Market Overview

The KSA smart clothing market is valued at USD ~ million (latest year), reflecting accelerating adoption of sensor-enabled apparel across fitness, health monitoring, and performance wear categories. The strongest demand pockets are tied to app-connected training ecosystems, biometric monitoring (heart rate, respiration, temperature, posture), and premium athleisure retail expansion. For context on upstream momentum, the global smart clothing market was valued at USD ~ billion (prior year), indicating a widening innovation funnel and faster commercialization cycles that also spill into KSA via global brands and cross-border e-commerce.

Within KSA, Riyadh and Jeddah dominate smart clothing demand because they concentrate premium retail, fitness chains, mall-based brand stores, and digitally engaged consumers who buy connected wearables as part of broader “quantified lifestyle” stacks. Dammam/Khobar matters due to higher adoption of performance and safety wear tied to industrial ecosystems. Globally, the U.S. and China tend to dominate smart clothing commercialization because they combine deep wearable-device ecosystems, strong sports-tech and digital-health platforms, and faster product iteration supported by large-scale consumer electronics supply chains—factors that shape product availability and brand penetration in KSA through imports and omnichannel distribution.

Market Segmentation

By Textile Type

KSA smart clothing is segmented into active smart, passive smart, and ultra smart. Recently, passive smart is indicated as the largest revenue-generating textile type in KSA smart clothing. The dominance logic is practical: passive smart products (conductive textiles + embedded sensing with stable, low-maintenance operation) fit the KSA market’s “buy-and-use” preference—minimal calibration, fewer charging constraints, and easier compatibility with common smartphone ecosystems. This makes passive smart particularly strong in smart fitness tops, posture/biometric shirts, and sensor-integrated underlayers where the value proposition is consistent monitoring rather than complex actuation. Retailers also find passive smart easier to sell because feature claims are simpler to demonstrate (tracking, alerts, comfort benefits), which reduces return risk. Finally, passive smart aligns well with KSA’s premium athleisure trajectory: consumers can adopt “smart” without sacrificing design, comfort, or washability expectations.

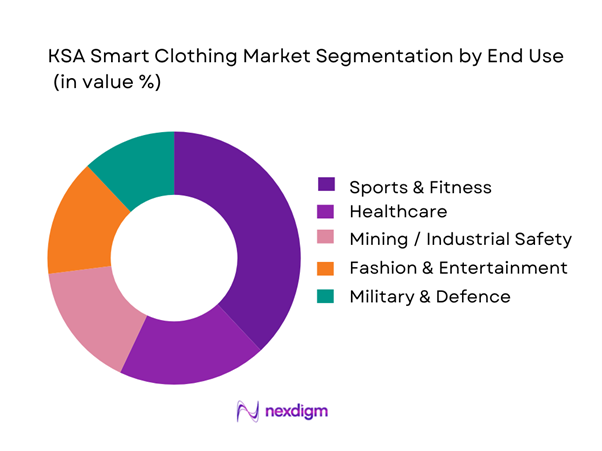

By End Use

KSA smart clothing demand clusters around sports & fitness, healthcare, fashion & entertainment, military & defence, and industrial safety (including mining), with “others” capturing niche applications. In KSA, sports & fitness typically becomes the commercial “entry segment” because smart clothing is easiest to justify when tied to training outcomes—heart-rate zones, exertion feedback, recovery metrics, and coaching ecosystems that work with gyms and home fitness. The purchase decision is faster because benefits are immediate and non-clinical, and products are distributed through athletic retailers, e-commerce, and brand stores. Healthcare adoption tends to be more controlled (clinical validation, procurement cycles, integration with care pathways), while defence and industrial deployments are program-based rather than retail-driven. Fashion-led smart clothing is growing but still faces “feature fatigue” unless the tech delivers clear comfort or safety value. Net: sports & fitness is structurally advantaged as the broadest, fastest conversion funnel.

Competitive Landscape

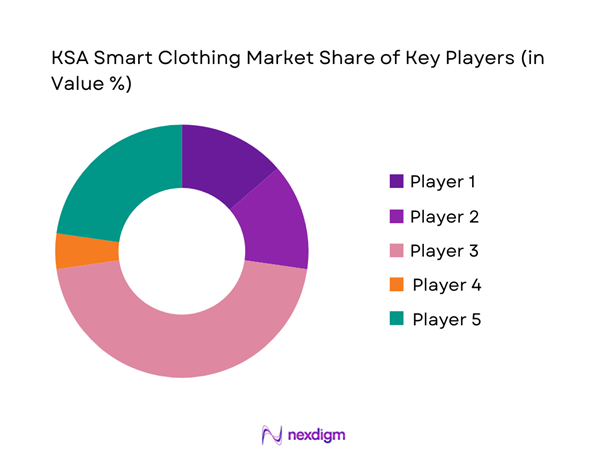

The KSA smart clothing market is still emerging and brand-led, with demand primarily served through global smart apparel and e-textile brands entering via e-commerce, premium sporting goods retailers, and selected health-tech distribution partners. Competition is defined by sensor accuracy, app ecosystem lock-in, garment durability/washability, and the ability to localize sizing, after-sales support, and Arabic UX for consumer adoption.

| Company | Est. Year | HQ | Core Smart Clothing Focus (KSA-relevant) | Sensor / Tech Stack | Primary Use Case Fit | App / Platform Approach | Washability & Durability Positioning | Channel Strength (KSA) | Differentiation Lever |

| AiQ Smart Clothing | 2009 | Taiwan | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Sensoria | 2013 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| MYZONE | 2011 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Wearable X | 2014 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Toray Industries | 1926 | Japan | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

KSA Smart Clothing Market Analysis

Growth Drivers

Lifestyle Fitness Momentum

Saudi Arabia’s smart clothing demand is structurally supported by a large, urban, high-income consumer base that can absorb “tech-in-textile” premium apparel as part of everyday fitness routines. The macro backdrop is strong: the Kingdom’s economy is valued at USD ~ billion and GDP per capita at USD ~, supporting discretionary spend on performance apparel, connected training, and app-led wellness habits. At the same time, Saudi Arabia’s population is ~, with continued population additions increasing the addressable base for sportswear and athleisure. In practice, smart clothing adoption in KSA tends to concentrate where gym density, sports events, and retail choice are highest—Riyadh and Makkah Region (Jeddah) are consistent consumption anchors because they host the largest concentrations of healthcare infrastructure and urban services (a proxy for dense consumer ecosystems and retail access). This “fitness + urban services” layering matters because smart clothing is rarely a one-off purchase; it is a behavior product tied to repeat workouts, replacements, and accessory ecosystems (apps, sensors, compatible devices). As more consumers use connected routines (mobile-first training content, coaching, and health tracking), smart clothing becomes an upgrade path from basic sportswear into “measurable performance” apparel—especially for compression, posture, and activity sensing use cases.

Preventive Health Orientation

Smart clothing in KSA benefits from an expanding prevention-and-continuous-monitoring mindset, where wearables and sensor garments sit adjacent to telehealth and hospital-linked remote monitoring workflows. The macro base again matters: USD ~ billion GDP and ~ residents create both system-scale health delivery demand and a sizeable consumer market for preventive products. On the provider side, Saudi Arabia’s healthcare capacity continues to expand, with the total number of hospitals reaching ~ and Riyadh Region alone hosting ~ hospitals—a scale that increases institutional touchpoints for monitoring programs, rehab pathways, and clinician familiarity with digital vitals data. Beyond brick-and-mortar, the Ministry of Health’s Seha Virtual Hospital model reinforces the feasibility of remote clinical oversight and connected care delivery; Seha is positioned to connect with ~ hospitals and provide ~ specialized services via telemedicine, building “care confidence” around continuous monitoring workflows that smart textiles can complement (e.g., rehab, cardiometabolic monitoring, and post-acute programs). This environment improves the receptivity to garments that can reduce friction versus device wear (e.g., embedded sensors in shirts/bras/shorts), particularly when compliance matters. As preventive care pathways mature, smart clothing becomes a “passive data capture” layer—capturing movement, respiration proxies, or posture signals—while leveraging a growing clinical and digital care scaffold.

Challenges

Washability and Durability Constraints

Smart clothing faces a structural execution challenge: garments must survive repeated washing, sweat exposure, heat, and abrasion while preserving sensor performance—an especially tough requirement in KSA given heavy outdoor use cases and high-heat work environments. The macro scale (population ~ and GDP USD ~ billion) implies broad potential demand, but it also implies broad variability in use intensity—from casual consumers to industrial workforces where garments experience harsher cycles. Enterprise contexts intensify durability requirements because programs must standardize kit performance across thousands of workers; the presence of formal heat/thermal OSH guidance in Saudi Arabia underlines that employers operate under documented expectations for managing heat exposure—raising the standard for reliability of any wearable-monitoring layer. Durability constraints also create operational friction: if garments fail early, programs face replacement administration, user distrust, and higher compliance burden (garment care instructions, correct washing practices, inspection routines). In consumer markets, washability issues directly translate into returns and reputational damage because the product category is “clothing first”—customers expect apparel-grade resilience, not gadget fragility. This is a core go/no-go barrier for scaling beyond pilots into mass deployment.

Signal Accuracy and Motion Artifacts

Smart clothing must deliver “trustworthy” signals (motion, respiration proxies, posture, muscle activation approximations) despite sweat, fabric shift, and complex movement—otherwise users abandon the product. The opportunity scale exists (GDP USD ~ billion, population ~), but accuracy expectations are higher in KSA because the category is increasingly compared against mainstream wearables and medically adjacent digital health initiatives. The Kingdom’s clinical and digital care infrastructure creates a higher bar for physiological monitoring products: there are ~ hospitals in the Kingdom and ~ in Riyadh Region alone, increasing the number of clinician-informed consumers and enterprise buyers who ask tougher questions about reliability and “fit-for-purpose” performance. In parallel, Seha Virtual Hospital’s networked care model (connected with ~ hospitals and delivering ~ specialized services) normalizes digitally mediated care—making consumers and providers more aware of the consequences of false positives/negatives and noisy signals. For smart apparel vendors, this pushes product requirements toward better sensor placement, advanced filtering algorithms, and real-world validation—especially for dynamic workouts and outdoor labor conditions where motion artifacts are greatest.

Opportunities

Clinical-Grade Monitoring Programs

A near-term opportunity is to position smart clothing as a “clinically aligned” monitoring layer—supporting rehabilitation, chronic care follow-ups, and post-acute pathways—without needing users to remember separate devices. The macro fundamentals support scaled programs: ~ hospitals in the Kingdom and ~ in Riyadh Region create dense provider networks where standardized digital pathways can be deployed and measured. Seha Virtual Hospital’s national model strengthens this opportunity by operationalizing remote delivery at scale, connecting ~ hospitals and offering ~ specialized services—a platform logic where continuous monitoring data can be actioned, triaged, and escalated. From an affordability and access lens, the Kingdom’s GDP per capita (USD ~) supports both consumer self-pay and payer/employer-sponsored programs in premium segments, while high mobile subscriptions (~ million) ensure the digital rails needed for garment telemetry and clinician dashboards. The growth lever here is not future projections but present system readiness: KSA already has the care network and telemedicine scaffolding to integrate smart textiles into defined care protocols (e.g., post-op recovery mobility tracking, respiratory proxy monitoring during rehab, posture correction programs).

Heat Stress Monitoring for Workforces

Heat stress monitoring is a KSA-specific “must-win” opportunity for smart clothing because physiological monitoring in high-temperature environments is directly relevant to construction, logistics, utilities, and oil & gas operations. Saudi Arabia has formal OSH guidance for thermal environments, including manuals that define roles and responsibilities for preventing heat-related impacts at work—creating an institutional framework in which monitoring solutions can be justified as compliance and risk reduction tools rather than “nice-to-have” wearables. Scale and connectivity are already present: reports indicate ~ million mobile telecom subscriptions, enabling site-level dashboards, alerts, and escalation workflows in real time. The macro base (GDP USD ~ billion) indicates the breadth of industrial and infrastructure activity where heat exposure risk is operationally material and where employers can finance prevention programs. Importantly, this opportunity can be advanced using current conditions (existing OSH requirements + existing connectivity + existing workforce scale), without relying on future market forecasts: pilots can be launched in high-risk roles with measurable outcomes such as reduced heat incidents, improved hydration compliance, and better shift planning.

Future Outlook

Over the next five to six years, KSA smart clothing demand is expected to expand from early-adopter fitness use into broader health monitoring, safety wear, and premium lifestyle categories. Growth will be supported by rising consumer comfort with connected wearables, better textile durability and washability of embedded electronics, stronger integration into coaching and wellness apps, and more brand launches through Saudi omnichannel retail. With the market projected to reach USD ~ million, scale-up will increasingly favor players that can localize sizing, improve Arabic UX, and build strong after-sales support for sensor-enabled garments.

Major Players

- AiQ Smart Clothing

- DuPont de Nemours, Inc.

- Myontec

- MYZONE

- Owlet Baby Care

- Sensoria

- Siren Care

- Toray Industries, Inc.

- Vulpés Electronics GmbH

- Wearable X

- Hexoskin

- OMsignal

- Myant

- Athos

Key Target Audience

- Investments and venture capitalist firms

- Sportswear & athleisure brands and license partners

- Fitness chains, gyms, and sports performance centers

- E-commerce platforms and omnichannel retailers

- Healthcare providers & hospital groups

- Industrial safety and PPE program owners

- Government and regulatory bodies

- Defence procurement ecosystem

Research Methodology

Step 1: Identification of Key Variables

We begin by mapping the KSA smart clothing ecosystem across brands, material suppliers, sensor stack providers, platforms, and distribution routes. Desk research consolidates segment definitions, product taxonomy, and adoption drivers to set the analytical scope and critical variables impacting demand.

Step 2: Market Analysis and Construction

We compile historical market signals and validate the addressable revenue pool by end use, textile type, and distribution routes. The analysis normalizes for product mix (apparel vs accessories/patches), channel pricing bands, and replacement cycles to construct a consistent revenue model.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on dominant use cases (fitness-first adoption, premium retail funnel, and safety-wear programs) are validated through structured expert interviews with brand distributors, retail category managers, and wearable platform stakeholders to confirm demand shape and buyer criteria.

Step 3: Research Synthesis and Final Output

We triangulate supplier-side inputs, channel checks, and platform ecosystem insights to finalize segmentation logic, competitive benchmarks, and market outlook. This step ensures the output is aligned to real procurement behavior, go-to-market pathways, and product feasibility in KSA.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Primary Interviews by Stakeholder Type, Device and Module Teardown Validation, Standards and Regulatory Mapping, Channel and Pricing Audit Approach, Data Triangulation Framework, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Adoption Story

- KSA Demand Context

- Industry Business Cycle and Seasonality

- Stakeholder Ecosystem

- Growth Drivers

Lifestyle Fitness Momentum

Preventive Health Orientation

Enterprise HSE Digitization

Wearable Ecosystem Pull

Premiumization of Sportswear - Challenges

Washability and Durability Constraints

Signal Accuracy and Motion Artifacts

Data Privacy and Consent Burden

Returns and Reverse Logistics

Counterfeit and Grey Market Exposure - Opportunities

Clinical-Grade Monitoring Programs

Heat Stress Monitoring for Workforces

Sports Academies and League Partnerships

API-Integrated Enterprise Deployments

Local Assembly and Localization - Trends

Detachable Electronics

Advanced Textile Sensors

AI Coaching and Biomarker Analytics

Wearable Interoperability

Subscription-Based Analytics Models - Regulatory & Policy Landscape

- Pricing and Commercial Model Analysis

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Volume, 2019–2024

- By Average Selling Price, 2019–2024

- Installed Base and Replacement Cycle, 2019–2024

- By Fleet Type (in Value %)

Smart T-Shirts and Base Layers

Smart Sports Bras and Compression Wear

Smart Socks and Insoles

Smart Jackets and Outerwear

Smart Workwear and PPE-Integrated Apparel - By Application (in Value %)

Sports Performance and Training Load

Remote Patient Monitoring and Chronic Care

Occupational Safety and Heat Stress Monitoring

Rehabilitation and Physiotherapy

Defense and Tactical Readiness - By Technology Architecture (in Value %)

Textile-Integrated Sensors

Detachable Sensor Modules

Hybrid Textile and Module Designs

Printed and Conductive Yarn Architectures

Patch-Integrated Garments - By Connectivity Type (in Value %)

Bluetooth and BLE

NFC

Wi-Fi and Gateway-Based

Cloud-Connected Platforms

Store-and-Forward On-Device Memory - By End-Use Industry (in Value %)

Consumers and Fitness Enthusiasts

Gyms and Sports Academies

Hospitals and Clinics

Enterprises with HSE Programs

Defense and Government - By Region (in Value %)

Central Region

Western Region

Eastern Region

Southern Region

Northern Region

- Market Share Assessment

Competitive Positioning Matrix - Cross Comparison Parameters (sensor signal fidelity and validation depth, wash-life and textile durability, detachable electronics and battery runtime, app and cloud analytics depth, API and enterprise integration readiness, KSA compliance readiness, warranty and local service coverage, channel control and grey-market exposure)

- Company SWOT Snapshot

- Strategic Moves Tracker

- Detailed Profiles of Major Companies

AiQ Smart Clothing

Athos

Carre Technologies

Sensoria

Clothing+

Cityzen Sciences

Wearable X

Myant Health

Xenoma

Myontec

Siren

Owlet

Toray Industries

DuPont

- KSA Smart Clothing Market End User Analysis

- Gyms, Fitness Chains & Sports Academies

- Healthcare Providers & Medical Institutions

- Industrial & Occupational Safety Users

- Defense & Government Security Agencies

- By Value, 2025–2030

- By Volume, 2025–2030

- By Average Selling Price, 2025–2030

- Installed Base and Replacement Cycle, 2025–2030