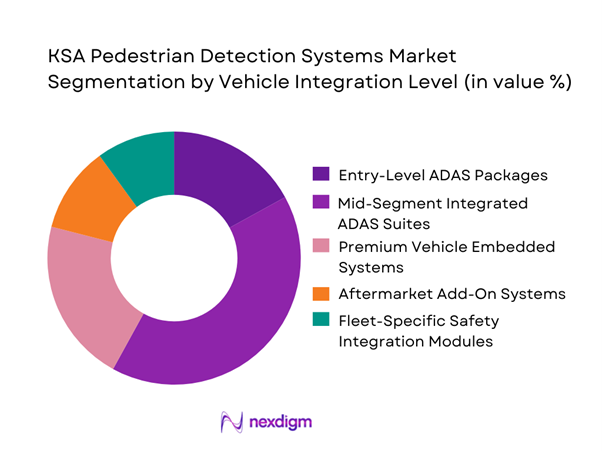

By Vehicle Integration Level

Mid-segment integrated ADAS suites account for the largest share of adoption, driven by increasing consumer demand for safety features without the premium pricing of high-end vehicles. This segment benefits from widespread deployment across mid-range passenger vehicles, which form the bulk of new vehicle sales in the Kingdom. Integrated ADAS packages allow pedestrian detection to function alongside lane assistance, collision avoidance, and adaptive cruise control, enhancing overall safety value. OEMs leverage this integration to differentiate models while complying with evolving safety expectations. As affordability improves and safety awareness rises, mid-segment integration continues to outpace both entry-level and premium-only deployments.

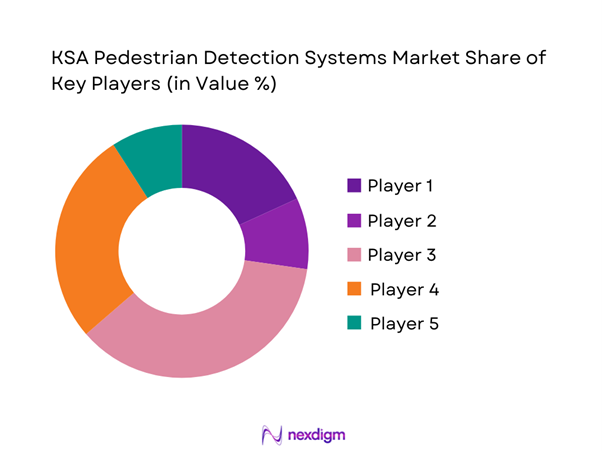

Competitive Landscape

The KSA Pedestrian Detection Systems market is dominated by a few major players, including Bosch and global or regional brands like Continental, ZF Friedrichshafen, and Mobileye. This consolidation highlights the significant influence of these key companies.

| Company | Est. Year | HQ | Pedestrian Detection Stack Strength | Typical Sensor Suite | AEB/Brake Integration Maturity | Functional Safety Readiness | OTA/Cyber Posture | KSA Route-to-Market | Calibration / After-sales Model |

| Robert Bosch GmbH | 1886 | Germany | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Continental AG | 1871 | Germany | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| ZF Friedrichshafen | 1915 | Germany | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Valeo | 1923 | France | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| DENSO | 1949 | Japan | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Pedestrian Detection Systems Market Analysis

Growth Drivers

Rising Road Safety Regulations and Vision Zero Targets

Saudi Arabia’s continued focus on reducing road fatalities and serious injuries has elevated pedestrian safety to a national priority. Regulatory authorities increasingly promote proactive vehicle safety technologies that mitigate collisions involving vulnerable road users, particularly in high-density urban corridors. Pedestrian detection systems align closely with these objectives by enabling early warnings and automatic braking interventions. OEMs view integration of such systems as a compliance-enhancing measure that also supports brand differentiation and risk mitigation. Over time, the alignment between regulatory intent, insurance expectations, and public safety outcomes strengthens adoption momentum across passenger and fleet vehicles.

Expansion of Advanced Driver Assistance Systems Adoption

The rapid expansion of advanced driver assistance systems across multiple vehicle categories has created a natural pathway for pedestrian detection penetration. As lane assistance, adaptive cruise control, and forward collision warning become widely accepted, pedestrian detection benefits from shared sensors, computing platforms, and consumer familiarity. Buyers increasingly perceive ADAS as a baseline safety expectation rather than a luxury feature. This shift reduces resistance to pedestrian-focused systems, encouraging manufacturers to include them as part of bundled safety architectures. As ADAS ecosystems mature, pedestrian detection becomes an integral function rather than a standalone add-on.

Challenges

High System Cost and Vehicle Price Sensitivity

Pedestrian detection systems rely on advanced cameras, radar modules, perception software, and braking integration, all of which contribute to higher vehicle costs. In price-sensitive segments, especially entry-level passenger vehicles and cost-driven commercial fleets, manufacturers must carefully balance safety enhancements with affordability. Importer pricing strategies, taxation structures, and dealer margins further influence final vehicle pricing. As a result, some OEMs restrict pedestrian detection to higher trims, slowing broader penetration. Managing component costs, simplifying sensor architectures, and leveraging platform-level standardization remain critical to overcoming adoption barriers.

Integration Complexity with Legacy Vehicle Platforms

Integrating pedestrian detection systems into older vehicle architectures presents significant technical challenges. Legacy platforms often lack sufficient processing power, sensor interfaces, or electronic control unit compatibility required for real-time perception and braking response. Retrofitting also introduces calibration complexity and reliability concerns, especially under harsh operating conditions such as heat, dust, and glare. These limitations restrict large-scale deployment beyond new vehicle programs. Consequently, pedestrian detection adoption remains concentrated in newer platforms where electrical architectures, software frameworks, and safety validation processes are already aligned with advanced ADAS requirements.

Opportunities

Localization of ADAS Software Development

Localization of pedestrian detection algorithms offers a strong opportunity to improve system effectiveness under Saudi driving conditions. Region-specific tuning can enhance performance in scenarios involving nighttime visibility, desert glare, dust interference, and dense urban traffic patterns. Developing local engineering capabilities also supports national objectives related to technology localization and skills development. OEMs and Tier-1 suppliers that invest in localized perception datasets, validation testing, and software adaptation can achieve higher detection accuracy and reduced false alerts. This differentiation strengthens competitiveness while aligning with long-term automotive digitalization goals.

Expansion of Pedestrian Detection in Commercial Fleets

Commercial fleets, including logistics, delivery, and ride-based mobility operators, represent a high-impact opportunity for pedestrian detection deployment. Fleet operators prioritize safety technologies that reduce accident frequency, vehicle downtime, insurance claims, and driver liability exposure. Centralized procurement models allow faster adoption compared to fragmented retail markets, especially when safety systems are linked to internal performance metrics and driver training programs. As fleet operators adopt standardized safety policies, pedestrian detection systems become scalable across entire vehicle pools, accelerating volume uptake and reinforcing the business case for broader market penetration.

Future Outlook

The KSA Pedestrian Detection Systems Market is expected to evolve toward deeper integration with intelligent transport systems and software-defined vehicle platforms. As safety regulations mature and consumer expectations shift, pedestrian detection will increasingly become a standard feature rather than an optional add-on. Continued collaboration between OEMs, technology providers, and regulators will shape a more resilient and technology-driven safety ecosystem aligned with the Kingdom’s long-term mobility vision.

Major Players

- Bosch

- Continental

- ZF Friedrichshafen

- Mobileye

- Valeo

- Aptiv

- Denso

- Magna International

- Autoliv

- Hella

- Veoneer

- Hyundai Mobis

Key Target Audience

- Passenger vehicle OEMs and assemblers

- Commercial fleet operators

- Logistics and last-mile delivery companies

- Ride-hailing and shared mobility platforms

- Automotive component distributors

- Aftermarket system integrators

- Investments and venture capitalist firms

- Government and regulatory bodies (Saudi Arabia)

Research Methodology

Step 1: Identification of Key Variables

Core variables related to system type, vehicle integration, technology architecture, and end-user demand were identified through structured industry mapping.

Step 2: Market Analysis and Construction

Supply-side and demand-side frameworks were developed to construct the market structure, focusing on OEM adoption patterns and regulatory influence.

Step 3: Hypothesis Validation and Expert Consultation

Industry assumptions were validated through expert consultations with automotive safety specialists and mobility ecosystem stakeholders.

Step 4: Research Synthesis and Final Output

Insights were synthesized into a cohesive market narrative, aligning qualitative analysis with structured segmentation and competitive assessment.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Pedestrian Detection Systems Usage and Value-Chain Mapping

- Business Cycle and Demand Seasonality

- KSA Automotive Safety and Mobility Architecture

- Growth Drivers

Rising Road Safety Regulations and Vision Zero Targets

Expansion of Advanced Driver Assistance Systems Adoption

Growth in Urban Traffic Density and Pedestrian Exposure

Smart City and Intelligent Transport System Investments

OEM Safety Differentiation and Consumer Awareness

Commercial Fleet Safety Compliance Requirements - Challenges

High System Cost and Vehicle Price Sensitivity

Integration Complexity with Legacy Vehicle Platforms

Harsh Environmental and Climatic Performance Constraints

Limited Standardization Across OEM Architectures

Dependence on Imported Sensors and Software Stacks - Opportunities

Localization of ADAS Software Development

Integration with Smart Infrastructure and V2X Platforms

Expansion of Pedestrian Detection in Commercial Fleets

AI-Driven Predictive and Preventive Safety Analytics

Aftermarket and Retrofit Solutions for Legacy Vehicles - Trends

AI-Enabled Sensor Fusion Advancements

Night-Time and Low-Visibility Detection Enhancements

Regulatory Push for Mandatory ADAS Features

Software-Defined Vehicle Safety Architectures

Integration with Autonomous Driving Roadmaps - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Pricing, 2019–2024

- By System Configuration Type (in Value %)

Camera-Based Detection Systems

Radar-Based Detection Systems

LiDAR-Enabled Detection Systems

Sensor Fusion-Based Detection Systems

Infrared and Night Vision Pedestrian Systems - By Vehicle Integration Level (in Value %)

Entry-Level ADAS Packages

Mid-Segment Integrated ADAS Suites

Premium Vehicle Embedded Systems

Aftermarket Add-On Systems

Fleet-Specific Safety Integration Modules - By Technology / Product Type (in Value %)

Monocular Vision Systems

Stereo Vision Systems

Millimeter-Wave Radar Modules

AI-Based Image Processing Software

Embedded Control Units - By Deployment / Distribution Model (in Value %)

OEM Factory-Fitted Systems

Authorized Dealer Installations

Aftermarket Retail Installations

Fleet Retrofit Programs - By End-Use Customer Type (in Value %)

Passenger Vehicle OEMs

Commercial Fleet Operators

Public Transportation Authorities

Logistics and Delivery Companies

Ride-Hailing and Mobility Operators - By Region (in Value %)

Riyadh Region

Makkah Region

Eastern Province

Madinah Region

Southern Provinces

- Competition ecosystem overview

- Cross Comparison Parameters (detection accuracy, sensor fusion capability, software update cycle, night-time performance, environmental resilience, OEM integration depth, localization readiness, cybersecurity compliance)

- SWOT analysis of major players

Pricing and commercial model benchmarking - Detailed Profiles of Major Companies

Bosch

Continental

ZF Friedrichshafen

Aptiv

Valeo

Mobileye

Denso

Magna International

Hyundai Mobis

Autoliv

Hella

Veoneer

Texas Instruments

NXP Semiconductors

NVIDIA

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Volume, 2025–2030

- By Pricing, 2025–2030