Market Overview

The KSA service handgun market recorded a market size of USD ~ billion based on a recent historical assessment derived from publicly disclosed defense procurement allocations, Saudi government budget releases, and small arms acquisition disclosures referenced by SIPRI and national defense procurement channels. Demand is driven by sustained internal security modernization, replacement of legacy sidearms across armed forces and internal security units, standardization of calibers and platforms, and the emphasis on operational readiness. Continuous force expansion, structured training requirements, and lifecycle replacement cycles further support consistent procurement volumes across institutional buyers.

The market is dominated by Riyadh as the central procurement, command, and integration hub due to the presence of defense authorities, procurement agencies, and military headquarters coordinating acquisitions. Jeddah plays a key role through logistics, import handling, and defense industrial partnerships linked to port access. The Eastern Province contributes through industrial participation and localized assembly initiatives aligned with national defense localization programs. National dominance is reinforced by Saudi Arabia’s centralized procurement model, regulatory control over firearms, and sustained defense spending priorities supporting internal security and military readiness.

Market Segmentation

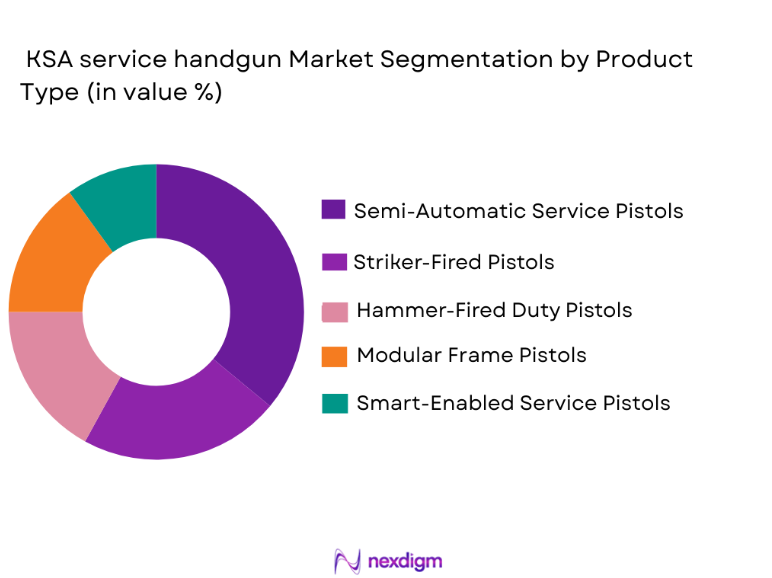

By Product Type

The KSA service handgun market is segmented by product type into semi-automatic service pistols, striker-fired pistols, hammer-fired duty pistols, modular frame pistols, and smart-enabled service pistols. Recently, semi-automatic service pistols have held a dominant market share due to their long-standing adoption across Saudi military and internal security forces, supported by standardized training doctrines, proven battlefield reliability, and compatibility with existing ammunition and maintenance infrastructure. These pistols are preferred for their balance of firepower, safety mechanisms, and ease of operation in both routine patrol and high-readiness scenarios. Institutional buyers favor platforms with established global service records, predictable lifecycle costs, and broad supplier availability. In addition, semi-automatic pistols integrate effectively with optics, tactical lights, and holsters already in service, reducing transition costs. Their adaptability across conventional forces, special units, and training academies further reinforces their dominance in centralized procurement programs.

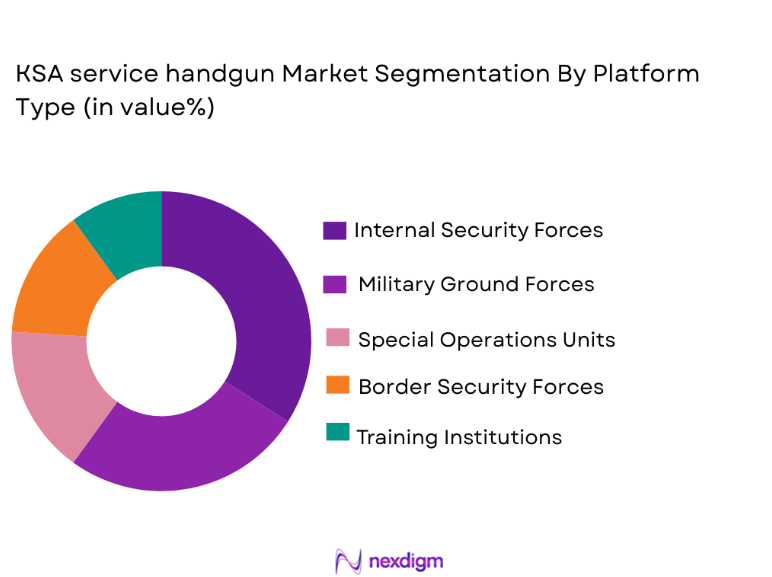

By Platform Type

The KSA service handgun market is segmented by platform type into military ground forces, internal security forces, special operations units, border security forces, and training institutions. Recently, internal security forces have dominated the market share due to their extensive personnel strength, continuous operational deployment, and primary responsibility for law enforcement, counterterrorism, and public security missions across urban and strategic locations. These forces require large volumes of standardized sidearms to support daily patrols, rapid response teams, and specialized units, resulting in recurring procurement cycles. High training throughput and frequent weapon rotation further elevate demand compared to other platforms. Additionally, internal security modernization programs prioritize ergonomics, safety, and accuracy, accelerating replacement of older inventories. Centralized budgeting and prioritization of homeland security reinforce sustained acquisition volumes, positioning this platform as the leading contributor to overall market demand.

Competitive Landscape

The KSA service handgun market is moderately consolidated, characterized by a limited pool of internationally established handgun manufacturers and a growing presence of Saudi defense entities supported by localization mandates. Competitive positioning is strongly influenced by compliance with Saudi regulatory standards, long-term government relationships, technology transfer commitments, and the ability to support local assembly, maintenance, and training. Major players retain influence through proven service reliability, standardized platforms, and lifecycle support capabilities, while local entities gain traction through industrial participation and alignment with national defense industrialization objectives.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Localization / Industrial Participation |

| Saudi Arabian Military Industries | 2017 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| Beretta Defense Technologies | 1526 | Italy | ~ | ~ | ~ | ~ | ~ |

| SIG Sauer | 1853 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Glock | 1963 | Austria | ~ | ~ | ~ | ~ | ~ |

| FN Herstal | 1889 | Belgium | ~ | ~ | ~ | ~ | ~ |

KSA Service Handgun Market Analysis

Growth Drivers

Defense modernization and internal security reinforcement programs

Defense modernization and internal security reinforcement programs drive the KSA service handgun market through sustained institutional demand generated by structured force upgrades, standardized equipment mandates, and continuous replacement of aging inventories across military and security forces, creating a stable procurement environment supported by government-backed funding mechanisms and long-term capability planning aligned with national security priorities. These programs emphasize reliability, interoperability, and lifecycle efficiency, ensuring that service handguns remain a foundational element of individual soldier and officer equipment across diverse operational scenarios. Modernization initiatives prioritize compatibility with contemporary accessories, improved ergonomics, and enhanced safety mechanisms, which accelerate adoption of newer platforms. Centralized procurement policies enable bulk acquisitions, reducing per-unit costs while maintaining strict quality thresholds. Training standardization further amplifies demand, as uniform weapon platforms simplify instruction and qualification processes. Additionally, increased focus on readiness levels drives recurring procurement cycles to maintain operational availability. The integration of service handguns into broader soldier systems reinforces their strategic importance. Continuous evaluation of performance feedback ensures iterative upgrades remain embedded within modernization frameworks.

Localization and domestic defense manufacturing expansion

Localization and domestic defense manufacturing expansion act as a critical growth driver by encouraging partnerships, licensed production, and assembly operations that align with national industrial objectives, thereby increasing procurement attractiveness for platforms offering local value addition and technology transfer commitments. Government policies promote domestic capability development, reducing reliance on imports while ensuring supply chain resilience. Service handguns represent an accessible entry point for localization due to manageable production complexity and scalable manufacturing processes. Local assembly reduces lead times and enhances maintenance responsiveness. Defense entities favor suppliers investing in domestic facilities, workforce training, and supplier ecosystems. These initiatives stimulate sustained demand through long-term contracts linked to localization milestones. Industrial participation requirements further incentivize vendors to adapt to offerings. Over time, localized production strengthens confidence in supply continuity and supports incremental upgrades aligned with national standards.

Market Challenges

Stringent regulatory controls and procurement compliance requirements

Stringent regulatory controls and procurement compliance requirements challenge the KSA service handgun market by imposing rigorous licensing, certification, and approval processes that extend procurement timelines and restrict supplier participation, thereby limiting competitive diversity and slowing acquisition cycles despite stable demand fundamentals. Firearms regulations necessitate exhaustive testing, documentation, and adherence to national security protocols. Compliance costs increase barriers for new entrants and smaller manufacturers. Approval processes involve multiple government stakeholders, adding procedural complexity. Delays in certification can defer delivery schedules and training programs. Additionally, evolving compliance standards require continuous product adaptation. Vendors must maintain robust regulatory expertise to navigate requirements effectively. These constraints can limit rapid adoption of innovative designs. Overall, regulatory rigor prioritizes security but constrains market agility.

Dependence on foreign technology and supply chains

Dependence on foreign technology and supply chains presents a challenge by exposing the market to external geopolitical risks, export controls, and supply disruptions that can affect availability, pricing, and delivery timelines of service handguns and critical components. Many advanced handgun platforms rely on imported parts, specialized materials, and proprietary technologies. Export licensing from supplier countries can cause uncertainty. Currency fluctuations influence procurement costs. Supply chain disruptions can delay scheduled deployments and training cycles. Localization efforts mitigate but do not eliminate reliance. Technology transfer negotiations can be complex and time-consuming. Strategic inventory management becomes essential to offset risks. This dependence necessitates diversified sourcing strategies to maintain readiness.

Opportunities

Expansion of optics-ready and modular handgun adoption

Expansion of optics-ready and modular handgun adoption presents a significant opportunity as Saudi security forces increasingly prioritize accuracy, adaptability, and mission-specific configuration, creating demand for platforms capable of integrating red-dot sights, suppressors, and modular grips without extensive modification. These features enhance operational effectiveness in urban and specialized environments. Procurement authorities favor future-proof platforms supporting incremental upgrades. Modular designs reduce the need for full replacement cycles. Training institutions benefit from standardized, yet adaptable systems. Vendors offering scalable configurations gain competitive advantage. Integration with digital training tools further supports adoption. This trend aligns with broader soldier modernization initiatives. As operational doctrines evolve, modular handguns become central to capability enhancement.

Long-term sustainment and lifecycle support contracts

Long-term sustainment and lifecycle support contracts offer opportunities by shifting procurement focus from one-time acquisitions to comprehensive support models encompassing maintenance, spare parts, training, and periodic upgrades, ensuring predictable revenue streams and deeper supplier integration. Saudi procurement frameworks increasingly value total lifecycle cost management. Sustainment contracts improve weapon availability and performance consistency. Local maintenance facilities enhance responsiveness. Training support strengthens user proficiency. Periodic upgrades extend service life and align with evolving requirements. Suppliers providing end-to-end solutions strengthen relationships. This approach supports defense of localization objectives. Over time, lifecycle contracts stabilize demand and reinforce market resilience.

Future Outlook

The KSA service handgun market is expected to maintain steady momentum over the next five years, supported by sustained internal security priorities and structured defense modernization programs. Continued emphasis on localization, modular weapon platforms, and lifecycle efficiency will shape procurement strategies. Technological developments such as optics-ready designs and enhanced safety mechanisms will gain prominence. Regulatory support for domestic manufacturing and stable institutional demand will collectively reinforce market growth and long-term stability.

Major Players

- Saudi Arabian Military Industries

- Beretta Defense Technologies

- SIG Sauer

- Glock

- FN Herstal

- Heckler & Koch

- CZ-UB

- Taurus

- Caracal International

- Norinco

- Rheinmetall Denel Munitions Arabia

- Zamil Defense

- AlEsnadManufacturing

- Kalashnikov Concern

- Advanced Military Maintenance Repair and Overhaul Center

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense procurement agencies

- Military modernization departments

- Internal security forces

- Defense manufacturers

- Weapons systems integrators

- Ammunition and accessories suppliers

Research Methodology

Step 1: Identification of Key Variables

Key demand, supply, regulatory, and technology variables were identified through defense budget analysis, procurement disclosures, and policy review to define market boundaries and influencing factors.

Step 2: Market Analysis and Construction

Data was analyzed using structured frameworks integrating procurement volumes, supplier positioning, and end-user demand to construct a coherent market model.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert consultations, cross-referencing with defense analysts, and comparison with historical procurement patterns.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a consolidated report ensuring internal consistency, accuracy, and alignment with defense market realities.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Modernization of small arms inventory

Rising internal security requirements

Standardization of service weapons

Focus on soldier lethality enhancement

Expansion of domestic defense manufacturing - Market Challenges

Stringent import and licensing controls

High qualification and testing requirements

Dependence on foreign technology inputs

Long procurement and approval cycles

Cost sensitivity in large-scale adoption - Market Opportunities

Localization under defense industrialization programs

Technology transfer and joint ventures

Upgrades through optics and accessory integration - Trends

Shift toward modular handgun platforms

Adoption of optics-ready service pistols

Increased use of polymer-based frames

Lifecycle upgrade programs for existing fleets

Emphasis on training-compatible weapon systems - Government Regulations & Defense Policy

Defense localization mandates

Strict firearms control regulations

Standardization policies for service weapons - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Semi-automatic service pistols

Modular frame duty handguns

Compact service handguns

Full-size service handguns

Smart-enabled service handguns - By Platform Type (In Value%)

Military ground forces

Internal security forces

Special operations units

Border security forces

Training and reserve units - By Fitment Type (In Value%)

Standard issue handguns

Mission-configured handguns

Accessory-ready handguns

Optics-ready handguns

Suppressed-compatible handguns - By End User Segment (In Value%)

Saudi Armed Forces

Saudi Arabian National Guard

Ministry of Interior forces

Special security forces

Government training academies - By Procurement Channel (In Value%)

Direct government procurement

Foreign military sales programs

Licensed local manufacturing contracts

Technology transfer agreements

Framework supply contracts - By Material / Technology (in Value %)

Polymer frame handguns

All-metal frame handguns

Hybrid alloy-polymer handguns

Advanced barrel coating technologies

Integrated fire-control technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Caliber options, Modularity level, Manufacturing localization, Compliance standards, Lifecycle cost)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Saudi Arabian Military Industries

Advanced Military Maintenance Repair and Overhaul Center

Zamil Defense

Al Esnad Manufacturing

Rheinmetall Denel Munitions Arabia

Beretta Defense Technologies

SIG Sauer Defense

Glock Ges.m.b.H.

FN Herstal

Heckler & Koch Defense

CZ-UB Defense

Taurus Defense

Kalashnikov Concern Small Arms

Norinco Small Arms Division

Caracal International

- Operational units prioritizing reliability and durability

- Training institutions emphasizing safety and standardization

- Special forces demanding modularity and customization

- Internal security users focusing on ergonomics and accuracy

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035