Market Overview

The KSA Short Range Air Defense System Market is valued at USD ~ billion based on a recent historical assessment, supported by procurement disclosures from the Saudi Ministry of Defense and contract announcements involving layered air defense acquisitions. Demand is driven by sustained investments in point defense systems protecting critical infrastructure, military bases, and urban assets, along with accelerated induction of mobile and fixed short-range interceptors. Rising threats from low-altitude aerial platforms, unmanned systems, and precision-guided munitions continue to reinforce procurement urgency across defense modernization programs.

Riyadh and key defense hubs such as Dhahran dominate the KSA Short Range Air Defense System Market due to centralized defense command structures, proximity to strategic energy infrastructure, and the presence of major military installations. Saudi Arabia leads regional dominance because of its integrated air defense doctrine, high defense expenditure capacity, and ongoing localization initiatives under Vision 2030. Strong government-to-government defense partnerships, domestic assembly programs, and technology transfer agreements further consolidate national leadership without reliance on distributed regional manufacturing centers.

Market Segmentation

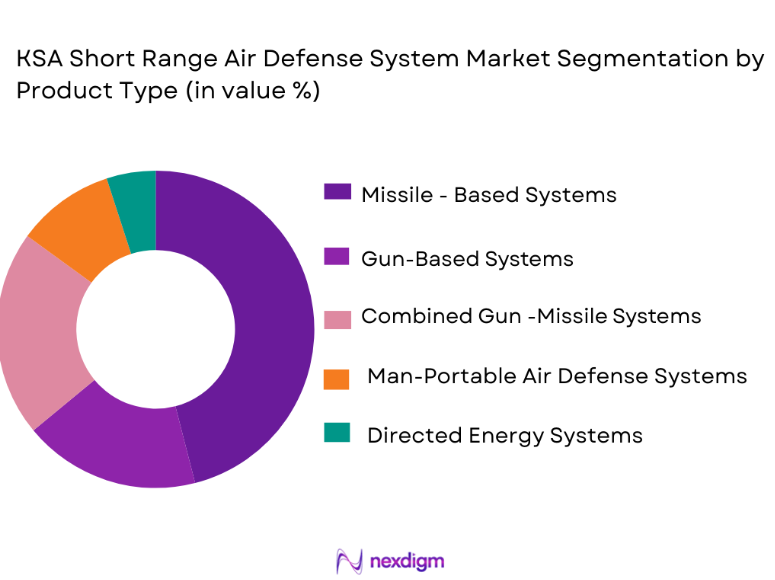

By Product Type

KSA Short Range Air Defense System market is segmented by product type into missile-based systems, gun-based systems, combined gun-missile systems, man-portable air defense systems, and directed energy-based systems. Recently, missile-based systems have had a dominant market share due to factors such as higher interception reliability, extended engagement envelopes within short-range classifications, and strong compatibility with existing radar and command networks. Saudi defense procurement emphasizes missile-based solutions to counter low-flying aircraft, cruise missiles, and unmanned aerial systems threatening critical oil, gas, and military assets. These systems benefit from proven combat performance, established logistics chains, and integration with national air defense architectures. Additionally, long-term supply agreements with international manufacturers and co-production arrangements under localization programs reinforce sustained procurement volumes. Missile-based platforms also align with the kingdom’s layered air defense strategy, prioritizing rapid reaction capability and scalable deployment across mobile and fixed installations.

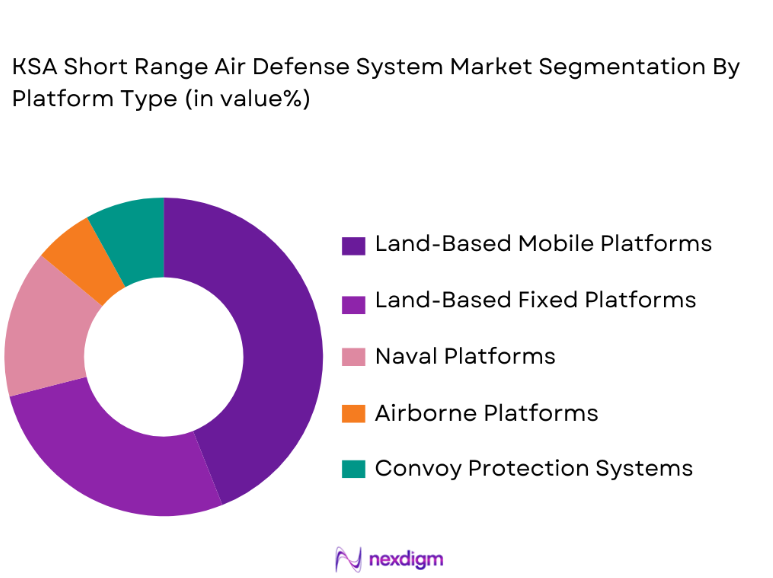

By Platform Type

KSA Short Range Air Defense System market is segmented by platform type into land-based mobile platforms, land-based fixed platforms, naval platforms, airborne platforms, and vehicle-integrated convoy protection systems. Recently, land-based mobile platforms have had a dominant market share due to factors such as operational flexibility, rapid redeployment capability, and suitability for protecting dispersed assets across vast geographic areas. Saudi Arabia’s defense posture requires systems capable of escorting maneuver forces, securing border regions, and responding quickly to asymmetric threats. Mobile platforms allow integration with wheeled and tracked vehicles already in service, reducing deployment timelines and infrastructure dependency. These systems are heavily favored for protecting oil fields, desalination plants, and forward-operating bases. Their dominance is further reinforced by procurement strategies emphasizing survivability, networked operations, and interoperability with national command-and-control systems.

Competitive Landscape

The KSA Short Range Air Defense System Market is moderately consolidated, with a small group of global defense prices and selected regional entities dominating high-value contracts through long-term government agreements. Competitive intensity is shaped by technology transfer commitments, local manufacturing partnerships, and system interoperability requirements, giving established players a strong advantage over new entrants.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Localization Partnerships |

| Raytheon Technologies | 1922 | United States | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ |

| MBDA | 2001 | Europe | ~ | ~ | ~ | ~ | ~ |

| Saab AB | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ |

KSA Short Range Air Defense System Market Analysis

Growth Drivers

Rising Low-Altitude Aerial Threat Proliferation

The KSA Short Range Air Defense System Market is significantly driven by the increasing frequency and sophistication of low-altitude aerial threats targeting critical infrastructure and military assets. Unmanned aerial vehicles, loitering munitions, and short-range precision weapons have become more accessible to both state and non-state actors, compelling Saudi Arabia to strengthen its close-in defensive layers. These threats operate below traditional radar coverage envelopes, necessitating dedicated short-range interception systems with rapid response times. The kingdom’s energy facilities, border regions, and urban centers require persistent protection against such asymmetric attack vectors. Continuous incidents across the wider Middle East reinforce the urgency of sustained investment in short-range air defense capabilities. Integration of advanced sensors, electro-optical tracking, and networked command systems further accelerates procurement. As threat profiles evolve, demand increases for systems capable of engaging multiple targets simultaneously. This persistent security environment ensures long-term procurement momentum for advanced short-range air defense platforms.

Defense Modernization and Vision 2030 Localization Objectives

Saudi Arabia’s broader defense modernization agenda strongly supports growth in the KSA Short Range Air Defense System Market through structured capability upgrades and domestic industrial participation. Vision 2030 emphasizes reduced reliance on imports and increased local defense manufacturing, encouraging sustained acquisition programs tied to technology transfer. Short-range air defense systems are prioritized due to their critical role in protecting strategic assets and military formations. Government-backed funding enables multi-year procurement cycles and upgrades of legacy systems. Localization requirements incentivize foreign manufacturers to establish assembly lines and maintenance hubs within the kingdom. This approach not only expands installed system bases but also extends lifecycle support contracts. Enhanced training, simulation, and sustainment ecosystems further strengthen market depth. Collectively, these modernization and localization drives create a stable and policy-backed growth foundation.

Market Challenges

High System Integration and Interoperability Complexity

One of the primary challenges in the KSA Short Range Air Defense System Market is the technical complexity associated with integrating new short-range systems into existing multi-layered air defense architectures. Saudi Arabia operates a diverse mix of legacy and modern platforms sourced from multiple international suppliers, creating interoperability constraints. Ensuring seamless data exchange between radars, command systems, and interceptors requires extensive customization. These integration efforts increase deployment timelines and program costs. Compatibility testing, cybersecurity hardening, and software validation further complicate implementation. The challenge is intensified when systems must coordinate with medium- and long-range defenses. Operational readiness can be affected if integration milestones are delayed. As system complexity grows, reliance on specialized foreign technical support remains high. This challenge can slow down procurement cycles despite strong demand fundamentals.

Dependence on Foreign Technology and Supply Chains

The KSA Short Range Air Defense System Market faces challenges linked to reliance on foreign technologies and international supply chains. Critical components such as seekers, propulsion systems, and advanced electronics are often sourced externally. Geopolitical constraints, export controls, and licensing approvals can delay deliveries and upgrades. This dependence exposes programs to schedule risks and cost escalation. Although localization initiatives are expanding, achieving full technological self-sufficiency remains a long-term objective. Skilled workforce development and intellectual property transfer require sustained investment. Any disruption in supplier relationships can impact system availability and sustainment. Managing these dependencies while maintaining operational readiness remains a strategic challenge for the market.

Opportunities

Expansion of Indigenous Manufacturing and Assembly Capabilities

The KSA Short Range Air Defense System Market presents strong opportunities through the expansion of indigenous manufacturing, assembly, and maintenance capabilities. Government mandates increasingly favor contracts that include local production content and workforce development. Establishing domestic assembly lines for launchers, support vehicles, and subsystems can significantly reduce lifecycle costs. Local maintenance, repair, and overhaul facilities improve system availability and reduce downtime. These initiatives attract long-term partnerships between Saudi defense entities and global OEMs. Over time, localized production can extend to higher-value components. This creates opportunities for supply chain development and export potential within allied markets. Indigenous capability growth strengthens national security while expanding market value.

Adoption of Advanced Counter-UAS and Directed Energy Solutions

The rising threat from small unmanned systems creates opportunities for next-generation short-range air defense technologies within the Saudi market. Counter-UAS systems incorporating electronic warfare, soft-kill measures, and directed energy weapons are gaining strategic attention. These solutions offer lower cost per engagement compared to traditional interceptors. Integration of lasers and high-power microwave systems aligns with future defense concepts. Saudi Arabia’s investment capacity enables early adoption and testing of such technologies. Pilot deployments around critical infrastructure can scale into broader procurement programs. This technological evolution opens new revenue streams and diversification opportunities for system providers.

Future Outlook

The KSA Short Range Air Defense System Market is expected to maintain steady expansion over the next five years, supported by sustained defense spending and evolving threat environments. Continued integration of advanced sensors, automation, and network-centric operations will define system upgrades. Regulatory support for localization and technology transfer will further shape procurement strategies. Demand growth will be driven by asset protection needs, counter-UAS requirements, and modernization of existing defense layers across the kingdom.

Major Players

- Raytheon Technologies

- Lockheed Martin

- Thales Group

- MBDA

- Saab AB

- Rafael Advanced Defense Systems

- KongsbergDefence

- ASELSAN

- Northrop Grumman

- Rheinmetall

- BAE Systems

- Leonardo

- Elbit Systems

- L3Harris Technologies

- Hanwha Defense

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense ministries

- Armed forces procurement agencies

- Homeland security agencies

- Critical infrastructure operators

- Defense system integrators

- Military modernization planners

Research Methodology

Step 1: Identification of Key Variables

Key market variables were identified through analysis of defense budgets, procurement programs, and threat assessments relevant to short-range air defense systems. Primary focus was placed on system types, platforms, and deployment models. Data points were cross validated using official government disclosures.

Step 2: Market Analysis and Construction

Market structure was constructed by evaluating active contracts, installed system bases, and ongoing modernization initiatives. Segmentation was developed based on operational relevance and procurement trends. Competitive positioning was assessed using publicly available company data.

Step 3: Hypothesis Validation and Expert Consultation

Initial findings were validated through consultations with defense analysts, industry experts, and retired military professionals. Feedback was incorporated to refine assumptions related to demand from drivers and constraints. Discrepancies were resolved through secondary source verification.

Step 4: Research Synthesis and Final Output

All validated inputs were synthesized into a cohesive market framework. Insights were structured to align with strategic decision-making needs. The final output emphasizes accuracy, clarity, and relevance to stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising threat from low-altitude aerial attacks and unmanned systems

Modernization of national air defense architecture

Protection requirements for critical energy infrastructure

Increased defense budget allocation toward air and missile defense

Emphasis on layered air defense doctrine - Market Challenges

High acquisition and lifecycle maintenance costs

Dependence on foreign technology suppliers

Integration complexity with existing defense networks

Skilled workforce and training requirements

Evolving threat profiles requiring frequent upgrades - Market Opportunities

Localization of air defense manufacturing and assembly

Development of counter-drone focused SHORAD systems

Integration of AI-enabled threat detection and response - Trends

Shift toward mobile and rapidly deployable SHORAD systems

Growing adoption of counter-UAS capabilities

Integration with national command and control networks

Increased use of multi-sensor fusion technologies

Focus on modular and upgradeable system architectures - Government Regulations & Defense Policy

National defense localization mandates

Defense procurement and offset policies

Airspace security and critical infrastructure protection regulations - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Man-portable air defense systems

Vehicle-mounted short range air defense systems

Radar-guided gun-based systems

Missile-based point defense systems

Hybrid gun-missile air defense systems - By Platform Type (In Value%)

Land-based fixed installations

Mobile ground vehicle platforms

Naval point defense platforms

Critical infrastructure protection systems

Forward-deployed tactical defense platforms - By Fitment Type (In Value%)

New system installations

System upgrade and modernization fitment

Retrofit on existing platforms

Integrated air defense network fitment

Rapid deployment modular fitment - By End User Segment (In Value%)

Saudi Armed Forces

Royal Saudi Air Defense Forces s

National Guard units

Critical infrastructure protection agencies

Strategic energy and industrial asset operators - By Procurement Channel (In Value%)

Direct government procurement

Foreign military sales programs

Local defense manufacturing partnerships

Technology transfer and licensed production

Joint venture procurement arrangements - By Technology (In Value%)

Infrared-guided interception systems

Radar-guided interception systems

Electro-optical targeting systems

Network-centric command and control systems

Counter-UAS and low-altitude threat technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Engagement range, Target type coverage, Mobility, Sensor integration, Command and control capability, Interoperability, Localization potential, Lifecycle support)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Raytheon Missiles & Defense

Lockheed Martin

MBDA

Rheinmetall Air Defence

Thales Group

Saab AB

Kongsberg Defence & Aerospace

ASELSAN

Rafael Advanced Defense Systems

Elbit Systems

BAE Systems

Leonardo

Hanwha Defense

Denel Dynamics

EDGE Group

- Military users emphasize rapid response and mobility

- Air defense forces prioritize network integration and reliability

- Infrastructure operators focus on continuous area protection

- Security agencies demand counter-UAS effectiveness

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035