Market Overview

The Saudi Arabia automotive airbags and seatbelts market — which includes seatbelt systems — is recognized as an essential component of vehicle safety systems, driven by increasing vehicle production and the inherent requirement for occupant protection in every vehicle. According to a comprehensive industry report on the Saudi Arabia automotive airbags & seatbelts market, revenues reflect a growing safety system equipment demand tied to passenger vehicle sales and safety component integration by OEMs. This growth is propelled by strengthening regulatory safety standards, investment in safety equipment, and expanding new vehicle fleets in KSA.

The Saudi seatbelts market’s dynamics are closely linked to the broader automotive sector and road safety environment in the Kingdom’s largest metropolitan areas such as Riyadh and Jeddah, where higher vehicle ownership and enforcement infrastructure exist. These urban centers dominate due to concentrated consumer demand, extensive dealership and service networks, and a higher incidence of regulatory compliance enforcement. Their dominance reflects both urbanization trends and concentrated automotive sales volumes in the Kingdom’s primary economic hubs.

Market Segmentation

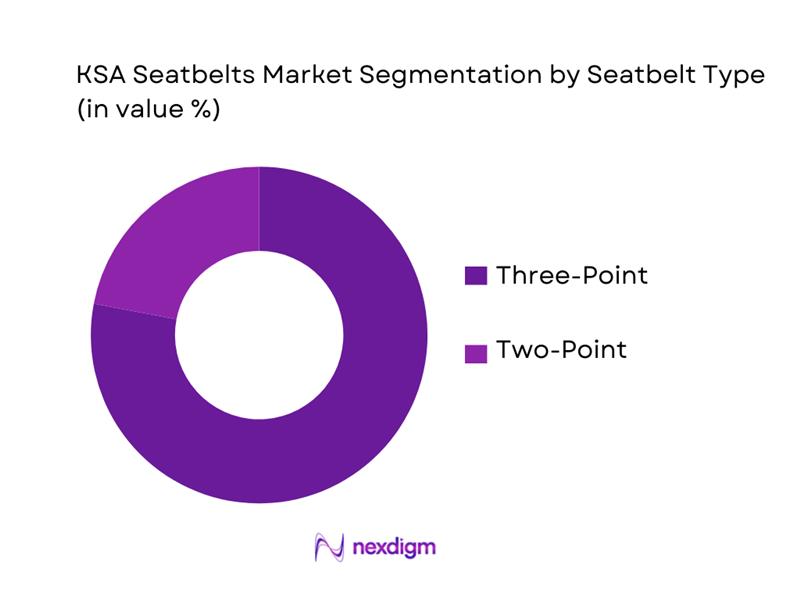

By Seatbelt Type

The Saudi seatbelts market is segmented into two-point and three-point seatbelt systems. In many automotive markets worldwide, three-point seatbelts hold a dominant share because they are the industry standard in passenger vehicles due to superior crash protection compared to two-point belts. Three-point systems are mandated by safety regulations in light passenger vehicles and are widely integrated by OEMs as a default safety feature, leading to their prevailing use. This higher safety performance and regulatory compliance explain their dominance in the segmentation mix, particularly in markets aligning with global automotive safety practices.

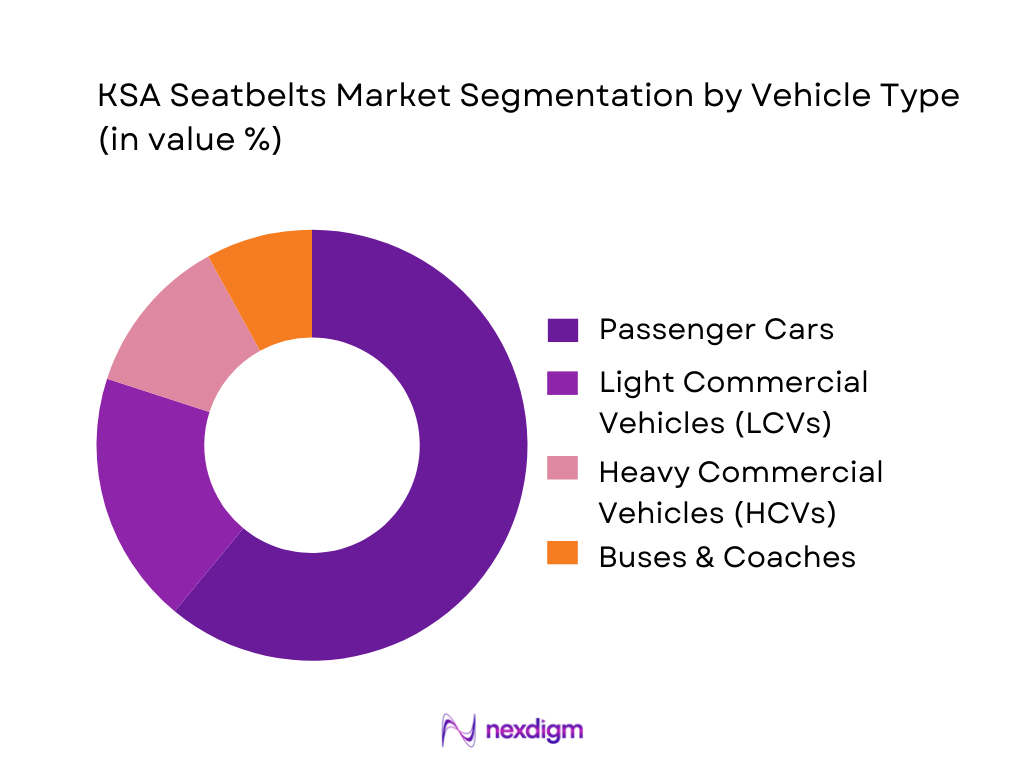

By Vehicle Type

The Saudi seatbelts market is segmented by vehicle category, including passenger cars, LCVs, HCVs, and buses/coaches. Across these, passenger cars dominate due to the significantly larger volume of personal vehicles sold and used in urban and suburban areas. Passenger cars account for the majority of automotive production and sales in Saudi Arabia, and thus the highest number of seatbelt systems installed yearly. Additionally, safety features in passenger cars — including seatbelts — are often prioritized by consumers and mandated in safety regulations, further reinforcing their dominant share. OEM integrations of advanced safety restraint technologies in passenger vehicles enhances the segment’s prominence over commercial vehicle categories.

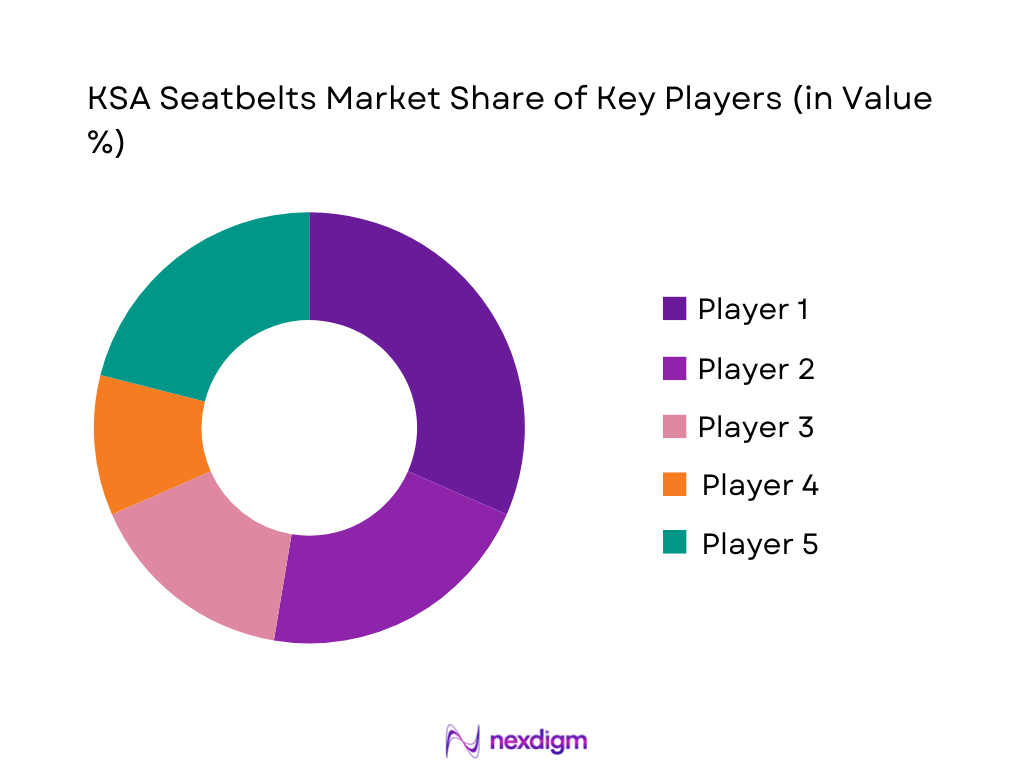

Competitive Landscape

The Saudi Arabia seatbelts sector operates within a highly globalized automotive safety systems market where leading international suppliers provide seatbelt systems to OEMs and aftermarket channels. The Saudi seatbelts market is influenced by major global automotive component manufacturers, with a competitive landscape shaped by technological capabilities, established OEM supply agreements, and regulatory compliance profiles. This concentration reflects the importance of quality, safety certification, and integration capacity with regional automotive manufacturers.

| Company | Est. Year | Headquarters | Seatbelt Tech Portfolio | OEM Integration Level | Regional Aftermarket Presence | Safety Certification Compliance | R&D Investment |

| Autoliv Inc. | 1953 | Sweden | ~ | ~ | ~ | ~ | ~ |

| ZF Friedrichshafen AG | 1915 | Germany | ~ | ~ | ~ | ~ | ~ |

| Joyson Safety Systems | 2003 | China / USA | ~ | ~ | ~ | ~ | ~ |

| Continental AG | 1871 | Germany | ~ | ~ | ~ | ~ | ~ |

| Robert Bosch GmbH | 1886 | Germany | ~ | ~ | ~ | ~ | ~ |

KSA Seatbelts Market Analysis

Growth Drivers

Safety Regulations Impact

Saudi Arabia’s seatbelt market is structurally supported by regulation-first enforcement, where seatbelt usage is treated as a monetizable safety violation rather than a voluntary behavior. The Ministry of Interior publishes penalties for seatbelt-related and safety violations, including fines stated at ~ Saudi riyals up to ~ Saudi riyals for specific traffic violations, strengthening compliance pressure across urban corridors. This regulatory push is reinforced by a large, economically active mobility base: Saudi Arabia’s population is ~ and GDP per capita is ~, enabling sustained vehicle ownership, licensing, and enforcement scale. Together, penalty-backed enforcement and strong macro fundamentals sustain steady OEM-fitment demand and aftermarket replacement volumes for compliant seatbelt assemblies.

Road Crash Statistics & Seatbelt Usage Correlation

Saudi Arabia’s road safety burden keeps seatbelts positioned as a “must-have” restraint component across OEM and retrofit demand, because crash frequency sustains replacement and safety-system scrutiny. Official road transport statistics show ~ serious traffic accidents and ~ traffic accident fatalities, alongside ~ traffic accident injuries (all recorded values for the same reporting period). In the same release, the mortality rate per ~ population is shown as 12.13, and injuries per ~ population are shown as 68.21, reinforcing the scale at which occupant protection remains a national priority. A vehicle parc of ~ million registered and roadworthy vehicles amplifies exposure: even small improvements in seatbelt usage compliance translate into large absolute reductions in fatalities and trauma load, keeping demand anchored in both compliance and safety outcomes.

Challenges

Low Seatbelt Adoption Behavior and Cultural Barriers

A core market constraint is that “installed seatbelts” do not always convert into “used seatbelts,” limiting the immediate safety outcome value and forcing policymakers to rely on enforcement intensity and behavior-change campaigns. The scale of road trauma in official transport statistics—~ fatalities and ~ injuries—signals that risk exposure remains elevated even with seatbelts present in vehicles. Meanwhile, a large active mobility base means even small pockets of non-usage translate into high absolute counts of injuries and fatalities, making behavior change difficult and slow. Macroeconomic stability can be a double-edged sword: inflation shown at 1.7 supports consumer spending continuity, but also reduces “cost pressure” that might otherwise push drivers toward safer behavior through insurance pricing or repair affordability constraints—requiring continued enforcement and targeted interventions to translate equipment availability into actual usage.

OEM Integration Complexity & Cost Constraints

Seatbelt systems are not standalone SKUs in modern vehicles; they are integrated into occupant sensing, airbag deployment logic, and compliance testing regimes, raising integration complexity for OEMs and Tier-1 suppliers serving the Saudi market. This is particularly relevant as the vehicle parc grows to ~ million and serious accidents reach ~, because regulators and OEMs must ensure restraint performance consistency under real-world crash conditions. From a macro lens, Saudi Arabia’s GDP per capita of ~ supports demand for safety-equipped vehicles, but OEMs still face platform-level cost trade-offs across trims and segments. Higher system complexity also increases homologation, validation, and service-training requirements across dealer networks—especially when the driver base expands, adding a fast-growing population of users whose vehicles need standardized serviceability and parts availability.

Opportunities

Enforcement-Led Replacement & Retrofit Opportunity

Saudi Arabia’s enforcement environment creates a clear pathway for higher replacement and retrofit demand, because penalties and compliance mechanisms convert seatbelt condition and usage into measurable consequences for drivers and fleets. The Ministry of Interior lists traffic violation penalties with fines ranging from ~ riyals to ~ riyals for specific violations, reinforcing behavioral enforcement and encouraging corrective action after citations. On the demand side, the installed base is massive—~ million registered vehicles—while serious accidents total ~ and injuries~, sustaining repair events where seatbelt assemblies may require replacement due to locking, pretensioner deployment, webbing damage, or accident-related diagnostics. With ~ new driving licenses issued, the active driver pool continues to expand, increasing road exposure and enforcement touchpoints. This combination supports a scalable aftermarket opportunity for certified retrofit kits, workshop-led replacement programs, and insurer/fleet partnerships that standardize post-accident restraint inspection and replacement.

OEM Localization & Vision-Aligned Manufacturing Incentives

Localization is a practical growth lever for seatbelts in Saudi Arabia because the market has a large, recurring unit demand base and a policy environment supportive of domestic industrial capability building. The vehicle parc at ~ million registered vehicles implies persistent replacement and OEM-fitment cycles, while ~ trillion GDP provides the macro capacity for industrial investment, supplier development, and production scale-up. The logistics ecosystem is also material: ~ million land-port passengers and ~ million tons of road freight exports through land ports reflect high cross-border movement, supporting both inbound component flows and outbound distribution potential for locally assembled safety parts. For suppliers, localization can reduce lead times, improve compliance traceability, and align with procurement preferences in government-linked fleet programs—creating a defensible pathway to long-term contracts without relying on speculative future statistics.

Future Outlook

Over the coming years, the Saudi Arabia seatbelts market is expected to continue growing alongside the broader automotive safety systems sector due to strengthened enforcement of safety regulations, increased focus on road traffic injury reduction, and rising adoption of advanced vehicle safety technologies. Integration of intelligent seatbelt systems, such as occupant sensing and pre-tensioning, may influence future procurement and OEM partnerships. Heightened enforcement of seatbelt usage laws and public safety campaigns will likely amplify the demand for compliant, certified restraint systems. Overall, regional automotive sector growth — including electrification and modernization of fleets — will support sustained expansion of seatbelt market revenues.

Major Players

- Autoliv Inc.

- ZF Friedrichshafen AG

- Joyson Safety Systems

- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- Hyundai Mobis Co., Ltd.

- Takata

- TRW Automotive Safety Systems

- Tokai Rika Co., Ltd.

- Lear Corporation

- Key Safety Systems

- Toyota Boshoku Corp.

- Aisin Seiki Co., Ltd.

Key Target Audience

- Vehicle OEMs and Procurement Heads

- Automotive Tier-1 Supply Chain Managers

- Investments and Venture Capitalist Firms

- Insurance and Risk Management Firms

- Government and Regulatory Bodies

- Automotive Aftermarket Distributors

- Fleet Operators and Leasing Companies

- Safety Standard Certification Authorities

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the Saudi Arabia automotive safety ecosystem, including automotive production, vehicle fleet composition, and applicable safety regulations. Secondary sources like industry reports and global seatbelt market data were leveraged to outline primary variables.

Step 2: Market Analysis and Construction

Historical data and industry insights were compiled to assess the influence of automotive safety standards and vehicle production on seatbelt system demand. While Saudi-specific revenue data are limited in open sources, global and regional trends provided a foundation for contextual approximation.

Step 3: Hypothesis Validation and Expert Consultation

Draft hypotheses about market growth drivers and segment dominance were validated through qualitative expert inputs and cross-referenced with reported industry analyses from credible publishers, ensuring alignment with observable automotive safety adoption trends.

Step 4: Research Synthesis and Final Output

Compiled insights were triangulated across global seatbelt market reports, regional automotive data, and regulatory frameworks to produce a coherent and research-validated narrative. Emphasis was placed on integrating publicly available data with authoritative projections.

- Executive Summary

- Research Methodology (Market Definitions & Assumptions, Abbreviations, Saudi Traffic Safety Regulatory Framework Mapping, Primary vs Secondary Research Approach, Vehicle Fleet Data Sources, Seatbelt Adoption Metrics Methodology, Limitations & Data Validation)

- Definition and Scope of Seatbelts & Restraint Systems

- Market Genesis & Development in Saudi Arabia

- Regulatory Milestones & Enforcement Landscape

- Saudi Automotive Safety Ecosystem

- Value Chain & Ecosystem Mapping

- Growth Drivers

Safety Regulations Impact

Road Crash Statistics & Seatbelt Usage Correlation

OEM Safety Feature Standardization Mandates

Rising Consumer Awareness & Insurance Impact on Seatbelt Demand

Technological Advancements - Challenges

Low Seatbelt Adoption Behavior and Cultural Barriers

OEM Integration Complexity & Cost Constraints

Aftermarket Fragmentation & Quality Assurance Issues

Material Cost Volatility - Opportunities

Enforcement-Led Replacement & Retrofit Opportunity

OEM Localization & Vision-Aligned Manufacturing Incentives

Fleet Safety Programs

Smart Seatbelt Adoption

Child Safety Restraint Standardization & Public Awareness Expansion - Trends

Smart Seatbelts

Child Safety Restraint Growth Opportunities

Connected Safety System Integration

Lightweight & Comfort-Driven Design Innovations - Policy & Regulatory Landscape

- Seatbelts Market SWOT Analysis

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Vehicle Type, 2019-2024

- By Seatbelt Type Penetration, 2019-2024

- By Distribution Channel, 2019-2024

- By OEM Tier Classification, 2019-2024

- By Vehicle Type (in Value %)

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

Electric & Hybrid Vehicles

- By Seatbelt Type (in Value %)

2-point

3-point

4-point

5-point

- By Application (in Value %)

Front

Rear

Child Restraint Systems

- By Sales Channel (in Value %)

OEM

Aftermarket / Retail Workshops

- By Material / Technology (in Value %)

Pretensioner

Load Limiter

Inflatable Seatbelt Adoption

- Market Share by Value & Volume

Competitive Benchmarking on Market Positioning & Technical Capabilities - Cross-Comparison Parameters (Company Overview, Product Portfolio Depth, Safety Certifications & Compliance, OEM Contracts & Tier-1 Integration Footprint, Distribution, Network Intensity & Aftermarket Penetration, Average Selling Price, R&D & Innovation Investment, Technical Support & Aftermarket Service Coverage)

- Detailed profile of Key Players

Autoliv Inc.

ZF Friedrichshafen AG

Joyson Safety Systems

Tokai Rika Co., Ltd.

Continental AG

Robert Bosch GmbH

TRW Automotive (ZF)

Hyundai Mobis Co., Ltd.

Denso Corporation

Aisin Seiki Co., Ltd.

Hyundai Transys

Sumitomo Riko Company

Lear Corporation

Takata

- Passenger Vehicle Owners

- Commercial Fleet Operators

- Government & Public Sector Transport Agencies

- Automotive OEMs and Authorized Dealership Networks

- Automotive Aftermarket Workshops & Repair Centers

- By Value, 2025-2030

- By Vehicle Type, 2025-2030

- By Seatbelt Type Penetration, 2025-2030

- By Distribution Channel, 2025-2030

- By OEM Tier Classification, 2025-2030