Market Overview

KSA Remote Patient Monitoring Market is valued at USD ~ million. Saudi Arabia’s Remote Patient Monitoring (RPM) market is scaling quickly as providers shift monitoring from inpatient settings to home, ambulatory, and virtual wards. The RPM devices market generated USD ~ million in 2023, reflecting rising procurement of connected vitals devices used for chronic care and post-acute follow-up. In 2024, the broader RPM system market is estimated at USD ~ million, supported by expanding virtual care pathways, stronger payer interest in utilization control, and faster hospital adoption of early-warning and escalation workflows.

In Saudi Arabia, Riyadh dominates RPM demand due to concentration of tertiary hospitals, digital-health programs, and large payer-provider contracts; Jeddah follows with high private-hospital density and a sizable chronic-care base; and the Dammam/Khobar cluster benefits from corporate healthcare purchasing and large integrated networks. On the supply side, RPM technology leadership is anchored outside the Kingdom—especially the U.S., Germany, the Netherlands, and Japan—because global patient-monitoring OEMs and regulated device platforms are headquartered there, while Saudi stakeholders focus on localization of delivery, integration, and service operations.

Market Segmentation

By Component

Saudi Arabia’s Remote Patient Monitoring market is segmented by component into devices, software/platform, and clinical monitoring & care services. In 2024, devices lead because health systems and large physician groups typically start RPM programs by standardizing connected measurement at scale—BP monitors, pulse oximeters, ECG patches/holters, glucometers, and multiparameter kits—before expanding into deeper analytics and longitudinal care services. Device dominance is also reinforced by procurement structures (capex/opex bundling), replacement cycles, and clinical governance preferences that prioritize validated hardware for patient safety. As programs mature, software and services grow faster through integration, workflow orchestration, alert triage, and care-coordination staffing—but device rollouts remain the “front door” that determines enrollment capacity and clinical coverage breadth.

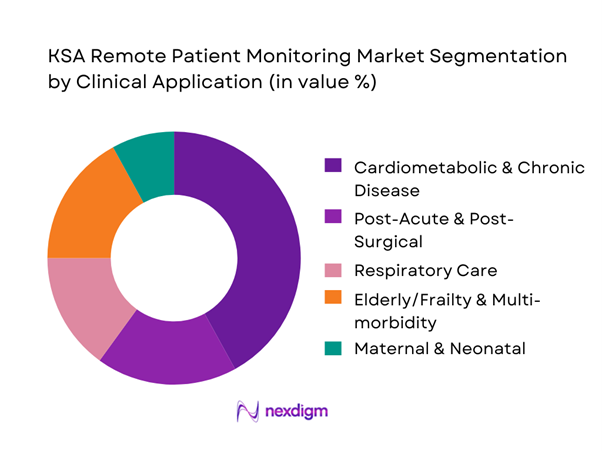

By Clinical Application

Saudi Arabia’s Remote Patient Monitoring market is segmented by clinical application into cardiometabolic & chronic disease, post-acute & post-surgical, respiratory care, elderly/frailty & multi-morbidity, and maternal & neonatal monitoring. Cardiometabolic & chronic disease dominates because it offers the most repeatable RPM economics and clinical cadence: frequent, low-friction measurements (BP, glucose, weight, rhythm) enable earlier interventions, medication titration, and prevention of avoidable deterioration. It also aligns with payer priorities—reducing emergency visits and inpatient days—and with provider operational goals of managing large panels through protocolized alerting and nurse-led outreach. Additionally, cardiometabolic RPM is easier to standardize across cities and networks using common device kits and structured pathways, making it the first clinical “lane” most Saudi health systems expand after initial pilots.

Competitive Landscape

The Saudi Arabia RPM market is shaped by a mix of global patient-monitoring OEMs and platform-led virtual-care players, with competition increasingly decided by integration depth, clinical workflow readiness, and local service capability rather than devices alone. Hospital groups and payers typically prefer vendors that can combine regulated monitoring hardware with secure connectivity, alert governance, and measurable outcomes across cardiometabolic and post-acute pathways. Global manufacturers lead on validated devices and enterprise monitoring, while platform players differentiate through care orchestration, analytics, and scalable monitoring operations.

| Company | Est. Year | HQ | KSA Market Presence Model | RPM Product Strength | Typical Buyer Channel | Integration Depth | Connectivity & Data | Local Service Coverage |

| Philips | 1891 | Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| GE HealthCare | 1994* | USA | ~ | ~ | ~ | ~ | ~ | ` |

| Medtronic | 1949 | Ireland | ~ | ~ | ~ | ~ | ~ | ~ |

| Abbott | 1888 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Masimo | 1989 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Remote Patient Monitoring Market Analysis

Growth Drivers

Chronic Disease Burden

Saudi Arabia’s clinical need-base for RPM is structurally high because the country combines a large and fast-growing resident base with substantial chronic-disease exposure. Total population is ~, while nominal GDP is USD ~, which underpins sustained system funding capacity for longitudinal care models. At the payer layer, mandatory insurance coverage scale is material—~ beneficiaries are covered under health insurance (up from ~), creating a large reimbursable pool for device-enabled disease management pathways when benefits are clarified. On the care delivery side, the health system operates at national scale with ~ physicians and a dense primary-care footprint, enabling RPM programs to be embedded into chronic clinics, family medicine, and specialty follow-ups. RPM demand is also reinforced by the national digital-health backbone where most of ~ regulated provider organizations exchange claims and clinical transactions through the national health insurance exchange, improving feasibility for longitudinal monitoring workflows that require continuous documentation and auditable clinical events.

Hospital Bed Optimization Pressure

RPM adoption accelerates when inpatient capacity and step-down pathways are under pressure—Saudi Arabia’s bed and facility base is significant but must support high throughput across regions and seasonal surges. The system reports ~ hospital beds per ~ population and detailed regional variation, which creates a strong operational incentive to use monitoring-at-home models to protect beds for acute and procedural demand. The same statistical release reports a total physician base of ~, indicating that bed optimization is not only a space issue but also a staffing utilization issue—reducing avoidable admissions and shortening length of stay becomes an operational KPI. National digital readiness also supports hospital-at-home style care: mobile telecommunications subscriptions reached ~, enabling reliable patient connectivity and device pairing at scale across urban centers and peripheral regions. These factors make RPM a pragmatic tool for hospital command centers and cluster operators to reduce readmissions, stabilize discharge, and extend specialty oversight to spoke hospitals—especially when integrated with virtual care networks such as the Ministry of Health’s virtual hospital program that connects ~ hospitals across ~ sub-specialties, enabling specialist escalation while monitoring the patient remotely.

Challenges

Clinical Adoption Barriers

Even with funding and connectivity, RPM can stall if clinical operations don’t redesign pathways—monitoring without response protocols creates alert fatigue and low clinician trust. Saudi care delivery is large and heterogeneous: the system includes ~ physicians and wide regional bed-density differences, implying variation in clinical governance, staffing models, and digital maturity by cluster and facility type. Adoption barriers often emerge at the interface between hospital specialists, primary-care follow-up, and home-care services—especially when escalation responsibility is unclear. While the virtual hospital network connects ~ hospitals across ~ sub-specialties, this also implies a complex operational environment where clinical responsibility may span hub-and-spoke care models; embedding RPM requires clear triage rules, clinical thresholds, and medico-legal alignment across facilities. Payer scale adds complexity: the insured base of ~ beneficiaries means adoption must work across multiple provider types, not just flagship hospitals. Finally, high population scale (~) can amplify workflow friction—if only a small fraction of clinicians refuse to use RPM dashboards or interpret device data, program performance can degrade quickly.

Reimbursement Ambiguity

RPM commercialization depends on “who pays” and “what is billable” across public programs and private insurance. Saudi Arabia has a large insured ecosystem: mandatory coverage extends to ~ beneficiaries (up from ~), and visitor insurance beneficiaries for tourism and Umrah reach ~—a scale that requires clear benefit definitions to avoid claim disputes. When reimbursement rules are ambiguous, providers hesitate to invest in devices, monitoring staff, and clinical time because revenue recognition is uncertain; payers hesitate because utilization management and clinical outcomes evidence may be inconsistent across providers. Interoperability progress helps but doesn’t solve policy: while the national exchange indicates most of ~ regulated provider organizations exchange claims via the platform, a connected claims rail does not automatically define RPM service codes, eligibility, frequency limits, or documentation standards. The macro budget allocation of SAR ~ to Health and Social Development supports reform capacity, but execution still requires explicit payer policy and audit-ready clinical documentation models, especially for chronic programs that run continuously rather than as single encounters.

Opportunities

Home-Based Chronic Care Expansion

The strongest RPM opportunity in Saudi Arabia is “care at home” for chronic cohorts—reducing avoidable admissions while maintaining clinical oversight. The system’s scale supports this: population is ~, with growth across both citizens (~) and residents (~), expanding the long-term chronic care base that benefits from home monitoring. Operational incentives are reinforced by bed utilization realities—hospital beds are reported at ~ per ~ population, so preventing admissions and enabling early discharge becomes a measurable capacity lever. Digitally, the ecosystem can support remote care at national scale: mobile subscriptions are ~, enabling device pairing and patient engagement without requiring hospital visits. Clinically, escalation capacity is being institutionalized through national virtual care—MOH’s virtual hospital connects ~ hospitals across ~ sub-specialties, enabling home-monitored patients to be escalated into specialist input via the hub-and-spoke model. For buyers, this opportunity translates into procurement of complete RPM pathways: devices plus onboarding, nurse monitoring, specialist escalation, and documentation integrated to payer workflows.

AI-Enabled Predictive Monitoring

Saudi Arabia is structurally positioned to move from “threshold alerts” to predictive RPM, including risk scoring, deterioration prediction, and automated triage, because it is scaling digital clinical operations and building centralized specialist networks. The virtual hospital’s national footprint—~ connected hospitals across ~ sub-specialties—creates a multi-site clinical environment where AI-enabled monitoring can standardize escalation decisions and reduce variance across regions. The payer and claims backbone also supports the data exhaust needed for predictive models: most of the ~ regulated provider organizations exchange claims transactions via the national exchange, improving the consistency of coded clinical events and utilization markers that can be linked to RPM signals. On the infrastructure side, mobile subscriptions at ~ enable continuous patient data capture and clinician communication loops. From a macro funding lens, the SAR ~ Health and Social Development budget envelope indicates capacity to fund pilots-to-scale transitions, including AI governance, model validation, and cybersecurity controls—critical for predictive RPM that influences clinical decisions. The near-term opportunity is building AI-enabled care pathways for high-risk cohorts, supported by centralized virtual specialist services.

Future Outlook

Over the next five to six years, Saudi Arabia’s RPM market is expected to expand through virtual wards and hospital-at-home models, payers pushing chronic-care control and reducing avoidable utilization, and tighter integration between device data, clinical workflows, and national digital-health infrastructure. The fastest progress is likely where providers can operationalize alert triage at scale, standardize device kits, and contract for outcomes with insurers and large employers. Success will increasingly depend on interoperability, clinical governance, and local execution capacity—not just technology.

Major Players

- Philips

- GE HealthCare

- Medtronic

- Abbott

- Masimo

- Nihon Kohden

- Mindray

- Dräger

- Roche

- OMRON

- Boston Scientific

- Honeywell

- Siemens Healthineers

- Teladoc Health

Key Target Audience

- Hospitals & Integrated Health Systems

- Large Private Hospital Groups & Specialty Networks

- Health Insurers & TPAs

- Employer & Corporate Healthcare Buyers

- Home Healthcare Providers & Post-Acute Care Networks

- Telehealth & Virtual Care Operators

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

We construct a Saudi RPM ecosystem map covering device OEMs, platform providers, hospital groups, payers, home-health operators, regulators, and integration partners. Desk research consolidates definitions, RPM use-cases, care pathways, and procurement patterns. This step identifies the variables that drive adoption—enrollment capacity, alert governance, integration, reimbursement and coverage, and clinical staffing models.

Step 2: Market Analysis and Construction

We compile historical indicators for RPM deployment across hospital, outpatient, and home settings, mapping device penetration, typical kit composition, and service-layer operating models. We assess how revenue is formed across devices, platforms, and monitoring services, and how utilization outcomes influence renewals and scaling decisions.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses through structured expert interviews with hospital digital-health leaders, clinicians running RPM pathways, payer medical-management teams, distributors, and platform operators. These interviews test assumptions on program design, contracting, and delivery constraints such as connectivity, staffing, and escalation.

Step 4: Research Synthesis and Final Output

We triangulate findings using bottom-up pathway sizing, vendor mapping, and procurement behavior, then stress-test results against secondary datasets and published market benchmarks. The output is finalized through internal consistency checks on segmentation logic, competitive positioning, and scenario-based outlook for adoption pathways in Saudi Arabia.

- Executive Summary

- Research Methodology (Market Definitions and RPM Scope Boundaries, Assumptions and Inclusions, Abbreviations, RPM Market Sizing Logic, Device-Led vs Platform-Led Estimation Approach, Bottom-Up Patient Enrollment Modeling, Provider Contract Mapping, Primary Interviews with Saudi Providers and Regulators, Data Triangulation Framework, Limitations and Forward-Looking Considerations)

- Definition and Scope

- Market Genesis and Evolution in Saudi Healthcare

- Timeline of RPM Adoption Across Public and Private Healthcare

- RPM Integration Within KSA Healthcare Delivery Cycle

- RPM Value Chain and Stakeholder Flow Analysis

- Growth Drivers

Chronic Disease Burden

Hospital Bed Optimization Pressure

Digital Health Budget Allocation

Physician Workforce Constraints

National Health Transformation Programs - Challenges

Clinical Adoption Barriers

Reimbursement Ambiguity

Data Interoperability Gaps

Patient Compliance Issues

Device Localization Constraints - Opportunities

Home-Based Chronic Care Expansion

AI-Enabled Predictive Monitoring

Public–Private RPM Contracts

Employer-Led Preventive Programs

Value-Based Care Enablement - Trends

Shift Toward Continuous Monitoring

AI-Driven Alerts

Wearable-First RPM Models

Integration with National Health Records

Subscription-Based Pricing - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Active RPM Patient Base, 2019–2024

- By Device Installed Base, 2019–2024

- By Platform Subscription and Service Fees, 2019–2024

- By Technology Architecture (in Value %)

RPM Medical Devices

Software Platforms

Data Analytics and AI Engines

Connectivity and Data Transmission Services

Clinical Monitoring and Support Services - By Application (in Value %)

Vital Signs Monitoring

Cardiac Monitoring

Glucose and Metabolic Monitoring

Respiratory Monitoring

Multi-Parameter and Wearable-Based Monitoring - By End-Use Industry (in Value %)

Public Hospitals and MOH Facilities

Private Hospital Chains

Specialty Clinics and Diagnostic Centers

Home Healthcare Providers

Corporate Health and Employer Programs - By Connectivity Type (in Value %)

Cloud-Based RPM Platforms

On-Premise and Hybrid Deployments

Government-Integrated National Platforms - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market Share of Major Players by Patient Base and Revenue Contribution

- Cross Comparison Parameters (Device Portfolio Breadth, RPM Patient Coverage Scale, Clinical Use-Case Depth, AI and Analytics Capability, Integration with Saudi Health Systems, Data Hosting and Localization Compliance, Contracting Model with Providers and Payers, After-Sales and Clinical Support Infrastructure)

- SWOT Analysis of Major Players

- Pricing and Contracting Model Analysis

- Detailed Profiles of Major Companies

Philips Healthcare

GE HealthCare

Medtronic

Abbott

Boston Scientific

Masimo

Omron Healthcare

Roche Diagnostics

Siemens Healthineers

Cerner

Teladoc Health

Biobeat

iRhythm Technologies

VivaLNK

Saudi German Health

- RPM Adoption Patterns by Provider Type

- Budget Allocation and Procurement Models

- Clinical Workflow Integration and Operational Impact

- Unmet Needs, Pain Points, and Adoption Barriers

- Decision-Making Hierarchy and Buying Criteria

- By Value, 2025–2030

- By Patient Enrollment, 2025–2030

- By Device and Platform Expansion, 2025–2030