Market Overview

Based on a recent historical assessment, the KSA shotgun and rifles market was valued at USD ~ billion, supported primarily by government defense procurement programs, internal security modernization initiatives, and controlled civilian sporting demand. Spending is driven by border security requirements, counterterrorism readiness, and structured defense allocations managed through centralized procurement agencies. Additional demand arises from licensed sporting and hunting activities regulated under strict firearm ownership frameworks, with imports and local assembly both contributing to total market value.

Based on a recent historical assessment, Riyadh and Eastern Province dominate activity due to the concentration of defense ministries, security forces headquarters, and procurement authorities. Riyadh benefits from policy-making proximity, contract administration, and centralized logistics hubs supporting national security forces. The Eastern Province gains importance from industrial infrastructure, port access, and defense manufacturing clusters supporting assembly and maintenance operations. International suppliers from the United States, Europe, and select Asian countries remain influential due to technology transfer agreements and long-standing defense relationships.

Market Segmentation

By Product Type

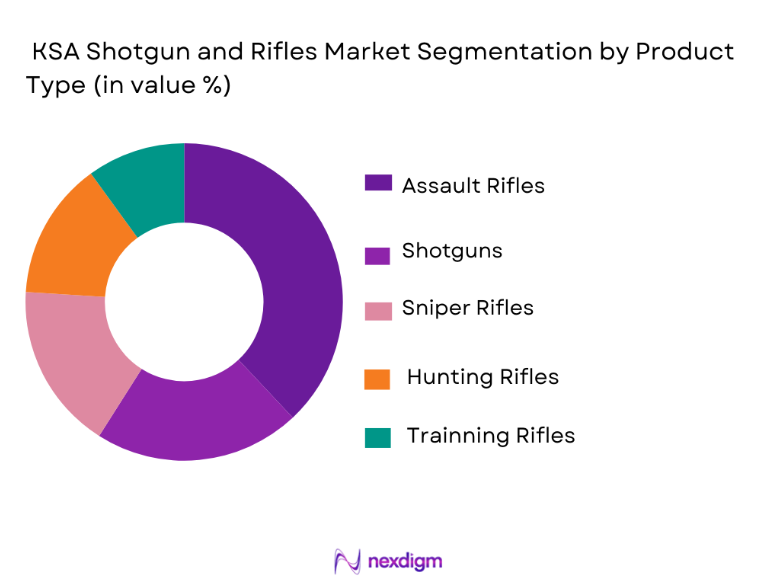

KSA shotgun and rifles market is segmented by product type into shotguns, assault rifles, sniper rifles, hunting rifles, and training rifles. Recently, assault rifles have a dominant market share due to sustained procurement by military and internal security forces, standardized weapon platform policies, and compatibility with existing ammunition and training systems. Assault rifles are favored for their adaptability across border security, counterterrorism, and rapid response operations. Government preference for modular platforms with upgrade potential further strengthens demand. Long-term supply contracts, lifecycle maintenance agreements, and interoperability with allied forces reinforce dominance. Centralized procurement reduces fragmentation, favoring proven assault rifle platforms over niche firearm categories.

By Platform Type

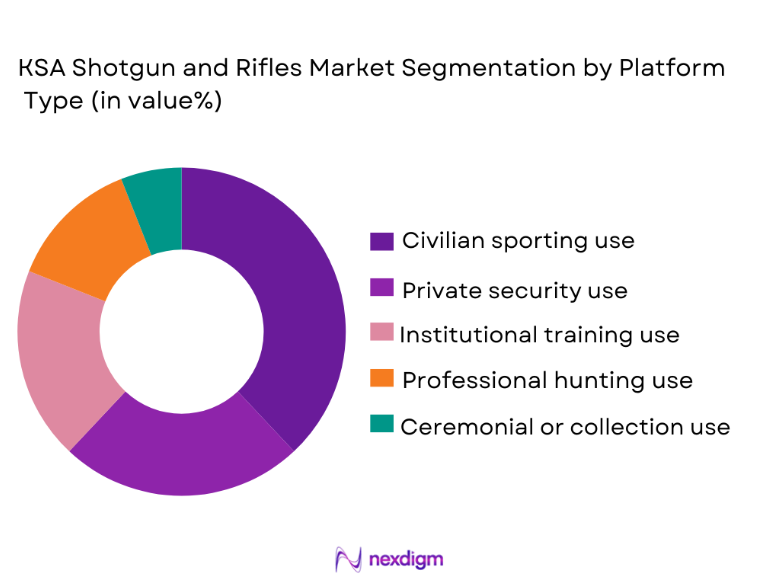

KSA shotgun and rifles market is segmented by platform type into civilian sporting use, private security use, institutional training use, professional hunting use, and ceremonial or collection use. Recently, civilian sporting use had a dominant market share due to increasing participation in regulated shooting sports, expansion of licensed firing ranges, and government-supported recreational frameworks. Civilian sporting platforms benefit from consistent consumer demand driven by hobbyist shooters, organized competitions, and club-based memberships. These platforms typically emphasize accuracy, durability, and customization, leading to higher per-unit spending on firearms and accessories. Regulatory clarity around sporting ownership has encouraged compliance-driven purchasing rather than informal alternatives. Retailers and distributors actively promote sporting-use platforms due to predictable turnover and lower regulatory risk. The rise of youth training programs and professional coaching ecosystems further sustains demand, ensuring civilian sporting use remains the most stable and scalable platform segment.

Competitive Landscape

The KSA shotgun and rifles market is moderately consolidated, with a limited number of international defense manufacturers dominating supply through long-term government contracts and authorized local partners. Major players benefit from established compliance with Saudi defense standards, localized support facilities, and technology transfer agreements. Competitive intensity is shaped by procurement regulations, offset requirements, and the ability to provide lifecycle support rather than price competition alone.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Local Partnership Presence |

| FN Herstal | 1889 | Belgium | ~ | ~ | ~ | ~ | ~ |

| Heckler & Koch | 1949 | Germany | ~ | ~ | ~ | ~ | ~ |

| Beretta | 1526 | Italy | ~ | ~ | ~ | ~ | ~ |

| SIG Sauer | 1853 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Colt | 1836 | United States | ~ | ~ | ~ | ~ | ~ |

KSA Shotgun and Rifles Market Analysis

Growth Drivers

Defense Modernization and Border Security Expansion

Defense modernization and border security expansion remain a core growth driver for the KSA shotgun and rifles market due to sustained national security priorities and evolving regional threat perceptions. The government continues to allocate substantial defense budgets toward upgrading infantry weaponry to ensure operational readiness across land borders and urban security zones. Shotguns and rifles remain essential tools for patrol units, rapid response teams, and border guards requiring reliability and adaptability. Procurement strategies emphasize standardized platforms to simplify logistics, training, and maintenance across multiple agencies. Increased focus on counterterrorism and critical infrastructure protection further expands demand for advanced rifle systems. Technology requirements such as improved accuracy, modular accessories, and compatibility with surveillance systems influence purchasing decisions. Long-term contracts and framework agreements ensure consistent procurement cycles. This structural commitment to security readiness sustains market growth through predictable institutional demand.

Localization and Defense Industry Development Programs

Localization and defense industry development programs significantly drive growth by encouraging domestic assembly, maintenance, and partial manufacturing of firearms within Saudi Arabia. National industrial strategies prioritize reducing import dependency while enhancing supply chain resilience for critical defense equipment. International manufacturers are incentivized to establish local partnerships, training centers, and production lines to comply with offset requirements. These initiatives increase procurement attractiveness by aligning acquisitions with national economic diversification goals. Localized operations also shorten delivery timelines and improve lifecycle support availability. Workforce development programs enhance technical skills related to weapons maintenance and quality control. Government-backed industrial zones provide infrastructure support for defense manufacturing activities. This ecosystem expansion strengthens long-term demand and embeds the market within broader industrial policy objectives.

Market Challenges

Stringent Regulatory Controls and Import Compliance Requirements

Stringent regulatory controls and import compliance requirements present a significant challenge for the KSA shotgun and rifles market due to strict oversight of firearms acquisition and ownership. Government authorities impose detailed licensing, end-user certification, and usage monitoring protocols to prevent misuse and unauthorized distribution. These controls extend to manufacturers and suppliers, requiring extensive documentation and approval processes. Import regulations mandate compliance with national security standards, slowing procurement timelines. Civilian market participation remains tightly restricted, limiting demand diversification. International suppliers must navigate complex approval frameworks and periodic policy revisions. Compliance costs increase operational burdens for smaller manufacturers. These regulatory complexities constrain market flexibility and slow expansion beyond institutional buyers.

Dependence on Government Procurement Cycles

Dependence on government procurement cycles challenges market stability because demand is heavily concentrated within military and internal security budgets. Procurement decisions are subject to fiscal prioritization, policy shifts, and administrative delays. Any reallocation of defense spending toward alternative capabilities can temporarily reduce firearm acquisition volumes. Limited civilian demand restricts counterbalancing revenue streams. Suppliers face uncertainty in forecasting order volumes and production schedules. Contract delays can impact on cash flow and operational planning. Competitive bidding processes intensify pressure on margins. This reliance on centralized procurement creates vulnerability to policy-driven demand fluctuations.

Opportunities

Local Manufacturing and Assembly Expansion

Local manufacturing and assembly expansion offers a significant opportunity for the KSA shotgun and rifles market as national policies favor domestic defense production. Establishing local assembly lines enables manufacturers to meet offset requirements while enhancing supply reliability. Domestic facilities support faster maintenance, repair, and overhaul services for security forces. Localization improves responsiveness to customization needs specific to Saudi operational environments. Government incentives reduce capital investment risks for international partners. Skilled workforce development supports long-term sustainability of manufacturing operations. Export potential to regional allies may emerge over time. This opportunity aligns commercial growth with national industrial objectives.

Advanced Training and Simulation Integration

Advanced training and simulation integration represents an opportunity by increasing demand for specialized rifles and training firearms compatible with modern training systems. Security forces increasingly adopt live-fire and simulated training environments requiring standardized and durable weapon platforms. Integration with digital targeting, monitoring, and evaluation systems enhances training effectiveness. Procurement of dedicated training rifles reduces wear on frontline weapons. This approach increases overall firearm inventory requirements. Training modernization programs receive consistent funding allocations. Suppliers offering integrated training solutions gain competitive advantage. This trend supports incremental and sustained market growth.

Future Outlook

The KSA shotgun and rifles market is expected to experience steady development over the next five years, supported by sustained defense spending and internal security priorities. Technological enhancements focusing on modularity, durability, and integration with modern training systems will shape procurement decisions. Regulatory frameworks will continue to favor controlled and institutional demand. Localization initiatives are likely to deepen, encouraging greater domestic involvement. Demand will remain driven by operational readiness and strategic security considerations.

Major Players

- FN Herstal

- Heckler & Koch

- Beretta

- SIG Sauer

- Colt

- CZ Group

- Kalashnikov Concern

- Remington Arms

- Mossberg

- Browning

- Ruger

- Smith & Wesson

- IWI

- Steyr Arms

- Norinco

Key Target Audience

- Defense Ministries

- Internal security agencies

- Law enforcement authorities

- Border security forces

- Defense manufacturers

- Authorized arms distributors

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables including product categories, end-user demand, procurement frameworks, and regulatory controls were identified through structured secondary research and policy reviews.

Step 2: Market Analysis and Construction

Data was analyzed to construct market structure, segmentation, and competitive positioning using validated industry and government sources.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through expert consultations with defense analysts, procurement specialists, and industry professionals.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a coherent market model ensuring consistency, accuracy, and relevance to strategic decision-making.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Sustained national defense spending focused on internal security and border protection

Modernization programs replacing legacy small arms with standardized platforms

Increased training and readiness requirements across armed and security forces

Localization initiatives encouraging domestic assembly and maintenance capabilities

Operational demand for reliable close quarter and medium range weapons - Market Challenges

Strict regulatory controls limiting civilian market expansion

Dependence on imported components for high precision systems

Lengthy government procurement cycles affecting supplier cash flows

Compliance costs related to international arms transfer regulations

Limited technology transfer in advanced weapon platforms - Market Opportunities

Expansion of local manufacturing under national industrial strategies

Upgrades and retrofit programs for existing weapon inventories

Aftermarket services including maintenance training and lifecycle support - Trends

Preference for modular weapon designs supporting multiple missions

Rising demand for optics ready and accessory compatible platforms

Focus on durability and performance in harsh desert environments

Integration of training simulators aligned with live weapon systems

Growing emphasis on standardization across force units - Government Regulations & Defense Policy

Tight licensing and end user certification requirements

Defense offset policies promoting local participation

Alignment with international arms control frameworks - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Pump action shotguns

Semi-automatic shotguns

Bolt action rifles

Semi-automatic rifles

Designated marksman rifles - By Platform Type (In Value%)

Infantry small arms

Vehicle mounted weapon support

Training and simulation weapons

Border security patrol weapons

Special operations tactical weapons - By Fitment Type (In Value%)

Standard issue factory fit

Optics ready configurations

Accessory rail integrated fit

Suppressor compatible fit

Ergonomic customized fit - By End User Segment (In Value%)

Military forces

Internal security forces

Border guard agencies

Special operations units

Licensed civilian sporting users - By Procurement Channel (In Value%)

Direct government procurement

Intergovernmental defense agreements

Authorized domestic distributors

Offset based local sourcing

Long term supply contracts - By Material / Technology (in Value %)

Steel based conventional systems

Lightweight alloy framed systems

Polymer composite furniture systems

Precision machined barrel technology

Enhanced durability coating technology

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Product portfolio breadth, compliance certification, local presence, pricing competitiveness, manufacturing capability, aftersales support, contract history, technology partnerships)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Saudi Military Industries

Advanced Defense Systems Saudi Arabia

Zamil Defence Manufacturing

Middle East Propulsion Company

Riyadh Military Industries

Al Esnad Manufacturing

Tawazun Industrial Park KSA Operations

SAMINavant Joint Ventures

Arabian Defence Industries

Desert Shield Arms

Gulf Small Arms Manufacturing

Najd Tactical Systems

Falcon Weapon Systems KSA

Red Sea Defense Solutions

Arabian Precision Arms

- Military users prioritize reliability, standardization, and interoperability across units

- Internal security agencies focus on close range effectiveness and rapid deployment

- Border security forces emphasize durability and ease of maintenance in remote areas

- Civilian sporting users remain niche and highly regulated with controlled demand

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035