Market Overview

Based on a recent historical assessment, the KSA small UAV market was valued at USD ~ billion, driven by sustained defense modernization spending, heightened border security requirements, and increasing reliance on unmanned systems for intelligence, surveillance, and reconnaissance missions. Procurement momentum is reinforced by the need for rapid situational awareness across vast land borders and critical infrastructure zones. Continuous adoption of small UAVs for force protection, patrol, and monitoring roles, combined with investments in secure communications and autonomous capabilities, supports steady demand across defense and government agencies.

Based on a recent historical assessment, Riyadh, Jeddah, and Dhahran emerged as dominant centers within the KSA small UAV market due to the concentration of defense procurement authorities, operational command centers, and key military bases. These cities host planning, integration, training, and deployment activities for unmanned systems. Proximity to border regions, coastal security zones, and strategic infrastructure accelerates operational deployment. Strong coordination between the Ministry of Defense, security forces, and domestic industrial partners further reinforces national dominance in small UAV adoption and sustainment.

Market Segmentation

By Product Type

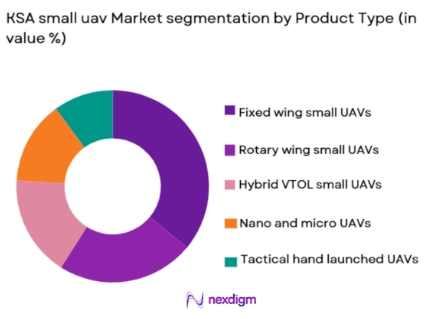

KSA small UAV market is segmented by product type into fixed wing small UAVs, rotary wing small UAVs, hybrid VTOL small UAVs, nano and micro UAVs, and tactical hand launched UAVs. Recently, fixed wing small UAVs have a dominant market share due to their longer endurance, extended operational range, and suitability for persistent border and area surveillance missions. These platforms are well suited for monitoring large desert expanses and critical infrastructure corridors. Lower operating costs, efficient aerodynamics, and compatibility with electro-optical and infrared payloads enhance adoption. Strong availability from international suppliers and increasing local assembly capability further reinforce preference. Operational familiarity and integration with existing command systems sustain dominant deployment across defense and security users.

By End User

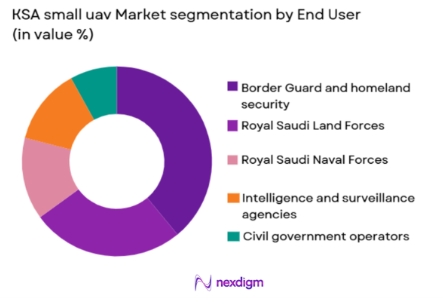

KSA small UAV market is segmented by end user segment into Royal Saudi Land Forces, Royal Saudi Naval Forces, Border Guard and homeland security agencies, intelligence and surveillance organizations, and civil government operators. Recently, Border Guard and homeland security agencies have a dominant market share due to extensive requirements for continuous border monitoring and intrusion detection. Small UAVs enable rapid deployment along remote and challenging terrains. Persistent ISR capability supports early warning and response. Integration with ground sensors and command centers enhances effectiveness. High operational tempo and sustained procurement programs reinforce dominant demand from border and internal security forces.

Competitive Landscape

The KSA small UAV market is moderately consolidated, shaped by international UAV manufacturers working alongside emerging domestic defense companies under localization initiatives. Major players benefit from government-backed procurement, technology transfer agreements, and long-term sustainment contracts, creating competitive advantages and high entry barriers.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Localization Activity |

| Saudi Arabian Military Industries | 2017 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ |

| Advanced Electronics Company | 1988 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ |

| Israel Aerospace Industries | 1953 | Lod, Israel | ~ | ~ | ~ | ~ | ~ |

| Baykar Technologies | 1984 | Istanbul, Türkiye | ~ | ~ | ~ | ~ | ~ |

| AeroVironment | 1971 | Virginia, USA | ~ | ~ | ~ | ~ | ~ |

The KSA Small UAV Market Analysis

Growth Drivers

Border Security and Internal Surveillance Requirements:

Border security and internal surveillance requirements are a primary growth driver for the KSA small UAV market as Saudi Arabia manages extensive land borders and critical infrastructure. Small UAVs provide cost-effective persistent monitoring across remote regions. Rapid deployment enhances response capability against infiltration and smuggling threats. Integration with ground sensors improves detection accuracy. Real-time data transmission supports command decisions. Reduced reliance on manned patrols lowers operational risk. Sustained homeland security funding supports continuous procurement. These factors collectively reinforce long-term demand growth.

Defense Modernization and Unmanned Force Expansion:

Defense modernization and unmanned force expansion significantly drive the KSA small UAV market as the armed forces adopt network-centric operations. Small UAVs enhance situational awareness at tactical levels. Integration with digital command systems improves coordination. Autonomous capabilities reduce operator workload. Miniaturized sensors expand mission versatility. Training infrastructure investments accelerate adoption. Interoperability with allied systems supports joint operations. These developments sustain replacement and fleet expansion cycles.

Market Challenges

Airspace Management and Regulatory Constraints:

Airspace management and regulatory constraints present a significant challenge for the KSA small UAV market as UAV density increases. Coordination with civil aviation authorities is required. Restricted zones limit training flexibility. Regulatory compliance adds administrative burden. Urban deployment raises safety considerations. Licensing processes can delay operations. Balancing security and aviation safety is complex. These factors may slow deployment scaling.

Electronic Warfare and Counter-UAV Vulnerabilities:

Electronic warfare and counter-UAV vulnerabilities challenge market growth by affecting operational survivability. Adversaries deploy jamming and spoofing systems. Communication disruption impacts mission success. Enhanced encryption increases system costs. Rapid threat evolution shortens upgrade cycles. Continuous R&D is required to maintain resilience. Budget pressures can affect upgrade timelines. These challenges necessitate sustained investment.

Opportunities

Defense Localization and Domestic UAV Manufacturing:

Defense localization and domestic UAV manufacturing present strong opportunity within the KSA small UAV market under Vision 2030 initiatives. Local assembly reduces procurement lead times. Technology transfer builds domestic expertise. Indigenous sustainment improves availability. Government incentives support partnerships. Workforce development strengthens industrial base. Export potential emerges regionally. This opportunity supports long-term market resilience.

Expansion into Civil and Public Safety Applications:

Expansion into civil and public safety applications offers opportunity as UAV regulations mature. Small UAVs support disaster response and infrastructure inspection. Public safety agencies benefit from aerial monitoring. Dual-use technology reduces costs. Regulatory clarity encourages adoption. Training programs expand user base. Domestic providers can diversify offerings. This opportunity broadens market scope.

Future Outlook

The KSA small UAV market is expected to grow steadily over the next five years, supported by border security priorities and defense modernization. Advances in autonomy, endurance, and secure communications will shape procurement. Government support for localization will strengthen domestic capabilities. Expanding civil and public safety use cases will further stimulate demand.

Major Players

- Saudi Arabian Military Industries

- Advanced Electronics Company

- Intra Defense Technologies

- Israel Aerospace Industries

- Elbit Systems

- Baykar Technologies

- AeroVironment

- Leonardo

- Thales Group

- L3Harris Technologies

- BAE Systems

- Hanwha Aerospace

- ASELSAN

- Roketsan

- Edge Group

Key Target Audience

- Defense ministries

- Military procurement agencies

- Border security forces

- Homeland security organizations

- Intelligence agencies

- Defense system integrators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables such as UAV fleet requirements, procurement budgets, operational missions, regulatory frameworks, and technology trends were identified through structured secondary research.

Step 2: Market Analysis and Construction

Data were analyzed to construct market size, segmentation, and competitive dynamics using validated analytical models and triangulation.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with defense officials, UAV operators, and industry specialists.

Step 4: Research Synthesis and Final Output

All validated insights were synthesized into a comprehensive report with consistency and reliability checks.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for ISR and border surveillance

Defense modernization and unmanned force expansion

Advances in autonomy and sensor miniaturization - Market Challenges

Airspace regulation and operational integration constraints

Electronic warfare and counter UAV threats

Limited endurance and payload capacity - Market Opportunities

Defense localization and indigenous UAV manufacturing

Growing adoption of UAV swarms and networked operations

Expansion of civil and public safety UAV applications - Trends

Increased use of AI enabled autonomous flight

Miniaturization of sensors and payload systems

Integration of UAVs into network centric operations

Growth in multi mission and modular UAV designs

Rising focus on counter UAV resilience - Government Regulations & Defense Policy

Alignment with Vision 2030 localization objectives

Strengthening of UAV airspace management frameworks

Support for indigenous defense technology development - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Fixed wing small UAVs

Rotary wing small UAVs

Hybrid VTOL small UAVs

Nano and micro UAVs

Tactical hand launched UAVs - By Platform Type (In Value%)

Land based UAV operations

Naval and coastal deployment platforms

Vehicle mounted UAV platforms

Backpack portable UAV platforms

Catapult and rail launch platforms - By Fitment Type (In Value%)

New UAV system procurement

Retrofit and upgrade installations

Mission specific payload integration

Training and simulation fitment

Modular configuration fitment - By EndUser Segment (In Value%)

Royal Saudi Land Forces

Royal Saudi Naval Forces

Border Guard and homeland security

Intelligence and surveillance agencies

Civil government and public safety operators - By Procurement Channel (In Value%)

Direct government defense procurement

Foreign military sales programs

Defense prime contractor sourcing

System integrator acquisition programs

R&D and pilot program procurement - By Material / Technology (in Value %)

Composite and lightweight airframe materials

Electric and hybrid propulsion systems

Electro optical and infrared payloads

Autonomous navigation and AI software

Secure data link and communication technologies

- Cross Comparison Parameters (Endurance, Payload Capacity, Operational Range, Launch Method, Autonomy Level, Sensor Integration, Communication Security, Lifecycle Cost, Localization Potential)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Saudi Arabian Military Industries

Advanced Electronics Company

Intra Defense Technologies

Israel Aerospace Industries

Elbit Systems

Baykar Technologies

AeroVironment

Leonardo

Thales Group

L3Harris Technologies

BAE Systems

Hanwha Aerospace

ASELSAN

Roketsan

Edge Group

- Strong reliance on UAVs for border and facility surveillance

- Preference for rapid deployment and portability

- Growing use in maritime and coastal monitoring

- Increasing demand for interoperable and secure UAV systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035