Market Overview

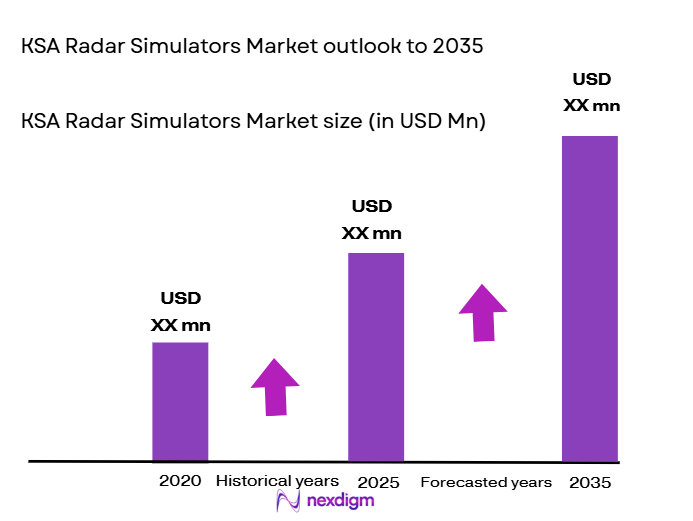

The radar simulators market is poised for significant growth, driven by increasing defense spending, technological advancements, and the need for advanced training systems. In recent assessments, the market size has been valued in the USD ~ million, with growth predominantly fueled by the expanding defense infrastructure in various regions, particularly in Saudi Arabia. Investments in military modernization and the adoption of radar simulators for training purposes are key factors driving the demand. Governmental efforts to improve the effectiveness and realism of defense training have further boosted the market’s trajectory, particularly in the Middle East region.

Saudi Arabia remains a dominant player in this market, owing to its substantial defense budget and strategic initiatives to modernize military operations. The country’s investments in high-tech military equipment and training systems contribute significantly to the demand for radar simulators. Furthermore, partnerships with global defense contractors and the development of indigenous defense capabilities ensure that Saudi Arabia maintains a competitive edge in radar simulation technologies. As the nation expands its defense and aerospace sectors, it is expected to continue being a key driver of growth in the radar simulators market.

Market Segmentation

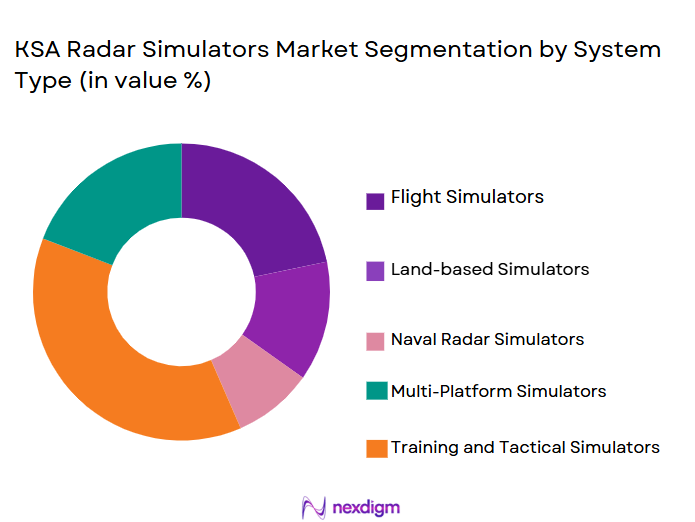

By System Type

The radar simulators market is segmented by product type into various categories such as synthetic aperture radar simulators, continuous wave radar simulators, pulse radar simulators, phased array radar simulators, and weather radar simulators. Currently, synthetic aperture radar simulators dominate the market share, driven by their wide range of applications in both military and civilian sectors. These simulators are used for advanced radar system training and research purposes, providing high-resolution imaging for radar system operators. The increasing adoption of SAR simulators is fueled by their efficiency in simulating complex radar environments, a critical factor for military readiness and civilian airspace management.

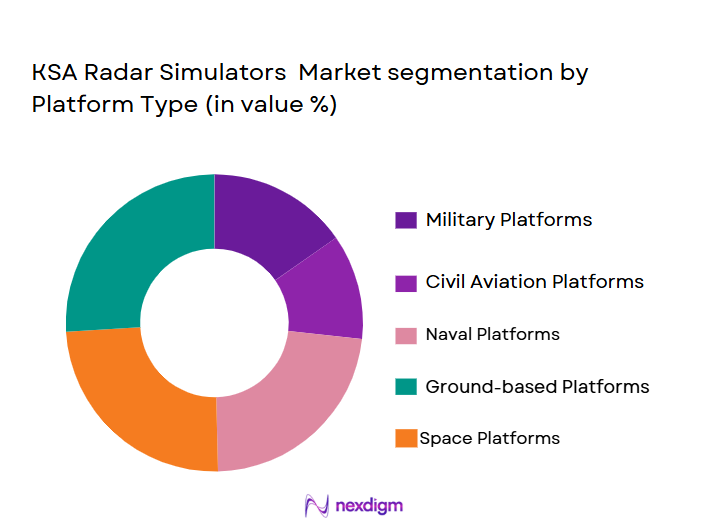

By Platform Type

The market is also segmented by platform type into ground-based radar simulators, airborne radar simulators, naval radar simulators, space-based radar simulators, and UAV radar simulators. Ground-based radar simulators hold the largest market share, primarily due to their widespread use in military training centers and defense forces. These systems are crucial for replicating various operational scenarios, enabling soldiers to familiarize themselves with radar systems before deploying them in real-world operations. The growing need for ground-based training facilities across regions with expanding defense budgets, such as the Middle East, contributes significantly to the dominance of this sub-segment.

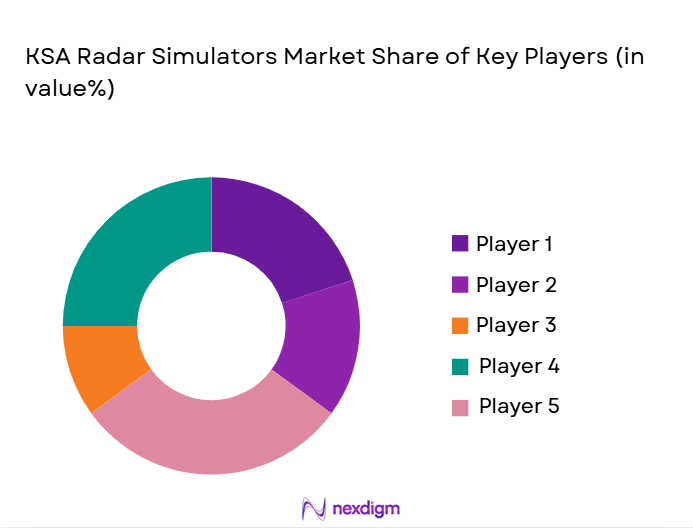

Competitive Landscape

The radar simulators market is highly competitive, with significant consolidation and strategic partnerships between major players. Companies are focusing on acquiring advanced technologies to stay competitive. The leading market players influence the market significantly through their technological innovations and extensive global reach. As radar simulators become an essential component of defense and aerospace infrastructure, companies are also expanding their product portfolios to cater to the increasing demand for enhanced simulation capabilities. This has resulted in an increasingly competitive environment, with global players vying for larger shares of the growing market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | USA | ~ | ~ | ~ | ~ | ~ |

| Saab Group | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

KSA radar simulators Market Analysis

Growth Drivers

Increasing Defense Budgets

The increasing defense budgets, particularly in the Middle East and Asia-Pacific regions, are one of the major drivers behind the growth of the radar simulators market. Countries like Saudi Arabia, India, and others have significantly raised their defense expenditure in recent years to modernize their military forces, driving the demand for advanced training tools such as radar simulators. These simulators are essential for improving the operational readiness of defense personnel by providing them with realistic training environments. The demand is further propelled by the rise in military tensions in various regions, which has led to increased investments in defense technologies. As nations focus on maintaining a robust defense capability, radar simulators play an indispensable role in enhancing the effectiveness of training programs.

Technological Advancements in Simulation Systems

Another key growth driver for the radar simulators market is the rapid advancement in simulation technologies. These advancements include improvements in system resolution, enhanced accuracy, and the ability to simulate more complex environments, which have expanded the scope of applications for radar simulators. As radar systems become more sophisticated, there is a growing need for simulators that can replicate these systems with higher fidelity. Innovations such as virtual reality (VR) and artificial intelligence (AI) have enabled more immersive and realistic training experiences, further driving market demand. The adoption of these technologies is expected to increase as military and defense organizations invest in next-generation simulators that offer higher performance and more scalable solutions.

Market Challenges

High Initial Investment Costs

One of the major challenges in the radar simulators market is the high initial investment required for acquiring and deploying advanced radar simulation systems. These systems, which include both hardware and software components, often come with significant upfront costs, making them less accessible to smaller defense organizations or countries with limited defense budgets. While these simulators offer substantial long-term benefits, such as enhanced training efficiency and operational readiness, the high cost can be a major barrier to adoption, especially in emerging markets. This challenge has led to slower market penetration in regions with budget constraints, despite the growing need for advanced training systems.

Integration Complexities

The complexity involved in integrating radar simulators with existing radar systems and military infrastructures is another significant challenge in the market. Many radar simulators require customization to match the specific requirements of different radar systems, making the integration process time-consuming and technically challenging. This complexity often leads to delays in the deployment of simulation systems and can result in additional costs for defense organizations. Moreover, integrating new radar simulators with legacy systems can sometimes be incompatible, further increasing the complexity of the integration process. As a result, organizations may face difficulties in maximizing the potential of their simulation investments.

Opportunities

Growing Military Modernization Programs

The increasing focus on military modernization programs presents significant opportunities for the radar simulators market. Countries across the globe, particularly in regions like the Middle East and Asia, are investing heavily in modernizing their military forces to enhance defense capabilities. As part of these modernization efforts, radar simulators are being integrated into training programs to ensure that military personnel are adequately prepared to operate advanced radar systems. The demand for cutting-edge simulation systems is expected to rise as military forces adopt more sophisticated technologies. These investments in radar simulators are seen as crucial for enhancing operational effectiveness and achieving strategic military objectives.

Adoption of AI and VR in Training Simulators

The adoption of artificial intelligence (AI) and virtual reality (VR) technologies in radar simulators represents a significant opportunity for market growth. These technologies are revolutionizing the way radar simulators are used, making training more realistic and efficient. AI enables the creation of dynamic, adaptive simulations that respond to user input in real-time, providing a more immersive experience. Meanwhile, VR offers users a fully immersive training environment, allowing them to experience radar operations from various perspectives. As defense organizations seek to enhance the effectiveness of training programs, the incorporation of AI and VR in radar simulators is expected to become a key trend, driving market growth.

Future Outlook

The radar simulators market is set to experience steady growth over the next five years, driven by technological advancements and increasing demand for enhanced military training systems. Innovations in AI, VR, and cloud-based simulation technologies are expected to revolutionize radar training, making it more accessible and efficient. Additionally, the growing defense budgets and modernization programs in key regions such as the Middle East and Asia will further propel market demand. Regulatory support and strategic defense initiatives will also play a crucial role in shaping the future of radar simulators, with increasing investments in advanced training tools by defense forces worldwide.

Major Players

- Raytheon Technologies

- Lockheed Martin

- Saab Group

- Thales Group

- Northrop Grumman

- BAE Systems

- L3 Technologies

- General Dynamics

- Leonardo

- Airbus

- Israel Aerospace Industries

- Rockwell Collins

- Elbit Systems

- Harris Corporation

- Textron Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military and defense organizations

- Aerospace and aviation companies

- Simulation and training providers

- Defense contractors

- Security and surveillance agencies

- Research and development firms

Research Methodology

Step 1: Identification of Key Variables

Key variables, such as market drivers, challenges, and segmentation factors, are identified through extensive market research and industry data analysis.

Step 2: Market Analysis and Construction

Comprehensive market analysis is conducted using both primary and secondary data sources, including industry reports, expert interviews, and historical data.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through consultations with industry experts, defense professionals, and market specialists to ensure accuracy and relevance.

Step 4: Research Synthesis and Final Output

Data synthesis and analysis result in a final report that highlights key trends, forecasts, and actionable insights into the radar simulators market.

- Executive Summary

- KSA Radar Simulators Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising defense budgets and military modernization programs in Saudi Arabia

Increasing demand for advanced training tools for radar operators

Development of indigenous radar systems and simulators in the Middle East - Market Challenges

High costs associated with advanced radar simulators and system upgrades

Complexity of radar simulator technology and integration challenges

Regulatory and compliance challenges in the defense and aerospace sectors - Market Opportunities

Expansion of defense cooperation between Saudi Arabia and international partners

Growing investments in simulation and training programs for defense sectors

Technological advancements in artificial intelligence and machine learning for radar systems - Trends

Shift towards cloud-based radar simulators for improved scalability and remote access

Increased adoption of virtual and augmented reality in radar simulation training

Focus on improving radar simulator realism and user experience for more effective training

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price,, 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Synthetic Aperture Radar Simulators

Continuous Wave Radar Simulators

Pulse Radar Simulators

Phased Array Radar Simulators

Weather Radar Simulators - By Platform Type (In Value%)

Ground-based Radar Simulators

Airborne Radar Simulators

Naval Radar Simulators

Space-based Radar Simulators

Unmanned Aerial Vehicle (UAV) Radar Simulators - By Fitment Type (In Value%)

Integrated Radar Simulators

Standalone Radar Simulators

Upgraded Radar Simulators

Portable Radar Simulators

Custom-fit Radar Simulators - By EndUser Segment (In Value%)

Military & Defense

Aerospace & Aviation

Public Safety & Homeland Security

Transportation & Infrastructure

Research & Education - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Procurement via System Integrators

Online Procurement Platforms

Third-party Resellers & Distributors

Government and Military Procurement

- Market Share Analysis

- Cross Comparison Parameters

(Market Share, Technology Adoption, Pricing Strategy, R&D Investment, Global Reach) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Antrix Corporation

Tata Communications

Bharti Airtel

Reliance Jio

Airbus Defence and Space

Northrop Grumman

Boeing Space and Launch

Thales Alenia Space

Lockheed Martin

Larsen & Toubro

Maxar Technologies

Sukhoi

Planet Labs

ExPace Technologies

- Increased demand for military and defense applications in the region

- Expansion of radar simulation usage in educational institutions and training centers

- Growth in adoption for aviation safety and air traffic management

- Increase in collaborative training programs between government and private sector

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035