Market Overview

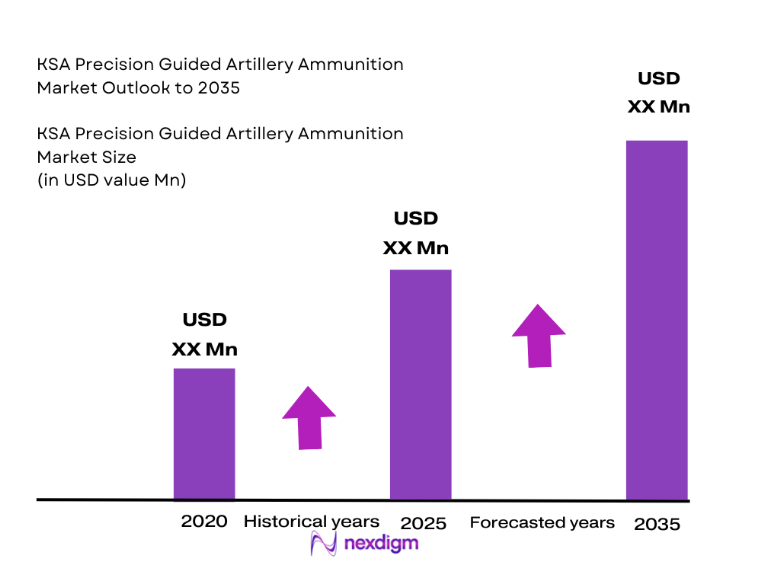

The KSA precision guided artillery ammunition market is driven by advanced technologies in guided artillery systems, with the market size reaching approximately USD ~Million. This market is primarily fueled by increasing military expenditures, enhanced defense strategies, and technological innovations in precision munitions. The demand for high-performance artillery solutions, particularly for countering modern threats such as drones and hypersonic weapons, significantly contributes to market growth. Additionally, ongoing investments in research and development by both government and defense contractors further boost market expansion.

Dominant countries such as Saudi Arabia lead the market due to their substantial defense budgets and geopolitical positioning in the Middle East. The kingdom has been making significant investments in modernizing its military capabilities, including enhancing its precision-guided artillery systems. These efforts are supported by strategic partnerships with international defense contractors, enabling the integration of cutting-edge technology. Saudi Arabia’s defense initiatives and its proactive stance in regional security ensure the dominance of this market, especially within the context of rising regional defense spending.

Market Segmentation

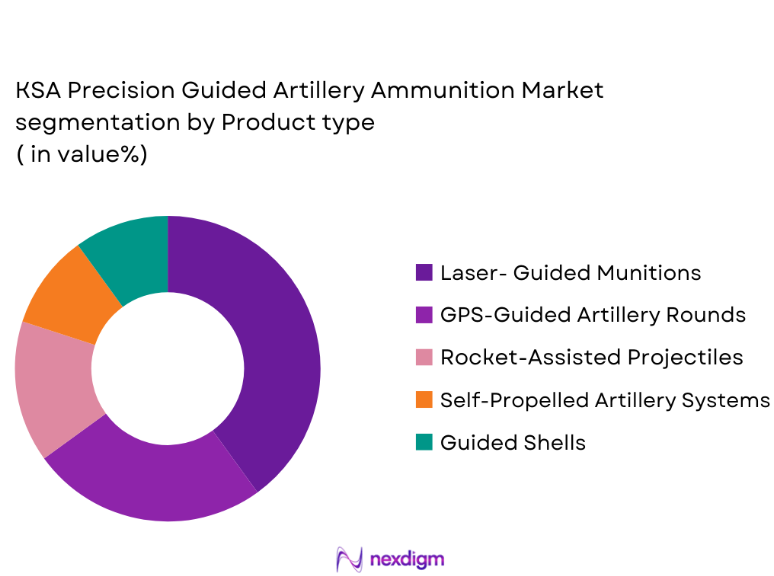

By Product Type

The KSA precision guided artillery ammunition market is segmented by product type into laser-guided munitions, GPS-guided artillery rounds, rocket-assisted projectiles, self-propelled artillery systems, and guided shells. The dominant sub-segment in this category is laser-guided munitions, owing to their precision, effectiveness in targeting, and adoption by both military forces and defense contractors. These munitions are highly sought after due to their ability to engage specific targets accurately, even in complex operational environments. Their growing use in Saudi Arabia’s defense forces and increasing deployment in the Middle East further solidifies their dominant market position.

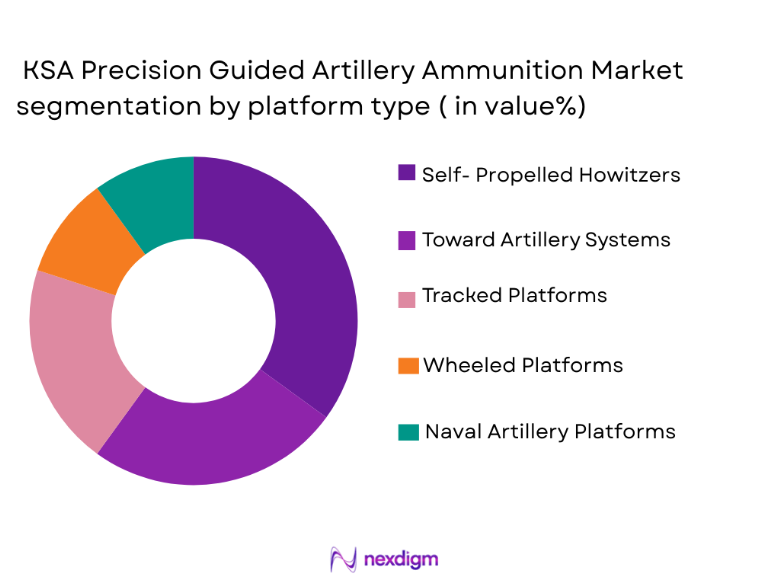

By Platform Type

The KSA precision guided artillery ammunition market is segmented by platform type into self-propelled howitzers, towed artillery systems, tracked platforms, wheeled platforms, and naval artillery platforms. The dominant sub-segment in this category is self-propelled howitzers, which are gaining increasing popularity due to their mobility, firepower, and ease of deployment in various terrains. These systems offer faster response times and greater battlefield flexibility compared to traditional towed artillery. As a result, self-propelled howitzers are widely used in Saudi Arabia’s modernized military forces, further boosting their market share in the region. The preference for these platforms is expected to continue due to their strategic advantages in rapidly changing combat situations.

Competitive Landscape

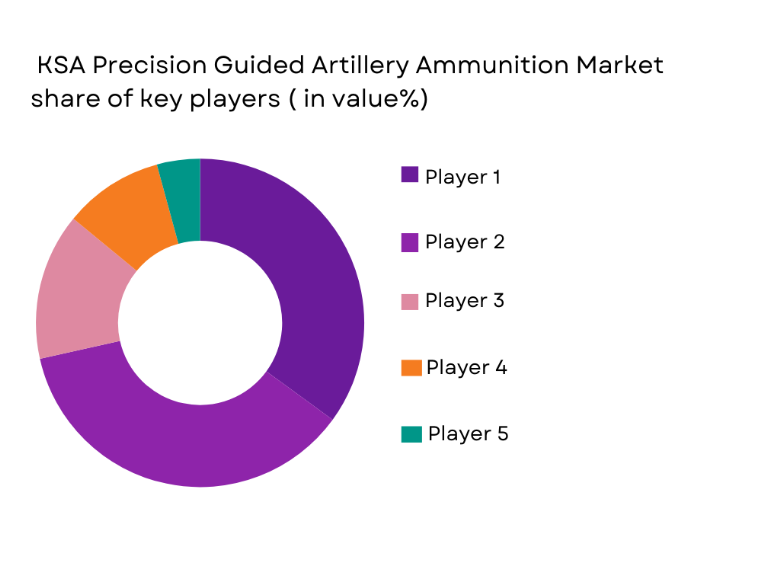

The competitive landscape of the KSA precision guided artillery ammunition market is shaped by a mix of global and regional players. Major defense companies, including Raytheon Technologies, Lockheed Martin, and BAE Systems, are at the forefront, leveraging their technological expertise and strong market presence. There has been increasing consolidation in the market as companies form strategic alliances and joint ventures to secure long-term contracts with defense ministries, particularly in the Middle East. The competition is highly intense, with companies focusing on innovation, production capacity, and cost efficiency to stay ahead in the market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Market Penetration |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Germany | ~ | ~ | ~ | ~ | ~ |

KSA Precision Guided Artillery Ammunition Market Analysis

Growth Drivers

Technological Advancements in Guided Systems

The continuous advancement in guidance technology plays a significant role in the growth of the KSA precision guided artillery ammunition market. With the increasing demand for higher accuracy and reliability, guided systems that integrate GPS and laser guidance mechanisms have become essential. These technologies enable the precise targeting of high-value assets, reducing collateral damage and ensuring strategic effectiveness in military operations. The development of dual-mode guidance systems has also contributed to meeting various combat needs, further driving growth. Additionally, innovations in materials that improve the range and explosive power of these munitions are helping manufacturers produce more powerful and efficient artillery shells. The increasing investments in research and development by global and regional players also accelerate technological progress, propelling the market forward

Increasing Defense Expenditures in the middle east

The ongoing political instability and military conflicts in the Middle East have significantly boosted defense budgets in countries like Saudi Arabia. These nations are increasingly investing in advanced defense technologies, including precision-guided artillery, to enhance their military capabilities and maintain regional security. The Saudi government has been particularly focused on modernizing its defense infrastructure, aiming to enhance operational efficiency and combat readiness. This focus on high-tech weaponry, driven by both strategic defense goals and the need to maintain a technological edge over adversaries, has led to an uptick in procurement of precision-guided artillery systems, directly driving market growth in the region. The region’s key role in global defense spending further supports sustained demand for these systems.

Market Challenges

High Development and Procurement Costs

The KSA precision guided artillery ammunition market faces significant challenges due to the high costs associated with the development and procurement of these systems. Precision-guided munitions require advanced technologies and complex manufacturing processes, which contribute to their expensive price tags. This includes the cost of research and development, as well as the integration of cutting-edge guidance and targeting systems. Additionally, maintaining a steady supply of these sophisticated munitions involves substantial logistical and production costs, often creating financial burdens for defense ministries. For countries with large defense budgets like Saudi Arabia, the financial strain is manageable, but for smaller nations, these high costs can hinder procurement, limiting market penetration. The ongoing complexity in keeping production costs competitive further exacerbates this challenge.

Technological Integration Issues

Another challenge faced by the market is the integration of advanced precision-guided artillery systems into existing defense infrastructures. Many military organizations already possess older artillery platforms that were not designed to accommodate modern guided munitions. This discrepancy can create compatibility issues, as retrofitting older platforms with new technologies requires extensive modifications, both in terms of hardware and software. This process can delay deployments and increase costs. Moreover, the training and skill development required to effectively use these advanced systems further complicates their integration into existing military operations. Overcoming these challenges necessitates significant investments, both in terms of capital and time.

Opportunities

Emerging Markets’ Interest in Advanced Artillery Systems

As defense spending grows in emerging markets, there is a notable opportunity for the KSA precision guided artillery ammunition market to expand beyond the Middle East. Countries in Asia and Africa, particularly those facing rising security threats, are increasingly looking for advanced artillery solutions. These regions, while traditionally relying on older artillery systems, are modernizing their military forces in response to new challenges. The need for precision and enhanced combat capabilities, coupled with growing defense budgets, opens up new avenues for sales of guided artillery systems. International collaborations and partnerships with emerging markets further provide significant opportunities for market growth, as these regions seek to enhance their defense capabilities.

Sustainability Trends in Munitions Development

Another promising opportunity lies in the development of environmentally sustainable artillery systems. As global regulatory bodies place increasing pressure on the defense industry to reduce environmental impact, companies in the KSA precision guided artillery ammunition market can invest in greener technologies. This includes the development of munitions that are less harmful to the environment upon detonation, as well as the exploration of alternative materials that reduce the ecological footprint of production. Not only does this meet regulatory demands, but it also appeals to governments looking to enhance the sustainability of their military operations, creating a competitive edge for companies that lead the way in this area.

Future Outlook

Over the next five years, the KSA precision guided artillery ammunition market is expected to experience robust growth, driven by advancements in technology and the continuous demand for more effective defense systems. Technological innovations such as AI-driven targeting and smart munitions will enhance system capabilities, improve accuracy and reduce collateral damage. Increasing geopolitical tensions and defense budgets will further drive demand, while ongoing research in environmentally sustainable artillery technologies will open new market opportunities. The market is poised for steady growth, with significant investments in defense modernization programs.

Major Players

- Lockheed Martin

- Raytheon Technologies

- BAE Systems

- Thales Group

- Rheinmetall AG

- Elbit Systems

- Saab AB

- Leonardo S.p.A.

- Denel Dynamics

- Kongsberg Gruppen

- Thales Australia

- L3 Technologies

- General Dynamics

- Northrop Grumman

- Israel Military Industries

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military defense contractors

- Aerospace and defense manufacturers

- International defense alliances

- Strategic defense planners

- Military technology research institutions

- Security and defense policy advisors

Research Methodology

Step 1: Identification of Key Variables

This step involves defining the essential market variables and parameters that drive the precision-guided artillery ammunition market. We identify the key product types, technological trends, and regional dynamics that influence the market’s direction.

Step 2: Market Analysis and Construction

This stage includes comprehensive data gathering from both primary and secondary sources. Market sizing, trends analysis, and competitive dynamics are analyzed to form a complete market picture.

Step 3: Hypothesis Validation and Expert Consultation

At this point, expert opinions from industry leaders, consultants, and military professionals are gathered to validate market assumptions and to gain insights into emerging trends and challenges.

Step 4: Research Synthesis and Final Output

The final research output is synthesized, offering a detailed market report with accurate data and projections. The synthesis includes detailed market dynamics, competitive landscape, and future market opportunities.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological advancements in guidance systems

Increasing defense budgets in the Middle East

Collaborations with global defense technology firms

Rise in asymmetric warfare and precision strike demands

Ongoing regional geopolitical tensions - Market Challenges

High development and procurement costs

Complexity in integration with existing platforms

Security concerns with advanced munitions technology

Logistical constraints in deployment

Regulatory and compliance hurdles for export - Market Opportunities

Development of environmentally friendly munitions

Increased demand from international defense markets

Emerging markets’ interest in advanced artillery systems - Trends

Rise of hybrid guidance systems

Shift towards modular, adaptable artillery solutions

Integration of artificial intelligence in targeting

Advancements in automation for fire control

Collaborations for joint defense technologies - Government Regulations & Defense Policy

Regulations for precision-guided munitions in international law

Defense partnerships under NATO and other alliances

Export control policies for military hardware - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Guided Shells

Laser-Guided Munitions

GPS-Guided Artillery Rounds

Rocket-Assisted Projectiles

Self-Propelled Artillery Systems - By Platform Type (In Value%)

Self-Propelled Howitzers

Towed Artillery Systems

Tracked Platforms

Wheeled Platforms

Naval Artillery Platforms - By Fitment Type (In Value%)

Direct Fire Systems

Indirect Fire Systems

Hybrid Systems

Automated Fire Control Systems

Dual-Mode Guided Systems - By EndUser Segment (In Value%)

Military Defense Forces

Artillery Brigades

Defense Contractors

Government Research Agencies

International Military Alliances - By Procurement Channel (In Value%)

Direct Government Procurement

Defense Contractors and Suppliers

International Defense Auctions

Private Military Companies

Public-Private Partnerships - By Material / Technology (In Value%)

Explosive Materials

Guidance Systems

Propellant Technology

Sensor Technology

Fusing and Detonation Systems

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Technology Adoption, Production Costs, Regional Presence, R&D Investments, Strategic Partnerships, Market Penetration, Product Portfolio, Pricing Strategies, Distribution Channels, Brand Recognition)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Northrop Grumman

Raytheon Technologies

BAE Systems

General Dynamics

Thales Group

Rheinmetall AG

Elbit Systems

Saab AB

Leonardo S.p.A.

Denel Dynamics

Kongsberg Gruppen

Thales Australia

L3 Technologies

Kuwait Steel Industries

- Enhanced demand from regional defense forces

- Shift towards modernized artillery systems in military

- Increased collaboration with defense contractors

- Growing influence of international military partnerships

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035