Market Overview

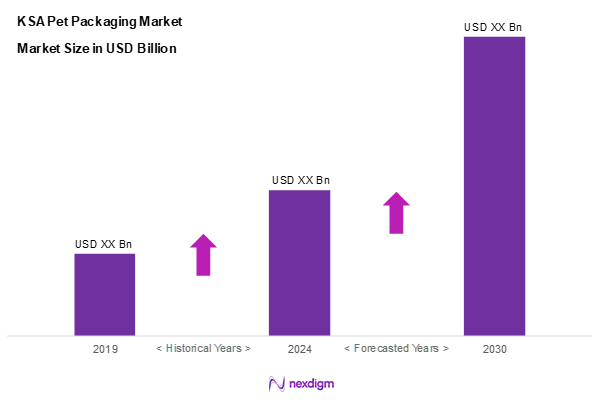

As of 2024, the KSA PET (Polyethylene Terephthalate) packaging market is valued at USD 80.2 billion, with a growing CAGR of 4.2% from 2024 to 2030, reflecting a robust growth trajectory supported by the country’s rapidly growing food and beverage, pharmaceutical, and personal care sectors. This growth is a direct consequence of the increased consumption of packaged food and bottled beverages, growing urbanization, and rising awareness of safe and hygienic packaging among consumers. According to data from the Saudi Ministry of Industry and Mineral Resources and corroborated by industry insights from the Gulf Petrochemicals and Chemicals Association (GPCA), the demand has surged consistently due to expanding FMCG and healthcare sectors.

Riyadh and Jeddah dominate the PET packaging market primarily due to their high population density, strong presence of industrial zones, and well-established distribution networks. Riyadh, being the administrative capital, facilitates bulk demand from institutional clients, while Jeddah, with its proximity to the Red Sea, acts as a key logistics and manufacturing hub. These cities lead due to their infrastructural advantage and concentration of end-user industries such as beverages, pharmaceuticals, and cosmetics.

Market Segmentation

By Packaging Type

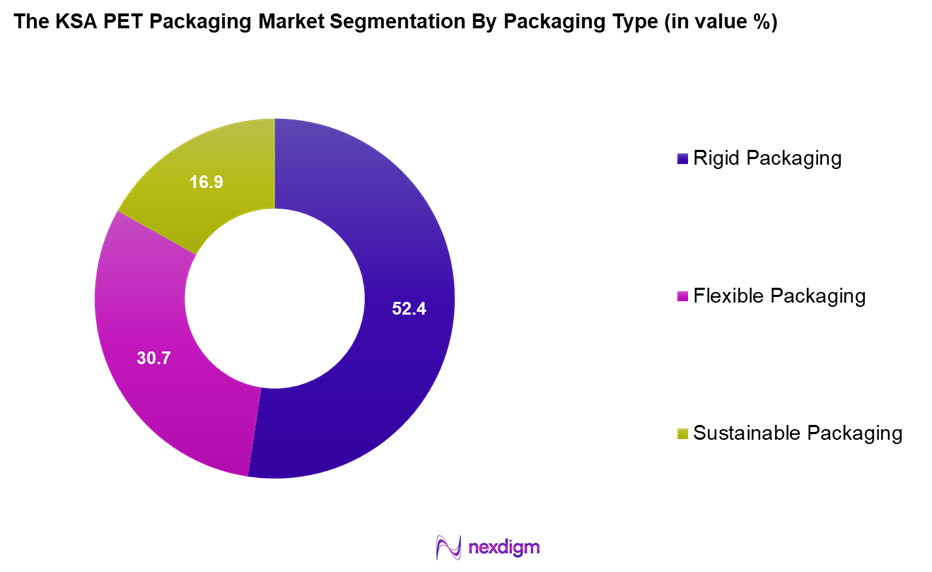

The KSA PET packaging market is segmented into rigid packaging, flexible packaging, and sustainable packaging. Rigid packaging is expected to dominate the market due to frequent use in bottled water, soft drinks, and pharmaceutical packaging segments where PET bottles and jars offer strength, recyclability, and shelf appeal. Rigid PET solutions are also preferred for their barrier properties and ease of transportation. Moreover, government-led health awareness campaigns have promoted increased consumption of bottled beverages, reinforcing demand for rigid PET packaging across the nation.

By Product Type

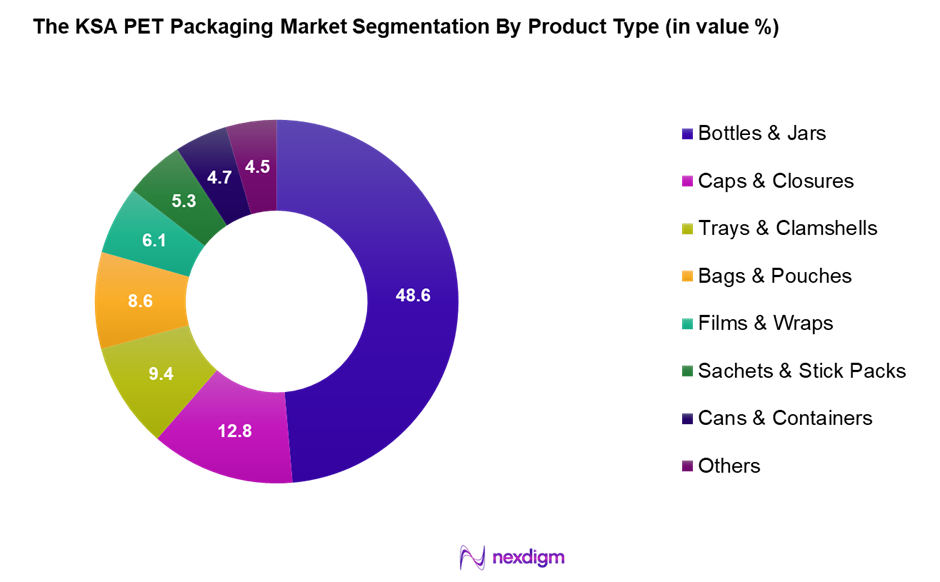

The KSA PET packaging market is segmented into bottles & jars, caps & closures, trays & clamshells, bags & pouches, films & wraps, sachets & stick packs, cans & containers, and others. Bottles & jars dominate the KSA PET packaging market under the product type segment due to their extensive use in beverages and pharmaceuticals. With bottled water consumption continuing to rise and pharmaceutical compliance requiring tamper-evident and leak-proof solutions, PET bottles offer a lightweight, cost-effective, and recyclable choice. Furthermore, innovations in bottle design and barrier technologies have enhanced shelf life and safety, increasing the preference for this sub-segment.

Competitive Landscape

The KSA PET packaging market is dominated by both regional and local manufacturers, leveraging proximity to raw materials, local sourcing advantages, and established customer relationships. The market features a mix of established players such as Arabian Plastics Industrial Company and Takween Advanced Industries along with mid-sized manufacturers offering competitive pricing.

| Company Name | Establishment Year | Headquarters | Market Share (%) | Revenue (USD) | Product Types |

| Arabian Plastics Industrial Co. | 1996 | Jeddah | – | – | – |

| Takween Advanced Industries Co. | 1993

|

Al Khobar

|

– | – | – |

| ZAMIL Plastic Industries Co. | 1980

|

Dammam

|

– | – | – |

| Saudi Modern Packaging Co. (Printopack) | 1997

|

Jeddah

|

– | – | – |

| Al-Sharq Plastics Industries | 1976 | Riyadh

|

– | – | – |

KSA PET Packaging Market Analysis

Growth Drivers

Increasing Demand for Sustainable Packaging

The demand for sustainable packaging solutions is rising in Saudi Arabia, supported by national sustainability initiatives and growing environmental consciousness among consumers and manufacturers. Companies across the packaging supply chain are shifting towards recyclable and eco-friendly materials like PET due to increased scrutiny of plastic waste. Government-driven circular economy goals are encouraging investments in local recycling capabilities, which is prompting PET packaging firms to incorporate recycled content and reduce reliance on virgin materials. As sustainability becomes a core part of business strategy, PET is emerging as a preferred choice due to its recyclability, lightweight properties, and versatility in applications.

The Growing Food and Beverage Industry

Saudi Arabia’s food and beverage sector is expanding rapidly due to changing consumer preferences, urbanization, and a rise in demand for processed and ready-to-consume foods. This growth has significantly increased the need for efficient and safe packaging solutions. PET packaging plays a vital role in this sector because of its durability, barrier properties, and suitability for beverages, dairy products, sauces, and condiments. Additionally, local production and packaging are being strengthened through government-supported agricultural and food processing initiatives, which are indirectly boosting PET packaging consumption across the country.

Market Challenges

Fluctuating Costs of Raw Materials and Reliance on Imports

One of the major hurdles for the PET packaging industry in Saudi Arabia is its reliance on imported raw materials, particularly polymer resins. While the Kingdom has developed petrochemical capabilities, a significant portion of raw materials for PET packaging are still sourced from international markets. This dependence exposes packaging companies to global price fluctuations and exchange rate volatility. Additionally, disruptions in global trade routes or supply chains can have downstream effects on packaging availability, production lead times, and input costs, creating operational risks for domestic players.

Increasing Pressure from Substitute Packaging Options

PET packaging is increasingly facing competition from alternative materials such as paper, biodegradable plastics, and glass, especially in applications where sustainability and regulatory compliance are top priorities. Growing international and regional restrictions on single-use plastics have intensified scrutiny on conventional plastic formats. This has led businesses, especially in consumer goods and retail, to explore alternative packaging formats that are either compostable or easier to recycle in closed-loop systems. As these alternatives become more accessible and cost-effective, PET packaging companies are under pressure to innovate and adapt.

Opportunities

Shift Toward Sustainable and Non-Toxic Films

There is an emerging opportunity for PET packaging manufacturers in Saudi Arabia to focus on producing sustainable and non-toxic films, particularly in response to rising awareness around food safety and environmental impact. With increasing online shopping and demand for hygienic product handling, the industry is seeing a move toward packaging solutions that are not only visually appealing but also safe, reusable, and suitable for recyclability. This trend opens doors for PET converters to upgrade their film technologies, incorporate bio-based additives, and build brand equity around eco-consciousness.

Advanced Barrier Film Technologies

Modern packaging demands superior protection against oxygen, moisture, and UV rays—especially for perishable and sensitive products. This has driven demand for advanced barrier film technologies within the PET segment. Manufacturers now have the opportunity to develop multi-layered PET packaging that extends shelf life and enhances product integrity across industries like food, pharmaceuticals, and cosmetics. These innovations align with Saudi Arabia’s broader industrial development vision, which emphasizes technological advancement, local manufacturing capabilities, and reducing import dependency.

Future Outlook

Over the next five years, the KSA PET Packaging Market is expected to witness strong expansion driven by national sustainability goals, growing consumer demand for hygienic packaging, and investments in modern packaging technologies. Government programs under Saudi Vision 2030, along with private sector initiatives, are likely to encourage advanced manufacturing and eco-friendly packaging solutions across industries.

Major Players

- Arabian Plastics Industrial Company Limited

- Saudi Modern Packaging Factory Co. Ltd. (Printopack)

- ZAMIL Plastic Industries Co

- Elmaimani Holding Group

- Saudi Plastic Factory Co. (SPF)

- Al-Sharq Plastics Industries

- Takween Advanced Industries Company

- Advanced Flexible Packaging Co.

- National Plastic Factory

- JEDDAH Plastic Company

- Al Watania Plastics

- MEPPCO (Middle East Paper Co.)

- Raqtan Group

- Rowad National Plastic Co.

- Al Amer Factory for Plastic Products

Key Target Audience

- PET Packaging Manufacturers

- Beverage and Bottled Water Companies

- Pharmaceutical Product Packaging Firms

- Personal Care & Cosmetics Brands

- Automotive Lubricants Bottling Firms

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Saudi Food & Drug Authority, Ministry of Industry and Mineral Resources)

- Distributors and Packaging Machinery Suppliers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA PET Packaging Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the KSA PET Packaging Market. This includes assessing market penetration, the ratio of packaging formats to end-users, and the resultant revenue generation. Furthermore, an evaluation of price trends and supply availability will be conducted to ensure the reliability and accuracy of the market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple PET packaging manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the KSA PET Packaging Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Historical Overview and Market Genesis

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

increasing demand for sustainable packaging

growing food and beverage industry - Market Challenges

Fluctuating Costs of Raw Materials and Reliance on Imports

Increasing Pressure from Substitute Packaging Options - Opportunities

Shift Toward Sustainable and Non-Toxic Films

Advanced Barrier Film Technologies - Trends

Rise of Custom Packaging Solutions

The focus on Saudi Vision 2030’s - Government Regulation

Packaging Waste Regulations

Import Restrictions - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Packaging Type (In Value %)

Rigid Packaging

– PET Bottles

– Jars

– Cans & Containers

Flexible Packaging

– Pouches

– Films & Wraps

– Sachets

Sustainable Packaging

– Recycled PET (rPET)

– Bio-based PET

– Lightweight PET Structures - By Product Type (In Value %)

Bottles & Jars

– Water Bottles

– Carbonated Drink Bottles

– Juice and Dairy Bottles

– Cosmetic and Pharma Jars

Caps & Closures

– Screw Caps

– Flip-Top Caps

– Child-Resistant Closures

– Tamper-Evident Closures

Trays & Clamshells

– Food Trays

– Bakery Clamshells

– Fruit & Vegetable Packaging

Bags & Pouches

– Stand-Up Pouches

– Vacuum Pouches

– Zipper Bags

Films & Wraps

– Shrink Films

– Stretch Wraps

– Barrier Films

Sachets & Stick Packs

– Single-Serve Food Sachets

– Nutraceutical Stick Packs

– Cosmetic and Skincare Sachets

Cans & Containers

– Rigid Food Containers

– Paint & Chemical PET Cans

– Powder Packaging Containers - By Filling Technology (In Value %)

Hot Fill

– Juices & Flavored Beverages

– Sauces and Liquid Condiments

Cold Fill

– Carbonated Soft Drinks

– Dairy Products

– Bottled Water

Aseptic Fill

– Nutraceuticals

– Long Shelf-Life Dairy

– Pharmaceuticals

Others

– Retort Filling

– Vacuum and Gas Flush Filling - By End-User (In Value %)

Food & Beverage

– Bottled Water

– Juices & Soft Drinks

– Sauces & Condiments

– Dairy & Yogurt Products

Pharmaceutical

– Syrup Bottles

– Tablet Packaging

– Nutraceuticals

Personal Care & Cosmetics

– Shampoo and Lotion Bottles

– Cream and Serum Jars

– Travel-size Packs

Automotive

– Lubricant Bottles

– Cleaner and Additive Containers

Electricals & Electronics

– Protective Packaging

– Component Pouches

Chemicals

– Household Cleaners

– Industrial Solvents

– Agricultural Chemicals

Building & Construction

– Adhesive Containers

– Small Hardware Packaging

Agriculture

– Fertilizer Bottles

– Agrochemical Sachets

Household

– Cleaning Product Bottles

– Air Freshener Packaging

Others

– Stationery

– Pet Food Packaging - By Region (In Value %)

Riyadh

Jeddah

Dammam

Khobar

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Product Type Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Product Type, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Arabian Plastics Industrial Company Limited

Saudi Modern Packaging Factory Co. Ltd. (Printopack)

ZAMIL Plastic Industries Co

Elmaimani Holding Group

Saudi Plastic Factory Co. (SPF)

Al-Sharq Plastics Industries

Takween Advanced Industries Company

Advanced Flexible Packaging Co.

National Plastic Factory

JEDDAH Plastic Company

Al Watania Plastics

MEPPCO (Middle East Paper Co.)

Raqtan Group

Rowad National Plastic Co.

Al Amer Factory for Plastic Products

- Market Demand and Utilization

- Purchasing Behaviour

- Regulatory and Compliance Requirements

- Consumer Insights and Preferences

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030