Market Overview

The KSA pharmaceutical secondary packaging market is anchored in the wider Saudi pharmaceutical packaging industry, which most syndicated sources place at about USD ~ billion in its latest base year. The Kingdom’s overall pharmaceutical market is at USD ~ billion in value across channels, underlining the scale of drug volumes flowing through packaging lines. A recent multi-source industry note similarly cites roughly USD ~ billion for the immediately preceding year, indicating a robust and stable base for packaging converters and contract packers servicing local and imported medicines.

Secondary packaging demand is heavily concentrated in Riyadh, Jeddah, Dammam/Khobar and Mecca–Medina, where most large pharmaceutical manufacturers, distributors, and third-party logistics hubs are located. Demographic data shows Saudi Arabia’s population at about ~ million, with roughly 80% living in major urban centres such as Riyadh, Jeddah, Mecca, Medina, Hofuf, Ta’if, Buraydah, Khobar, Yanbu, Dhahran, and Dammam. These cities host SFDA-licensed manufacturing plants, cold-chain depots and hospital clusters, driving sustained demand for folding cartons, labels, leaflets and corrugated shippers for solid oral, injectable, vaccine and biologics portfolios.

Market Segmentation

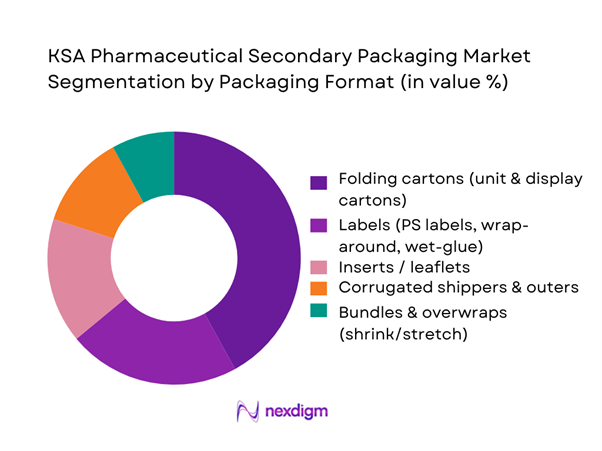

By Packaging Format

The KSA pharmaceutical secondary packaging market is led by folding cartons, which hold the dominant share due to their central role as the SFDA-mandated carrier of critical information, tamper-evident features and brand differentiation. Local vertically integrated manufacturers such as SPIMACO, Tabuk Pharmaceuticals, Jamjoom Pharma and Sudair Pharma run high-speed carton lines for solid oral generics, oncology therapies and specialty care medicines, all of which require printed cartons with Arabic/English text, serialized codes and overt security devices. The strong presence of regional and global carton converters—Napco National, Sahari Pack, Noor Carton & Packaging Industry and MM Packaging—further reinforces folding cartons’ dominance by offering high-quality, compliant litho-printed and die-cut formats tailored for hospital, retail and tender business.

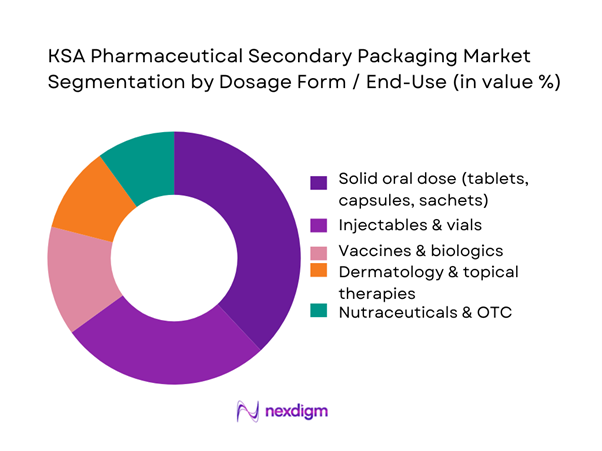

By Dosage Form / End-Use

Within the KSA pharmaceutical secondary packaging market, solid oral dose products dominate secondary packaging volumes because they constitute the largest share of prescriptions and pharmacy sales across chronic disease areas like diabetes, cardiovascular conditions and hypertension. Data shows Saudi Arabia as the largest pharmaceutical market in MEA, at USD ~ billion, with a heavy skew toward chronic and lifestyle therapies typically delivered as tablets or capsules. Local champions such as SPIMACO, Tabuk, Jamjoom and Tamer Group operate high-output blistering and bottling lines that feed into carton-based secondary packaging optimized for tender packs, retail SKUs and export lines, reinforcing the dominance of solid oral dosage in terms of secondary packaging impressions, SKUs, and annual carton/leaflet consumption.

Competitive Landscape

The KSA pharmaceutical secondary packaging market is characterised by a hybrid competitive structure that combines local paper & board converters, global label and carton specialists, and vertically integrated pharmaceutical manufacturers with in-house secondary packaging capabilities. On the supply side, players like Napco National, Noor Carton & Packaging Industry, Sahari Pack, MM Packaging and CCL Industries provide folding cartons, inserts, labels and corrugated outers. On the demand side, large domestic pharma manufacturers such as SPIMACO, Tabuk, Jamjoom and Sudair Pharma shape format decisions and print specifications as they expand generic portfolios and specialty lines for oncology and biologics.

| Company | Establishment Year | Headquarters (Global) | KSA Pharma-Secondary Focus | Key Formats Supplied to Pharma | KSA Footprint / Production Base | Technology & Compliance Strengths | Typical Client Profile in KSA Pharma | Service Model & Value-Add |

| Napco National | 1956 | Dammam, Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| Noor Carton & Packaging (Salman Group) | ~1988 (Group origin) | Eastern Province, KSA | ~ | ~ | ~ | ~ | ~ | ~ |

| Sahari Pack | Early 1970s | Jeddah, Saudi Arabia | ~ | ~ | ~ | ~ | ~ | ~ |

| MM Packaging (MM Group) | 1950s (carton production origins) | Vienna, Austria | ~ | ~ | ~ | ~ | ~ | ~ |

| CCL Industries / CCL Healthcare | 1951 | Toronto, Canada | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Pharmaceutical Secondary Packaging Market Analysis

Growth Drivers

Localisation

Saudi Arabia’s population has risen from 32,175,224 to 35,300,280 over the recent three-year period, while nominal GDP has reached about USD ~ trillion and GDP per capita USD ~, indicating a larger, wealthier treatment base that the Kingdom wants to serve with locally made medicines and packaging. Imports of medicaments reached USD ~ thousand in 2024, with exports at only USD ~ thousand, underlining heavy import reliance and a strong localisation gap that must be closed through local fill–finish and secondary packaging capacity. Vision-linked policies aim to raise domestic production and use NUPCO’s procurement pool, valued around SAR ~ billion for pharmaceutical tenders, to favour manufacturers with local packaging and regional headquarters, directly pulling secondary packaging operations into KSA.

CDMO packaging growth

Saudi Arabia accounts for about 60 percent of GCC healthcare expenditure, and the government allocated USD ~ billion to healthcare and social development in 2022, rising to USD ~ billion in 2023, making it one of the largest health budgets in the region. Public expenditure represents roughly three-quarters of total health spending, with current health expenditure per capita around USD ~ in 2022, signalling robust funding flows for medicines and related packaging. Vision 2030’s Health Sector Transformation Program and Privatization Program plan to privatize around 290 hospitals and 2,300 primary health centres and raise private sector participation in healthcare from about 25–40 percent toward 35–65 percent, expanding outsourcing of fill-finish, artwork management, late-stage customisation and quality-intensive secondary packaging to CDMOs operating inside the Kingdom.

Market Challenges

Substrate volatility

Saudi industrial activity is expanding rapidly, with total imports reaching SAR ~ billion in Q1 2023 versus SAR ~ billion in Q1 2022, highlighting rising exposure to global commodity and logistics cycles for board, paper and polymer substrates used in pharma cartons, labels and blisters. World Bank analysis shows global commodity prices fell 14 percent in the first quarter of 2023 and by March were around 30 percent below their June 2022 peak, after an earlier period when the index had risen 5 percent and stood 45 percent above its 2015-19 average—illustrating extreme price swings across pulp, timber and petrochemical value chains that feed packaging materials. For Saudi converters and secondary packers supplying a pharma tender pool of about SAR ~ billion, these rapid shifts complicate long-term substrate contracts, squeeze margins on fixed-price NUPCO awards, and create working-capital stress when inventory must be held for validated pack formats across multiple SKUs.

Artwork complexity

Saudi Arabia’s population reached 35,300,280 in 2024, up from 33,702,731 the previous year, with official statistics showing 55.6 percent Saudi nationals and 44.4 percent non-Saudis, and more than 70 percent of citizens below 35. This mix drives complex multi-lingual and age-appropriate artwork requirements in both Arabic and English, across hospital, retail and export channels. SFDA’s detailed barcoding and labelling rules specify how GTINs, serial numbers, batch codes, and expiry dates must be displayed on secondary packs, tamper-evident seals and aggregation labels, while DSCSA-style expectations from global partners add more data layers. At the same time, Saudi Arabia acts as a re-export hub within the GCC, accounting for 60 percent of regional healthcare spending, which often requires GCC-wide pack harmonisation and country-specific over-labelling, stretching artwork studios and increasing the risk of version errors, text overflow, and regulatory non-compliance.

Market Opportunities

Value-added features

Saudi Arabia’s healthcare and social development budget of USD ~ billion in 2022 and USD ~ billion in 2023, combined with the fact that the Kingdom accounts for around 60 percent of GCC healthcare spending, creates a high-value environment for medicines that can justify premium secondary packaging with tamper-evidence, child-resistance and patient-engagement features. SFDA’s fully implemented track-and-trace regime mandates serialisation of all human and animal medicines, and the latest barcoding updates focus on aggregated packaging, encouraging investments in shippers and case-level labels that integrate IoT, RFID or advanced security inks to combat diversion and parallel trade. Health-system digitalisation, including flagship initiatives like a national digital diabetes command centre, shows how care models are shifting towards remote monitoring and adherence, opening demand for smart folding cartons, blister wallets with printed QR-enabled instructions, and packaging designed for courier and home-delivery channels linked to e-pharmacies.

Localisation of substrates

Under Vision 2030’s National Industrial Development and Logistics Program, Saudi Arabia is actively promoting local manufacturing in high-growth sectors, issuing 83 new industrial licences and bringing 58 new factories online in just one month of 2025, backed by investments above SAR ~ billion. Total employed persons have climbed to 18,179,370, and real GDP growth has reached 4.8 percent in a recent quarter, signalling strong momentum in non-oil industrial output that can support local paperboard, corrugated, flexible film and label-stock production for pharma packs. Non-oil exports, including packaging-intensive manufactured goods, stood at SAR ~ billion in a recent month, while imports rose to SAR ~ billion in Q1 2023 from SAR ~ billion a year earlier, giving policymakers a clear incentive to localise substrates and reduce exposure to global pulp and polymer price shocks—an opportunity for integrated converters and resin-to-roll packaging clusters dedicated to pharmaceutical secondary packaging.

Future Outlook

Over the coming six to seven years, the KSA pharmaceutical secondary packaging market is expected to expand in tandem with the broader pharmaceutical packaging sector, which will grow at around 8.2% CAGR over the medium term. Saudi Arabia already accounts for 36% of MEA pharmaceutical sales underscores the long-term volume potential for compliant cartons, labels and leaflets. Increasing chronic disease prevalence, a young and urbanising population, and Vision 2030’s localisation of pharma manufacturing will drive higher SKU counts, more sophisticated tamper-evident and serialisation features, and a shift toward paper-based, recyclable secondary packaging. Global converters are likely to deepen their local presence, while domestic players invest in digital printing, inspection systems and cold-chain-ready formats to meet SFDA and export-market expectations.

Major Players

- Napco National

- Noor Carton & Packaging Industry

- Sahari Pack

- MM Packaging

- CCL Industries / CCL Healthcare

- SPIMACO Addwaeih

- Tabuk Pharmaceuticals Manufacturing

- Jamjoom Pharmaceuticals Factory

- Sudair Pharmaceutical Company

- Pharmapack Sudair Industrial

- Tamer Group

- Gulf Carton Factory Company

- United Carton Industries Company

- Obeikan Investment Group

Key Target Audience

- Domestic generic and branded pharmaceutical manufacturers

- Multinational pharmaceutical companies with KSA manufacturing or packaging hubs

- Contract packaging organisations (CPOs) and third-party logistics providers

- Folding carton, paperboard and label converters

- Hospital groups and healthcare provider networks

- Government and regulatory bodies

- Investments and venture capitalist firms

- Technology providers and machinery OEMs

Research Methodology

Step 1: Identification of Key Variables

The first step involved mapping the full ecosystem of the KSA pharmaceutical secondary packaging market, spanning SFDA, local pharma manufacturers, packaging converters, logistics providers, and technology vendors. Extensive secondary research was conducted using syndicate market reports, SFDA publications, multilateral sources (World Bank, WHO), enabling the identification of critical variables such as pharma market value, secondary vs primary packaging mix, regulatory milestones, and localisation policies that influence demand for cartons, labels and leaflets.

Step 2: Market Analysis and Construction

Next, we compiled and triangulated historical information on Saudi pharmaceutical and packaging markets, including ex-factory drug sales, the size of the pharma packaging segment, and the share of secondary applications within wider paper & paperboard packaging. We assessed volume drivers (chronic disease prevalence, population growth, health expenditure), regulatory requirements (tamper-evidence, serialisation) and technology adoption to construct a coherent top-down view of market value and structure, while bottom-up insights from converter capacity and pharma plant footprints were used to validate segmental splits.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary hypotheses on format dominance (folding cartons, labels), dosage-form mix, and growth pockets (biologics, vaccines, high-value injectables) were tested through structured discussions with packaging engineers, operations leads at KSA pharma plants, and regional sales managers of carton and label suppliers. These computer-assisted or virtual interviews focused on line utilisation, SKU complexity, artwork changeover patterns, and regulatory audits, providing operational perspectives that refined assumptions around market shares, investment priorities, and pain points in secondary packaging (e.g., leaflet insertion, code verification, aggregation).

Step 4: Research Synthesis and Final Output

Finally, insights from top-down data sources and bottom-up expert inputs were synthesised into a unified view of the KSA pharmaceutical secondary packaging market. Where multiple syndicated estimates existed, we prioritised convergent figures from recognised providers and clearly noted when values represent broader pharmaceutical or packaging segments rather than secondary packaging alone. The result is a validated, context-rich assessment of current market size, structural segmentation, competitive dynamics and regulatory trends, designed to support strategic decisions by manufacturers, converters, investors and policymakers.

- Executive Summary

- Research Methodology (Market Definitions, Taxonomy and Scope, Top-Down Assessment of Addressable Demand, Bottom-Up SKU and Line-Level Build-Up, Data Sources, Expert Interviews and Validation Framework, Market Sizing, Forecasting and Scenario Design, Assumptions, Limitations and Sensitivity Checks)

- Definition and Scope of Secondary Packaging in KSA Pharma Supply Chain

- Role of Cartons, Labels, Leaflets, Overwraps and Shippers in Patient and Supply-Chain Safety

- Evolution of KSA Pharma Localisation and Its Implications for Secondary Packaging

- Business Cycle: From Board, Films and Inks to Packed, Serialized and Aggregated Shipments

- Supply Chain and Value Chain Structure for KSA Pharma Secondary Packaging

- Growth Drivers

Localisation

CDMO packaging growth

Healthcare expansion

Regulatory enforcement - Market Challenges

Substrate volatility

Artwork complexity

Qualification burden

Human capital - Opportunities

Value-added features

Localisation of substrates

CDMO partnerships - Trends

Serialization and aggregation

Smart packs

Sustainability

e-commerce pharmacy - Government and Regulatory Landscape

- Technology and Automation Landscape

- Sustainability and Circularity Analysis

- Stake Ecosystem Mapping

- Porter’s Five Forces

- SWOT Analysis of KSA Pharmaceutical Secondary Packaging Ecosystem

- By Value, 2019-2024

- By Volume, 2019-2024

- Average Realisation per Pack Set, 2019-2024

- Substrate and Format Mix Contribution to Market Value, 2019-2024

- By Packaging Format (in Value %)

Standard Folding Cartons

Microflute and Litho-Laminated Cartons

Corrugated Shippers and Transport Boxes

Shelf-Ready and Counter-Display Cartons

Bundles, Shrink-Wraps and Overbags - By Material Substrate (in Value %)

Coated SBS and FBB Board

Recycled and White-Top Testliner Board

Kraft and Brown Board for Shippers

Plastic Films, Laminates and Shrink for Secondary Overwrap

Specialty Boards and Barrier-Coated Substrates - By Packaging Functionality (in Value %)

Standard Non-Security Secondary Cartons

Tamper-Evident and Anti-Counterfeit Cartons and Labels

Child-Resistant and Senior-Friendly Cartons

Serialized and Aggregation-Ready Packs

Cold-Chain and Temperature-Controlled Secondary Packaging Kits - By Dosage Form Packed (in Value %)

Solid Oral Dosage

Sterile Injectables and Vials

Vaccines and Biologics

Ophthalmic, ENT and Respiratory

Dermatology, Topicals and Cosmetics-Adjacent Pharma - By End-User Type (in Value %)

Local Branded Pharma Manufacturers

Generic and Biosimilar Manufacturers

Multinational Originator and Innovator Companies

Nutraceutical and Food Supplement Brand Owners

Hospitals, Institutional Pharmacies and Government Procurement Bodies - By Service Model (in Value %)

Captive In-House Secondary Packaging in Pharma Plants

Outsourced Healthcare Contract Packaging and CDMOs

Hybrid and Overflow Packaging Models - By Region (in Value %)

Central Region

Western Region

Eastern Region

Northern Region

Southern Region - By Scope Tables (in Value %)

Packaging Format vs Dosage Form Matrix

Packaging Format vs End-User Type Matrix

Service Model vs Region Matrix

Functionality Tier vs End-User Type Matrix

- Market Share of Major Players on the Basis of Value and Volume

Competition Ecosystem Mapping - Cross Comparison Parameters (share of KSA revenue from pharma secondary packaging, installed pharma-carton and label capacity, serialization and aggregation line capabilities, tamper-evident and child-resistant portfolio depth, pharma quality certifications footprint, localisation ratio of board/film substrates, artwork and prepress changeover agility, sustainability and recyclable-material initiatives)

- Pricing Architecture and SKU-Level Benchmarks

- Partnership and Contracting Models with Pharma and CDMOs

- Detailed Profiles of Major Companies

Napco Group

Salman Group

Al Kifah Paper Products Co.

Takamul Industries

Al Jawad Carton & Packaging Factory

Smartpack

CCL Industries

Sealed Air Saudi Arabia

Amber Packaging Industries LLC

Jabil Inc.

Aptar Group

Emirates Printing Press (EPP)

LGR Packaging

MM Group Pharma & Healthcare Cartons

- End-User Taxonomy

- Procurement and Vendor-Qualification Practices

- Pack Design, Artwork and Change-Management Workflows

- Needs, Pain Points and Service-Level Expectations

- Budgeting, Cost-Breakdown and Value Perception

- By Value, 2025-2030

- By Volume, 2025-2030

- Average Realisation per Pack Set, 2025-2030

- Substrate and Format Mix Contribution to Market Value, 2025-2030