Market Overview

The KSA reusable water bottle market is valued at USD 2.4 billion, with a growing CAGR of 5.4% from 2024 to 2030. This market growth is primarily driven by rising environmental concerns and the increasing demand for sustainable products among consumers. As awareness around the detrimental effects of single-use plastics escalates, consumers are shifting their preferences towards reusable alternatives, contributing significantly to market expansion.

Several cities in Saudi Arabia, such as Riyadh, Jeddah, and Dammam, dominate the reusable water bottle market. These cities are the most populous and economically significant regions, which drive higher demand for environmentally friendly products. Urban consumers in these areas are increasingly seeking alternatives to single-use plastics, coupled with significant government initiatives promoting sustainability, making them key players in the market landscape.

Market Segmentation

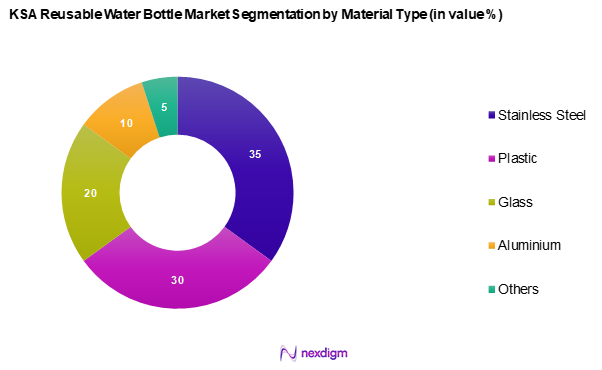

By Material Type

The KSA reusable water bottle market is segmented into stainless steel, plastic, glass, aluminium, and others. Stainless steel segment dominate the market due to its durability, eco-friendliness, and insulation properties. With increasing awareness regarding health and sustainability, consumers favour stainless steel bottles as they do not leach harmful chemicals and keep beverages hot or cold for extended periods. This segment continues to grow as brands launch innovative designs, enhancing user experience and encouraging repeat purchases.

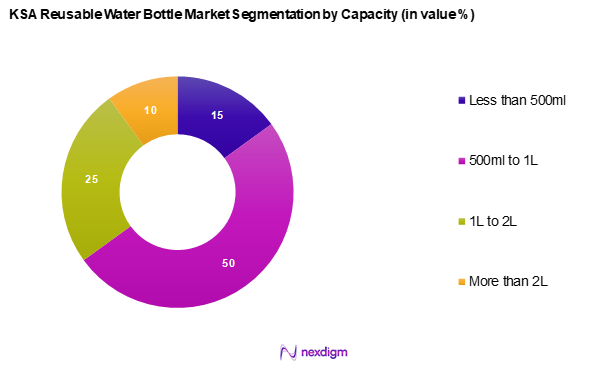

By Capacity

The KSA reusable water bottle market segmented into less than 500ml, 500ml to 1L, 1L to 2L, and more than 2L. The 500ml to 1L segment dominates the market due to its convenience for both hydration and portability, making it especially appealing to consumers with active lifestyles, such as those engaged in sports and outdoor activities. This size is perceived as ideal for daily use, striking a balance between sufficient volume and ease of transport. Brands are also increasingly targeting this capacity range with diverse designs and functionalities.

Competitive Landscape

The KSA reusable water bottle market is dominated by several key players, including established brands that have been pioneers in promoting eco-friendly consumer products. The consolidation of these brands reflects their substantial influence and strong market presence. Notable companies include Hydro Flask, CamelBak, and S’well, who leverage brand recognition and consumer loyalty to maintain their market positioning.

| Company Name | Establishment Year | Headquarters | Market Share (%) | Average Selling Price (USD) | Product Range | Sustainability Practices | Distribution Channels |

| Hydro Flask | 2009 | Oregon, USA | – | – | – | – | – |

| CamelBak | 1989 | Arizona, USA | – | – | – | – | – |

| S’well | 2010 | New York, USA | – | – | – | – | – |

| Nalgene | 1949 | New York, USA | – | – | – | – | – |

| Klean Kanteen | 2004 | California, USA | – | – | – | – | – |

KSA Reusable Water Bottle Market Analysis

Growth Drivers

Rising Environmental Awareness

Rising environmental awareness among the Saudi population is significantly driving the KSA reusable water bottle market. Studies reveal that 70% of the Saudi population expresses concern about environmental issues and the impact of plastic waste on ecosystems. The Kingdom’s 2030 vision aims to bolster sustainable living, promoting initiatives to reduce plastic consumption. As a result, the number of Saudi citizens advocating for environmental sustainability and consciously opting for reusable products is increasing. By 2025, the country aims to recycle 85% of waste, indicating a national commitment to environmentally-friendly practices.

Health Consciousness

Health consciousness is another vital factor propelling the growth of the KSA reusable water bottle market. Data indicates that 35% of the Saudi population engages in regular physical activities, leading to increased demand for hydration solutions. Furthermore, an alarming 51% of the Saudi adult population is overweight, prompting consumers to seek healthier lifestyles and alternatives to sugary beverages. This shift towards healthier choices enhances the preference for reusable water bottles, perceived as a healthier and convenient hydration option. Robust advertising strategies highlighting the health benefits of hydration also catalyze this growth.

Market Challenges

Intense Competition

The KSA reusable water bottle market faces intense competition, with numerous brands vying for consumer attention. Numerous local and global companies are engaged in producing reusable water bottles, making it challenging for new entrants to penetrate the market. In 2023, it is estimated that over 30 brands operate in this space, with established companies benefiting from brand loyalty and extensive distribution networks. Consequently, price wars and aggressive marketing tactics are prevalent, making it difficult for smaller companies to sustain profitability and cultivate brand recognition in the saturated market landscape.

Price Sensitivity

Price sensitivity among consumers is a challenge that significantly impacts the KSA reusable water bottle market. Economic fluctuations resulting from changes in oil prices have led to a volatile consumer spending climate. Nearly 60% of consumers indicate that price greatly influences their purchasing decisions, particularly in the wake of rising living costs due to inflation. As a result, many consumers gravitate toward lower-cost, lower-quality options instead of investing in premium reusable bottles, leading to reduced margins for manufacturers aiming to produce high-quality, eco-friendly products.

Opportunities

Adoption of Eco-friendly Packaging

The adoption of eco-friendly packaging presents significant opportunities for growth in the KSA reusable water bottle market. With the global shift toward sustainability, approximately 28% of companies in the KSA are now committed to implementing eco-friendly packaging solutions. As consumers increasingly demand fully recyclable or biodegradable packaging, brands that prioritize sustainable packaging for their reusable bottles gain competitive advantages. Market players that emphasize their commitment to sustainability technologies enable them to tap into a growing environmentally conscious consumer base.

Innovations in Design and Technology

Innovations in design and technology offer substantial market opportunities for growth in the KSA reusable water bottle sector. Recent trends reveal that companies investing in smart water bottle technologies, such as hydration reminders and integrated filtering system features, experience increased consumer interest. For instance, the global smart bottle market is projected to reach USD 1.2 billion by 2025, reflecting growing acceptance among technology-savvy consumers. Capitalizing on these innovations allows brands to differentiate themselves and appeal to a wider audience, thus driving market growth.

Future Outlook

Over the next five years, the KSA reusable water bottle market is expected to experience robust growth driven by increasing consumer awareness surrounding sustainability, coupled with governmental policies aimed at reducing plastic waste. Additionally, the expansion of e-commerce and innovative branding strategies in this sector will likely enhance product accessibility and appeal, further propelling the market forward.

Major Players

- Hydro Flask

- CamelBak

- S’well

- Nalgene

- Klean Kanteen

- Brita

- Takeya

- Contigo

- Simple Modern

- Zojirushi

- Yeti

- OXO

- Thermos

- Vapur

- Aquaovo

Key Target Audience

- Retailers and Distributors

- Eco-Friendly Product Manufacturers

- Health and Wellness Brands

- Sports and Outdoor Equipment Stores

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Environment, Municipality Authorities)

- Corporate Sustainability Departments

- Event Management Companies

- Hospitality Industry Stakeholders

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves outlining the ecosystem of stakeholders relevant to the KSA reusable water bottle market. This step combines extensive secondary research and proprietary databases to gather comprehensive industry information. The primary objective is to identify and define critical variables that influence market dynamics, including consumer preferences, industry trends, and regulatory developments.

Step 2: Market Analysis and Construction

In this phase, we compile and analyse historical data specific to the KSA reusable water bottle market. This includes examining market penetration, consumer adoption rates, and the impact of sustainability trends on product demand. Data from retailers, manufacturers, and market reports are evaluated to build a robust framework that accurately represents market size and growth potential.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on initial findings and subsequently validated through expert consultations. These interviews, conducted via Computer-Assisted Telephone Interviews (CATIs), include representatives from leading brands and industry experts. Insights provided during these discussions help refine the hypotheses and contribute to a deeper understanding of market dynamics.

Step 4: Research Synthesis and Final Output

The final phase aggregates insights from multiple sources involving direct engagements with manufacturers, distributors, and retailers. This step focuses on obtaining detailed insights regarding product offerings, sales performance, consumer preferences, and pricing strategies. This interaction ensures the synthesis of data from top-down and bottom-up approaches, allowing for an accurate and comprehensive market analysis.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Environmental Awareness

Health Consciousness - Market Challenges

Intense Competition

Price Sensitivity - Opportunities

Adoption of Eco-friendly Packaging

Innovations in Design and Technology - Trends

Increase in Customizable Options

Rise of Subscription Models - Government Regulation

Plastic ban Laws

Import Tariffs on Reusable Bottles - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Material Type (In Value %)

Stainless Steel

– Insulated Stainless Steel Bottles

– Non-insulated Stainless Steel Bottles

Plastic

– BPA-Free Plastic Bottles

– Tritan-based Bottles

– Recycled Plastic Bottles

Glass

– Borosilicate Glass Bottles

– Tempered Glass Bottles with Silicone Sleeves

Aluminium

– Single Wall Aluminium Bottles

– Coated Aluminium Bottles

Others

– Copper Bottles

– Bamboo and Hybrid Material Bottles - By Capacity (In Value %)

Less than 500ml

– Pocket-Sized Bottles

– Kids’ Bottles

500ml to 1L

– Standard Office & Gym Bottles

– Travel Bottles

1L to 2L

– Hydration Trackers

– Sports Bottles

More than 2L

– Heavy-duty Hydration Bottles

– Camping & Outdoor Use Bottles - By Distribution Channel (In Value %)

Online Retail

Supermarkets/Hypermarkets

Specialty Stores

Convenience Stores - By End-User (In Value %)

Individual Consumers

– Daily Personal Use

– Travel & Commute

Corporate/Government

– Office Use

– Corporate Gifting

Educational Institutions

– School & University Students

– Faculty & Staff Use

Health and Fitness Centres

– Gym-goers

– Fitness Trainers

– Yoga Studios - By Region (In Value %)

Riyadh

Jeddah

Dammam

Khobar

Makkah

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Material Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Revenues by Material Type, Distribution Channels, Number of Dealers and Distributors, Profit Margins, Manufacturing Plants and Production Capacity, Sustainability Certifications, Unique Value Offerings, Customization and Design Innovation Capabilities, Geographic Reach, Pricing Strategy)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Hydro Flask

CamelBak

S’well

Nalgene

Klean Kanteen

Brita

Takeya

Contigo

Simple Modern

Zojirushi

Yeti

OXO

Thermos

Vapur

Aquaovo

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030