Market Overview

The pharmaceutical packaging market in Saudi Arabia is valued at about USD ~ billion, derived from a multi-year historical analysis by leading research providers. Within this, tertiary formats – corrugated shipping cartons, pallets, insulated shippers and active containers – represent the largest share, reflecting the country’s sizeable finished-dose pharma market, which exceeds USD ~ billion in sales value and is the largest in the Middle East. Expansion of chronic-disease therapies, biologics and vaccine flows, along with containerboard capacity additions by local producers, is translating pharmaceutical volume growth directly into higher tertiary-packaging demand.

Tertiary packaging demand is concentrated around Riyadh, Jeddah and the Eastern Province, which together host the bulk of Saudi Arabia’s pharmaceutical manufacturing plants, import gateways and healthcare hubs. The Kingdom’s pharmaceutical market – now above USD ~ billion in value and still expanding – is anchored in these metropolitan areas that concentrate population, hospital capacity and distribution centres for wholesalers and 3PLs. Riyadh acts as the primary central warehousing and tender-driven supply hub, Jeddah links Red Sea trade lanes to West-region healthcare networks, and Dammam/Jubail anchor Gulf-facing logistics, making these corridors the core consumption zones for pallets, shippers and shipping cartons.

Market Segmentation

By Packaging Format

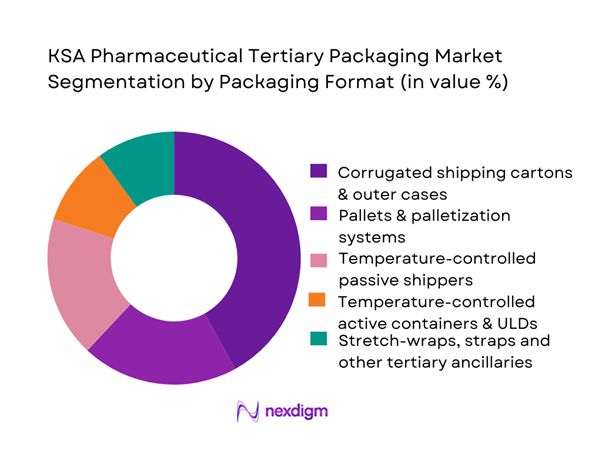

The KSA pharmaceutical tertiary packaging market is segmented by format into corrugated shipping cartons and outer cases, pallets and palletization systems, temperature-controlled passive shippers, temperature-controlled active air-cargo containers and unit load devices (ULDs), and stretch-wraps, straps and protective ancillaries. Corrugated shipping cartons dominate this segmentation because most prescription and OTC pharmaceuticals in the Kingdom still move as ambient products packed into case-level shippers, supported by a strong local containerboard base and major corrugated producers. High volumes through retail pharmacy, institutional tenders and government distribution create consistent demand for standardised case formats, while the growth of domestic containerboard capacity in Jeddah and Dammam under Vision 2030 manufacturing policy makes locally produced cartons cost-competitive and widely available, reinforcing their leadership over more specialised insulated formats.

By End-Use / Product Class

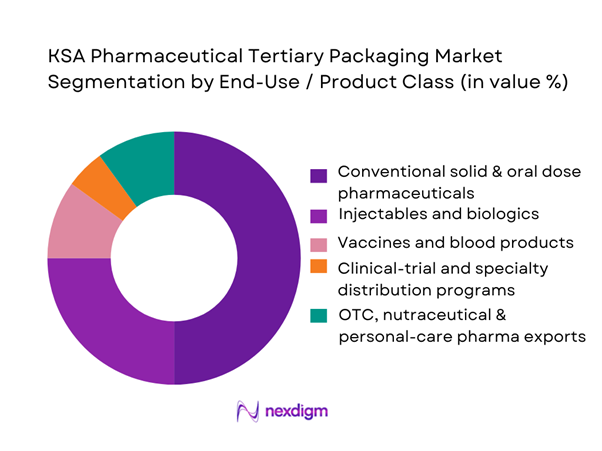

The KSA pharmaceutical tertiary packaging market is segmented by product class into conventional small-molecule solid and oral dose products, injectables and biologics, vaccines and blood products, clinical-trial and specialty programs, and OTC, nutraceutical and personal-care exports. Conventional solid and oral dose medicines dominate tertiary-packaging consumption because they constitute the largest share of Saudi Arabia’s pharma sales by value and volume, driven by chronic-disease therapies and generics utilization. The majority of these products move as case-packed ambient shipments from manufacturers and importers into central warehouses and retail pharmacy networks, requiring high volumes of corrugated cases and pallets rather than specialised active containers. While vaccines, biologics and specialty therapies require high-value cold-chain solutions, their shipment volumes are smaller and more consolidated, meaning they contribute disproportionately to revenue per shipment but not yet to overall tertiary-packaging tonnage, leaving oral-dose logistics as the primary demand anchor.

Competitive Landscape

The KSA pharmaceutical tertiary packaging market combines large domestic packaging converters with global cold-chain and active-container specialists. Local players such as Napco National, Obeikan, Al Watania for Industries, Saudi Printing and Packaging Company and MEPCO supply corrugated cases, industrial packaging and containerboard that underpin most ambient pharma distribution. In parallel, multinational providers including Sonoco, Cold Chain Technologies/Softbox, CSafe, Envirotainer, Peli BioThermal and va-Q-tec deliver insulated shippers, pallet shippers and active containers for biologics and vaccine flows. This dual structure results in a market where domestic firms dominate volume and route coverage, while global specialists capture high-value, risk-critical lanes for temperature-sensitive therapies.

| Company | Establishment Year | Headquarters | KSA Presence Type (Tertiary Focus) | Core Tertiary Offerings for Pharma in KSA | Key Customer Segments in KSA | Cold-Chain / GDP Compliance Capabilities | Notable Regional Initiatives / Assets |

| Napco National | 1956 | Dammam, Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| Obeikan Investment Group | 1982 | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| Al Watania for Industries | 1980s | Riyadh, Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| Sonoco Products Company | 1899 | Hartsville, USA | ~ | ~ | ~ | ~ | ~ |

| Cold Chain Technologies | 1967 | Franklin, USA | ~ | ~ | ~ | ~ | ~ |

KSA Pharmaceutical Tertiary Packaging Market Analysis

Growth Drivers

Expansion of Local Pharma, Biologics and Vaccine Manufacturing Footprint

Saudi Arabia’s overall economy remains substantial, with a nominal GDP of USD ~ billion in 2024. This strong economic base underpins government and private investments in local pharmaceutical manufacturing capacity, including active pharmaceutical ingredients (APIs), solid-dose generics, biologics, and vaccine fill-finish plants. Simultaneously, the country’s healthcare expenditure per capita was about USD ~ in 2022. High per-capita health spending reflects both demand for medicines and capacity for higher-value therapies — thereby increasing demand for tertiary packaging (shipping cartons, pallets, and protective solutions) to serve domestic manufacturing output. As local production rises, more medicines are loaded, packaged, palletized and shipped internally and across GCC/MEA corridors — directly boosting tertiary packaging demand.

Increasing Cold-Chain Shipments for Specialty and Biologic Therapies

The Saudi healthcare system is seeing growing complexity in therapy mix. Government health budgets remain robust; in 2023, the national healthcare and social development budget allocation was about USD ~ billion, making it one of the largest single-line items in the national budget. This level of investment supports expansion of advanced therapies, biologics, vaccines, and cold-chain dependent products. As biologics and vaccines require validated cold-chain distribution, demand rises for insulated shippers, passive/active temperature-controlled containers and thermal-qualified tertiary solutions. The sheer volume of overall healthcare spend and rising per-capita healthcare usage signals increased cold-chain shipment volumes — significantly driving demand for high-performance tertiary packaging beyond standard corrugated cases.

Challenges

High Cost of High-Performance Insulated and Reusable Tertiary Solutions

While demand for cold-chain packaging increases, high-performance insulated shippers, reusable containers and thermal-qualified pallet solutions remain expensive to procure and maintain. The upfront cost of these systems is substantially higher than simple corrugated cartons, and their return on investment depends on sufficiently high shipment volumes and reuse cycles. For many smaller pharmaceutical suppliers or lower-volume cold-chain users, these costs deter adoption. Given that average health expenditure per capita in Saudi Arabia was USD ~ in 2022, but not all pharma flows require cold-chain, the cost-benefit economics of adopting high-end tertiary solutions remain challenging — slowing down broader market penetration of insulated or reusable tertiary packaging.

Extreme Climate, Long Hauls and Lane Variability

Saudi Arabia’s geography involves long domestic shipping lanes, often under harsh ambient climate conditions. Temperature extremes can impair product integrity and increase risk during transport. This makes logistics of temperature-sensitive pharmaceuticals particularly challenging. Repeated long-haul shipments increase exposure to heat, vibration, and handling, which demands high-performance tertiary packaging capable of withstanding thermal and mechanical stress. The variable and demanding shipping conditions reduce the lifecycle of packaging components, raise damage or spoilage risk, and increase overall logistics costs, thereby deterring some pharma players from fully investing in cold-chain tertiary systems across all shipments.

Market Opportunities

Localization of Corrugated, Pallet and Insulated Shipper Manufacturing in KSA

Given the country’s strong economic fundamentals — with nominal GDP at USD ~ billion and GDP per capita at USD ~ in 2024. there is both the capital and demand to support scaling of local manufacturing capacity. Local containerboard and corrugated packaging producers already supply ambient packaging needs; expanding into insulated shippers, thermal cartons and pallet solutions locally could reduce import dependency, shorten supply lead times, and improve cost-efficiency for pharma companies operating within the Kingdom. This also aligns with national economic diversification and industrialisation goals. Localizing insulated-shipper production would lower cost barriers for reusable and cold-chain tertiary packaging, enabling broader adoption across the pharma sector.

Expansion of Reusable and Pooling Models for Pallets and Insulated Shippers

With the overall healthcare spending and supply volumes high — per-capita health expenditure in 2022 was USD ~. And with significant volumes of both ambient and cold-chain pharmaceuticals moving domestically and across GCC/MEA corridors, there is a strong case for reusable, pool-based tertiary packaging models. Reusable pallets and insulated shippers, managed through pooling schemes, can lower unit cost over repeated cycles, reduce packaging waste, and improve sustainability. For large-scale users such as hospitals, central medical warehouses, 3PLs, and distributors, pooled packaging could represent cost-efficient, compliant, and scalable solutions — encouraging investment in reusable tertiary systems and stimulating a new segment of packaging suppliers and service-providers in the Kingdom.

Future Outlook

Over the next several years, the KSA pharmaceutical tertiary packaging market is expected to expand steadily on the back of continued growth in pharma demand, logistics infrastructure upgrades and Vision 2030 localisation of manufacturing. Country-level research suggests that overall pharmaceutical packaging in Saudi Arabia should grow at a high single-digit CAGR through 2030, with leading studies indicating around 7–9% annual growth in value. As tertiary formats already dominate product mix by value, their trajectory is likely to mirror or modestly outpace this trend.

Major Players

- Napco National

- Obeikan Investment Group

- Al Watania for Industries

- Saudi Printing and Packaging Company

- Zamil Plastic Industries

- Middle East Paper Company

- EasternPak / INDEVCO Group

- Tamer Logistics

- Sonoco Products Company / Sonoco ThermoSafe

- Cold Chain Technologies

- CSafe Global

- Envirotainer

- Peli BioThermal

- va-Q-tec – VIP/PCM

Key Target Audience

- Pharmaceutical manufacturers and importers in KSA

- Biologics, vaccines and biosimilar producers

- Contract manufacturing and packaging organisations

- Healthcare logistics and 3PL/4PL companies

- Hospital groups, health systems and group purchasing bodies

- Retail and wholesale pharmacy chains

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the full ecosystem of the KSA pharmaceutical tertiary packaging market, including drug manufacturers, importers, logistics providers, containerboard suppliers, corrugated converters and thermal-packaging OEMs. We conduct extensive desk research across global databases, national tender data, SFDA documentation and pharma-logistics publications to identify the key variables that drive demand – such as pharma sales by therapy class, import versus local production, containerboard capacity, cold-chain lane structures and regulatory mandates.

Step 2: Market Analysis and Construction

In the second phase, we compile and analyse historical data for Saudi Arabia’s pharmaceutical and packaging sectors, drawing on multiple market-research sources for pharma revenue and packaging value. We then construct a bottom-up model that links unit volumes and shipment flows by product class to tertiary-packaging formats (corrugated cases, pallets, insulated shippers, active containers), adjusting for case size, pallet utilisation, and lane characteristics. This is cross-checked against containerboard and corrugated output data from local producers to validate order-of-magnitude estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses around segment shares, format adoption and growth hotspots are validated through semi-structured interviews and computer-assisted calls with supply-chain executives in pharma companies, 3PLs, cold-chain solution providers and packaging converters operating in KSA. These discussions provide on-the-ground insight into typical shipper configurations, modal splits, damage and excursion rates, and upcoming regulatory changes, helping refine assumptions on tertiary-packaging intensity per product class and the relative uptake of advanced insulated and active systems.

Step 4: Research Synthesis and Final Output

The final step synthesises all validated quantitative and qualitative inputs into a cohesive market model and narrative. We triangulate top-down estimates from syndicated reports with bottom-up flows and expert feedback, reconciling any discrepancies to present a range-consistent view of 2024 market size and the forward CAGR through 2030. Scenario analysis is used to stress-test the impact of localisation, cold-chain expansion and regulatory tightening on tertiary-packaging demand, which is then translated into segment-wise forecasts, competitive mapping and strategic recommendations tailored to investors, industrial players and policymakers in the KSA pharmaceutical tertiary packaging market.

- Executive Summary

- Research Methodology (Market Definitions, Boundary Conditions and Assumptions, Abbreviations and Terminology for Tertiary Pharma Logistics, Market Sizing and Forecasting Approach, Data Triangulation and Validation, Primary Research Design with KSA Stakeholders, Secondary Research Sources and Benchmarking, Bottom-Up Estimation from Key Accounts and Lanes, Top-Down Calibration to KSA Pharma Consumption and Trade, Limitations, Sensitivity Checks and Scenario Design)

- Definition and Scope of Tertiary Packaging in Pharma Supply Chain

- Evolution of Tertiary Packaging in KSA Pharma and Biologics Distribution

- Role of Tertiary Packaging in GDP-Compliant Cold-Chain and Ambient Distribution

- Business Cycle: From Raw Materials to Tertiary Pack-out and Reverse Logistics

- Supply Chain and Value Chain Structure across Converters, 3PLs and Pharma Manufacturers

- Growth Drivers

Expansion of Local Pharma, Biologics and Vaccine Manufacturing Footprint

Increasing Cold-Chain Shipments for Specialty and Biologic Therapies

Centralized Procurement and Distribution via MOH and NUPCO

Vision-Linked Logistics and Warehousing Infrastructure Investments

Regulatory Tightening on GDP, Temperature Excursions and Product Integrity - Challenges

High Cost of High-Performance Insulated and Reusable Tertiary Solutions

Extreme Climate, Long Hauls and Lane Variability

Fragmented Distribution and Inconsistent Handling Practices

Limited Local Capacity in Advanced Cold-Chain Packaging and VIP/PCM Platforms Compliance Risk: Aggregation, Serialization and Documentation at Shipper/Pallet Level - Market Opportunities

Localization of Corrugated, Pallet and Insulated Shipper Manufacturing in KSA

Expansion of Reusable and Pooling Models for Pallets and Insulated Shippers

Smart and Connected Tertiary Packaging

Sustainability-Focused Tertiary Solutions

Value-Added Packaging Services from 3PLs and CDMOs - Trends

Migration from Generic to Lane-Specific Packaging Design

Standardization of Shipper and Pallet Footprints Across KSA and GCC Networks

Growth of Qualification, Validation and Lane Mapping Studies

Digitalization of Temperature and Shock Monitoring at Tertiary Level

Integration of Anti-Counterfeit and Tamper-Evident Features on Tertiary Units - Government and Regulatory Framework

- SWOT Analysis of KSA Pharmaceutical Tertiary Packaging Market

- Stake Ecosystem Mapping

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Physical Volume, 2019-2024

- By Shipment Units, 2019-2024

- By Temperature Band, 2019-2024

- By Distribution Node, 2019-2024

- By Tertiary Packaging Format (in Value %)

Corrugated Shipper Cartons and Master Cases

Pallets and Skids

Plastic Crates, Bins and Totes

Insulated Shippers and Pallet Shippers

Stretch Wrap, Strapping, Corner Boards and Dunnage - By Material Platform (in Value %)

Virgin Kraft and High-Performance Corrugated Boards

Recycled-Content Corrugated and Lightweight Boards

Plastics: HDPE, PP, PET and Engineered Foams

Wood and Composite Pallets

Hybrid and Advanced Materials - By Temperature-Control Requirement (in Value %)

Ambient and CRT Tertiary Solutions

Refrigerated Range Tertiary Solutions

Frozen Range Tertiary Solutions

Ultra-Cold and Specialty Biologics Tertiary Solutions

Multi-Temperature and Hybrid Shipments - By Application / Product Class (in Value %)

Solid Oral Doses Distribution Shippers

Sterile Injectables and Biologics Tertiary Solutions

Vaccines and High-Sensitivity Biologicals

Clinical Trial and Investigational Medicinal Product Logistics

OTC, Consumer Health and Nutraceuticals - By End User (in Value %)

Multinational Innovator Pharma Companies

Local Generics Manufacturers and CMOs/CDMOs

Biopharma, Vaccine and Plasma-Derived Product Manufacturers

Government Institutions and Central Medical Procurement Bodies

Private Hospitals, Clinic Chains and Retail Pharmacy Networks - By Distribution Node and Channel (in Value %)

Plant-to-Central Warehouse Shipments

Central Warehouse-to-Regional DC Shipments

DC-to-Hospital, Clinic and Pharmacy Deliveries

Direct-to-Patient and Home-Delivery Pharma

Cross-Border Exports and GCC Re-exports - By Region (in Value %)

Central Region – Riyadh and Surrounding Pharma Clusters

Western Region – Jeddah, Makkah, Medina and Red Sea Gateways

Eastern Region – Dammam, Al-Khobar, Jubail and Industrial Corridors

Northern Region – Frontier Markets and Remote Distribution Nodes

Southern Region – High-Temperature Transit and Terrain-Driven Packaging Needs

- Market Share of Major Players by Value and Volume

Market Share of Major Players by Key Customer Type - Cross Comparison Parameters for Major Players (KSA Manufacturing and Assembly Footprint, Cold-Chain and Temperature-Band Coverage, Portfolio Breadth in Tertiary Formats, SFDA/GDP and Global Compliance Credentials, Reusable vs Single-Use Solution Mix and Pool-Management Capabilities, KSA and GCC Lane Coverage, Service Network and Partner Ecosystem, Innovation, Digital and Sensor-Enabled Offerings, Commercial and Service Model Flexibility)

- SWOT Analysis of Major Players

- Pricing and Value Analysis

- Detailed Profiles of Major Companies

Napco National

Obeikan Healthcare

CCL Industries / CCL Healthcare

Sealed Air

Becton, Dickinson and Company

Sonoco ThermoSafe

Pelican BioThermal LLC

Cold Chain Technologies Inc.

Cryopak

Sofrigam Company

Intelsius (A DGP Company)

Softbox Systems Ltd

Clip-Lok SimPak

Chill-Pak

CCP Logistics

- Demand and Utilization Patterns across End-User Clusters

- Budgeting, Total Cost of Ownership and Payback Expectations

- Regulatory, QA and Audit Requirements at End-User Level

- Needs, Pain Points and Service-Level Expectations

- Decision-Making and Supplier-Selection Processes

- By Value, 2025-2030

- By Physical Volume and Shipment Units, 2025-2030

- By Temperature Band and Application Cluster, 2025-2030

- By End User and Distribution Node, 2025-2030