Market Overview

The KSA Remote Diagnosis market is valued at USD ~ billion in 2024. This market is characterized by its rapid evolution, driven by the increased demand for healthcare services, particularly remote consultations and diagnostics. The increasing penetration of high-speed internet, growing adoption of telemedicine, and supportive government initiatives play a crucial role in propelling market demand. The market also enjoys heightened interest due to the global pandemic, pushing healthcare providers to embrace remote diagnostic services as a reliable and efficient solution.

Riyadh, Jeddah, and Mekkah are the major cities driving demand for remote diagnosis in Saudi Arabia, with Riyadh standing as the hub for technological innovation and healthcare investments. The broader global trends influencing supply and technology in this market include developments in AI and cloud computing from leading tech nations. These cities dominate due to their infrastructure development, large populations, and healthcare facilities that lead the country’s healthcare digitization efforts.

Market Segmentation

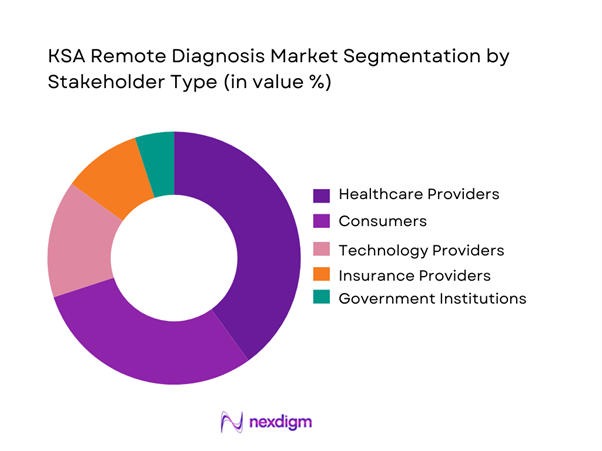

By Stakeholder Type

The KSA Remote Diagnosis market can be segmented by key stakeholders, including healthcare providers, consumers, technology providers, insurance providers, and government institutions. Each of these sub-segments plays a vital role in the adoption and growth of remote diagnostic services.

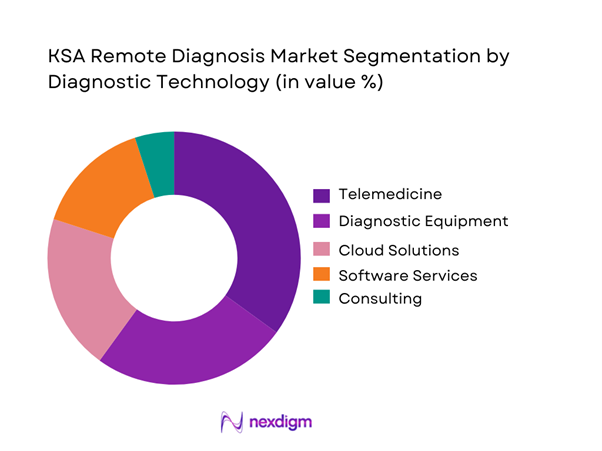

By Diagnostic Technology

Another way to segment the market is by the types of diagnostic technologies employed, including telemedicine, diagnostic equipment, cloud solutions, software services, and consulting. These technologies enable the effective delivery of remote diagnosis and support improved healthcare outcomes.

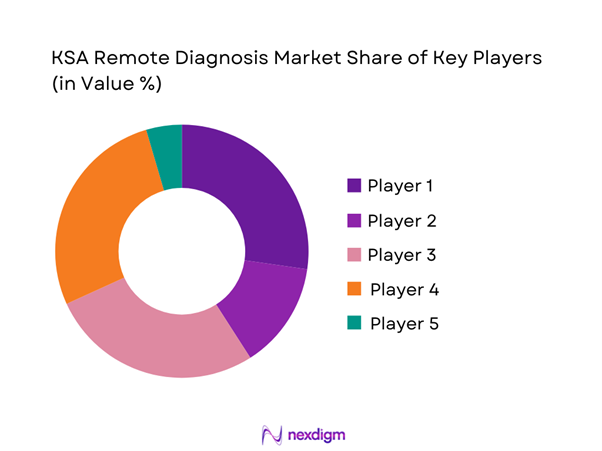

Competitive Landscape

The KSA Remote Diagnosis market is dominated by a few major players, including Seha Virtual Hospital and global or regional brands like Altibbi, Vezeeta, and Mawid. This consolidation highlights the significant influence of these key companies.

| Company | Establishment Year | Headquarters | Service Focus | Technology Stack | Geographic Reach | Partnerships & Alliances |

| Seha Virtual Hospital | 2022 | Riyadh | ~ | ~ | ~ | ~ |

| Altibbi | 2008 | Amman | ~ | ~ | ~ | ~ |

| Vezeeta | 2016 | Cairo | ~ | ~ | ~ | ~ |

| Mawid (MoH) | 2017 | Riyadh | ~ | ~ | ~ | ~ |

| Okadoc | 2017 | Dubai | ~ | ~ | ~ | ~ |

KSA Remote Diagnosis Market

Growth Drivers

Expansion of Telehealth Infrastructure

The expansion of telehealth infrastructure in Saudi Arabia has played a crucial role in advancing remote diagnosis services. Investments in high-speed internet, mobile health applications, and telemedicine platforms have made healthcare more accessible to both urban and rural populations. The ability to conduct virtual consultations and remotely monitor patients has improved the efficiency of healthcare delivery, particularly for chronic disease management. Telemedicine has reduced barriers to healthcare, enabling patients to access specialized services without the need to travel, thus contributing to better healthcare outcomes and optimizing the use of healthcare resources.

Government Initiatives Supporting Digital Healthcare

The Saudi Arabian government has significantly supported the growth of digital healthcare through its Vision 2030 initiative. The government is heavily investing in the development of a robust digital infrastructure to facilitate telemedicine and remote diagnostic services. Regulatory frameworks have been established to ensure the secure implementation of telehealth services, while funding has been allocated to enhance the country’s technological capacity. Government-backed programs have promoted digital health education, fostering both public and private sector participation in telemedicine. These initiatives are paving the way for remote diagnosis solutions to become an integral part of the country’s healthcare system.

Market Challenges

Lack of Regulatory Standardization

A key challenge in the KSA Remote Diagnosis market is the lack of consistent regulatory standards governing telemedicine and remote diagnosis services. This creates uncertainties for healthcare providers and technology companies attempting to navigate the legal landscape. Without a unified framework, there are risks of inconsistencies in service delivery, reimbursement policies, and patient care protocols. Regulatory gaps may also hinder cross-border telemedicine services, as international regulations differ. Establishing clear and standardized regulations will be essential to ensure the security, safety, and quality of remote diagnosis services across the country.

Security and Privacy Concerns

Security and privacy concerns remain a significant challenge in the KSA Remote Diagnosis market. The increased use of digital health platforms and remote diagnostics leads to the collection and sharing of sensitive patient data, which raises concerns over data breaches and unauthorized access. Healthcare providers must implement stringent cybersecurity measures to protect patient information from malicious attacks or leaks. Additionally, maintaining compliance with data protection regulations, such as the General Data Protection Regulation (GDPR), is crucial for gaining patient trust and ensuring the long-term sustainability of remote diagnosis services in Saudi Arabia.

Market Opportunities

Investment in AI and Machine Learning for Diagnosis

One of the most significant opportunities in the KSA Remote Diagnosis market is the integration of artificial intelligence (AI) and machine learning into diagnostic tools. These technologies have the potential to revolutionize the accuracy and speed of medical diagnoses. By analyzing vast amounts of patient data, AI-powered systems can identify patterns and detect diseases earlier than traditional methods. The growing demand for AI-driven solutions presents significant investment opportunities for both local and international players in the healthcare space. By investing in AI and machine learning, companies can improve clinical outcomes, reduce diagnostic errors, and streamline healthcare processes.

Growth in Health-Tech Startups and Innovation

The health-tech startup ecosystem in Saudi Arabia is rapidly growing, creating new opportunities for innovation within the remote diagnosis sector. The rise of digital health solutions, including mobile health apps, telehealth platforms, and remote monitoring devices, is opening up avenues for innovative healthcare startups to enter the market. These startups are developing user-friendly platforms that improve access to healthcare and enhance patient engagement. As the market for remote diagnosis expands, there is ample space for new entrants to introduce disruptive technologies that can enhance the quality of care and create more personalized healthcare experiences for patients.

Future Outlook

The KSA Remote Diagnosis market is poised for steady growth over the next decade. Technological advancements, along with continued government support for digital healthcare initiatives, will play an essential role in expanding the market. Partnerships and investments in digital health platforms will drive wider adoption, making remote diagnosis a key feature of the Saudi healthcare system.

Major Players

- Seha Virtual Hospital

- Altibbi

- Vezeeta

- Mawid (Ministry of Health)

- Okadoc

- Cura Healthcare

- Shifa App

- Medisense

- Aster DM Healthcare

- Saudi German Hospitals

- Al Nahdi Medical Company

- DabaDoc

- Healthigo

- Telemedico / Doctor Anywhere

- MediCare

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (Saudi Ministry of Health)

- Healthcare providers

- Technology providers

- Insurance providers

- Pharmaceutical companies

- Hospitals

- Clinics

Research Methodology

Step 1: Identification of Key Variables

The key variables for the KSA Remote Diagnosis market include technology adoption rates, regulatory policies, consumer demand trends, and healthcare infrastructure investments.

Step 2: Market Analysis and Construction

We analyzed industry reports, healthcare trends, and market dynamics to assess the market size and potential. Data were collected through primary and secondary research, including expert interviews and case studies.

Step 3: Hypothesis Validation and Expert Consultation

We validated the assumptions using input from industry experts, market stakeholders, and thought leaders. This helped in confirming trends, growth drivers, and market challenges.

Step 4: Research Synthesis and Final Output

The final report synthesizes the analyzed data, highlighting critical insights on market trends, competition, and opportunities within the KSA Remote Diagnosis sector.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Remote Diagnosis Usage / Value-Chain / Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- KSA Industry / Service / Delivery Architecture

- Growth Drivers

Expansion of Telehealth Infrastructure

Government Initiatives Supporting Digital Healthcare

Technological Advancements in AI and Remote Monitoring

Increasing Demand for Remote Healthcare Services

Enhancements in Mobile Connectivity and Internet Access - Challenges

Lack of Regulatory Standardization

Security and Privacy Concerns

Limited Awareness and Acceptance of Remote Diagnosis

High Cost of Implementation

Integration with Existing Healthcare Systems - Opportunities

Investment in AI and Machine Learning for Diagnosis

Growth in Health-Tech Startups and Innovation

Public-Private Partnerships to Boost Healthcare Accessibility

Expansion of Digital Health Platforms in Rural Areas

Adoption of Remote Diagnosis for Chronic Disease Management - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Revenue per User/Service, 2019–2024

- Diagnostic Technology Adoption Rate, 2019–2024

- By Stakeholders Type (in Value %)

Healthcare Providers

Consumers

Technology Providers

Insurance Providers

Government Institutions - By Service Type (in Value %)

Telemedicine

Diagnostic Equipment

Cloud Solutions

Software Services

Consulting - By Platform Type (in Value %)

Virtual Care Platforms

Remote Monitoring Tools

Teleconsultation Software

Artificial Intelligence Tools

Diagnostics Devices - By Deployment Model (in Value %)

On-Premise

Cloud-Based

Hybrid Models - By Customer Type (in Value %)

Hospitals

Clinics

Insurance Providers

Pharmaceutical Companies

Government Healthcare Institutions - By Region (in Value %)

Riyadh

Jeddah

Mekkah

Al Khobar

Dammam

- Competition ecosystem overview

- Cross Comparison Parameters (Technology integration, regulatory compliance, user adoption, pricing models, customer satisfaction, scalability, brand recognition, market share, product variety, customer support)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Saudi Telemedicine Company

Seha Virtual Hospital

Altibbi

Vezeeta

Okadoc

Mawid

Cura Healthcare

Shifa App

Medisense

Aster DM Healthcare

Saudi German Hospitals

Al Nahdi Medical Company

DabaDoc

Healthigo

Telemedico / Doctor Anywhere

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Revenue per User/Service, 2025–2030

- Diagnostic Technology Adoption Rate, 2025–2030