Market Overview

The KSA pharmaceutical primary packaging market is valued at USD ~ million (glass-packaging segment) as of 2024. The demand has been driven by rapid expansion of the domestic pharmaceutical industry, rising generic drug production, growth in biologics and injectable therapies, and increased regulatory stringency around drug stability, sterility, and packaging quality — all prompting a surge in demand for high-quality primary containers like vials, bottles, ampoules, and syringes.

Within Saudi Arabia and the broader Middle East region, major cities such as Riyadh, Jeddah, and Eastern-region hubs dominate packaging demand. These cities host the bulk of pharmaceutical manufacturing, distribution, and institutional healthcare infrastructure — including large hospitals, government procurement agencies, CMOs, and national drug distribution centers — making them focal points for packaging consumption. The concentration of drug manufacturing plants, regulatory bodies, and logistic hubs in these urban centers ensures their dominance in the primary packaging market.

Market Segmentation

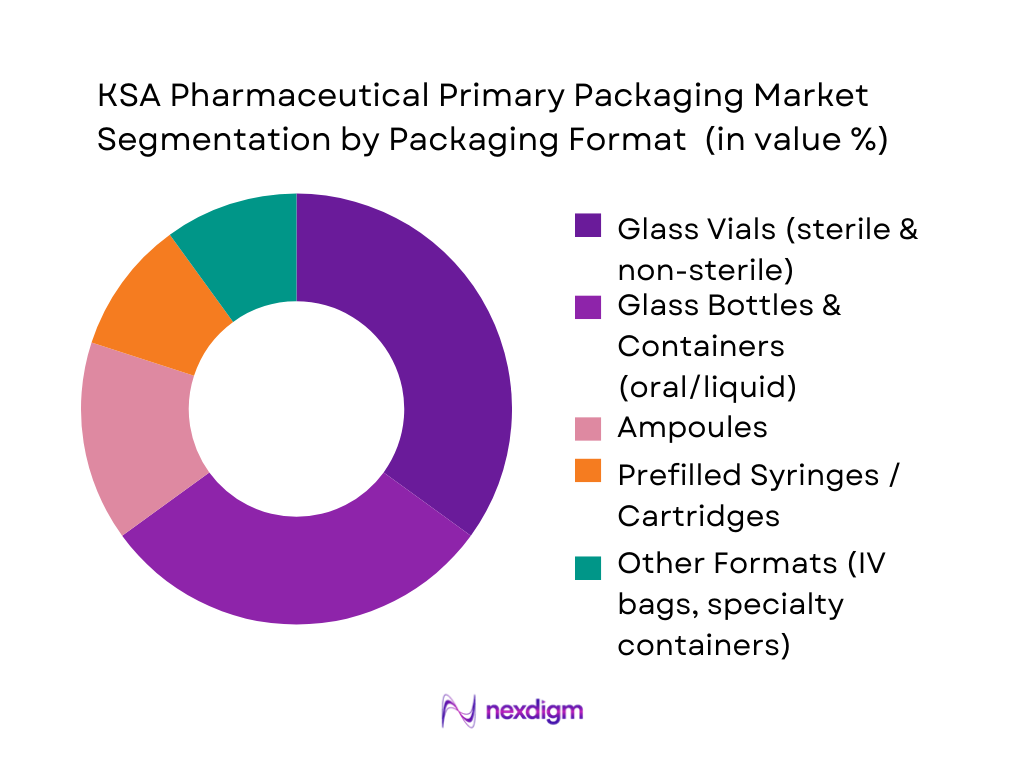

By Packaging Format

Among the different packaging formats, glass vials command the largest share of the primary packaging market. This dominance arises from the increasing demand for sterile injectable therapies, biologics, vaccines, and hospital-use parenterals — where glass vials offer chemical inertness, product stability, and compatibility with high-purity requirements. Regulatory standards for sterility and drug safety in KSA further reinforce vials as the preferred format. Glass bottles and containers are the second-largest segment, widely used for solid oral dosage and liquid syrups, benefiting from high generic drug volume and oral medication demand. Ampoules remain relevant for certain injectables and emergency-use formats due to cost-effectiveness, while prefilled syringes and cartridges — though growing — still represent a smaller share as adoption gradually increases with biologics and chronic-disease treatments.

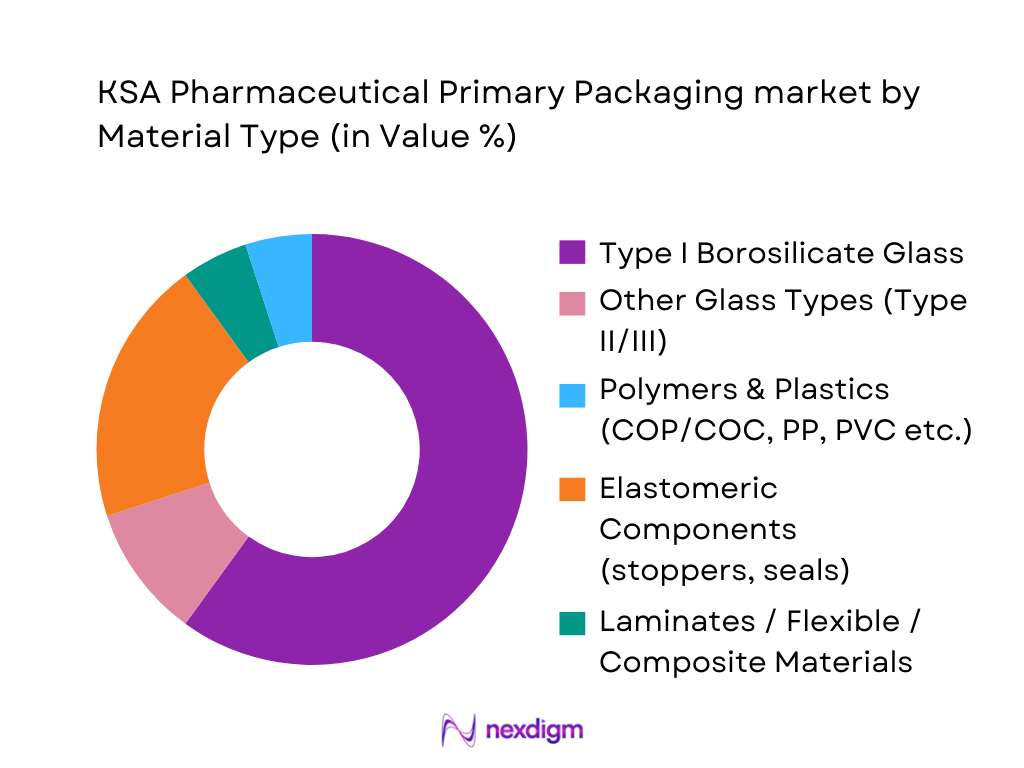

By Material Type

Type I borosilicate glass leads the material-segmentation in 2024. The material’s chemical resistance, impermeability, and proven compatibility with a wide variety of drugs — especially injectables, biologics, and sensitive formulations — make it the gold standard for pharmaceutical containers in KSA. As many local and multinational manufacturers supply both generics and advanced therapies, Type I glass ensures compliance with stringent quality and sterility norms. Polymer-based plastics and materials constitute the second largest share, driven by cost-effective solutions for non-sterile oral drugs, flexible packaging for liquid syrups, and growing interest in lightweight, breakage-resistant containers. Other glass types, elastomers (stoppers, seals), and flexible/composite materials serve niche needs such as closures, ampoules, and specialty containers, but their share remains modest.

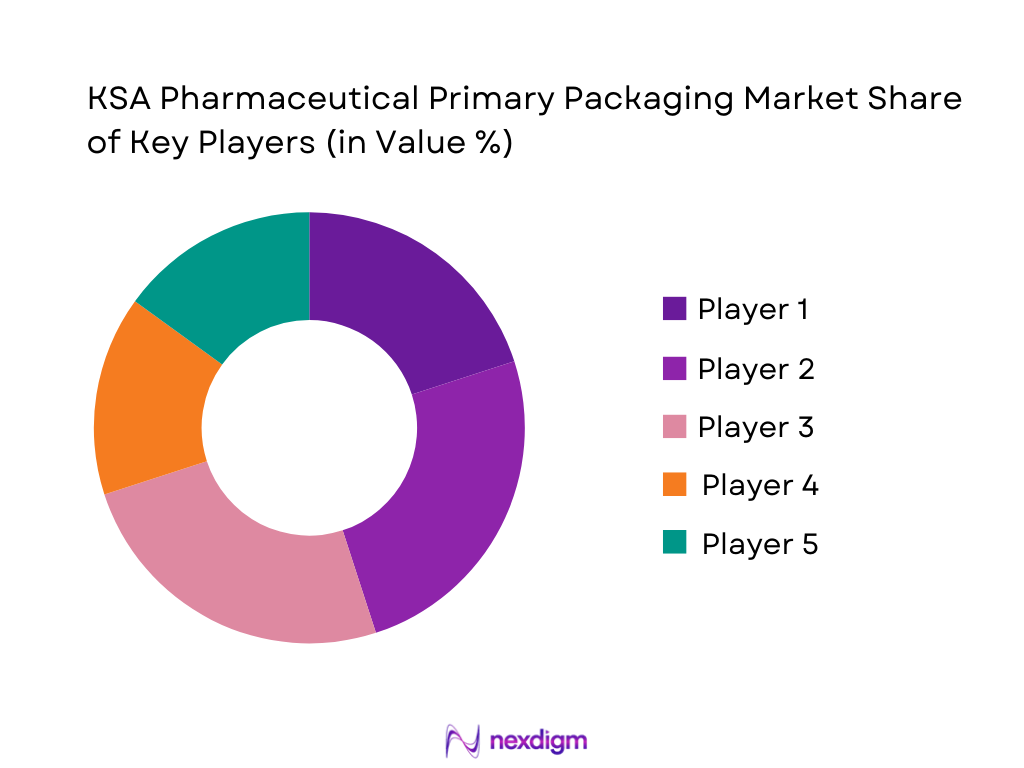

Competitive Landscape

The competitive landscape of the KSA pharmaceutical primary packaging market is shaped by a mix of global and regional players supplying glass containers, polymer-based packaging, closures, and injectable-related containment solutions. Large multinational suppliers dominate, while regional and local providers serve generic and cost-sensitive segments. The presence of these established global and regional players drives consolidation in the market. Their competitive strength lies in the depth of product portfolio (vials, bottles, syringes, closures), regulatory compliance (cGMP, ISO, SFDA standards), ability to supply both sterile injectable-packaging and non-sterile containers, and distribution networks across KSA and GCC countries. This consolidation benefits major hospitals, MOH procurement agencies, and pharmaceutical firms which prefer working with reliable, quality-certified suppliers.

| Company | Establishment Year | Headquarters | Product Portfolio (Formats & Materials) | Glass Type / Material Specialization | Sterile / RTU Capabilities | KSA / GCC Presence |

| Becton, Dickinson and Company (BD) | 1897 | New Jersey, USA | ~ | ~ | ~ | ~ |

| Corning Incorporated | 1851 | New York, USA | ~ | ~ | ~ | ~ |

| DWK Life Sciences GmbH | 1922 | Mainz, Germany | ~ | ~ | ~ | ~ |

| Pharmaceutical Solutions Industry Ltd (PSI) | — | Middle East / GCC | ~ | ~ | ~ | ~ |

| Napco National Group (Healthcare & Pharma Div.) | — | Middle East / GCC | ~ | ~ | ~ | ~ |

KSA Pharmaceutical Primary Packaging Market Analysis

Growth Drivers

Expansion of KSA Pharma & Biologics Manufacturing Capacity and Branded Generics Base

Saudi Arabia is rapidly building a domestic pharmaceutical and medical supplies base, which directly lifts demand for vials, ampoules, prefilled syringes, blister packs and closures. Official industrial data indicate 206 pharmaceutical and medical device factories operating in the Kingdom with total investments of 10 billion SAR. This base is expanding in line with Vision 2030 and the National Industrial Strategy, which lists pharmaceuticals and medical devices among 12 strategic industrial sectors prioritized for localization. On the product side, leading domestic manufacturers such as Jamjoom Pharma report 268 registered human medicines and 103 registered herbal and health products with SFDA in one recent year

Rising Chronic Disease Burden & Injectable Therapy Uptake (Oncology, Diabetes, Autoimmune) Driving Sterile Primary Packaging Demand

Noncommunicable diseases (NCDs) are now the dominant health burden in Saudi Arabia and are strongly associated with parenteral therapies that require sterile vials, cartridges and prefilled syringes. Recent public health research shows that NCDs account for 73% of all deaths in the Kingdom. Diabetes is a major driver: the International Diabetes Federation estimates 4.3 million adults living with diabetes in Saudi Arabia, 1.7 million undiagnosed adults, 2.2 million adults with impaired glucose tolerance and 39,700 annual diabetes-related deaths, generating sustained insulin and GLP-1 analog demand in cartridges, pens and syringes. Oncology needs are also rising. GLOBOCAN data for Saudi Arabia report 28,113 new cancer cases, 13,399 cancer deaths, and 94,951 five-year prevalent cancer cases, underpinning strong demand for cytotoxic and biologic injectables that need high-integrity glass and elastomer systems.

Market Challenges

High Capex, Cleanroom & Sterile Infrastructure Requirements for Glass & RTU Lines

Building and operating sterile primary packaging plants in Saudi Arabia requires large upfront capital, sophisticated cleanroom infrastructure and ongoing operating budgets, and these must compete with other pressing health system demands. National budget documents allocate 214 billion SAR to the Health and Social Development sector, while broader government communications cite health-related allocations of about 260 billion SAR in a recent year and some analyses project 265 billion SAR for healthcare in the following budget cycle.

Dependence on Imported High-Barrier Glass, COP/COC & Specialized Elastomers

Despite progress on localization, Saudi Arabia still relies heavily on foreign technology owners and overseas sites for critical primary packaging materials such as Type I borosilicate glass tubing, high-barrier polymer resins (COP/COC) and advanced elastomeric closures. Pharmacovigilance inspection data from the Saudi Food and Drug Authority show that international marketing authorization holders (MAHs) dominate the market: between 2019 and 2022, inspectors recorded 1,122 inspection findings, and international MAHs accounted for 60% of all MAHs in the sample, highlighting the reliance on global companies whose supply chains and component specifications are standardized around non-local suppliers.

Market Opportunities

Local Manufacturing of Vials, Ampoules, PFS & RTU Systems in KSA

The combination of industrial policy, regulatory maturity and growing therapeutic demand creates a strong case for scaling local primary packaging lines for vials, ampoules, cartridges and prefilled syringes in Saudi Arabia. Industrial data confirm 206 factories in the pharmaceutical and medical devices segment with cumulative investments of 10 billion SAR, including 56 pharmaceutical factories, indicating that a substantial manufacturing base and utilities infrastructure already exist to host glass conversion, molding and RTU preparation. At the same time, the government’s Health and Social Development allocation of 214 billion SAR and broader health-sector spending around 260–265 billion SAR ensure strong and predictable domestic demand for injectable medicines used in oncology, diabetes and autoimmune indications.

Sustainable & Eco-Friendly Pharma Primary Packaging (Recyclable Polymers, Lightweight Glass, Bio-Based Materials)

Environmental and resource-efficiency considerations are emerging as differentiators in Saudi Arabia’s pharmaceutical ecosystem, opening opportunities for greener primary packaging solutions. Macroeconomic data show that Saudi Arabia is investing heavily in healthcare while maintaining relatively low inflation—budget analyses for 2025 note healthcare allocations of 265 billion SAR and headline inflation around 1.9%, which encourages long-term cost optimization via lighter and more energy-efficient packaging rather than short-term price cuts alone. Health spending per capita of 1,593.37 USD signals a high-income health system that can adopt eco-designed containers and closures with better lifecycle performance

Future Outlook

Over the next six years, the KSA pharmaceutical primary packaging market is expected to exhibit strong growth, driven by rising domestic drug manufacturing (both generics and biologics), expansion in injectable therapies, and stringent regulatory emphasis on packaging quality. Demand for sterile vials, prefilled syringes, and advanced container formats is likely to surge as the country increases focus on chronic disease management, biopharma R&D, and cold-chain logistics. Key trends to watch include a shift towards polymer-based packaging and flexible containers for cost-efficiency and lightweight transport, growth in RTU/RTS sterile formats, and increasing adoption of sustainable and smart-packaging solutions by forward-looking manufacturers aiming to reduce carbon footprint and improve supply-chain traceability.

Major Players

- Becton, Dickinson and Company (BD)

- Corning Incorporated

- DWK Life Sciences GmbH

- Pharmaceutical Solutions Industry Ltd (PSI)

- Napco National Group (Healthcare & Pharma)

- Gerresheimer AG

- Schott Pharma AG & Co. KGaA

- SGD Pharma

- Amcor plc

- Berry Global Group, Inc.

- AptarGroup, Inc. / Aptar Pharma

- Middle East Glass Manufacturing Company (Regional glass supplier)

- Sealed Air Corporation (Flexible / Foil-based packaging inputs)

- Integrated Plastics Packaging / Obeikan Flexible & Film Co. (Regional film/plastic supplier)

- Local Saudi CMOs / Generic Manufacturers with captive packaging (as suppliers or in-house)

Key Target Audience

- Pharmaceutical manufacturers (generic and biologic drug producers)

- Contract Manufacturing & Development Organizations (CMOs/CDMOs)

- Investments & Venture Capitalist Firms (pharma manufacturing and packaging infrastructure)

- Government and Regulatory Bodies (e.g., Ministry of Health – MOH KSA, SFDA, GCC-regulatory agencies)

- Hospital Procurement Units & Institutional Buyers

- Pharmaceutical Packaging Suppliers & Converters (glass, polymer, film producers)

- Logistics & Cold-Chain Service Providers engaged in drug distribution

- Importers / Distributors of Drugs and Medical Supplies

Research Methodology

Step 1: Identification of Key Variables

We first mapped the complete ecosystem of stakeholders in the Saudi pharmaceutical packaging market — encompassing drug manufacturers (generics, biologics), packaging converters (glass, polymers, closures), distributors, regulators, and end-users. This was done via extensive desk research using secondary databases, industry reports, regulatory filings, and public health expenditure data.

Step 2: Market Analysis and Construction

Historical data on packaging consumption (units of vials, bottles, ampoules, etc.), pharmaceutical production volume, generic vs biologic drug mix, and healthcare demand trends were compiled. We assessed packaging demand relative to drug output to estimate volume and value of primary packaging used.

Step 3: Hypothesis Validation and Expert Consultation

We formulated hypotheses regarding growth drivers — like increased injectable usage, regulatory pressure, shift to local manufacturing — and validated them through consultations with industry experts, packaging suppliers, and procurement officers in Saudi Arabia (via phone interviews or questionnaires).

Step 4: Research Synthesis and Final Output

We synthesized data from top-down estimates (macro pharmaceutical market growth, drug consumption) and bottom-up packaging demand calculations. This synthesis was cross-verified with insights from subject-matter experts and publicly available market reports to ensure reliability, consistency, and practical relevance in the final analysis.

- Executive Summary

- Research Methodology (Market Definitions & Classification, KSA Pharmaceutical Primary Packaging Taxonomy, Scope & Coverage, Data Sources & Secondary Desk Research, Primary Interviews with SFDA-registered Manufacturers & Importers, Top-Down & Bottom-Up Market Sizing, Data Triangulation & Sanity Checks, Forecasting Logic & Scenario Building, Assumptions & Limitations, Validation with KSA Packaging & Pharma Experts)

- Definition, Scope & Delineation of Primary vs Secondary & Tertiary Packaging

Role of Primary Packaging Across KSA Pharma Value Chain (Small Molecule, Biologics, Vaccines, Biosimilars) - KSA Pharmaceutical Industry Structure & Capacity Snapshot (Local Generics, Multinational Plants, CMOs, MOH & Institutional Supply)

- Primary Packaging in Injectable, Solid Oral, Liquid Oral, Ophthalmic, Nasal, Respiratory & Topical Therapies

- Demand Linkages with Branded Generics, Tender-Driven Supplies & Private Retail Channels

- Role of Primary Packaging in Drug Stability, Sterility, Anti-Counterfeiting & Patient Adherence

- Growth Drivers

Expansion of KSA Pharma & Biologics Manufacturing Capacity and Branded Generics Base

Rising Chronic Disease Burden & Injectable Therapy Uptake (Oncology, Diabetes, Autoimmune) Driving Sterile Primary Packaging Demand

Localization Push under Vision 2030 & Industrial Clusters for Pharma & Medical Supplies

Growth in Cold-Chain & Temperature-Sensitive Products (Vaccines, Biologics, Insulins)

Digital Health, E-Pharmacy & Homecare Therapies Increasing User-Friendly Primary Packs - Market Challenges

High Capex, Cleanroom & Sterile Infrastructure Requirements for Glass & RTU Lines

Dependence on Imported High-Barrier Glass, COP/COC & Specialized Elastomers

Stringent SFDA, GCC & International Quality / Documentation Requirements (ISO, cGMP, PIC/S)

Tender-Driven Price Pressure in MOH & Institutional Procurement

Supply Chain Risks for APIs & Sterile Components, Lead Times & Logistics Constraints - Opportunities

Local Manufacturing of Vials, Ampoules, PFS & RTU Systems in KSA

Sustainable & Eco-Friendly Pharma Primary Packaging (Recyclable Polymers, Lightweight Glass, Bio-Based Materials)

Smart & Connected Primary Packaging (Anti-Counterfeit, Track-and-Trace, Temperature Indicators)

Contract Primary Packaging & CDMO Services for GCC & Wider MENA Markets - Key Market Trends

Shift from Ampoules to Vials and PFS in Injectable & Biologic Therapies

Adoption of RTU / RTS Systems for High-Risk & High-Value Drugs

Increasing Use of High-Barrier Polymers & Coated Glass for Stability Improvement

Move Towards Serialization-Ready & Tamper-Evident Primary Packaging in KSA - Regulatory, Quality & Standards Landscape

- Technology & Innovation Roadmap

- Stakeholder Ecosystem Mapping

- Porter’s Five Forces Analysis for KSA Pharmaceutical Primary Packaging

- SWOT Analysis of KSA Pharmaceutical Primary Packaging Sector

- By Value, 2019-2024

- By Volume (Units / Containers), 2019-2024

- Average Price Realisation by Major Primary Packaging Formats, 2019-2024

- By Packaging Format (in Value %)

Glass Vials (Sterile & Non-Sterile)

Glass Ampoules

Prefilled Syringes & Cartridges

Bottles & Jars (Solid Oral & Liquid Oral)

Blister Packs & Strip Pack - By Material Type (in Value %)

Type I Borosilicate Glass

Other Glass Types (Moulded, Type II/III)

Cyclic Olefin Polymers (COP/COC)

Polyethylene (HDPE, LDPE)

Polypropylene (PP) - By Dosage Form & Application (in Value %)

Solid Oral Dosage (Tablets, Capsules, Powders)

Liquid Oral & Syrups

Small-Volume Parenterals (SVPs)

Large-Volume Parenterals (LVPs) & Infusion Solutions

Vaccines & Biologics (Cold-Chain & High-Barrier Requirements) - By Container Sterility & Format (in Value %)

Non-Sterile Bulk Primary Containers

Ready-To-Sterilize (RTS) Containers

Ready-To-Use (RTU) Sterile, Nested & Cleanroom-Packed Systems

5High-Containment Primary Packaging for High-Potency APIs & Biologics - By End User / Customer Type (in Value %)

Local Branded Generics & Branded Pharma Manufacturers

Multinational Pharma & Biopharma Players with KSA / GCC Footprint

Government & Institutional Manufacturers (MOH, Military, University Hospitals)

Hospital Pharmacies & Compounding Pharmacies

Contract Manufacturing & Development Organizations (CMOs / CDMOs) - By Fill-Finish & Supply Model (in Value %)

Captive In-House Fill-Finish with Integrated Primary Packaging Lines

Outsourced Fill-Finish with Customer-Supplied Containers

Turnkey RTU / RTS Packs for Biologics, Vaccines & Critical Care Injectables

Imports of Finished, Sterile Primary Containers & Closure Systems - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern & Northern Region

- Market Share of Major Players by Value & Volume

Market Share by Key Packaging Format (Vials, Ampoules, PFS, Bottles, Blisters, IV Bags)

Market Share by Material Type (Glass, Plastics, Elastomers, Aluminum & Laminates - Cross Comparison Parameters (Company Overview & KSA Presence, Primary Packaging Portfolio Depth by Format, Material & Technology Specialization (Glass, COP/COC, Plastics, Elastomers), KSA & GCC Manufacturing / Localization Footprint, Regulatory & Quality Compliance Footprint (SFDA, ISO, cGMP, PIC/S), Sterile / RTU / RTS Capabilities & Cleanroom Classification, Key KSA Customer Segments & Therapy Areas Served, Supply Chain & Service Model (Lead Time, JIT, Technical Support))

- Detailed Company Profiles

Pharmaceutical Solutions Industry Ltd

Napco National Group

Becton, Dickinson and Company

DWK Life Sciences GmbH

Corning Incorporated

Middle East Glass Manufacturing Company SAE

Amcor plc

Gerresheimer AG

Schott Pharma AG & Co. KGaA

SGD Pharma

Berry Global Group, Inc.

AptarGroup, Inc. / Aptar Pharma

Sealed Air Corporation

Arab Pharmaceutical Glass Company / RAK Ghani Glass LLC

- End User Profiling (Local Generics, Multinationals, MOH Plants, Hospitals, CMOs, Clinical Trials)

- Procurement & Tendering Behaviour (Public vs Private, Long-Term Frameworks, Vendor Qualification)

- Quality, Documentation & Regulatory Expectations from Primary Packaging Suppliers

- Innovation, Service & Supply Chain Expectations (Lead Times, Inventory Models, Technical Support)

- Unmet Needs & Pain Point Analysis in KSA Pharma Primary Packaging

- By Value, 2025-2030

- By Volume, 2025-2030

- Average Price Realisation by Major Primary Packaging Formats, 2025-2030