Market Overview

The KSA rocket propulsion systems market is projected to experience notable growth, driven by increasing demand for both defense and commercial space applications. The market is primarily supported by significant government investments in space and defense technologies, as well as a growing interest in the development of indigenous propulsion systems. In recent assessments, the total value of the KSA rocket propulsion systems market is expected to reach approximately USD ~, reflecting the expanding space program and defense needs in the region.

The dominant players in this market are primarily located in countries with advanced aerospace and defense sectors, such as the United States, Russia, and China. These nations have established themselves as leaders in rocket propulsion systems, contributing to the global competitive landscape. Additionally, KSA’s recent efforts to boost its space program and defense capabilities have positioned it as a key player in the Middle East’s evolving aerospace industry. KSA’s investment in military and civilian space exploration technologies also solidifies its position as a future leader in rocket propulsion development.

Market Segmentation

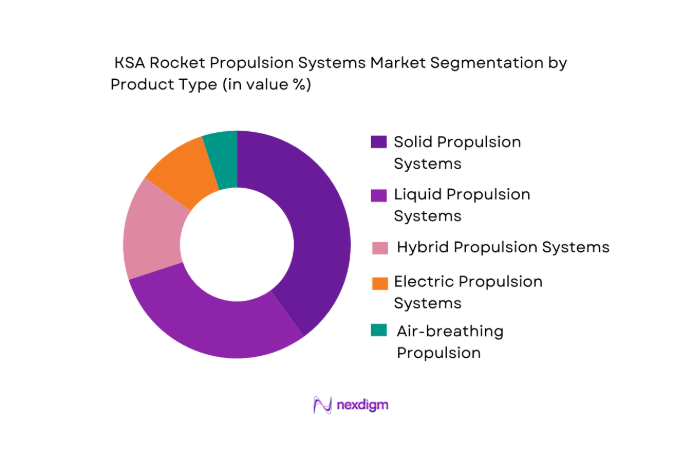

By Product Type:

The KSA rocket propulsion systems market is segmented by product type into solid propulsion systems, liquid propulsion systems, hybrid propulsion systems, and electric propulsion systems. Among these, solid propulsion systems have a dominant market share due to their reliability, high thrust output, and relatively lower cost compared to liquid and hybrid systems. The simplicity of solid propulsion systems in terms of design and operation makes them highly suitable for a variety of defense and space applications, including missile systems and small launch vehicles. Furthermore, solid propulsion systems benefit from established manufacturing processes and a robust supply chain network, further contributing to their market dominance.

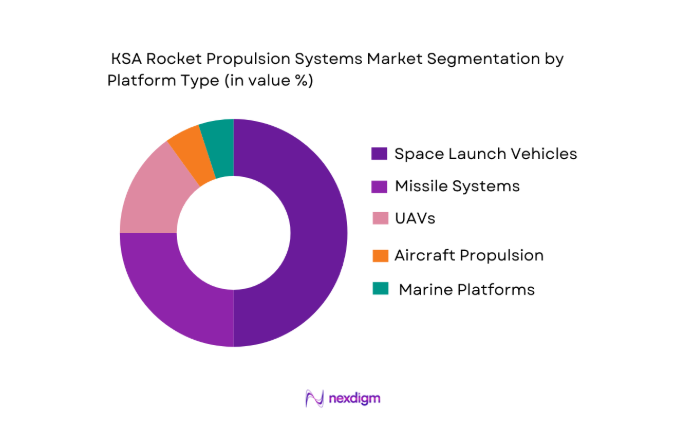

By Platform Type:

The KSA rocket propulsion systems market is segmented by platform type into space launch vehicles, missile systems, unmanned aerial vehicles (UAVs), aircraft propulsion, and marine platforms. Space launch vehicles hold the largest market share due to the increasing demand for satellite launches and space exploration initiatives. As KSA enhances its space program, the demand for reliable propulsion systems for orbital launch vehicles has surged. The government’s investments in both military and civilian space programs further drive the adoption of space launch vehicle propulsion systems, supported by the nation’s ambition to become a leading player in the space industry by 2030.

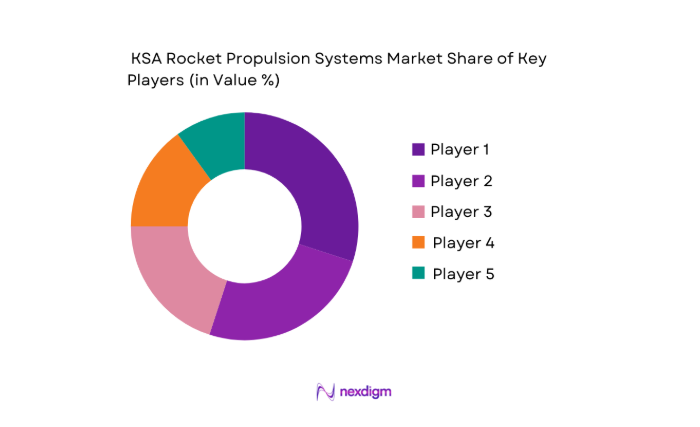

Competitive Landscape

The KSA rocket propulsion systems market features a mix of established global players and regional contenders, reflecting a competitive landscape marked by technological innovation and strategic partnerships. Major players focus on developing advanced propulsion technologies tailored for both defense and commercial sectors, leveraging government funding and defense contracts. The market is becoming increasingly consolidated, with a few key players dominating the technological and manufacturing space.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1993 | USA | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ | ~ |

| Arianespace | 1980 | France | ~ | ~ | ~ | ~ | ~ |

KSA Rocket Propulsion Systems Market Analysis

Growth Drivers

Government Investment in Space and Defense Sectors

The growing KSA government investment in both space exploration and defense technologies is a primary growth driver. The Saudi Vision 2030, which emphasizes self-sufficiency and leadership in space technologies, directly supports the demand for advanced rocket propulsion systems. These investments are not only focused on the defense sector but also on launching commercial satellites and interplanetary missions. The government’s financial commitment ensures the development of indigenous propulsion technologies, reducing dependence on foreign suppliers. The increasing number of space missions and military operations within the region further elevates the demand for robust and cost-effective propulsion solutions. This trend is expected to continue, driven by a combination of strategic partnerships, international collaborations, and a growing pool of government funds allocated to space projects.

Commercial Space Growth and Satellite Demand

Another key growth driver is the rapid expansion of the commercial space industry, spurred by increasing demand for satellite launches and other space services. KSA is positioning itself as a leading space player in the Middle East, and the growth of private sector space companies within the region is driving demand for reliable propulsion systems. With new satellites being launched for communication, navigation, and environmental monitoring, rocket propulsion systems are a critical enabler of this growing industry. Additionally, technological advancements and cost reductions in satellite launch services have opened up opportunities for smaller payloads to be launched into space, further boosting the demand for propulsion systems tailored to these smaller, more frequent missions.

Market Challenges

High Cost of Development and Manufacturing

One significant challenge facing the KSA rocket propulsion systems market is the high cost of research, development, and manufacturing. Developing cutting-edge propulsion technologies requires significant investments in R&D, along with the procurement of specialized materials and components. This financial burden is a key barrier for new entrants and has slowed the pace of technological advancements. As a result, the reliance on established global suppliers for advanced propulsion technologies remains high, posing challenges for KSA to achieve full self-sufficiency. Furthermore, the complex regulatory environment and stringent certification processes further elevate costs, making it difficult for smaller players to compete in this high-stakes market.

Regulatory and Certification Challenges

Another key market challenge is the strict regulatory and certification requirements that rocket propulsion systems must meet. These regulations are necessary to ensure the safety and reliability of propulsion technologies, especially when dealing with defense and space exploration applications. However, the lengthy approval process for new technologies can delay product development and market entry. Additionally, evolving international regulations surrounding space exploration and missile development further complicate the regulatory landscape, requiring companies to stay ahead of constantly changing compliance requirements. This not only increases operational costs but also slows the pace of innovation.

Opportunities

Growth in Private Space Sector

The expansion of the private space sector presents a significant opportunity for the KSA rocket propulsion systems market. With a growing number of private companies entering the space industry, the demand for reliable and cost-effective propulsion systems has increased. KSA’s strategic geographic location also makes it an attractive launch site for private space companies aiming to reduce the cost of space launches. The government’s support for private space initiatives and the establishment of space parks in the region further bolster this opportunity, encouraging both local and international players to invest in propulsion systems tailored to the needs of commercial space ventures.

Technological Advancements in Green Propulsion Systems

Technological advancements in green propulsion systems offer a significant opportunity in the KSA rocket propulsion systems market. As environmental concerns grow, there is increasing pressure on the aerospace industry to adopt sustainable practices. The development of more environmentally friendly propulsion technologies, such as electric and hybrid propulsion systems, aligns with global efforts to reduce the carbon footprint of space missions. KSA’s space and defense sectors can capitalize on this opportunity by investing in and developing innovative green propulsion systems. These technologies not only reduce environmental impact but also lower operational costs, providing a competitive advantage in the growing global market for sustainable aerospace technologies.

Future Outlook

The future outlook for the KSA rocket propulsion systems market is promising, with increasing demand for both defense and commercial space propulsion technologies. Expected technological advancements, such as the development of more efficient and eco-friendly propulsion systems, will drive innovation in the market. Additionally, government support for space exploration initiatives and defense programs will continue to be a key driver. As KSA becomes more self-sufficient in its space and defense technologies, its role in the global rocket propulsion systems market will expand significantly, positioning it as a key player in the Middle East’s aerospace sector.

Major Players

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies

- Boeing

- Arianespace

- SpaceX

- Blue Origin

- Roscosmos

- China Aerospace Corporation

- NASA

- Saab AB

- General Electric

- Sukhoi Design Bureau

- MBDA

- United Launch Alliance

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace manufacturers

- Space exploration agencies

- Defense contractors

- Private space companies

- Military agencies

- Research institutions

Research Methodology

Step 1: Identification of Key Variables

Identification of key factors influencing the KSA rocket propulsion systems market, including technological trends, government policies, and investment patterns.

Step 2: Market Analysis and Construction

Conducting a detailed market analysis, examining historical data, and evaluating current market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Validating market assumptions through expert consultations and input from industry leaders in the aerospace and defense sectors.

Step 4: Research Synthesis and Final Output

Synthesizing all research findings into a comprehensive market report, ensuring all data points are backed by credible sources.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased government funding for space and defense sectors

Rising demand for advanced missile systems

Technological advancements in propulsion system efficiency - Market Challenges

High development and production costs

Regulatory and certification challenges

Dependency on foreign technology and expertise - Market Opportunities

Expanding private space sector in the region

Emerging applications in commercial aerospace

Technological advancements in green propulsion technologies - Trends

Increased focus on reusable propulsion systems

Growing integration of AI in propulsion systems

Shift towards hybrid and electric propulsion technologies - Government Regulations

Tighter defense export controls

Increased space regulatory framework

Environmental regulations for rocket emissions

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Solid Propulsion Systems

Liquid Propulsion Systems

Hybrid Propulsion Systems

Electric Propulsion Systems

Air-breathing Propulsion Systems - By Platform Type (In Value%)

Space Launch Vehicles

Missile Systems

Aircraft Propulsion

Unmanned Aerial Vehicles

Marine Platforms - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Custom Fitment

Upgraded Fitment - By EndUser Segment (In Value%)

Government / Defense

Commercial Space Companies

Aerospace & Aviation Industry

Research Organizations

Private Contractors - By Procurement Channel (In Value%)

Direct Procurement

OEM Procurement

Third-Party Procurement

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Northrop Grumman

Raytheon Technologies

Boeing

SpaceX

Blue Origin

Thales Group

Arianespace

Roscosmos

China Aerospace Corporation

NASA

Saab AB

General Electric

Sukhoi Design Bureau

MBDA

- Government agencies and defense contractors

- Commercial space exploration firms

- Aerospace manufacturers

- Private military and defense contractors

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035