Market Overview

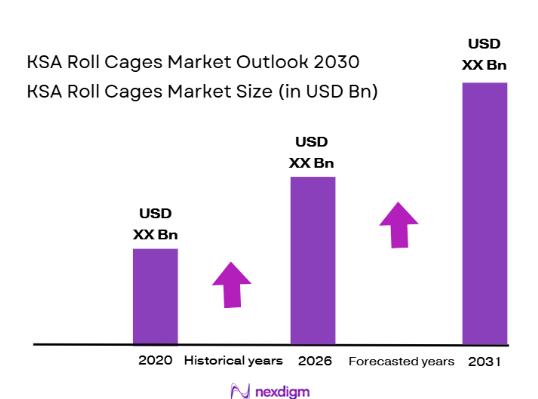

The KSA Roll Cages market, a key segment in the material handling and logistics industry, is valued at over USD ~ million in 2024. This growth is driven by the burgeoning warehousing and logistics sectors within Saudi Arabia, fueled by the country’s Vision 2030 initiatives to diversify the economy and improve infrastructure. The government’s focus on expanding ports, logistics hubs, and retail infrastructure is creating an increasing demand for roll cages, which are essential for the safe, efficient transportation and storage of goods. Furthermore, the rise in e-commerce is contributing to the market’s expansion, with more businesses requiring secure storage solutions to manage goods efficiently.

The key regions dominating the KSA Roll Cages market are primarily centered around major cities such as Riyadh, Jeddah, and Dammam. Riyadh, the capital, leads due to its central position in logistics and trade, while Jeddah’s proximity to the Red Sea and its port makes it a hub for import/export activities. Dammam, located in the Eastern Province, is pivotal due to its proximity to oil and gas industries, which demand robust material handling solutions. These cities benefit from strong infrastructure development under Saudi Arabia’s Vision 2030, along with high commercial and industrial growth, positioning them as prime markets for roll cages.

Market Segmentation

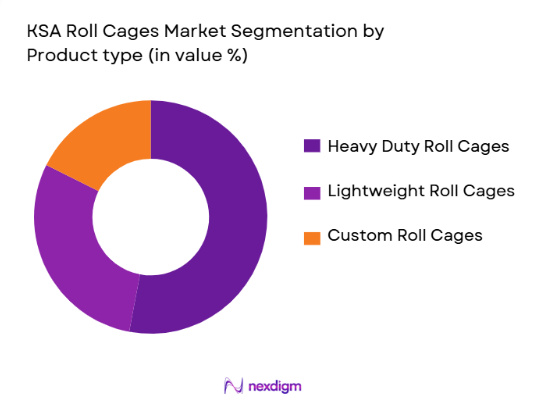

By Product Type

The KSA Roll Cages market is segmented into heavy-duty roll cages, lightweight roll cages, and custom roll cages. Heavy-duty roll cages are currently dominating the market due to their widespread use in industries requiring robust storage and transportation solutions such as retail and logistics. The demand for heavy-duty cages is driven by the need for high-load capacity and durability in handling goods during warehousing and distribution processes. Lightweight roll cages, though growing in demand, are more commonly used in the food and pharmaceuticals industries for lighter goods. Custom roll cages are becoming popular due to the flexibility they offer in terms of size and specific needs, but their share is comparatively smaller in volume.

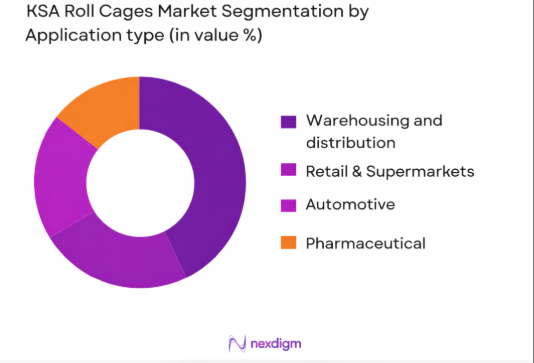

By Application

The roll cage market in KSA is segmented based on application into warehousing and distribution, retail and supermarkets, automotive, and pharmaceuticals. Warehousing and distribution account for the largest share of the market. The rapid growth of e-commerce and logistics in the country has increased the demand for efficient and safe goods handling solutions in warehouses. Roll cages are extensively used for storing and transporting products in retail outlets and supermarkets, helping reduce the time spent on inventory management and enhancing operational efficiency. The automotive sector uses roll cages primarily for transporting auto parts and assemblies, while the pharmaceutical sector uses them for temperature-sensitive products, driving growth in specialized cage solutions.

Competitive Landscape

The KSA Roll Cages market is characterized by a few dominant players, including local and international manufacturers. Companies such as Al-Jazira Roll Cages, Saudi Roll Cages, and SAAHEM lead the market with their established distribution networks and diverse product offerings. Additionally, global companies like Aujan Group and Unilever have a presence in the region, contributing to competition and innovation in the market. The market is highly competitive with manufacturers focusing on the customization of roll cages and offering innovative solutions tailored to specific industries, such as pharmaceuticals and retail.

| Company Name | Establishment Year | Headquarters | Product/Service | Key Region Focus | Revenue (2024) | Technology Offered |

| Al-Jazira Roll Cages | 1985 | Saudi Arabia | ~ | ~ | ~ | ~ |

| Saudi Roll Cages | 1990 | Saudi Arabia | ~ | ~ | ~ | ~ |

| SAAHEM | 1992 | Saudi Arabia | ~ | ~ | ~ | ~ |

| Aujan Group | 1935 | Saudi Arabia | ~ | ~ | ~ | ~ |

| Unilever | 1930 | United Kingdom | ~ | ~ | ~ | ~ |

KSA Roll Cages Market Analysis

Growth Drivers

Urbanization

Saudi Arabia has seen rapid urbanization with its urban population growing by an average of ~% annually. In 2024, the urban population was around ~% of the total population, reflecting the increase in industrial and commercial activities that drive demand for efficient material handling solutions such as roll cages. Urban centers like Riyadh, Jeddah, and Dammam have seen significant growth in e-commerce and retail, creating a steady demand for logistics solutions to support this expansion. The government’s investment in infrastructure and urban planning under Vision 2030 further accelerates demand for roll cages as part of modern warehousing and distribution systems

Industrialization

The industrial sector in Saudi Arabia has grown steadily, driven by the country’s diversification efforts away from oil dependence. The manufacturing industry has increased by ~% in 2024, creating demand for advanced logistics equipment such as roll cages. This growth is evident in sectors like automotive, pharmaceuticals, and food processing, where roll cages are increasingly used for product transportation and storage. The government is also promoting local manufacturing industries as part of its Vision 2030 strategy, enhancing the role of roll cages in the supply chain and logistics infrastructure

Challenges

High Initial Costs

The high cost of manufacturing roll cages, particularly heavy-duty models made from materials such as steel and aluminum, has been a significant restraint in the KSA market. In 2024, the raw material costs saw an increase of around ~% due to global supply chain disruptions, impacting the production costs of roll cages. While the long-term benefits of roll cages in operational efficiency justify the investment, the initial cost remains a barrier for small and medium enterprises in Saudi Arabia, especially when there are cheaper, lower-quality alternatives available in the market.

Technical Challenges

There is a lack of standardization in roll cage designs, and manufacturers often face technical challenges in adapting them to meet the diverse needs of industries such as pharmaceuticals, food, and retail. The need for customization increases the complexity of design and production, leading to longer lead times and additional costs. The continuous development of smart logistics solutions, including automated handling systems, poses another challenge, as roll cages must increasingly be designed to integrate with advanced technologies like RFID tracking systems and automated guided vehicles (AGVs)

Opportunities

Technological Advancements

The roll cage market in Saudi Arabia presents opportunities for growth driven by technological advancements. Innovations in materials, such as the development of lightweight but durable composite materials, are transforming the market. Additionally, the integration of smart technologies like RFID, GPS, and IoT sensors in roll cages is opening up new avenues for manufacturers to offer advanced solutions. The rise in automation in warehouses and logistics centers also presents a significant opportunity for the roll cage market, with automated systems requiring specialized cages for efficient material handling.

International Collaborations

Saudi Arabia is increasingly looking towards international partnerships to support its growing manufacturing and logistics industries. The KSA Roll Cages market can benefit from these collaborations, particularly with global companies offering advanced roll cage technologies and solutions. These partnerships can help local manufacturers adopt best practices, improve product quality, and expand their reach in international markets. Furthermore, foreign investment in the Kingdom’s infrastructure and logistics sectors is expected to boost the demand for innovative roll cage solutions.

Future Outlook

Over the next five years, the KSA Roll Cages market is expected to show significant growth, primarily driven by Saudi Arabia’s ongoing investments in logistics and warehousing infrastructure under Vision 2030. The country’s push towards becoming a global logistics hub is expected to boost demand for roll cages across various industries, particularly e-commerce and retail. Moreover, innovations in material science and automation in warehouses are likely to shape the future of the roll cage market, leading to more durable, lightweight, and cost-efficient solutions.

Major Players

- Al-Jazira Roll Cages

- Saudi Roll Cages

- SAAHEM

- Aujan Group

- Gulf Roll Industries

- Al-Faisal Group

- Cargill

- Unilever

- Ajwa Group

- Tawazun

- Makkah Roll Refineries

- Al-Futtaim

- Savola Group

- United Roll Cages Manufacturing

- Al-Watania

Key Target Audience

- Manufacturers of roll cages and material handling equipment

- Warehousing and logistics service providers

- E-commerce companies

- Retailers and supermarket chains

- Automotive industry suppliers and manufacturers

- Pharmaceutical companies with temperature-sensitive products

- Government and regulatory bodies

- Investments and venture capitalist firms

- Corporate buyers in industries requiring material handling solutions

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders in the KSA Roll Cages Market. This step utilizes a combination of secondary and primary research, gathering industry-level information from government publications, business directories, and trade associations.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled and analyzed to understand market penetration, the ratio of suppliers to buyers, and how demand is shaped by infrastructure projects and regulatory changes in Saudi Arabia. This helps provide accurate revenue estimates for the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through expert interviews and consultations with key industry players. These consultations provide operational insights, which refine the data and help adjust market projections, making them more realistic.

Step 4: Research Synthesis and Final Output

The final phase synthesizes the findings from all previous steps. Direct engagement with manufacturers helps in gathering insights into market needs, product preferences, and technology adoption. The final output offers a validated analysis of the market dynamics and growth trends.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Market Definitions and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing E-Commerce and Logistics Demand

Expanding Retail and Warehousing Sectors

Government Infrastructure Investments - Market Challenges

High Cost of Production and Raw Materials

Regulatory and Compliance Requirements

Counterfeit and Low-Cost Product Concerns - Opportunities

Rising Demand for Customizable and Durable Roll Cages

Adoption of Automated Warehousing Systems

Growth in the Automotive and Pharmaceuticals Sectors - Trends

Sustainability and Eco-friendly Materials Usage

Increasing Integration of Smart Technology in Roll Cages

Customization and Advanced Design in Roll Cages - Government Regulation

- SWOT Analysis

- Porter’s Five Forces

- Competition Ecosystem

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price, 2019-2025

- By Product Type, (In Value %)

Heavy Duty Roll Cages

Lightweight Roll Cages

Custom Roll Cages - By Application, (In Value %)

Warehousing & Distribution

Retail & Supermarkets

Automotive

Pharmaceuticals - By Distribution Channel, (In Value %)

Online Retail

Direct Sales

Distributors - By Region, (In Value %)

Central Region

Eastern Region

Western Region

Southern Region - By Material Type, (In Value %)

Steel

Aluminum

Plastic

- Market Share (Value/Volume)

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Roll Cage, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value Offering, and Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Al-Jazira Roll Cages

Saudi Roll Cages

SAAHEM

Al-Watania

United Roll Cages Manufacturing

Aujan Group

Gulf Roll Industries

Al-Faisal Group

Cargill

Unilever

Ajwa Group

Tawazun

Makkah Roll Refineries

Al-Futtaim

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2026-2030

- By Volume, 2026-2030

- By Average Price, 2026-2030