Market Overview

The KSA Smart Blood Pressure Monitors market sits within the broader blood pressure monitoring devices category, where Saudi Arabia’s total blood pressure monitoring devices revenue is USD ~ million, supported by a multi-year historical trend analysis and forecast framework. Demand is being pulled by home-based hypertension monitoring, where Saudi Arabia’s home blood pressure monitoring devices revenue is USD ~ million, alongside rising clinician preference for longitudinal readings, app-enabled tracking, and remote follow-up pathways that reduce repeat in-person visits and improve treatment adherence.

Market demand is concentrated in Riyadh, Jeddah, and the Dammam–Khobar corridor, driven by the country’s densest clusters of tertiary hospitals, large private hospital networks, and specialty cardiology/endocrinology care. These metros also anchor the largest pharmacy chains, distributor headquarters, and e-commerce logistics, enabling faster product availability and warranty service. On the supply side, global manufacturing hubs such as Japan, Europe, China, and the US dominate product inflow because they lead in clinically validated devices, sensor quality, and app ecosystems that integrate better with consumer smartphones and provider workflows.

Market Segmentation

By Product Type

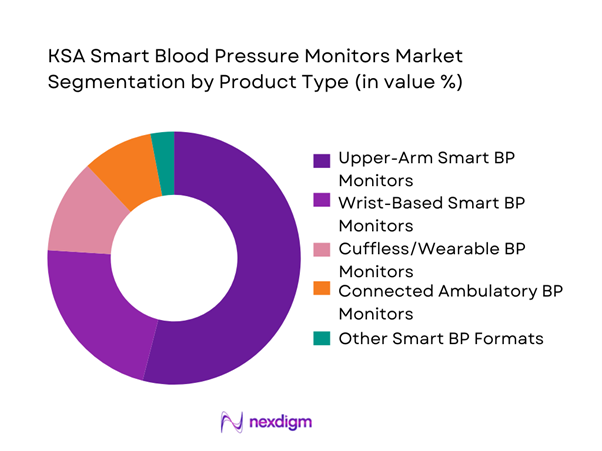

KSA Smart Blood Pressure Monitors market is segmented by product type into upper-arm smart BP monitors, wrist-based smart BP monitors, cuffless/wearable BP monitors, connected ambulatory BP monitors, and other smart BP formats. Recently, upper-arm smart BP monitors hold the dominant market share under product type because they best balance consumer convenience with clinical trust. Upper-arm cuffs remain the reference choice in many care pathways, especially for older patients and chronic disease follow-up, while smart features (Bluetooth/Wi-Fi syncing, multi-user memory, irregular heartbeat detection prompts, and trend reports) reduce manual logging and support teleconsultation discussions. In Saudi Arabia, pharmacy-led retail and homecare purchases favor familiar cuff formats, and premiumization is occurring through “medical-grade” positioning, multi-language apps, and easier data sharing for family caregivers.

By Distribution Channel

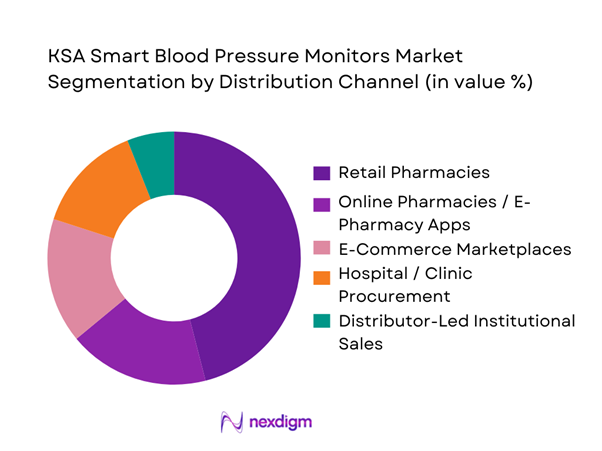

KSA Smart Blood Pressure Monitors market is segmented by distribution channel into retail pharmacies, online pharmacies/e-pharmacy apps, e-commerce marketplaces, hospital/clinic procurement, and distributor-led institutional sales. Recently, retail pharmacies dominate channel share because they are the primary “point-of-decision” for self-care devices in Saudi Arabia: consumers can compare models physically, seek pharmacist guidance on cuff sizing and usage, and resolve warranty/returns with less friction than online purchases. Retail pharmacies also capture demand from newly diagnosed patients after clinic visits, where immediate purchase is common. While online channels are scaling quickly—especially for repeat purchases and accessory replacements—pharmacy chains still anchor trust, authenticity assurance, and after-sales support, which is critical in medical monitoring devices where accuracy perception drives brand selection.

Competitive Landscape

The KSA Smart Blood Pressure Monitors market is influenced by a set of global device brands with strong clinical credibility and consumer recognition, alongside regional distribution-led players that shape shelf visibility and channel access. Competition is primarily defined by clinical validation reputation, app ecosystem strength, cuff comfort/accuracy perception, channel coverage (pharmacy + online), and after-sales service.

| Company | Established | Headquarters | Core Smart BP Portfolio | App / Ecosystem Strength | Clinical Validation Positioning | KSA Channel Strength | Warranty & Service Model | Typical Buyer Focus |

| Omron | 1933 | Kyoto, Japan | ~ | ~ | ~ | ~ | ~ | ~ |

| Philips | 1891 | Amsterdam, Netherlands | ~ | ~ | ~ | ~ | ~ | ~ |

| Withings | 2008 | Issy-les-Moulineaux, France | ~ | ~ | ~ | ~ | ~ | ~ |

| Microlife | 1981 | Widnau, Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Rossmax | 1988 | Taipei, Taiwan | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Smart Blood Pressure Monitors Market Analysis

Growth Drivers

Rising Hypertension Burden

Saudi Arabia’s non-communicable disease load is large enough to keep blood-pressure screening and monitoring structurally “always on” across primary care, cardiology, and employer/visitor health pathways. A key demand signal is the scale of insured lives and system touchpoints: Council of Health Insurance reported ~ million insured beneficiaries, up from ~ million, and ~ beneficiaries for visitor products (tourism/Umrah) in the same reporting cycle—both expanding the addressable base for home BP monitoring tied to covered care pathways.

On the macro side, Saudi Arabia’s economy size (GDP USD ~ trillion) and population (~ million) support continued expansion of chronic-disease programs, device access through pharmacy/retail, and digitized follow-ups that pull smart cuffs into routine care.

Digital Health Adoption

Digital-first care delivery is scaling in Saudi Arabia in ways that directly increase the “why now” for connected BP monitors: virtual cardiology/medicine pathways reduce friction for ongoing monitoring, while national exchange/insurance digitization makes readings more actionable. CHI documented system-scale digitization activity around NPHIES with operational enforcement volume—~ supervisory visits and ~ warnings issued for non-compliance with the NPHIES platform—evidence that digital workflows are becoming mandatory, not optional, for providers and payors.

In parallel, telemedicine infrastructure is producing real utilization: Seha Virtual Hospital outcomes reporting shows outpatient encounters rising to ~ (and stroke cases to ~) in the latest published period, which increases the clinical value of reliable home BP data during remote follow-ups. With GDP at USD ~ trillion and unemployment around ~, the system’s capacity to fund digitization and workforce productivity tools remains supportive of connected-monitor adoption in clinical and employer settings.

Challenges

Clinical Accuracy Expectations

Smart BP monitors face a higher bar than basic cuffs because readings increasingly inform medication changes and remote care decisions—so “accuracy trust” becomes a gating factor for repeat purchase and clinician endorsement. In Saudi Arabia, the scale of supervised digital health operations increases scrutiny: CHI reports ~ supervisory visits and ~ violations of service providers, signaling an environment where documentation, adherence, and clinical governance are actively enforced.

In parallel, Seha Virtual Hospital’s growing remote care volumes amplify the clinical impact of measurement error—remote clinicians are more dependent on home vitals when physical re-checks are not immediate. With the economy at USD ~ trillion, Saudi providers are investing in higher-acuity digital pathways; that typically raises the minimum acceptable device quality, increasing pressure on brands to prove validation and reduce “false high/false low” user experiences in Arabic-first, multi-user households.

Regulatory Compliance Requirements

Regulatory readiness is a friction point because smart BP monitors blend medical-device requirements with software, labeling, and sometimes connected-data features. While detailed SFDA process documents can vary by pathway, the market reality is that compliance expectations are tightening across the health ecosystem, as shown by CHI’s enforcement volumes: ~ warnings for non-compliance with NPHIES and ~ submissions of provider violations to the Health Institutions Violations Committee—figures that reflect a compliance-first operating environment.

This creates practical challenges for device vendors and distributors: ensuring correct Arabic IFU/labeling, maintaining authorized channels, and aligning app behavior with clinical claims. Macroeconomic context also matters: with unemployment around ~ and GDP per capita ~USD ~, Saudi Arabia is positioned to pay for higher-standard regulated products—raising the cost of non-compliance via delisting, channel lockout, or institutional rejection.

Opportunities

Remote Patient Monitoring Integration

A key growth opportunity is embedding smart BP monitors into remote patient monitoring (RPM) pathways where readings trigger clinician workflows, not just user dashboards. Saudi Arabia’s virtual-care scale provides the “plumbing” for RPM: Seha Virtual Hospital reporting shows sharp growth in remote management volumes (outpatient encounters reaching ~; stroke cases ~ in the published outcomes set), which increases the clinical utility of continuous BP data in post-discharge care, medication titration, and comorbidity management.

On the payer side, CHI’s documented oversight of NPHIES and sector digitization (including ~ establishments enabled to join NPHIES) indicates that interoperability and standardized claims/referral flows are expanding—conditions that make RPM programs easier to operationalize across provider networks. The macro base (GDP USD ~ trillion) supports sustained investment into these integrated care models without needing near-term “future market” assumptions.

AI-Enabled Analytics

AI-enabled features—irregular heartbeat flags, trend-based risk alerts, adherence nudges, and clinician-ready summaries—can shift smart BP monitors from “device purchase” to “care tool,” especially in large provider systems and insurer programs. The prerequisite is data scale and structured exchange: CHI’s reported digitization program indicates NPHIES is broadening participation (with ~ establishments enabled) and the council recorded high operational throughput (~ total requests logged in its figures section), both of which point to a system increasingly oriented around standardized digital health data.

The main near-term commercial unlock is targeting institutions that can operationalize AI insights (large hospital groups, insurer care-management teams, occupational health programs) under Saudi privacy constraints where non-compliance can trigger penalties up to SAR ~ (PDPL frameworks as summarized by leading legal guides).

Future Outlook

Over the next ~ years, the KSA Smart Blood Pressure Monitors market is expected to expand steadily as Saudi Arabia deepens preventive care models, telemedicine follow-ups, and home monitoring adoption for chronic disease management. Growth will increasingly come from connected upper-arm devices, rising uptake of remote patient monitoring-style workflows, and higher consumer willingness to pay for trusted brands with strong apps. Regulatory maturity, distributor consolidation, and pharmacy-led omnichannel strategies will further professionalize the market.

Major Players

- Omron Healthcare

- Philips

- Withings

- Microlife

- Rossmax

- A&D Medical

- Beurer

- iHealth Labs

- Xiaomi

- Panasonic

- Braun Healthcare

- Yuwell

- SunTech Medical

- Welch Allyn

- GE HealthCare

Key Target Audience

- Strategic sourcing and procurement heads

- Category heads and procurement

- Leadership teams at online pharmacies and e-pharmacy apps

- Owners/decision-makers

- Digital health and remote-care program owners

- Product and partnerships heads at health insurers / payers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We build a stakeholder ecosystem map covering manufacturers, importers, distributors, pharmacy chains, hospitals, insurers, and regulators. Desk research leverages secondary sources, company filings, and structured channel mapping to define the variables shaping device adoption, pricing tiers, and connectivity preferences.

Step 2: Market Analysis and Construction

We compile historical market indicators and align them with channel activity, device mix shifts (smart vs non-smart), and procurement behavior across retail and institutional routes. This phase also includes benchmarking of product architectures (upper-arm, wrist, wearable/cuffless) and their adoption context.

Step 3: Hypothesis Validation and Expert Consultation

We validate hypotheses through CATI-style interviews with distributors, pharmacy category teams, biomedical engineers, and clinicians. These interactions refine assumptions around demand drivers, preferred features, service issues, and channel economics.

Step 4: Research Synthesis and Final Output

We synthesize findings into a triangulated model, reconciling bottom-up channel signals with credible market totals and forecast logic. Additional manufacturer/distributor touchpoints confirm portfolio direction, partner strategy, and go-to-market execution priorities.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Device Classification Framework, Market Sizing Approach, Bottom-Up and Top-Down Validation, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Secondary Research Sources, Data Triangulation, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Evolution of Digital Blood Pressure Monitoring in KSA

- Role of Vision 2030 in Preventive and Digital Healthcare

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Hypertension Burden

Digital Health Adoption

Homecare Expansion

Insurance-Driven Preventive Screening

Smartphone Penetration - Challenges

Clinical Accuracy Expectations

Regulatory Compliance Requirements

Data Privacy and Hosting Norms

Price Sensitivity

Device Calibration Issues - Opportunities

Remote Patient Monitoring Integration

AI-Enabled Analytics

Hospital-to-Home Care Models

Employer Wellness Programs

Chronic Disease Platforms - Trends

Shift Toward Medical-Grade Smart Devices

App-Based Longitudinal Tracking

Integration with Telemedicine Platforms

Cloud-Based Patient Dashboards - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- By Value, 2019–2024

- By Volume, 2019–2024

- Installed Base, 2019–2024

- By Average Selling Price, 2019–2024

- By Fleet Type (in Value %)

Upper Arm Monitors

Wrist Monitors

Wearable/Continuous BP Monitors

Ambulatory BP Monitors

Hybrid Medical-Consumer Devices - By Connectivity Type (in Value %)

Bluetooth-Enabled

Wi-Fi Enabled

NFC-Based

App-Integrated Offline Sync - By End-Use Industry (in Value %)

Hospitals

Clinics

Home Healthcare Patients

Pharmacies

Corporate Wellness Programs - By Distribution Channel (in Value %)

Hospital Procurement

Retail Pharmacies

Online Pharmacies

E-Commerce Marketplaces

Direct-to-Consumer - By Application (in Value %)

Hypertension Management

Cardiac Risk Monitoring

Geriatric Care

Post-Operative Monitoring

Maternal Health Monitoring - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market Share Analysis of Major Players (Value and Volume Basis)

- Cross Comparison Parameters (Product Portfolio Breadth, Clinical Accuracy and Validation, Connectivity and App Ecosystem, Regulatory Approvals, Distribution Footprint, Pricing Positioning, Brand Trust and Recall, After-Sales and Service Capability)

- SWOT Analysis of Major Players

- Pricing Analysis by Key SKUs and Device Categories

- Detailed Profiles of Major Companies

Omron Healthcare

Philips Healthcare

Withings

A&D Medical

Beurer

Rossmax

Microlife

iHealth Labs

Xiaomi

Braun Healthcare

Panasonic Healthcare

Yuwell Medical

Medisana

Citizen Systems

- Demand Patterns and Utilization Behavior

- Purchasing Power and Budget Allocation

- Procurement and Tendering Dynamics

- Needs, Desires, and Pain Point Analysis

- Decision-Making and Brand Selection Criteria

- By Value, 2025–2030

- By Volume, 2025–2030

- Installed Base, 2025–2030

- By Average Selling Price, 2025–2030