Market Overview

Based on a recent historical assessment, the KSA Small Caliber Ammunition market was valued at USD ~ billion, supported by sustained defense procurement allocations, internal security modernization programs, and continuous ammunition consumption for training and operational readiness. Demand is driven by large standing armed forces, recurring replenishment cycles, and heightened border security operations. Domestic manufacturing initiatives under national localization programs further support procurement volumes, while long-term supply contracts ensure stability. This valuation is supported by defense expenditure disclosures, procurement briefings, and arms trade assessments published by SIPRI and official Saudi defense and industrial authorities.

Based on a recent historical assessment, Saudi Arabia dominates the small caliber ammunition landscape within the Gulf region, with Riyadh functioning as the central command, procurement, and coordination hub due to the presence of defense ministries, military headquarters, and ammunition production facilities. Jeddah supports the market through its strategic port infrastructure, enabling inbound logistics of raw materials and components. The Eastern Province contributes through industrial zones and defense manufacturing clusters. Dominance is reinforced by centralized defense budgeting, localization mandates, and sustained demand from land forces, national guard units, and internal security agencies.

Market Segmentation

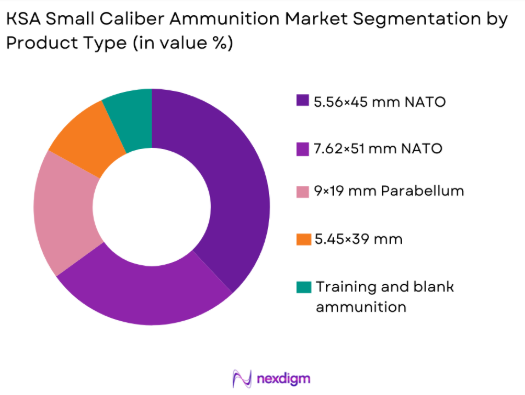

By Product Type

KSA Small Caliber Ammunition market is segmented by product type into 5.56×45 mm NATO, 7.62×51 mm NATO, 9×19 mm Parabellum, 12.7×99 mm, and training and blank ammunition. Recently, 5.56×45 mm NATO ammunition has a dominant market share due to its standardization across assault rifles deployed by Saudi land forces and internal security units. This caliber supports high-volume training cycles, interoperability with allied platforms, and compatibility with domestically assembled rifles. Localization initiatives prioritize this ammunition type to secure supply continuity, reduce import dependence, and support sustained operational readiness across multiple force branches.

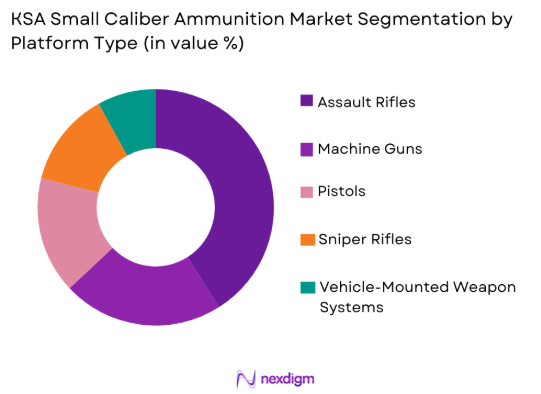

By Platform Type

KSA Small Caliber Ammunition market is segmented by platform type into assault rifles, machine guns, sniper rifles, pistols, and vehicle-mounted weapon systems. Recently, assault rifles had a dominant market share due to their extensive deployment across army, national guard, and internal security forces. High personnel strength, routine live-fire training requirements, and continuous modernization of infantry equipment sustain ammunition consumption for this platform. Assault rifles are central to border security, counterterrorism operations, and urban security missions, leading procurement authorities to prioritize ammunition compatibility, availability, and lifecycle supply assurance for these platforms.

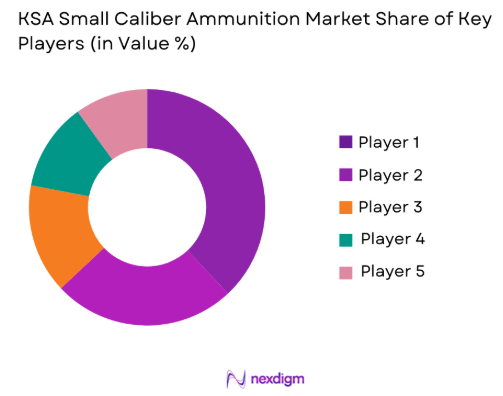

Competitive Landscape

The competitive landscape of the KSA Small Caliber Ammunition market is moderately consolidated, shaped by a mix of state-backed domestic manufacturers and international defense firms operating through joint ventures and localization agreements. Market influence is concentrated among players aligned with national defense strategies, benefiting from long-term government contracts and technology transfer frameworks. Localization policies limit open competition while favoring established partners with proven compliance, quality assurance capabilities, and secure supply chains, resulting in high entry barriers and stable competitive positioning.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Localization Capability |

| Saudi Arabian Military Industries | 2017 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall Denel Munitions Saudi Arabia | 2016 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| Advanced Electronics Company | 1988 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| BAE Systems Saudi Arabia | 1985 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| Nammo Middle East | 2019 | UAE | ~ | ~ | ~ | ~ | ~ |

KSA Small Caliber Ammunition Market Analysis

Growth Drivers

Defense Localization and Industrial Expansion Mandates

Defense localization and industrial expansion mandates represent a central growth driver for the KSA Small Caliber Ammunition market because national policy frameworks prioritize sovereign control over critical military consumables. Government programs encourage domestic production through joint ventures, offset obligations, and technology transfer agreements that directly benefit ammunition manufacturing facilities. Small caliber ammunition is categorized as a high-consumption and operationally critical item, making it a priority for localization compared to complex weapon platforms. Long-term procurement commitments issued by defense authorities provide predictable demand signals that justify capital investment in production lines, quality assurance systems, and skilled labor development. Localization reduces exposure to geopolitical supply disruptions and import restrictions that historically affected ammunition availability. Domestic production also enables faster replenishment cycles, which is essential for training-intensive armed forces. Industrial clustering around defense zones improves cost efficiency and supply coordination. Regulatory preference for locally produced ammunition further reinforces procurement volumes. Collectively, these factors structurally expand market size and provide sustained growth momentum.

Sustained Operational Readiness and Training Consumption Requirements

Sustained operational readiness and training consumption requirements are a major growth driver for the KSA Small Caliber Ammunition market due to the scale and structure of Saudi Arabia’s armed forces and internal security organizations. Large personnel strength across army, national guard, and security forces necessitates frequent live-fire exercises to maintain proficiency. Training doctrines emphasize realistic engagement scenarios, which significantly increase ammunition expenditure per soldier compared to basic qualification programs. Continuous border security operations and counterterrorism readiness further elevate consumption beyond routine training needs. Ammunition replenishment cycles are institutionalized within defense budgeting frameworks, ensuring recurring procurement regardless of platform acquisition cycles. Standardization of calibers across service branches amplifies volume demand for specific ammunition types. Even during periods of reduced equipment procurement, training ammunition demand remains stable due to non-discretionary readiness requirements. Operational lessons learned drive incremental increases in training intensity and ammunition usage. This structurally embedded consumption pattern ensures a consistent and resilient demand base for the market.

Market Challenges

Dependence on Imported Raw Materials and Critical Inputs

Dependence on imported raw materials and critical inputs is a major challenge for the KSA Small Caliber Ammunition market because core components such as brass, copper, propellants, and primer chemicals are not fully available through domestic upstream industries. Despite progress in localized assembly and manufacturing, the supply chain for raw inputs remains exposed to international trade restrictions, shipping disruptions, and supplier concentration risks. Global commodity price volatility directly affects ammunition production costs, creating budgeting uncertainties for both manufacturers and government procurement agencies. Import licensing requirements and hazardous material regulations add further complexity to sourcing timelines and inventory management. Any disruption in raw material availability can cascade into delayed deliveries, affecting training schedules and operational readiness. Strategic stockpiling provides partial mitigation but increases carrying costs and storage compliance burdens. Currency fluctuations introduce additional cost pressure when procurement contracts are denominated in foreign currencies. Limited domestic alternatives restrict supplier diversification strategies. Overcoming this challenge requires long-term investment in metallurgical, chemical, and energetic material ecosystems, which involves high capital intensity, extended development timelines, and regulatory approvals.

Stringent Regulatory Compliance and Military Quality Assurance Standards

Stringent regulatory compliance and military quality assurance standards pose a significant challenge for participants in the KSA Small Caliber Ammunition market because ammunition is classified as a safety-critical and mission-critical product. Manufacturers must comply with rigorous military specifications, ballistic performance criteria, and environmental safety standards before products are approved for use. Certification processes involve extensive testing, batch validation, and documentation, which increase production lead times and operational costs. Continuous audits by defense authorities require dedicated compliance infrastructure and specialized technical personnel. Any deviation in quality can result in batch rejection, reputational damage, and contractual penalties. Export controls and technology transfer restrictions further complicate equipment sourcing and process optimization. Smaller or newer manufacturers face high entry barriers due to the cost of meeting compliance thresholds. Frequent updates to military standards require ongoing reinvestment in testing equipment and quality systems. While these regulations are essential for operational safety and reliability, they increase complexity, reduce production flexibility, and place sustained pressure on margins across the market.

Opportunities

Export-Oriented Ammunition Manufacturing and Regional Supply Expansion

Export-oriented ammunition manufacturing and regional supply expansion represent a significant opportunity for the KSA Small Caliber Ammunition market as domestic production capacity, quality standards, and compliance maturity continue to improve. Saudi Arabia maintains strategic defense relationships with multiple regional and allied countries that require reliable sources of NATO-standard small caliber ammunition. As global supply chains remain sensitive to geopolitical disruptions, buyers increasingly favor politically aligned and logistically stable suppliers. Locally produced ammunition can leverage government-backed export facilitation mechanisms, defense cooperation agreements, and offset-linked trade frameworks to access regional markets. Export demand improves capacity utilization rates for domestic factories, reducing per-unit production costs and enhancing competitiveness. Compliance with international military standards enables participation in foreign tenders and long-term supply contracts. Export diversification also reduces reliance on domestic procurement cycles, stabilizing revenue streams for manufacturers. Scale efficiencies achieved through higher production volumes support reinvestment in advanced manufacturing technologies. This opportunity aligns with national objectives to expand defense exports and position Saudi Arabia as a regional hub for military consumables.

Advanced Ammunition Technology Development and Specialization

Advanced ammunition technology development and specialization offer a strong opportunity for value creation within the KSA Small Caliber Ammunition market as end users increasingly demand performance-enhanced and mission-specific rounds. Modern military operations require ammunition with improved penetration, accuracy, and controlled terminal effects to address diverse operational environments. Special operations units and internal security forces seek specialized rounds such as armor-piercing, reduced-collateral, and environmentally compliant ammunition. Technology transfer agreements enable domestic manufacturers to absorb advanced projectile design, propellant optimization, and casing technologies. Investment in research and development supports differentiation from basic commodity ammunition suppliers. Advanced products command higher procurement value and strengthen supplier positioning in competitive tenders. Integration of digital quality tracking and smart logistics improves lifecycle management and traceability. Specialized ammunition supports operational effectiveness and training realism. By focusing on technological specialization, manufacturers can move up the value chain, enhance margins, and support long-term competitiveness within both domestic and export markets.

Future Outlook

The KSA Small Caliber Ammunition market is expected to experience steady expansion over the next five years, supported by sustained defense spending priorities and localization-driven industrial growth. Technological upgrades in ammunition design and quality assurance are anticipated to improve operational performance. Regulatory support for domestic manufacturing will continue to strengthen supply security. Demand-side factors such as training intensity, border security requirements, and force modernization will collectively sustain consumption levels.

Major Players

- Saudi Arabian Military Industries

- Rheinmetall Denel Munitions Saudi Arabia

- Advanced Electronics Company

- BAE Systems Saudi Arabia

- Nammo Middle East

- Thales Saudi Arabia

- General Dynamics Saudi Arabia

- Northrop Grumman Saudi Arabia

- Poongsan Defense Saudi Arabia

- CBC Global Ammunition Saudi Arabia

- Zamil Defence Manufacturing

- Chemring Saudi Arabia

- Denel Saudi Arabia

- Edge Group Saudi Operations

- Milipol Advanced Industries

Key Target Audience

- Defense ministries

- Armed forces procurement departments

- Internal security agencies

- Border security forces

- Defense manufacturing companies

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense exporters and suppliers

Research Methodology

Step 1: Identification of Key Variables

The research identifies core variables including ammunition types, procurement volumes, manufacturing capacity, and regulatory frameworks. Data points are mapped across defense, industrial, and security domains. Variable relevance is validated through defense documentation. This step establishes the analytical foundation.

Step 2: Market Analysis and Construction

Collected data is structured to define market boundaries and segmentation. Demand and supply interactions are assessed across end users. Historical procurement patterns are analyzed for consistency. Market structure is constructed using verified sources.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings are validated through expert consultations and defense industry insights. Assumptions are tested against official disclosures. Contradictions are reconciled through triangulation. This ensures analytical accuracy.

Step 4: Research Synthesis and Final Output

Validated insights are synthesized into a coherent market narrative. Quantitative and qualitative findings are integrated. Consistency checks are applied across sections. The final report reflects verified, policy-aligned conclusions.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising defense spending and modernization initiatives

Expansion of domestic ammunition manufacturing capacity

Ongoing military readiness and training requirements

Border security and internal threat mitigation focus

Localization policies under national industrial strategies - Market Challenges

High dependency on imported raw materials

Stringent regulatory and licensing requirements

Supply chain vulnerabilities for critical components

Quality assurance and standardization complexities

Cost pressures from advanced projectile technologies - Market Opportunities

Local production partnerships with global OEMs

Technology transfer for advanced ammunition types

Export potential to regional allied forces - Trends

Shift toward locally manufactured ammunition

Adoption of improved ballistic and penetration designs

Focus on interoperability with NATO standard calibers

Increased use of training and simulation ammunition

Integration of smart logistics and inventory systems - Government Regulations & Defense Policy

Defense localization and offset mandates

Strict compliance with military standards and certifications

Controlled export and import regulations

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

5.56×45 mm NATO ammunition

7.62×51 mm NATO ammunition

9×19 mm Parabellum ammunition

12.7×99 mm ammunition

Training and blank ammunition - By Platform Type (In Value%)

Assault rifles

Machine guns

Sniper rifles

Pistols

Light armored weapon systems - By Fitment Type (In Value%)

Man portable weapons

Vehicle mounted weapon systems

Naval weapon stations

Fixed defense installations

Training and simulation systems - By End User Segment (In Value%)

Army forces

National guard

Internal security forces

Special operations units

Law enforcement agencies - By Procurement Channel (In Value%)

Direct government procurement

Local licensed manufacturing contracts

Foreign military sales programs

Defense offset agreements

Emergency and replenishment procurement - By Material / Technology (in Value %)

Brass cased ammunition

Steel cased ammunition

Lead core projectiles

Armor piercing projectiles

Enhanced ballistic performance rounds

- Market share snapshot of major players

- Cross Comparison Parameters (caliber range, production capacity, localization level, technology capability, quality standards, government contracts, supply reliability, cost competitiveness, export readiness)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Saudi Arabian Military Industries

Advanced Electronics Company

Rheinmetall Denel Munitions Saudi Arabia

Zamil Defence Manufacturing

Milipol Advanced Industries

BAE Systems Saudi Arabia

Denel Saudi Arabia

Chemring Saudi Arabia

Nammo Middle East

Thales Saudi Arabia

General Dynamics Ordnance Saudi Programs

Northrop Grumman Saudi Arabia

Edge Group Saudi Operations

Poongsan Defense Saudi Arabia

CBC Global Ammunition Saudi Arabia

- Military forces prioritize reliability and interoperability

- Internal security units emphasize urban combat suitability

- Special forces demand precision and specialized rounds

- Law enforcement focuses on controlled penetration ammunition

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035