Market Overview

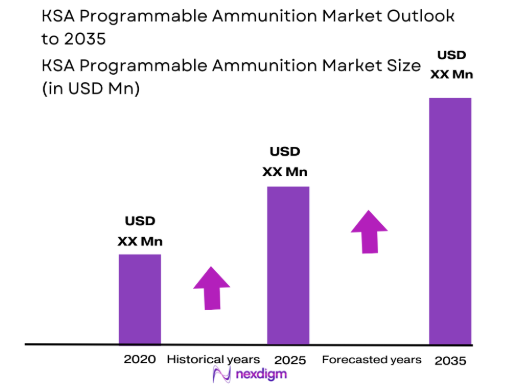

Based on a recent historical assessment, the KSA Programmable Ammunition Market was valued at approximately USD ~ million, supported by officially disclosed defense budget allocations, procurement contracts, and supplier revenue disclosures from recognized defense manufacturers. Market expansion is driven by structured modernization of ground combat systems, increasing procurement of precision-enabled munitions, and integration of programmable ammunition with advanced fire control and targeting systems. Additional demand arises from operational requirements to enhance lethality, reduce collateral impact, improve mission adaptability, and align ammunition capabilities with digitally enabled battlefield doctrines adopted by national defense forces.

Based on a recent historical assessment, dominance in the KSA Programmable Ammunition Market is centered in Saudi Arabia, with operational concentration across Riyadh, the Eastern Province, and Western coastal regions due to the presence of central command authorities, logistics hubs, and major military installations. These regions benefit from proximity to naval bases, armored formations, and border security commands that actively deploy programmable ammunition systems. National dominance is reinforced by strong sovereign defense spending capacity, industrial localization initiatives, secure procurement frameworks, and long-term partnerships with established international defense technology providers.

Market Segmentation

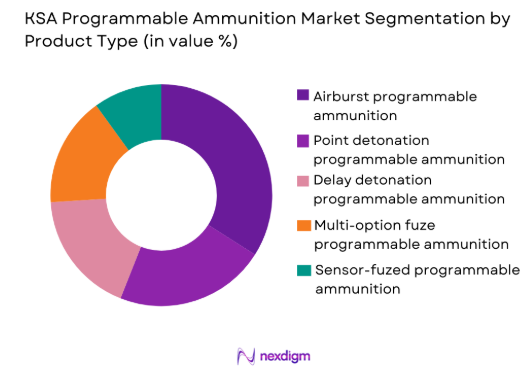

By Product Type

KSA Programmable Ammunition Market is segmented by product type into airburst programmable ammunition, point detonation programmable ammunition, delay detonation programmable ammunition, multi-option fuze programmable ammunition, and sensor-fulled programmable ammunition. Recently, airburst programmable ammunition has a dominant market share due to its superior effectiveness against concealed and defilade targets, which are common in complex terrain and urban combat scenarios. Its adoption is reinforced by compatibility with modern fire control units, higher engagement flexibility, and operational efficiency for infantry and vehicle-mounted systems. The ability to program detonation distance enhances accuracy while reducing ammunition wastage. Strong preference from land forces, combined with standardized training and interoperability across platforms, further sustains demand. Additionally, airburst systems support mission adaptability across border security and mechanized operations, consolidating their dominance within the product segmentation landscape.

By Platform Type

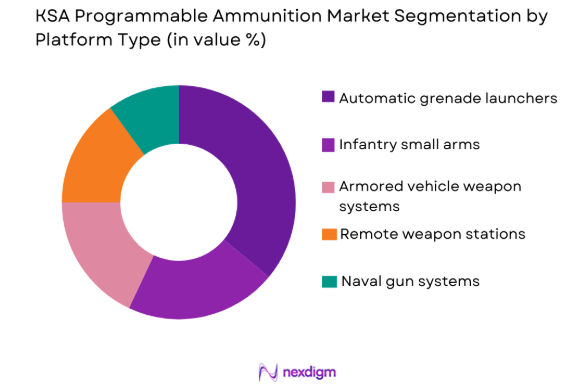

KSA Programmable Ammunition Market is segmented by platform type into infantry small arms, automatic grenade launchers, armored vehicle weapon systems, naval gun systems, and remote weapon stations. Recently, automatic grenade launchers have emerged as the dominant platform due to their widespread deployment across land forces and border security units. Their dominance is supported by extended engagement range, high lethality, and seamless integration with programmable ammunition systems that improve effectiveness against dispersed targets. Compatibility with existing inventories minimizes transition costs, while continuous upgrades to launcher-mounted programmers enhance reliability. Strong operational demand from mechanized and rapid response units further accelerates adoption. Additionally, automatic grenade launchers provide tactical flexibility in both defensive and offensive operations, sustaining their leading position within platform-based segmentation.

Competitive Landscape

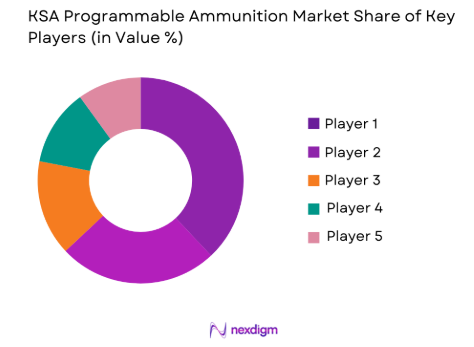

The competitive landscape of the KSA Programmable Ammunition Market is moderately consolidated, with a limited number of established international defense manufacturers holding strong positions through long-term supply agreements and technology partnerships. Market influence is shaped by technological maturity, reliability of programmable fuze systems, and the ability to support localization objectives. High entry barriers, stringent qualification requirements, and integration complexity favor incumbent players, while collaborative manufacturing and offset arrangements reinforce competitive positioning.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Localization Capability |

| Rheinmetall Denel Munitions | 2008 | South Africa | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ |

| Saab Bofors Dynamics | 1887 | Sweden | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ |

KSA Programmable Ammunition Market Analysis

Growth Drivers

Precision-Oriented Defense Modernization Programs

Precision-oriented defense modernization programs act as a foundational growth driver for the KSA Programmable Ammunition Market by embedding accuracy, adaptability, and controlled lethality into national procurement and force development strategies across land, air defense, and naval domains. Saudi defense modernization policies prioritize replacement of conventional munitions with advanced programmable alternatives that can dynamically adjust detonation parameters, enabling improved engagement outcomes in complex and congested operational environments. Significant capital allocation toward digitally enabled weapon platforms increases structural demand for programmable ammunition that is interoperable with modern fire control, targeting, and battlefield management systems. These modernization programs also emphasize reduced collateral damage and improved mission precision, aligning programmable ammunition adoption with evolving operational doctrines and international engagement standards. Long-term procurement planning cycles integrate programmable ammunition into standardized loadouts, ensuring recurring demand rather than episodic purchases. Localization initiatives tied to modernization further stabilize demand by committing to domestic assembly, co-production, and licensed manufacturing of smart munitions. Training reforms and doctrinal updates ensure operational familiarity, which reinforces end-user confidence and sustained utilization across units. Interoperability requirements across allied and coalition platforms further incentivize adoption of standardized programmable solutions. Collectively, modernization programs transform programmable ammunition from a niche capability into a core element of future force structures.

Border Security and Asymmetric Threat Mitigation Requirements

Border security and asymmetric threat mitigation requirements strongly drive the KSA Programmable Ammunition Market by creating sustained operational demand for flexible, adaptive, and precision-controlled ammunition solutions. Saudi security forces operate across diverse terrains that include deserts, urban peripheries, and critical infrastructure zones, where threats are often concealed, mobile, and irregular in nature. Programmable ammunition provides the ability to tailor detonation distance and effect in real time, improving engagement effectiveness against defilade targets, light structures, and dispersed adversaries. Persistent border surveillance and patrol operations result in consistent ammunition consumption, reinforcing recurring procurement cycles. Integration of programmable ammunition with electro-optical sensors, radars, and command systems enhances responsiveness and situational awareness for frontline units. Reduced ammunition wastage and improved first-round effectiveness support operational efficiency during prolonged deployments. Vehicle-mounted and static defense systems both benefit from programmable capabilities, broadening platform-level demand. Continuous operational feedback loops validate performance advantages and influence procurement renewal decisions. As asymmetric threats evolve in sophistication, the operational relevance of programmable ammunition remains structurally reinforced. This driver ensures demand continuity independent of broader geopolitical fluctuations.

Market Challenges

High Cost and Integration Complexity of Programmable Systems

High cost and integration complexity of programmable systems represent a major structural challenge for the KSA Programmable Ammunition Market despite clear operational benefits. Programmable ammunition incorporates advanced electronic fuzes, sensors, and embedded software, which substantially increase unit costs compared to conventional munitions. Integration with legacy weapon platforms frequently requires additional investments in fire control upgrades, programming interfaces, and compatibility testing, elevating overall acquisition expenditure. Lifecycle costs are further increased by the need for specialized maintenance, calibration, and testing infrastructure to ensure reliability and safety. Training personnel to operate, maintain, and troubleshoot programmable systems requires extended timelines and dedicated resources. Budgetary constraints force procurement authorities to prioritize among competing modernization needs, sometimes limiting scale of adoption. Imported electronic components expose costs to currency volatility and supplier pricing structures. Smaller operational units may face barriers to access due to cost concentration. These economic and technical complexities slow broader deployment across all force segments. Addressing cost optimization and integration efficiency remains essential for long-term market scalability.

Dependence on Foreign Technology and Supply Chains

Dependence on foreign technology and supply chains poses a significant challenge to the resilience and strategic autonomy of the KSA Programmable Ammunition Market. Critical components such as programmable fuzes, microelectronics, and sensor modules are predominantly sourced from international suppliers, limiting domestic control over key technologies. Export regulations, licensing requirements, and geopolitical considerations can affect delivery schedules and contract execution timelines. Supply chain disruptions create uncertainty in inventory planning and operational readiness. Technology transfer negotiations often involve prolonged approval processes that delay localization objectives. Limited availability of domestic alternatives reinforces reliance on external partners for upgrades, maintenance, and lifecycle support. Currency fluctuations directly influence procurement costs and budget predictability. Strategic ambitions for self-reliance are difficult to realize under persistent foreign dependency. Mitigating these vulnerabilities requires long-term industrial investment and capability development. Until then, supply chain exposure remains a structural constraint.

Opportunities

Expansion of Localized Manufacturing and Technology Transfer

Expansion of localized manufacturing and technology transfer represents a high-impact opportunity for strengthening the KSA Programmable Ammunition Market and reducing structural vulnerabilities. Localization initiatives enable domestic production of programmable ammunition components, reducing dependence on imported systems and enhancing supply security. Technology transfer agreements facilitate skill development, intellectual capability growth, and long-term knowledge retention within the national defense industrial base. Domestic manufacturing allows customization of ammunition to specific operational requirements and environmental conditions. Over time, localized supply chains can reduce per-unit costs through economies of scale and logistics efficiencies. Government incentives and offset policies encourage foreign manufacturers to establish local partnerships and production facilities. Workforce development programs aligned with localization improve technical proficiency and employment generation. Local ecosystems foster innovation and incremental upgrades. Enhanced domestic capability supports strategic autonomy objectives. This opportunity aligns closely with national industrial and security priorities.

Integration with Network-Centric and Digital Battlefield Systems

Integration with network-centric and digital battlefield systems presents a major opportunity by significantly enhancing the functional value and relevance of programmable ammunition within future force architectures. Programmable ammunition designed to interface seamlessly with digital command, control, and targeting systems enables data-driven engagement decisions and optimized detonation outcomes. Real-time information exchange improves accuracy, responsiveness, and situational adaptability during operations. Interoperability with networked platforms increases procurement attractiveness for digitally enabled units. Continuous software updates extend system lifecycle relevance without requiring full hardware replacement. Integration supports broader force transformation initiatives centered on connectivity and information dominance. Demand increases as more units transition to network-centric operational models. System-level integration differentiates suppliers beyond standalone ammunition performance. Technological convergence strengthens long-term competitiveness. This opportunity supports sustained market expansion aligned with digital modernization trends.

Future Outlook

The future outlook of the KSA Programmable Ammunition Market over the next five years is shaped by sustained defense modernization priorities, increasing emphasis on precision warfare, and continued alignment with digitally enabled combat doctrines. Demand is expected to remain stable as programmable ammunition becomes a standard requirement across land forces, border security units, and select naval platforms, rather than a niche capability. Technological developments in electronic fuzing, multi-option detonation control, and sensor-assisted programming are likely to improve reliability, safety, and interoperability with advanced fire control systems. Regulatory and policy support for defense localization will further influence market structure, encouraging domestic assembly, licensed production, and gradual expansion of indigenous manufacturing capabilities. On the demand side, evolving security requirements, asymmetric threat environments, and the need for controlled engagement in complex terrains will continue to justify procurement of programmable ammunition, reinforcing its role as a critical component of Saudi Arabia’s future force readiness and operational effectiveness.

Major Players

- Rheinmetall Denel Munitions

- BAE Systems

- Elbit Systems

- Saab Bofors Dynamics

- Thales Group

- Nammo

- Leonardo

- Northrop Grumman

- Hanwha Defense

- ASELSAN

- Eurenco

- CBC Global Ammunition

- Mesko

- Alliant Techsystems

- Rostec

Key Target Audience

- Defense procurement agencies

- Ministry of Defense entities

- Border security forces

- Naval command authorities

- Armored and mechanized units

- Special operations commands

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables influencing demand, supply, and regulation were identified through secondary research. Procurement disclosures were reviewed. Industry drivers were mapped. Variables were validated.

Step 2: Market Analysis and Construction

Market structure was developed using verified data. Segmentation was constructed. Competitive positioning was assessed. Market sizing was validated.

Step 3: Hypothesis Validation and Expert Consultation

Findings were reviewed with defense experts. Assumptions were tested. Feedback was incorporated. Consistency was ensured.

Step 4: Research Synthesis and Final Output

Data was synthesized into a structured report. Analytical coherence was verified. Insights were aligned. Final quality checks were completed.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for precision and reduced collateral damage

Modernization of ground combat and border security forces

Increased adoption of network-centric warfare systems

Localization and defense industrialization initiatives

Integration with advanced fire control and C4ISR systems

- Market Challenges

High unit cost of programmable ammunition systems

Complex integration with legacy weapon platforms

Dependence on imported critical electronic components

Training and operational complexity for end users

Stringent testing and certification requirements - Market Opportunities

Expansion of local manufacturing under defense localization programs

Upgrades of existing weapon systems with programmable capability

Growing demand for urban warfare and counter-drone ammunition - Trends

Shift toward multi-option and multi-sensor fuzing

Increased interoperability with digital fire control systems

Emphasis on smart ammunition for asymmetric warfare

Rising focus on lifecycle cost reduction

Growing collaboration with international defense technology partners

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Airburst programmable rounds

Point detonation programmable rounds

Delay detonation programmable rounds

Multi-option fuze programmable rounds

Sensor-fused programmable rounds

- By Platform Type (In Value%)

Infantry small arms

Automatic grenade launchers

Naval gun systems

Armored vehicle weapon systems

Remote weapon stations

- By Fitment Type (In Value%)

Factory-integrated ammunition

Field-programmable ammunition

Weapon-mounted programmer dependent

Fire-control system integrated

Standalone handheld programmer compatible

- By End User Segment (In Value%)

Land forces

Naval forces

Air defense units

Border security forces

Special operations forces

- By Procurement Channel (In Value%)

Direct government procurement

Defense OEM contracts

Licensed local manufacturing

Offset and localization programs

Intergovernmental defense agreements

- By Material / Technology (in Value %)

Electronic fuze-based systems

MEMS-enabled fuze technology

Proximity sensor-based technology

Time-based digital programming

Multi-sensor hybrid technology

- Market share snapshot of major players

- Cross Comparison Parameters (Product range, Platform compatibility, Programmability options, Localization capability, Technology maturity, Integration support, Pricing competitiveness, Supply chain resilience, After-sales support)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Rheinmetall Denel Munitions

BAE Systems

Northrop Grumman

Nammo

Leonardo

Elbit Systems

Saab Bofors Dynamics

Thales Group

Alliant Techsystems

Hanwha Defense

CBC Global Ammunition

Mesko

Eurenco

Rostec

ASELSAN

- Land forces prioritizing precision engagement in complex terrains

- Naval forces adopting programmable rounds for surface threat mitigation

- Border security forces focusing on controlled engagement capabilities

- Special forces demanding adaptable and mission-specific ammunition

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035