Market Overview

The KSA shoulder fired weapons market recorded an estimated market size of USD~ billion based on a recent historical assessment, supported by official defense expenditure disclosures, arms import registers, and procurement contract values published by the Saudi Ministry of Defense and SIPRI databases. The market is driven by sustained investments in infantry modernization, rising demand for man-portable air defense and anti-armor systems, and large-scale procurement programs aligned with national defense transformation initiatives. Additional demand is generated by replacement cycles of legacy systems, expanding force readiness requirements, and integration of advanced guidance and fire-and-forget technologies across ground combat units.

The market is dominated by Saudi Arabia as the sole national market, with Riyadh emerging as the central procurement and command hub due to the presence of defense ministries, acquisition authorities, and strategic planning bodies. Industrial activity is concentrated around Riyadh, Jeddah, and Dhahran due to proximity to military bases, logistics corridors, and defense manufacturing clusters. Dominance is reinforced by strong government-backed localization policies, strategic partnerships with global defense of OEMs, and centralized procurement mechanisms supporting large-volume, long-term acquisition programs.

Market Segmentation

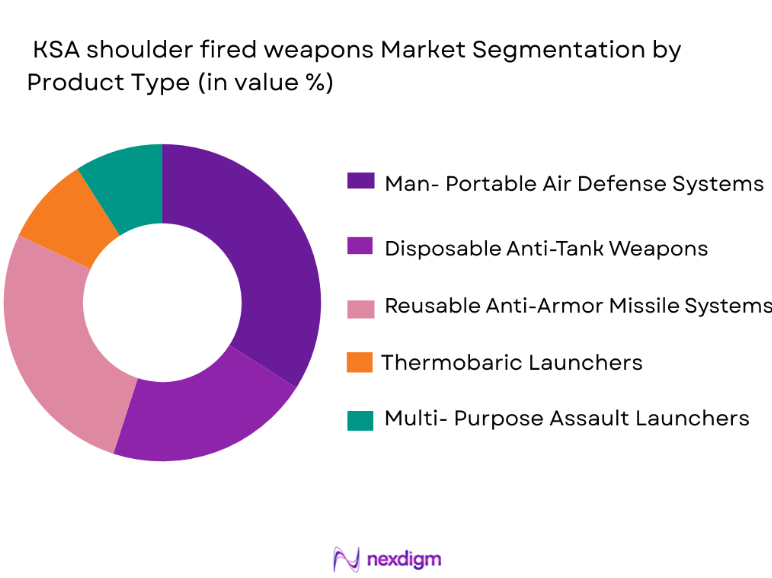

By Product Type

KSA shoulder fired weapons market is segmented by product type into man-portable air defense systems, disposable anti-tank weapons, reusable anti-armor missile systems, thermobaric launchers, and multi-purpose assault launchers. Recently, man-portable air defense systems have held a dominant market share due to increasing emphasis on countering low-altitude aerial threats, unmanned aerial systems, and rotary-wing platforms operating near borders and critical infrastructure. The dominance is supported by sustained procurement programs focused on layered air defense, rising deployment of short-range systems for rapid response units, and strong interoperability requirements with allied forces. Additionally, these systems benefit from higher unit costs, advanced seeker technologies, and recurring upgrade cycles, which collectively elevate their value contribution. Government prioritization of force survivability, rapid mobility, and battlefield flexibility further reinforces their leading position

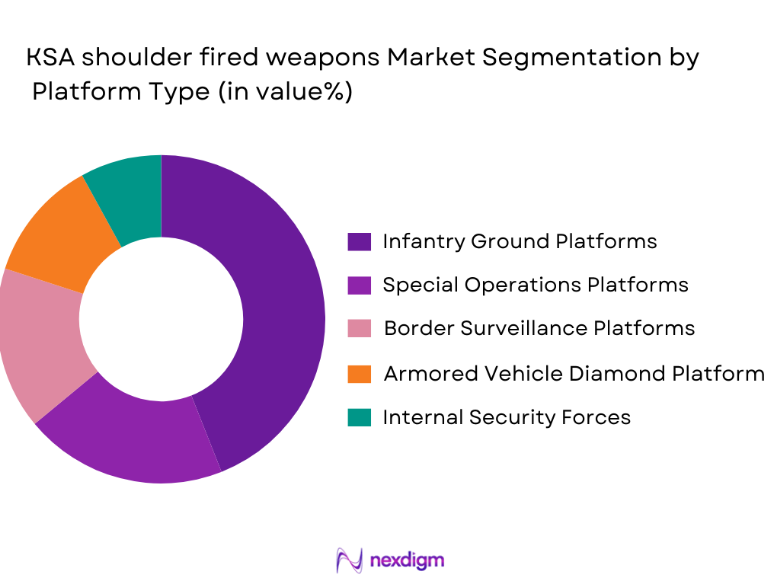

By Platform Type

KSA shoulder fired weapons market is segmented by platform type into infantry ground platforms, special operations platforms, border surveillance platforms, armored vehicle dismounted platforms, and naval boarding platforms. Recently, infantry ground platforms have had a dominant market share due to their central role in conventional land warfare, border defense operations, and rapid deployment missions. Saudi ground forces rely heavily on infantry formations as the primary users of shoulder fired weapons, supported by standardized training, doctrine alignment, and logistical infrastructure. High troop density, continuous readiness cycles, and frequent field exercises reinforce sustained demand from infantry units. Additionally, infantry platforms offer operational flexibility across urban, desert, and mountainous environments, making them more versatile than specialized or maritime platforms. Integration with ground-based command systems and ease of deployment further consolidate their dominance within overall procurement planning.

Competitive Landscape

The KSA shoulder fired weapons market is moderately consolidated, characterized by the presence of a limited number of global defense primes operating alongside emerging domestic manufacturers. Market dynamics are shaped by government-to-government contracts, offset obligations, and long-term framework agreements, which favor established players with proven combat systems and strong localization capabilities. Major companies exert significant influence through technology transfer partnerships, licensed production, and sustainment support, while domestic entities are expanding their roles across assembly, testing, and lifecycle management.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Localization Capability |

| Saudi Arabian Military Industries | 2017 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| Advanced Electronics Company | 1988 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ |

| Saab Dynamics | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ |

KSA Shoulder Fired Weapons Market Analysis

Growth Drivers

Infantry Modernization and Force Readiness Programs

Infantry modernization and force readiness programs represent a primary growth driver for the KSA shoulder fired weapons market due to their direct linkage with national defense transformation priorities and evolving operational doctrines. The Saudi defense establishment has placed strong emphasis on equipping infantry units with modern, mobile, and highly effective weapon systems capable of responding to asymmetric threats and high-intensity conflict scenarios. This driver is reinforced by continuous procurement cycles supporting new brigade formations, replacement of aging legacy systems, and alignment with advanced battlefield concepts. Investment focus includes improved lethality, reduced operator exposure, and enhanced accuracy under diverse environmental conditions. These programs are further supported by structured training, simulation, and sustainment initiatives that increase system utilization rates. Integration of shoulder fired weapons into combined arms operations has expanded their role beyond traditional infantry use. As force readiness metrics to gain importance, demand for reliable and rapidly deployable systems continues to rise. The strategic objective of maintaining a technologically superior and combat-ready ground force ensures sustained acquisition of momentum across this segment.

Regional Security Environment and Border Protection Requirements

The regional security environment and border protection requirements significantly drive demand for shoulder fired weapons by increasing the need for mobile, short-range defensive capabilities. Saudi Arabia’s extensive land borders and critical infrastructure assets require rapid-response systems capable of neutralizing armored vehicles, low-flying aircraft, and unmanned platforms. Shoulder fired weapons offer cost-effective, flexible solutions suited for dispersed deployments across challenging terrain. Heightened vigilance along borders and key installations has led to sustained procurement of man-portable systems supporting patrol units and rapid reaction forces. This driver is strengthened by operational lessons emphasizing decentralized firepower and autonomy at the unit level. Increased emphasis on counter-drone and low-altitude air defense further expands application areas. As regional threat dynamics remain complex, these requirements continue to influence procurement priorities. The result is consistent demand across multiple weapon categories within this market.

Market Challenges

Dependence on Foreign Technology and Supply Chains

Dependence on foreign technology and supply chains presents a critical challenge for the KSA shoulder fired weapons market by limiting full operational autonomy and increasing exposure to geopolitical constraints. Many advanced guidance systems, seekers, and propulsion technologies are sourced from international suppliers, creating vulnerabilities related to export controls and licensing restrictions. This dependence complicates procurement planning and can delay system upgrades or replenishment cycles. While localization initiatives are progressing, achieving complete technology sovereignty remains complex and capital intensive. Supply chain disruptions can also affect maintenance and spare parts availability, impacting operational readiness. The challenge is amplified by the need to integrate foreign systems with domestic command and control frameworks. Regulatory compliance across multiple jurisdictions further increases administrative complexity. Addressing this challenge requires sustained investment, long-term partnerships, and gradual capability transfer.

High Lifecycle Costs and Sustainment Complexity

High lifecycle costs and sustainment complexity pose a significant challenge due to the advanced nature of modern shoulder-fired weapon systems. Beyond acquisition costs, expenses related to training, storage, maintenance, and periodic upgrades place pressure on defense budgets. Sophisticated systems require specialized handling, environmental controls, and skilled personnel to maintain performance standards. Sustainment complexity increases in harsh operating conditions, where temperature extremes and sand exposure accelerate wear. Logistics planning must account for ammunition shelf life and system certification requirements. These factors complicate long-term cost forecasting and procurement optimization. Balancing capability enhancement with cost control remains a persistent challenge for defense planners. Effective lifecycle management strategies are therefore critical but resource intensive.

Opportunities

Defense Localization and Licensed Production Expansion

Defense localization and licensed production expansion present a major opportunity for the KSA shoulder fired weapons market by enabling domestic value creation and capability development. Government-backed initiatives encourage international OEMs to establish local assembly, testing, and maintenance operations. This approach reduces dependency on imports while building skilled labor and industrial infrastructure. Localization also enhances supply chain resilience and shortens delivery timelines. Opportunities extend to component manufacturing, system integration, and lifecycle support services. Over time, localized production can support export ambitions to regional allies. These developments align with national industrial diversification goals. As localization depth increases, the market is expected to benefit from improved cost efficiency and strategic autonomy.

Integration with Digital Battlefield and Soldier Systems

Integration with digital battlefield and soldier systems offers a significant growth opportunity by enhancing the effectiveness and relevance of shoulder fired weapons. Modern combat environments increasingly rely on networked sensors, data sharing, and real-time targeting information. Shoulder fired systems integrated with digital soldier platforms can achieve higher accuracy and faster engagement cycles. This opportunity supports demand for upgraded fire control units and smart munitions. Integration also enables interoperability across joint forces and allied operations. Enhanced situational awareness improves survivability and mission success rates. As digital transformation progresses, demand for compatible weapon systems is expected to rise. This creates opportunities for system upgrades and new procurement programs.

Future Outlook

The KSA shoulder fired weapons market is expected to maintain steady growth over the next five years, supported by continued defense modernization, localization initiatives, and evolving security requirements. Technological advancements in guidance systems, lightweight materials, and digital integration will shape procurement priorities. Regulatory support for domestic manufacturing and offset programs will strengthen local industry participation. Demand is likely to remain robust across ground forces, border security, and special operations units.

Major Players

- Saudi Arabian Military Industries

- Advanced Electronics Company

- Lockheed Martin

- Raytheon Technologies

- Saab Dynamics

- MBDA

- Rafael Advanced Defense Systems

- Thales Group

- Denel Dynamics

- Roketsan

- Hanwha Defense

- Nammo

- L3Harris Technologies

- Northrop Grumman

- General Dynamics

Key Target Audience

- Defense ministries and armed forces

- Government and regulatory bodies

- Investments and venture capitalist firms

- Defense OEMs and system integrators

- Ammunition and missile manufacturers

- Defense logistics and sustainment firms

- Security and border protection agencies

- Strategic policy and procurement authorities

Research Methodology

Step 1: Identification of Key Variables

Key variables including system types, procurement volumes, pricing structures, and end-user demand were identified through defense databases and official procurement disclosures.

Step 2: Market Analysis and Construction

Market structure was constructed using historical contract values, arms transfer records, and validated defense expenditure data.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert consultations with defense analysts, industry specialists, and regional security observers.

Step 4: Research Synthesis and Final Output

All insights were synthesized into a structured market model ensuring accuracy, consistency, and relevance to stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Infantry modernization and force readiness enhancement

Rising regional security threats and border protection needs

Government-backed defense localization initiatives - Market Challenges

Dependence on foreign technology for critical subsystems

High lifecycle costs and sustainment complexity

Regulatory and offset compliance requirements - Market Opportunities

Expansion of licensed local manufacturing and assembly

Upgrades and retrofitting of legacy weapon systems

Integration with digital battlefield and soldier systems - Trends

Increased adoption of fire-and-forget technologies

Growing use of lightweight composite materials

Demand for multi-role and adaptable weapon systems

Emphasis on interoperability with allied forces

Focus on lifecycle support and sustainment services - Government Regulations & Defense Policy

Strengthening of defense localization mandates

Tightening of export control and technology transfer rules

Alignment of procurement with national industrial strategy - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Man-Portable Air Defense Systems

Disposable Anti-Tank Weapons

Reusable Anti-Armor Missile Systems

Thermobaric Shoulder Fired Weapons

Multi-Purpose Assault Launchers - By Platform Type (In Value%)

Infantry-Deployed Systems

Special Forces-Deployed Systems

Vehicle-Carried Portable Launchers

Border Security Deployment Units

Rapid Reaction Force Equipment - By Fitment Type (In Value%)

Standalone Man-Portable Systems

Tripod-Assisted Portable Systems

Vehicle-Assisted Portable Systems

Integrated Targeting Fitments

Modular Configurable Fitments - By EndUser Segment (In Value%)

Army Ground Forces

Special Operations Forces

Royal Guard Units

Border Security Forces

Internal Security Forces - By Procurement Channel (In Value%)

Direct Government Procurement

Government-to-Government Agreements

Licensed Local Production Contracts

Offset-Based Acquisition Programs

Urgent Operational Requirement Purchases - By Material / Technology (in Value %)

Composite Launcher Structures

Advanced Propellant Technologies

Infrared and Imaging Guidance Units

Fire-and-Forget Missile Technology

Enhanced Warhead and Fuse Materials

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (system range, guidance technology, system weight, reload capability, localization level, lifecycle cost, interoperability, delivery lead time)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Saudi Arabian Military Industries

Advanced Electronics Company

Lockheed Martin

Raytheon Technologies

Saab Dynamics

MBDA

Rafael Advanced Defense Systems

Thales Group

Denel Dynamics

Roketsan

Hanwha Defense

Nammo

L3Harris Technologies

Northrop Grumman

General Dynamics

- Army units prioritize versatility and large-scale deployment capability

- Special forces demand lightweight and high-precision systems

- Border security forces focus on reliability in harsh environments

- Internal security units emphasize ease of operation and safety

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035