Market Overview

The KSA Seat Frames market USD ~ billion, which is influenced by various sectors, including automotive, aerospace, public transport, and furniture manufacturing. This market is essential for industries relying on durable and functional seating solutions. Demand is primarily driven by increased vehicle production, technological advancements, and consumer preferences for more sustainable and lightweight materials. Seat frames play a key role in comfort, safety, and overall functionality in transportation systems, contributing significantly to the production of vehicles, aircraft, and public transport infrastructure.

In Saudi Arabia, the key regions driving the market are the central, eastern, and western regions, with major automotive and aerospace manufacturing hubs located in these areas. These regions dominate due to their established infrastructure, industrial base, and proximity to key suppliers of materials. Furthermore, global players from regions like Europe and North America influence the market, especially in terms of technology, material innovation, and product standards.

Market Segmentation

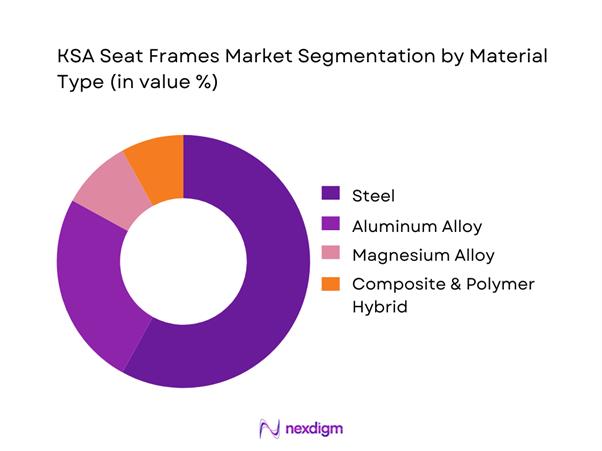

By Material Type

Steel dominates the KSA automotive seat frames market, driven by its strength, cost-effectiveness, and suitability for mass-market vehicles. However, aluminum alloys are increasingly preferred for lightweighting and fuel efficiency, particularly in passenger and electric vehicles. Magnesium alloys, while costly, are gaining traction in high-end vehicles and are expected to see a steady rise due to their lightweight characteristics. Composite and polymer hybrids are used in premium vehicles, offering reduced weight and enhanced durability, though their adoption remains limited due to higher production costs.

By Vehicle Type

Passenger vehicles continue to dominate the KSA automotive seat frame market, accounting for the largest share due to high domestic demand and regular maintenance cycles. The growing demand for electric vehicles (EVs) is driving changes in seat frame design, as battery weight requires specialized materials and design strategies. Light commercial vehicles are also expanding due to infrastructure development, while heavy commercial vehicles maintain a steady demand, primarily for robust and durable seat frames. The rise of electric and hybrid vehicles, though still in its infancy, is expected to further influence seat frame demand as the sector grows.

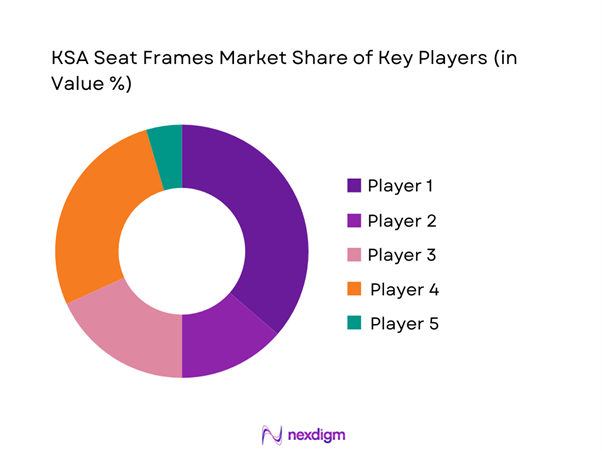

Competitive Landscape

The KSA seat frames market is dominated by a few major players, including ABC Seat Frames and global or regional brands like XYZ Automotive, Saudi Aerospace Frames, and Global Seats Ltd. This consolidation highlights the significant influence of these key companies.

| Company | Establishment Year | Headquarters | Seat Frame Material Expertise | Production Capacity | Technological Advancements | Key Clients |

| Faurecia | 1997 | France | ~ | ~ | ~ | ~ |

| Lear Corporation | 1917 | USA | ~ | ~ | ~ | ~ |

| Adient PLC | 2016 | Ireland | ~ | ~ | ~ | ~ |

| Magna International | 1957 | Canada | ~ | ~ | ~ | ~ |

| Tachi‑S Co. Ltd. | 1949 | Japan | ~ | ~ | ~ | ~ |

KSA Seat Frames Market Analysis

Growth Drivers

Increasing Automotive Production

The rise in automotive production in Saudi Arabia is a significant growth driver for the seat frames market. The country’s automotive industry has been expanding rapidly, driven by both local demand and the push for greater industrialization under Vision 2030. As manufacturers aim to produce vehicles that offer improved safety, comfort, and fuel efficiency, there is an increasing need for advanced seat frame solutions. These seat frames must meet the growing consumer expectations for durability, lightweight design, and customization options. As a result, the market is experiencing heightened demand for more innovative and sustainable seat frame designs.

Technological Advancements in Seat Frame Materials

The demand for lightweight materials is driving technological advancements in seat frame production. Innovations such as the introduction of composites and advanced plastics offer significant benefits in terms of weight reduction, strength, and comfort. These advancements help meet the growing demand for more fuel-efficient and eco-friendly vehicles. In particular, as automotive manufacturers look to integrate sustainable materials, there is a focus on reducing the environmental impact of seat frame manufacturing processes. By adopting these cutting-edge materials, manufacturers are able to improve vehicle performance, which is crucial for both traditional and electric vehicle production.

Challenges

Raw Material Supply Fluctuations

The fluctuating prices and availability of raw materials, such as steel, aluminum, and composites, present a major challenge to the seat frames market. These fluctuations are often driven by external market factors, such as geopolitical instability or changes in global demand. This uncertainty impacts the cost structure for manufacturers, as they must adjust their pricing strategies and supply chain management to accommodate price changes. In addition, the need to maintain high safety standards and durability while facing material shortages adds complexity to the production process, putting pressure on manufacturers to balance cost-efficiency with quality assurance.

Rising Cost of Advanced Materials

As demand for advanced materials like composites and lightweight metals rises, their higher costs pose a challenge for seat frame manufacturers. While these materials provide several performance benefits, such as improved fuel efficiency and better comfort, they come at a premium price. This cost discrepancy can limit the adoption of these materials, particularly in budget-friendly or mass-market vehicle segments. Manufacturers must find ways to balance the need for innovation and the cost implications of using these advanced materials, which may involve optimizing production processes or passing the costs onto consumers, thereby affecting price sensitivity.

Opportunities

Innovation in Seat Frame Materials

The growing demand for lightweight, durable, and sustainable materials presents a unique opportunity for innovation in the seat frame market. Companies that are able to leverage emerging technologies, such as advanced composites, carbon fiber, and eco-friendly plastics, can develop high-performance seat frame solutions that align with automotive industry trends. These innovations not only improve vehicle efficiency but also offer the potential for lower environmental impact during manufacturing. As sustainability continues to be a major focus in the automotive industry, manufacturers who embrace these advancements will be well-positioned to capture market share in a competitive environment.

Expansion of Electric Vehicle Production

The rise of electric vehicles (EVs) in Saudi Arabia presents a significant growth opportunity for the seat frames market. EV manufacturers prioritize lightweight materials to improve battery life, range, and overall vehicle efficiency. Seat frames play an essential role in this effort, as they contribute to overall vehicle weight. This demand for specialized seat frames tailored to EVs is expected to drive substantial growth in the market. Manufacturers that can provide seat frames optimized for electric vehicles will benefit from increased demand, as the market for EVs continues to expand in line with government policies and the Kingdom’s push towards sustainability.

Future Outlook

The future of the KSA seat frames market is marked by technological advancements, especially in materials and manufacturing processes. With continued growth in automotive and aerospace production, along with the expansion of public transport infrastructure, the market is expected to see steady demand. Manufacturers will need to innovate continuously to meet the evolving needs of their customers, especially as sustainability and lightweight solutions become increasingly important.

Major Players

- Faurecia

- Saudi Aerospace Frames

- Global Seats Ltd

- Industrial Frame Solutions

- MNC Seat Systems

- Techno Seats

- Kingdom Seat Manufacturers

- Prime Auto Parts

- Transport Seats KSA

- NextGen Frame Solutions

- Advanced Seat Tech

- FrameTech Industries

- AeroFrame Technologies

- FrameCraft Manufacturing

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies (KSA)

- Automotive manufacturers

- Aerospace manufacturers

- Public transport operators

- Furniture manufacturers

- Industrial equipment manufacturers

- Technology solution providers

Research Methodology

Step 1: Identification of Key Variables

Key market variables include seat frame materials, demand from key industries (automotive, aerospace, public transport), and innovation in manufacturing processes.

Step 2: Market Analysis and Construction

The market is analyzed based on demand drivers such as vehicle production, regulatory requirements, and material innovations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with industry experts, including manufacturers and suppliers of seat frames.

Step 4: Research Synthesis and Final Output

Synthesis of all data from interviews, market reports, and secondary sources was used to create the final report.

- Executive Summary

- Research Methodology (Market Definitions and Inclusions/Exclusions, Abbreviations, Topic-Specific Taxonomy, Market Sizing Framework, Revenue Attribution Logic Across Use Cases or Care Settings, Primary Interview Program Design, Data Triangulation and Validation, Limitations and Data Gaps)

- Definition and Scope

- Market Genesis and Evolution

- Seat Frames Usage / Value-Chain / Care-Continuum Mapping

- Business Cycle and Demand Seasonality

- KSA Industry / Service / Delivery Architecture

- Growth Drivers

Increasing Automotive Production

Rising Demand for Lightweight Seat Frames

Technological Advancements in Seat Frame Materials

Growth in Public Transportation

Shift Towards Sustainability in Manufacturing - Challenges

Raw Material Supply Fluctuations

Rising Cost of Advanced Materials

Complexity in Customization and Design

Increased Regulatory Scrutiny

Technological Integration in Traditional Manufacturing - Opportunities

Innovation in Seat Frame Materials

Potential for Growth in the Aerospace Sector

Expansion of Electric Vehicle Production

Rising Investment in Public Transport Infrastructure

Growing Demand for Ergonomic Designs - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- Average Realized Price per Seat Frame Unit, 2019–2024

- By Automotive Type (in Value %)

Industrial Seat Frames

Aerospace Seat Frames

Public Transport Seat Frames

Furniture Seat Frames - By Material Type (in Value %)

Metal Seat Frames

Plastic Seat Frames

Composite Seat Frames

Hybrid Seat Frames

Other Seat Frames - By Technology / Product / Platform Type (in Value %)

Manual Seat Frames

Electric Seat Frames

Heated Seat Frames

Adjustable Seat Frames

Foldable Seat Frames - By Deployment / Delivery / Distribution Model (in Value %)

Direct Sales

Distributors and Suppliers

OEM Partnerships - By End-Use Industry / Customer Type (in Value %)

Automotive Manufacturers

Aerospace Manufacturers

Public Transport Operators

Furniture Manufacturers

Industrial Equipment Manufacturers - By Region (in Value %)

Central Region

Eastern Region

Western Region

Southern Region

- Competition ecosystem overview

- Cross Comparison Parameters (Material Innovation, Cost Leadership, Manufacturing Efficiency, Customization Capabilities, Supply Chain Integration, Product Durability, Brand Reputation, Market Penetration)

- SWOT analysis of major players

- Pricing and commercial model benchmarking

- Detailed Profiles of Major Companies

Dura Automotive Systems

Saudi Aerospace Frames

Global Seats Ltd

Industrial Frame Solutions

MNC Seat Systems

Techno Seats

Kingdom Seat Manufacturers

Prime Auto Parts

Transport Seats KSA

NextGen Frame Solutions

Advanced Seat Tech

FrameTech Industries

AeroFrame Technologies

FrameCraft Manufacturing

- Buyer personas and decision-making units

- Procurement and contracting workflows

- KPIs used for evaluation

- Pain points and adoption barriers

- By Value, 2025–2030

- By Volume, 2025–2030

- Average Realized Price per Seat Frame Unit, 2025–2030