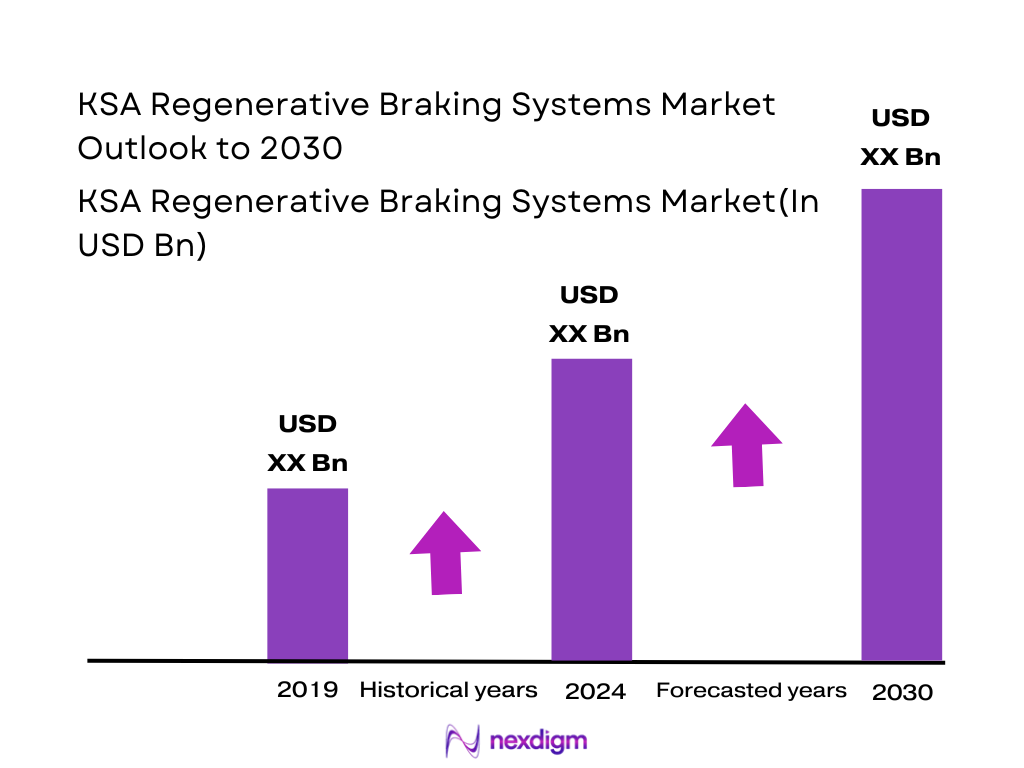

Market Overview

The KSA regenerative braking systems market is assessed at roughly the high-thirty-million-dollar level in system revenues, derived from the Kingdom’s share of a Middle East & Africa value pool of about USD ~ million and global revenues of more than USD ~ billion. This value is driven by rapid electrification—Saudi Arabia aims to make 30% of vehicles in its capital electric and to localize up to hundreds of thousands of EVs annually through investments in brands such as Lucid and Ceer—combined with policy emphasis on efficiency, emissions reduction and advanced brake-by-wire architectures that embed regenerative braking as a standard feature.

Within the Kingdom, usage and value creation in regenerative braking systems are concentrated in Riyadh, Jeddah and the Eastern Province corridor (Dammam–Dhahran–Khobar). These hubs combine the highest new-vehicle registrations, premium and fleet customers, and early adoption of electric and hybrid vehicles—including electric buses, ride-hailing fleets and corporate cars. National targets to make a substantial share of vehicles in Riyadh electric, large-scale EV plants at King Abdullah Economic City, and corridor-based charging infrastructure plans further anchor these cities as the primary demand centres for regenerative braking technology in KSA.

Market Segmentation

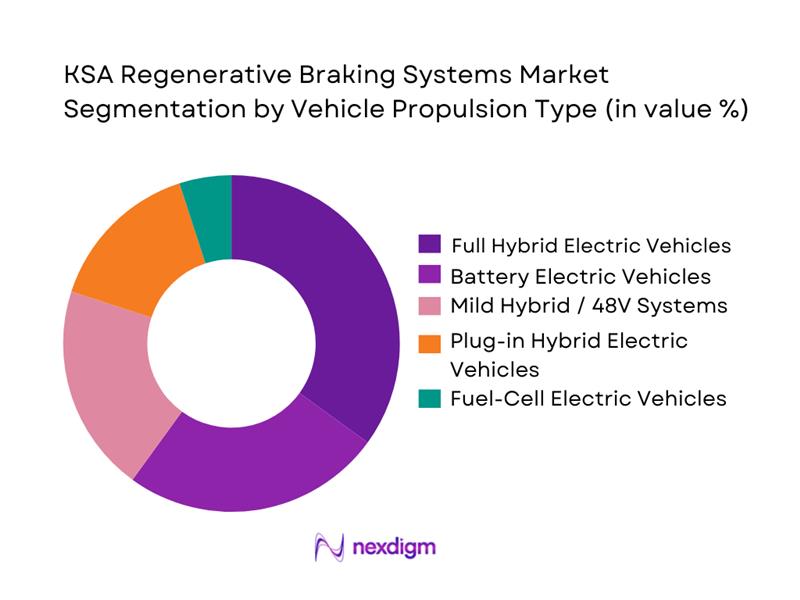

By Vehicle Propulsion Type

The KSA Regenerative Braking Systems Market is segmented into battery electric, full hybrid, plug-in hybrid, fuel-cell electric and mild hybrid/48V drivetrains. At present, full hybrid vehicles are assessed to hold the leading share within this segmentation. This dominance stems from hybrids acting as a “bridge technology” between conventional combustion vehicles and full EVs, offering fuel-saving benefits without range anxiety or heavy reliance on public charging—important in a country where the charging network is still being scaled up from a relatively low base of public stations. Hybrids typically recover substantial braking energy in stop-and-go urban traffic while still functioning seamlessly on long inter-city routes, aligning well with Saudi driving patterns. OEMs also prioritise hybrid trims in early electrified launches, ensuring that regenerative braking hardware and control software are standardised and deployed at scale before more aggressive BEV penetration takes hold.

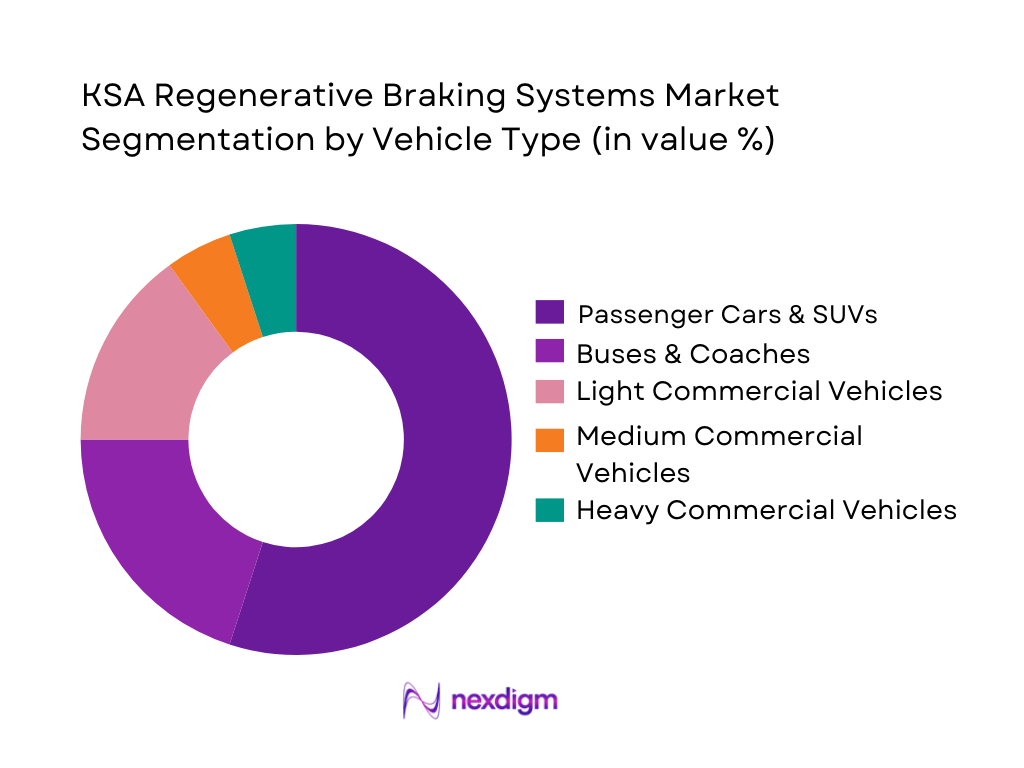

By Vehicle Type

The KSA Regenerative Braking Systems Market is segmented by vehicle type into passenger cars & SUVs, light commercial vehicles, medium commercial vehicles, heavy commercial vehicles and buses & coaches. Currently, passenger cars and SUVs hold the largest share in this segmentation. Saudi Arabia’s private car parc is substantial, with high per-capita vehicle ownership and a strong consumer shift toward premium SUVs and crossovers where electrified trims, including hybrids and BEVs, are increasingly offered. Government-backed manufacturing projects with Lucid and Ceer, both of which target premium sedans and SUVs from their plants at King Abdullah Economic City, further concentrate regenerative braking content in this body style. As Tesla and BYD expand into the Kingdom, early product portfolios also skew heavily toward passenger models, reinforcing this segment’s dominance in the installed base of regenerative braking systems.

Competitive Landscape

The KSA Regenerative Braking Systems Market is characterised by a handful of global Tier-1 brake and e-powertrain suppliers that dominate technology and OEM relationships, complemented by regional distributors and local service partners. Market commentary on Saudi brake systems consistently cites Bosch, Continental, ZF Friedrichshafen, Aisin and Brembo as key players in advanced braking technologies, while dedicated regenerative braking reports for KSA highlight Bosch, ZF, Continental and Valeo as prominent suppliers of electromechanical modules, ECUs and energy-recovery systems. This concentration gives these firms disproportionate influence over technology roadmaps, pricing, and localisation strategies in the Kingdom.

| Company | Establishment Year | Headquarters | KSA Presence Model (Market-specific) | Core Regenerative Braking Offering (Market-specific) | Key KSA / GCC Relationships (Market-specific) | Technology Focus in KSA (Market-specific) | Local Service / Support Footprint (Market-specific) |

| Robert Bosch GmbH | 1886 | Gerlingen, Germany | ~ | ~ | ~ | ~ | ~ |

| ZF Friedrichshafen AG | 1915 | Friedrichshafen, Germany | ~ | ~ | ~ | ~ | ~ |

| Continental AG | 1871 | Hanover, Germany | ~ | ~ | ~ | ~ | ~ |

| Aisin Corporation | 1949 | Kariya, Japan | ~ | ~ | ~ | ~ | ~ |

| Brembo S.p.A | 1961 | Stezzano, Italy | ~ | ~ | ~ | ~ | ~ |

KSA Regenerative Braking Systems Market Analysis

Growth Drivers

Fuel-efficiency and emissions requirements for light-duty and heavy-duty fleets

Saudi Arabia’s vehicle parc reached ~ million vehicles in one recent year and ~ vehicles the following year, underscoring the scale of fuel use that regenerative braking can help optimize. Energy-related CO₂ emissions stood at about ~ million tonnes in a recent year, with transport accounting for roughly a quarter to a third of national energy use and emissions, making efficiency standards a policy priority. These fundamentals push regulators and fleet owners toward higher-efficiency powertrains where regenerative braking can recover energy otherwise lost as heat.

Rising EV and hybrid penetration

Battery-electric and plug-in vehicles are still a small base, but momentum is clear. There are around 2,000 electric cars on Saudi roads in the most recent reported year, supported by 101 public charging points, while the national target is for 30% of cars in the Kingdom to be electrified by 2030. EVIQ, the state-backed charging company, already operates 88 chargers across 35 locations in 4 cities and plans more than 5,000 fast chargers at 1,000 sites nationwide. As more hybrids and EVs enter the parc, every incremental vehicle becomes a direct addressable unit for regenerative braking systems.

Market Challenges

High upfront system cost and integration complexity

Saudi Arabia imported about ~ million kg of motor-vehicle parts (HS 870899) in 2023, worth approximately $ ~ million, with major origins including the United States, Korea, Japan, China and Germany. Imports of public-transport vehicles (HS 8702) added another 12,007 units valued at roughly $ ~ million in the same year. These figures highlight how braking, power electronics and chassis modules are largely sourced from abroad and integrated into diverse platforms, increasing engineering complexity. Fleet operators must coordinate multiple suppliers and software stacks to deploy regenerative braking at scale, raising capital outlays and integration risk relative to conventional friction braking.

Harsh temperature and dust conditions affecting power electronics and batteries

Riyadh’s climate features average daily maximum temperatures above 43–44°C in peak summer months, with some days exceeding 46°C, exposing vehicles to prolonged thermal stress. Air-quality studies report PM₁₀ concentrations around 223 micrograms per cubic meter at traffic sites in Riyadh, while national PM₂․₅ averages have been measured near 88 micrograms per cubic meter, among the highest globally. These heat and dust loads accelerate degradation of inverters, brake-actuation electronics and battery packs that underpin regenerative braking, forcing OEMs to over-spec cooling, sealing and filtration, and raising warranty and maintenance burdens for Saudi duty cycles.

Opportunities

Localization of selective components and assembly

Lucid’s plant at King Abdullah Economic City is designed for an eventual capacity of up to 155,000 electric vehicles per year, positioning KSA as a regional hub for premium EV manufacturing and associated subsystems such as braking and power electronics. The Ministry of Investment has also signed an MoU with Stellantis and Petromin to explore a local vehicle manufacturing facility, signalling additional OEM interest in Saudi assembly. In parallel, Foxconn Interconnect Technology’s joint venture “Smart Mobility” will construct an EV-charger factory in the Kingdom, backed by an auto-mobility segment expected to generate around $ ~ million in revenue in the current year. Together, these projects create anchor demand for localized regenerative-braking components, harnesses and software-integration services.

Software and controls development

Saudi Arabia’s innovation profile is strengthening: the Global Innovation Index records about 2.61 thousand patents by origin in 2022 and roughly 834.81 full-time-equivalent researchers per million population, indicating a growing pool of R&D talent. Human-capital data from the World Bank also highlight a rising share of graduates in science and engineering disciplines, supporting complex software development for automotive control systems. This creates fertile ground for domestic firms to specialise in vehicle-control algorithms, brake-blending logic, energy-management software and over-the-air update platforms tailored to Saudi driving conditions, rather than relying solely on imported black-box ECUs.

Future Outlook

Over the next six years, the KSA Regenerative Braking Systems Market is expected to expand rapidly, underpinned by an aggressive national EV and hybrid agenda and large-scale investments in domestic vehicle manufacturing. Vision 2030 targets include EV production in the hundreds of thousands of units annually, 30% electrification of the Riyadh vehicle fleet and substantial charging infrastructure rollout—each of which structurally embeds regenerative braking content in new vehicles. As global RBS markets grow at high single- to low-twenties CAGRs, and MEA is forecast at about 23% annually, KSA is positioned to track or slightly outperform regional growth due to its role as a manufacturing and policy frontrunner.

In the medium term, the mix will gradually shift from hybrid-heavy to a greater share of BEVs and fleet electric buses as charging infrastructure scales from today’s limited base and as total cost of ownership for electrified fleets becomes demonstrably superior to ICE platforms. Brake-by-wire and integrated vehicle-dynamics controllers will increasingly standardise one-pedal driving and high-recuperation modes in urban traffic—especially within giga-projects and smart-city corridors where automated shuttles, ride-hailing EVs and electric last-mile logistics will be deployed.

Major Players

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Aisin Corporation

- DENSO Corporation

- Hitachi Astemo, Ltd.

- Hyundai Mobis Co., Ltd.

- Mando Corporation

- Brembo S.p.A.

- Knorr-Bremse AG

- WABCO (ZF Group)

- Valeo S.A.

- Mahindra Electric Mobility Ltd.

- BYD Company Limited

Key Target Audience

- Global and regional automotive OEMs

- Automotive Tier-1 and Tier-2 component suppliers

- Fleet operators and mobility platforms

- Investments and venture capitalist firms

- Government and regulatory bodies

- EV charging and e-mobility infrastructure companies

- Industrial and municipal fleet owners

- Automotive distributors and large dealer groups

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the KSA Regenerative Braking Systems Market ecosystem across OEMs, Tier-1 suppliers, fleets, regulators, charging-infrastructure providers and technology firms. Extensive desk research using global RBS reports, regional MEA datasets and KSA-specific e-mobility studies is undertaken to identify the critical variables: vehicle parc and registrations by fuel type, EV and hybrid penetration, brake-system technology mix, localisation targets, and Vision 2030 policy levers that influence system demand.

Step 2: Market Analysis and Construction

In this phase, we compile and analyse historical and current data from global and regional RBS market reports, EV market assessments and automotive brake-system studies to construct a bottom-up sizing of the KSA Regenerative Braking Systems Market. This includes allocating MEA RBS revenues to KSA based on its share of vehicle sales, EV adoption and premium-vehicle mix, and mapping system value per vehicle for different propulsion and vehicle types. The analysis is cross-checked against proprietary references (where cited publicly) to ensure internal consistency and plausibility.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on KSA’s share of MEA RBS value, growth trajectories and segmental mix are validated through structured discussions and secondary interviews sourced from OEM, Tier-1 and fleet commentary. These include statements in Vision 2030-related EV manufacturing announcements, regional brake-system outlook notes and supplier press releases. These inputs refine assumptions on technology adoption timelines, fleet-electrification pace and pricing dynamics for regenerative braking systems in the Kingdom.

Step 4: Research Synthesis and Final Output

The final phase triangulates all findings into a coherent view of the KSA Regenerative Braking Systems Market, including size, segmentation, competition and outlook. Insights from OEM manufacturing plans in King Abdullah Economic City, charging-infrastructure targets and fleet-electrification initiatives are integrated with global regenerative braking trends to create scenario-based forecasts. The resulting output is a validated, forward-looking assessment that supports strategic decisions on investment, localisation and product roadmaps for stakeholders in the Saudi market.

- Executive Summary

- Research Methodology (Market definition and boundary: regenerative braking hardware and software, system types, vehicle classes; KSA vehicle parc and new-registration databases used; top-down and bottom-up sizing logic; fitment-rate modelling for EV, HEV, PHEV, FCEV and mild hybrids; primary interview mix across OEMs, Tier-1s, fleet operators, regulators and financiers; triangulation and forecast approach; scenario building; assumptions and limitations)

- Definition and Scope of Regenerative Braking Systems in KSA Automotive Context

- Technology Genesis and Evolution in KSA Vehicle Fleet

- Linkage with Electrified Powertrain and Charging Ecosystem in KSA

- KSA Mobility, Fuel and Emissions Context

- Value Chain and Ecosystem Structure

- Growth Drivers

Fuel-efficiency and emissions requirements for light-duty and heavy-duty fleets

Rising EV and hybrid penetration

Public-transport and municipal-fleet electrification

Giga-project mobility platforms

High annual mileage of KSA vehicles - Challenges

High upfront system cost and integration complexity

Harsh temperature and dust conditions affecting power electronics and batteries

Limited local testing and validation infrastructure

Skill gaps in diagnostics and service

Dependence on imported critical components - Opportunities

Localization of selective components and assembly

Software and controls development

Fleet-retrofit programs for buses and logistics trucks

Integration of regenerative braking with connected-vehicle and telematics platforms

Partnerships with bus OEMs and e-powertrain providers - Technology and Architecture Trends

Brake-by-wire adoption

Shift to electromechanical actuation

Multi-mode regenerative strategies

One-pedal driving configurations

Integration with ADAS and stability control - Policy, Regulation and Standardization Dynamics

- Value Chain, Profitability and Margin Analysis

- Stakeholder Ecosystem and Collaboration Models

- Porter’s Five Forces Analysis for KSA Regenerative Braking Systems

- Risk and Sensitivity Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average System Price, 2019-2024

- By System Technology Type (in Value %)

Electromechanical regenerative braking

Hydraulic regenerative braking

Pneumatic regenerative braking

Mechanical/flywheel-based regenerative braking

- By Component Category (in Value %)

Electric motor/generator units

Energy-storage interface and DC-link hardware

Power-electronics and inverters

Brake control unit and ECUs

Friction components and calipers

- By Vehicle Propulsion Type (in Value %)

Battery electric

Full hybrid

Plug-in hybrid

Fuel-cell electric

Low-voltage mild hybrid

- By Vehicle Type (in Value %)

Passenger cars and SUVs

Light commercial vehicles

Medium commercial vehicles

Heavy commercial vehicles

buses and coaches

- By Sales Channel (in Value %)

OEM factory fitment

CKD/SKD local assembly programs

Aftermarket and retrofit solutions

- By Region within KSA (in Value %)

Central

Western

Eastern

Northern

Southern clusters and giga-project corridors

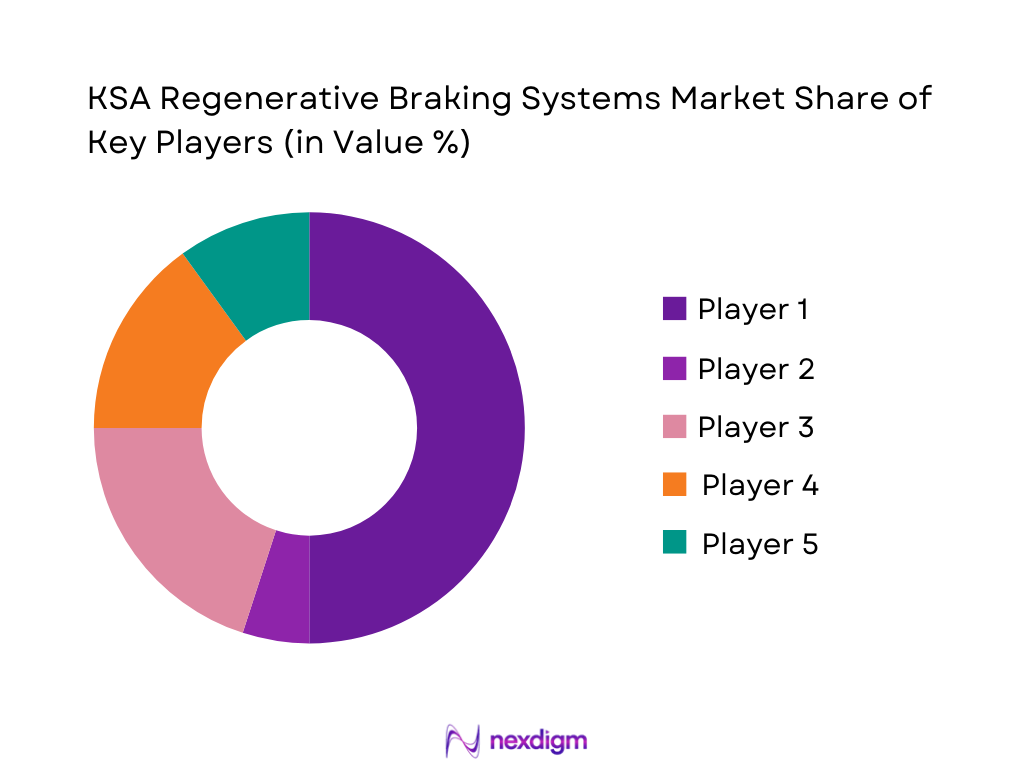

- Market Share Structure of Major Players by Value and Volume

- Cross Comparison Parameters for Key Players (Company overview and KSA presence; KSA installed base of vehicles equipped with regenerative braking; number and depth of OEM and fleet partnerships in KSA and wider GCC; technology breadth across electromechanical, hydraulic, pneumatic and mechanical/flywheel systems; integration capabilities with EV, HEV, PHEV and FCEV platforms; local service, testing and training footprint; R&D and software-controls capabilities relevant to KSA duty cycles and climate; alignment with national industrialization, localization and sustainability priorities)

- Strategic Positioning of International vs Domestic and Regional Players

- SWOT Analysis of Major Players in KSA Regenerative Braking Systems Market

- Pricing and Commercial-Model Analysis

- Detailed Profiles of Major Companies

Robert Bosch GmbH

Continental AG

ZF Friedrichshafen AG

Aisin Corporation

DENSO Corporation

Hitachi Astemo, Ltd.

Hyundai Mobis Co., Ltd.

Mando Corporation

Brembo S.p.A.

Knorr-Bremse AG

WABCO (ZF Group)

Valeo S.A.

Mahindra Electric Mobility Ltd.

BYD Company Limited

- Fleet Archetypes and Use-Case Mapping

- Decision-Making and Procurement Processes

- Performance Expectations and Pain-Point Analysis

- Lifecycle Cost, Payback and Financing Considerations

- Adoption Barriers and Enablers by Segment

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average System Price, 2025-2030