Market Overview

The KSA Road Sign Recognition Systems Market is value at USD ~ million. The KSA road sign recognition systems market is commercialized primarily through ADAS packages where traffic sign recognition and speed-limit intelligence are bundled with other safety features. The addressable spend is anchored by the Saudi driver assistance systems market valued at USD ~ million in the latest reported base year, while Saudi ADAS revenue is reported at USD ~ million in the same base year by a separate source. In the prior year, KSA ADAS revenue is reported at USD ~ million, reflecting rising feature penetration in new vehicle sales and option-pack bundling.

Demand concentration is strongest in Riyadh, Jeddah–Makkah corridor, and Dammam/Khobar, because these metros combine higher new-vehicle turnover, denser multi-lane road networks, and heavier commuting/ride-hailing and logistics intensity—conditions where speed-limit recognition, gantry/lane-control interpretation, and driver alerts reduce incident risk and improve compliance. On the institutional side, road regulators and transport safety bodies (e.g., Roads General Authority, National Transport Safety Center, and the General Department of Traffic) create a policy environment that favors measurable safety outcomes and digital enforcement-ready infrastructure, indirectly accelerating adoption.

Market Segmentation

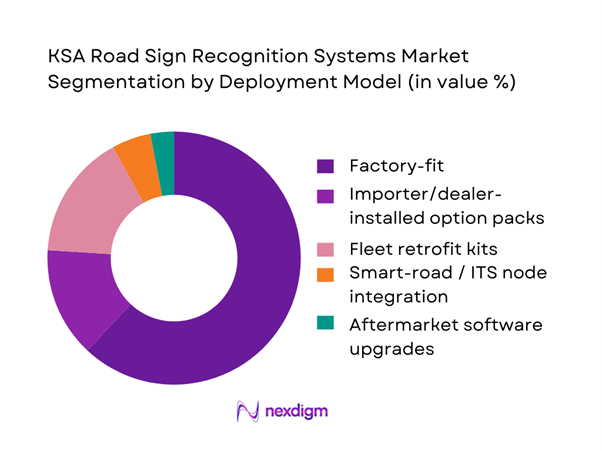

By Deployment Model

KSA road sign recognition systems are segmented by deployment model into factory-fit (OEM embedded), importer/dealer-installed option packs, fleet retrofit kits, smart-road/ITS node integration, and aftermarket software upgrades (OTA feature unlocks). Recently, factory-fit dominates because TSR is increasingly delivered as part of integrated ADAS stacks (camera + compute + HMI + validation logic) at the vehicle platform level, where OEM validation, warranty coverage, and functional-safety engineering are already standardized. Dealer-installed solutions face constraints around calibration capacity and liability, while retrofits are typically reserved for fleets with clear safety ROI. This is reinforced by the broader Saudi driver assistance systems market structure, where TSR is treated as a packaged safety feature rather than a standalone purchase decision.

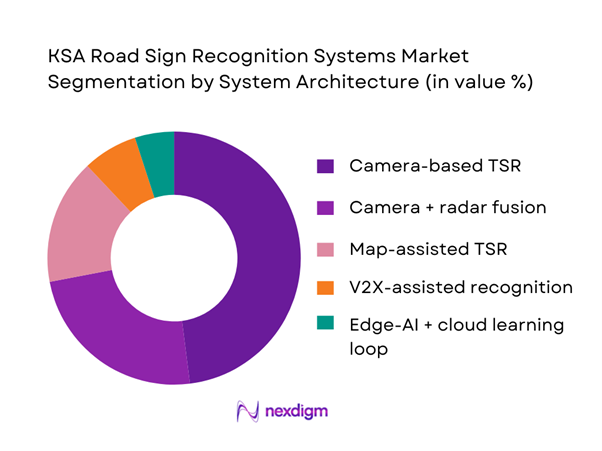

By System Architecture

The market is segmented by architecture into camera-based TSR, camera + radar fusion, map-assisted TSR, V2X-assisted recognition, and edge-AI + cloud learning loop. Recently, camera-based TSR dominates deployments because it is the lowest-friction integration path: it leverages the forward camera already used for lane departure warning, AEB, and other perception tasks, reducing incremental hardware complexity. In Saudi driving conditions (highway-heavy mileage, strong sunlight and glare, and frequent variable speed contexts around construction), vendors progressively layer fusion and map validation, but the “entry” architecture remains vision-led with incremental software improvements and OTA updates. This mirrors how ADAS is commercialized in KSA—feature packaging first, then progressive enhancement via higher compute and redundancy.

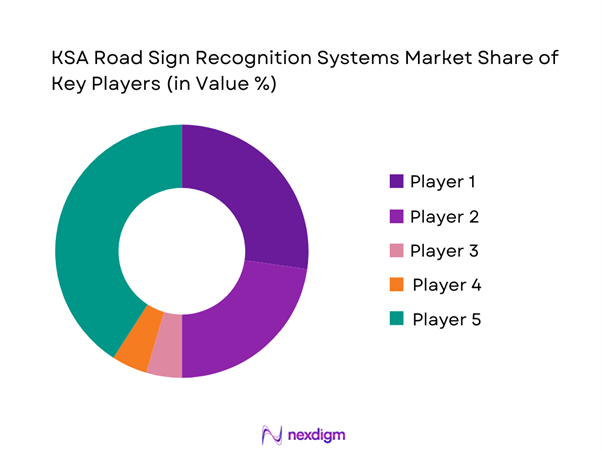

Competitive Landscape

The KSA road sign recognition systems market is stack-driven and partnership-heavy: Tier-1 suppliers and perception software leaders win largely through OEM platform programs, while map-layer providers, compute vendors, and local integrators shape field performance and deployment scalability. Because TSR is rarely bought standalone, competitive advantage comes from localization quality, robust performance in harsh lighting, integration with intelligent speed assistance, and update cadence that keeps sign libraries and confidence logic current.

| Company | Est. Year | HQ | RSR/TSR Stack Role | KSA-Readiness Lever | Integration Surface | Validation & Safety Posture | OTA / Update Model | Local Delivery Model |

| Mobileye | 1999 | Israel | ~ | ~ | ~ | ~ | ~ | ~~ |

| Robert Bosch | 1886 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Continental | 1871 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| ZF | 1915 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Valeo | 1923 | France | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Road Sign Recognition Systems Market Analysis

Growth Drivers

Fleet Safety KPI Enforcement

Fleet safety performance in Saudi Arabia is increasingly quantified with real-world data: ~ registered vehicles are operating on KSA roads, up from ~ the prior year, pointing to escalating fleet activity and heightened exposure to road incidents. Road Transport Statistics ~ reported over ~ serious traffic accidents and ~ traffic fatalities in the latest period — underscoring acute safety challenges that fleet operators must address. These quantifiable safety metrics drive demand for technologies like road sign recognition, which support fleet KPIs including incident reduction, speed compliance, and driver alerting. As fleets invest in telematics and ADAS-feature stacks that include traffic sign recognition to meet operational KPIs and risk controls, enforcement of fleet safety KPIs becomes a key market driver for RSR adoption.

Alignment with Speed Regulation and Compliance Frameworks

Saudi Arabia’s road safety environment reveals actionable compliance pressures: ~ serious traffic accidents and an injury rate of ~ per ~ population reflect ongoing challenges in speed management and road-rule adherence. In response, authorities are advancing digital enforcement frameworks that reward compliance with posted signage and speed regulations. In the Riyadh Region alone, ~ of new driving licenses were issued, compared to ~ in Makkah and ~ in the Eastern Region, suggesting concentrated regulatory engagement with road-law compliance in major mobility corridors. These enforcement expectations create demand for automated sign-recognition systems that can be integrated into commercial and passenger vehicles to support adherence to tangible regulatory frameworks.

Challenges

Arabic and Bilingual Sign Variability

Saudi road networks utilize signs in both Arabic and English, with varied typography and local context-specific symbols not always captured in standard global training sets. A comprehensive listing of Saudi road signs shows a wide range of regulatory, warning, mandatory, and temporary symbols that significantly complicate machine-vision recognition accuracy. This linguistic and symbolic diversity increases model complexity and requires specialized datasets for reliable performance — presenting barrier-to-entry costs for vendors. Without accurate, localized training data, systems struggle to interpret signs with the fidelity required for safe real-world deployment.

Environmental Stress Factors Including Dust, Glare, and Heat

Saudi Arabia’s climate presents extreme environmental conditions that impact camera- and sensor-based systems. Desert heat, frequent dust storms, and intense sunlight create visibility challenges, glare, and sensor contamination. While exact dust frequency statistics are not widely published in government reports, the region’s known climatic conditions — including mean peak daytime temperatures often reaching over ~°C — significantly affect perception systems. Harsh light reflection and thermal load further degrade image quality, requiring more robust hardware and advanced signal processing, increasing development and deployment costs. These environmental stressors are a persistent challenge to reliable sign-recognition performance.

Opportunities

Intelligent Speed Assistance–Linked Deployments

Saudi enforcement contexts that emphasize compliance with posted speed limits — part of broader traffic safety campaigns — create a natural opportunity for road sign recognition systems to be integrated with intelligent speed assistance (ISA). With ~ newly issued driving licenses in the latest reporting period, growing driver populations engage with digital road-rule compliance frameworks reinforced by ISA capabilities. Coupling RSR with ISA enables vehicles to use sign data to advise or automatically adjust speed thresholds, offering measurable safety benefit and supporting regulatory objectives. This integration bolsters the functional relevance of RSR systems in commercial and passenger fleets looking to align with enforceable compliance expectations.

Commercial Fleet Retrofitting

Saudi Arabia’s ~ registered vehicles include vast numbers of commercial fleets — logistics, transportation, delivery, and service fleets — that have strong incentives to adopt retrofittable safety technologies. With ~ reported road injuries and ongoing operational safety pressures, commercial fleet owners are actively investing in telematics and ADAS suites to improve accident prevention and insurance risk profiles. Retrofitting RSR systems enables incremental safety upgrades without waiting for OEM feature-pack adoption and aligns with fleet digital transformation programs aimed at improving driver compliance and operational performance. This creates a tangible commercial demand pathway for RSR vendors targeting fleet segments where safety is tied directly to bottom-line risk reductions.

Future Outlook

Over the next planning cycle, KSA road sign recognition systems adoption is expected to expand as ADAS penetration deepens in new vehicle imports, domain controllers consolidate perception workloads, and smart-mobility programs push measurable reductions in incidents and compliance violations. The strongest momentum will come from (i) TSR coupling with intelligent speed assistance, (ii) fleet safety scorecards that reward validated driver behavior, and (iii) improved robustness under glare/night/occlusion via sensor fusion and map validation.

Major Players

- Mobileye

- Robert Bosch GmbH

- Continental

- ZF

- Aptiv

- Valeo

- Denso

- Magna International

- Hyundai Mobis

- NVIDIA

- Qualcomm

- HARMAN

- Gentex

- Autoliv

Key Target Audience

- Vehicle OEMs & national distributors/importers

- Tier-1 automotive suppliers

- Fleet operators

- Telematics & fleet safety platforms

- Smart-city / ITS program owners and delivery entities

- Investments and venture capitalist firms

- Insurance & underwriting stakeholders

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We build a KSA-specific ecosystem map covering OEM/importer channels, Tier-1 stacks, fleet buyers, integrators, and regulators. Desk research is used to define the market boundary (in-vehicle TSR/ISA + retrofit + ITS nodes) and isolate key variables such as fitment pathways, calibration requirements, and software update models.

Step 2: Market Analysis and Construction

Historical commercialization is constructed using a bottom-up approach: vehicle parc and new sales mix, feature attach rates via option packs, and deployment type split (OEM vs dealer vs fleet). A parallel build sizes integration/service value pools (calibration, validation, maintenance).

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through expert interviews (CATI/VC) with OEM importer product teams, Tier-1 channel partners, fleet procurement heads, and ITS integrators. This is used to validate real-world failure modes (glare, occlusion, sign variability) and local sign taxonomy requirements.

Step 4: Research Synthesis and Final Output

Triangulation is performed against published ADAS market endpoints and documented government transport safety ecosystem priorities to finalize the narrative, competitive benchmarking, and the forward outlook, ensuring consistency across top-down and bottom-up views.

- Executive Summary

- Research Methodology (Market definitions & taxonomy, scope boundaries, assumptions, abbreviations, demand–supply mapping logic, market sizing approach, data triangulation framework, primary interview plan, validation workshops with stakeholders, modeling limitations, sensitivity checks, quality control & audit trail)

- Definition and Scope

- Market Genesis and Adoption Timeline

- KSA Operating Context

- Business Cycle and Buying Motions

- Stakeholder & Influence Map

- Growth Drivers

Fleet safety KPI enforcement

Alignment with speed regulation and compliance frameworks

Vehicle feature premiumization in passenger and commercial segments

Smart mobility and ITS initiatives

Insurer and fleet risk management influence - Challenges

Arabic and bilingual sign variability

Environmental stress factors including dust, glare, and heat

Temporary signage and construction-zone misclassification

Dataset scarcity for local sign typologies

False-positive liability and driver trust erosion - Opportunities

Intelligent speed assistance–linked deployments

Commercial fleet retrofitting

V2X and roadside unit augmentation

Ride-hailing and MaaS safety stacks

Smart-city and controlled ODD pilots - Trends

Transformer-based vision stacks

Multi-modal sensor and map fusion

Synthetic data and self-supervised learning

Edge compute optimization

Continuous learning with OTA governance - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- KSA Data and Performance Engineering Deep-Dive

- By Value, 2019–2024

- By Units / Installed Base, 2019–2024

- By Vehicle Parc Penetration, 2019–2024

- By Software vs Hardware vs Services Revenue Mix, 2019–2024

- By OE Fitment vs Retrofit Deployments, 2019–2024

- By Technology Architecture (in Value %)

Vision-only TSR (monocular / stereo camera)

Sensor fusion TSR (camera with radar or LiDAR confidence arbitration)

Map fusion TSR (HD map or speed-limit database reconciliation)

V2X-assisted sign awareness

Multi-source arbitration engines - By Fleet Type (in Value %)

Passenger cars

SUVs and crossovers

Light commercial vehicles

Heavy trucks and buses

Special purpose and municipal fleets - By Application (in Value %)

Standalone traffic sign recognition

TSR with intelligent speed assistance linkage

TSR integrated with ADAS functions

TSR with navigation and route guidance

TSR with fleet safety and driver coaching - By Connectivity Type (in Value %)

Embedded onboard processing

Cloud-assisted recognition and updates

OTA-enabled software-defined systems

Telematics-integrated fleet systems

V2X-connected recognition platforms - By End-Use Industry (in Value %)

OEMs and authorized vehicle importers

Dealership groups and service networks

Logistics and transportation fleets

Public transport operators

Insurance-linked safety and compliance programs - By Region (in Value %)

Central region

Western region

Eastern region

Southern region

Mega-project zones and smart-city corridors

- Competitive intensity mapping

- Cross Comparison Parameters (Arabic/GCC sign-class coverage, desert robustness and environmental tolerance, latency and false-positive severity index, intelligent speed assistance integration depth, map and V2X fusion readiness, OTA and MLOps governance maturity, type-approval and standards evidence readiness, localization depth in KSA)

- Competitive benchmarking matrix

- SWOT Analysis of Key Players

- Strategic moves and partnership tracking

- Company Profiles

Mobileye

Robert Bosch GmbH

Continental AG

ZF Friedrichshafen AG

Denso Corporation

Valeo

Aptiv PLC

Magna International

Hyundai Mobis

NVIDIA

Qualcomm

NXP Semiconductors

HERE Technologies

TomTom

Harman

- Use-case workflows by end user

- Pain points and failure modes

- KPI and ROI mapping

- Adoption readiness by segment

- Voice-of-customer requirements

- By Value, 2025–2030

- By Units / Installed Base, 2025–2030

- By Vehicle Category, 2025–2030

- By Software vs Hardware vs Services Revenue Mix, 2025–2030

- By OE Fitment vs Retrofit Mix, 2025–2030