Market Overview

Based on a recent historical assessment, the KSA sea skimmer missile market was valued at USD ~billion, driven by sustained naval force expansion, heightened maritime threat exposure across the Red Sea and Arabian Gulf, and large-scale procurement under national defense modernization programs. Demand is reinforced by the need for long-range, low-altitude anti-ship strike capabilities capable of penetrating advanced naval air defense systems. Continuous investment in coastal defense, fleet survivability, and sea denial missions supports steady acquisition of advanced sea skimmer missile systems.

Based on a recent historical assessment, Riyadh, Jeddah, and Jubail emerged as dominant centers within the KSA sea skimmer missile market due to the concentration of defense procurement authorities, naval command headquarters, and key naval bases. Western coastal regions support Red Sea operations, while eastern hubs are critical for Arabian Gulf maritime security. Strong alignment between the Royal Saudi Naval Forces, defense acquisition agencies, and international missile suppliers reinforces centralized procurement and deployment. Strategic port infrastructure and logistics networks further strengthen national dominance in sea skimmer missile integration.

Market Segmentation

By Product Type

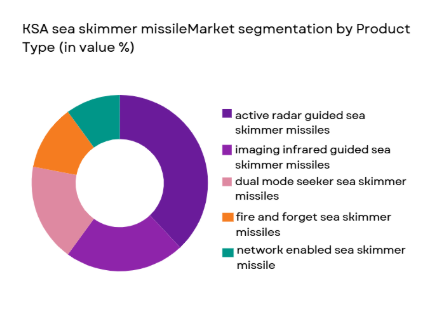

KSA sea skimmer missile market is segmented by product type into active radar guided sea skimmer missiles, imaging infrared guided sea skimmer missiles, dual mode seeker sea skimmer missiles, fire and forget sea skimmer missiles, and network enabled sea skimmer missiles. Recently, active radar guided sea skimmer missiles have a dominant market share due to their extended engagement range, all-weather capability, and proven effectiveness against surface combatants. These missiles enable autonomous mid-course navigation and terminal homing, reducing reliance on continuous targeting support. Strong compatibility with shipborne and coastal launch platforms enhances operational flexibility. Established logistics chains, training familiarity, and sustained procurement from allied suppliers reinforce preference. Continuous upgrades in electronic counter-countermeasures and seeker sensitivity further sustain dominance across KSA naval strike programs.

By Platform Type

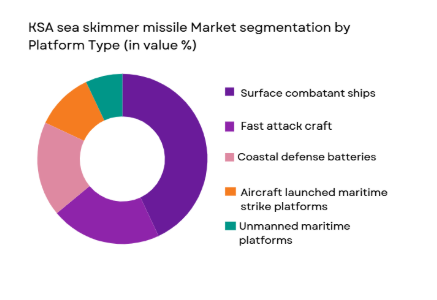

KSA sea skimmer missile market is segmented by platform type into surface combatant ships, fast attack craft, coastal defense missile batteries, aircraft launched maritime strike platforms, and unmanned maritime platforms. Recently, surface combatant ships have a dominant market share due to their primary role in fleet-based maritime deterrence and power projection missions. Frigates and corvettes form the backbone of naval strike capability and require robust anti-ship weapons for sea control operations. Integration with advanced combat management systems enables coordinated multi-target engagement. Continuous fleet modernization and sustainment programs support ongoing missile fitment. High readiness requirements and long deployment cycles reinforce dominant installation on surface combatants.

Competitive Landscape

The KSA sea skimmer missile market is highly consolidated and dominated by major international defense primes supplying proven missile systems through government-to-government and strategic partnership frameworks. Market influence is shaped by long-term procurement contracts, interoperability with allied naval forces, and alignment with national defense localization objectives, creating high barriers for new entrants.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Localization Capability |

| Boeing Defense | 1916 | Virginia, USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | Maryland, USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Virginia, USA | ~ | ~ | ~ | ~ | ~ |

| MBDA | 2001 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Kongsberg Defence & Aerospace | 1814 | Kongsberg, Norway | ~ | ~ | ~ | ~ | ~ |

KSA Sea Skimmer Missile Market Analysis

Growth Drivers

Naval Force Expansion and Maritime Deterrence Strategy

Naval force expansion and maritime deterrence strategy is a key growth driver for the KSA sea skimmer missile market as Saudi Arabia prioritizes protection of critical sea lanes, ports, and offshore energy infrastructure. Increasing naval patrol intensity across two major maritime theaters requires credible long-range anti-ship strike capability. Sea skimmer missiles provide low-altitude penetration that reduces detection by enemy radar systems. Fleet modernization programs emphasize advanced strike weapons integrated with networked command systems. Joint operations with allied navies further drive interoperability-focused procurement. Long-term defense spending commitments sustain acquisition cycles. Indigenous sustainment initiatives support lifecycle management. These factors collectively reinforce strong demand growth.

Regional Maritime Threat Environment and Coastal Defense Requirements

Regional maritime threat environment and coastal defense requirements significantly drive the KSA sea skimmer missile market due to persistent asymmetric and conventional naval risks. Coastal installations require mobile and fixed missile batteries to counter surface threats. Sea skimmer missiles offer rapid response and high lethality against hostile vessels. Integration with surveillance and targeting assets enhances situational awareness. Investment in layered maritime defense supports sea denial strategies. Continuous readiness posture demands reliable missile inventories. Procurement aligns with national security doctrine. These dynamics ensure sustained market momentum.

Market Challenges

High Acquisition Costs and Lifecycle Sustainment Burden

High acquisition costs and lifecycle sustainment burden pose a major challenge for the KSA sea skimmer missile market as advanced missiles involve significant unit pricing and long-term maintenance expenses. Dependence on foreign suppliers increases procurement costs. Sustainment requires specialized training and infrastructure. Missile upgrades and software updates add recurring expenditure. Inventory management complexity impacts budget planning. Currency exposure influences contract values. Long delivery timelines affect readiness planning. These cost pressures constrain rapid scaling.

Dependence on Foreign Technology and Export Restrictions

Dependence on foreign technology and export restrictions challenge market flexibility by limiting supplier diversity and customization. Missile systems are subject to strict export controls. Approval processes can delay deliveries. Geopolitical considerations influence availability. Limited access to source codes restricts upgrade autonomy. Localization efforts face technical barriers. These constraints reduce strategic independence and complicate long-term planning.

Opportunities

Defense Localization and Indigenous Sustainment Capability Development

Defense localization and indigenous sustainment capability development present strong opportunity within the KSA sea skimmer missile market under national industrial strategies. Establishing local assembly and MRO facilities reduces lifecycle costs. Technology transfer programs enhance domestic expertise. Local sustainment improves operational availability. Government incentives support defense manufacturing partnerships. Workforce development strengthens industrial base. Export servicing potential expands regional influence. These initiatives create long-term value.

Integration with Next Generation Naval and Unmanned Platforms

Integration with next generation naval and unmanned platforms offers opportunity as Saudi Arabia invests in advanced surface combatants and autonomous systems. New platforms require compatible strike weapons. Sea skimmer missiles provide flexible payload options. Unmanned vessels enhance reach and persistence. Networked targeting improves effectiveness. Reduced personnel risk supports adoption. Platform diversification expands demand. This opportunity broadens market scope.

Future Outlook

The KSA sea skimmer missile market is expected to grow steadily over the next five years, supported by continued naval modernization and maritime security priorities. Advances in seeker fusion, extended range, and countermeasure resistance will shape procurement. Government backing for defense localization will strengthen sustainment capabilities. Rising emphasis on coastal defense and unmanned maritime platforms will further drive demand.

Major Players

- Boeing Defense

- Lockheed Martin

- Raytheon Technologies

- MBDA

- Kongsberg Defence & Aerospace

- Rafael Advanced Defense Systems

- Israel Aerospace Industries

- Thales Group

- Leonardo

- L3Harris Technologies

- BAE Systems

- Hanwha Aerospace

- ASELSAN

- Roketsan

- Naval Group

Key Target Audience

- Naval procurement agencies

- Defense ministries

- Maritime security commands

- Coastal defense forces

- Defense system integrators

- Missile technology developers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables such as naval fleet size, missile inventories, procurement budgets, threat environment, and regulatory frameworks were identified through structured secondary research.

Step 2: Market Analysis and Construction

Collected information was analyzed to construct market size, segmentation, and competitive dynamics using validated analytical models and cross-checks.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with naval officers, defense procurement specialists, and missile technology experts.

Step 4: Research Synthesis and Final Output

All validated insights were synthesized into a comprehensive report with consistency checks to ensure reliability and decision relevance.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Naval force modernization and maritime deterrence strategy

Rising regional maritime threat perception

Expansion of coastal defense and sea denial capabilities - Market Challenges

High acquisition and lifecycle sustainment costs

Dependence on foreign technology and suppliers

Integration complexity with existing naval platforms - Market Opportunities

Development of indigenous missile assembly and MRO capabilities

Integration with next generation naval and unmanned platforms

Strengthening of defense industrial localization initiatives - Trends

Increasing adoption of multi mode seeker configurations

Focus on extended range and low altitude penetration profiles

Integration with network centric command and control systems

Shift toward modular launcher and deployment architectures

Emphasis on survivability against advanced naval air defenses - Government Regulations & Defense Policy

Alignment with Vision 2030 defense localization objectives

Strengthening of naval deterrence and coastal security mandates

Regulatory support for strategic missile capability acquisition - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Active radar guided sea skimmer missiles

Imaging infrared guided sea skimmer missiles

Dual mode seeker sea skimmer missiles

Fire and forget sea skimmer missiles

Network enabled sea skimmer missiles - By Platform Type (In Value%)

Surface combatant ships

Fast attack craft

Coastal defense missile batteries

Aircraft launched maritime strike platforms

Unmanned maritime platforms - By Fitment Type (In Value%)

New naval platform integration

Mid life upgrade and retrofit programs

Mobile coastal defense launcher fitments

Permanent shipborne installations

Joint force integrated deployment fitments - By EndUser Segment (In Value%)

Royal Saudi Naval Forces

Coastal and border security forces

Joint maritime strike commands

Special operations maritime units

Defense research and test organizations - By Procurement Channel (In Value%)

Direct government defense procurement

Foreign military sales programs

Defense prime contractor agreements

System integrator led acquisition programs

Emergency and rapid capability procurement - By Material / Technology (in Value %)

Low observable airframe materials

Advanced seeker and sensor fusion technologies

High precision inertial and satellite navigation systems

Solid fuel propulsion and booster technologies

Electronic counter countermeasure systems

- Market share snapshot of major players

- Cross Comparison Parameters (Range Performance, Sea Skimming Altitude, Seeker Technology, Target Discrimination Accuracy, Platform Integration Flexibility, Survivability Against Countermeasures, Guidance Precision, Lifecycle Support, Localization Potential)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Boeing Defense

Lockheed Martin

Raytheon Technologies

MBDA

Kongsberg Defence & Aerospace

Rafael Advanced Defense Systems

Israel Aerospace Industries

L3Harris Technologies

Thales Group

Leonardo

Hanwha Aerospace

ASELSAN

Roketsan

Naval Group

BAE Systems

- Operational focus on Red Sea and Arabian Gulf maritime security

- Preference for long range and high survivability strike systems

- Demand for interoperability with allied naval forces

- Increasing emphasis on coastal defense and sea denial missions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035