Market Overview

The Saudi Arabian smart parking solutions market is valued at approximately USD ~ million, with projections showing substantial growth driven by a combination of urbanization, smart city initiatives, and technological advancements. The market is significantly influenced by the rising demand for efficient parking solutions in high-traffic urban areas, alongside government investments under Vision 2030 aimed at modernizing urban infrastructure. The growing adoption of IoT-based solutions, along with the increasing need to optimize space and reduce congestion, contributes to the expanding market size.

Riyadh, Jeddah, and Dammam are the dominant cities driving the Saudi Arabia smart parking solutions market. Riyadh, being the capital and the largest city, leads due to its high urbanization rate and the significant pressure on public infrastructure. Jeddah follows closely, with its rapidly growing commercial and residential developments, while Dammam is a strategic hub for the Eastern Province’s industrial and transport sectors. The dominance of these cities is largely attributed to government initiatives for smart city development and increasing investments in urban mobility.

Market Segmentation

By System Type

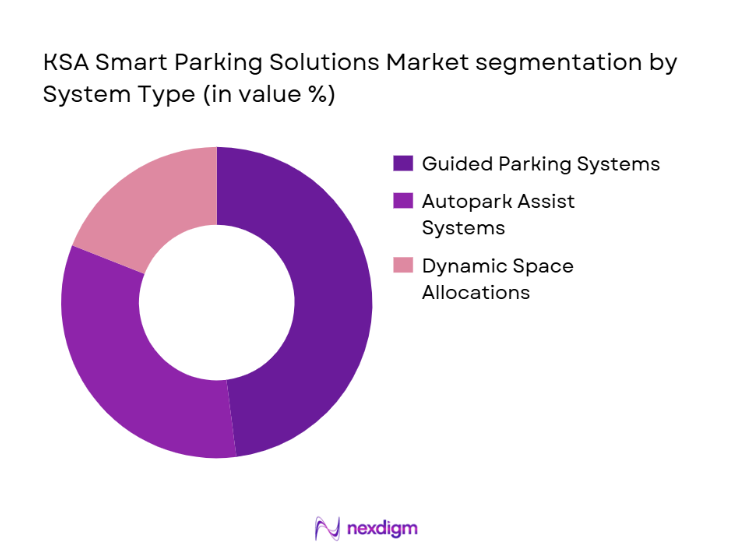

The Saudi Arabian smart parking solutions market is segmented by system type into guided parking systems, autonomous parking (autopark) assist systems, and dynamic space allocation solutions. Among these, guided parking systems dominate the market due to their proven technology and widespread adoption across public and commercial spaces. These systems, utilizing sensors and real-time data, provide a seamless parking experience that helps reduce traffic congestion and improve space utilization. The increasing demand for efficient parking solutions in busy urban areas like Riyadh and Jeddah is fueling the growth of this sub-segment.

By Technology Stack

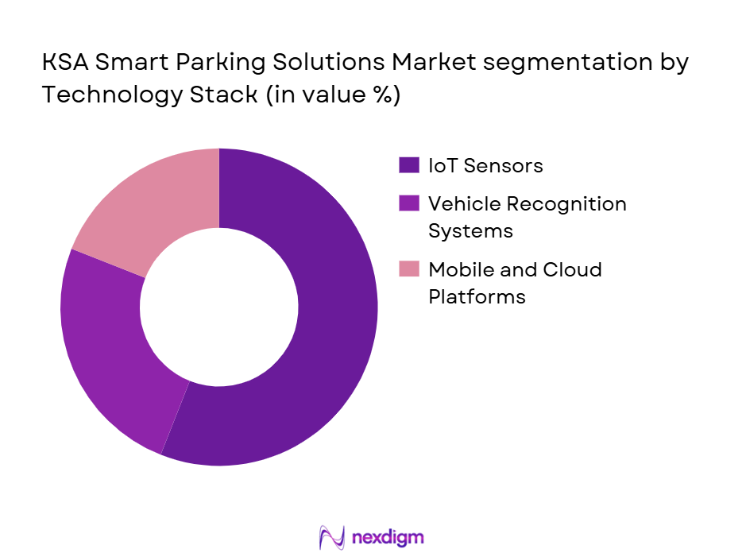

The market is also segmented by technology stack, including IoT sensors, vehicle recognition systems (ANPR), mobile and cloud-based platforms. IoT sensors are the most dominant sub-segment, owing to their critical role in enabling real-time parking guidance and monitoring. These sensors, ranging from ultrasonic to radar-based solutions, are integral to the functioning of smart parking systems, contributing to their dominance. With the continued development of IoT infrastructure in Saudi cities and the growth of 5G connectivity, the use of IoT-based systems is expected to expand further in the near future.

Competitive Landscape

The Saudi Arabian smart parking solutions market is relatively consolidated, with several key global players competing alongside local firms. Companies like IDEX Services, Omnitec Group, and Parkopedia dominate the market, leveraging their extensive product portfolios and technological innovations. These companies have the capability to deliver integrated solutions, from parking guidance systems to payment integration, positioning themselves as leaders in the market.

| Company | Establishment Year | Headquarters | Tech Stack | Key Offerings | Market Position | Strategic Focus |

| IDEX Services | 2002 | Riyadh | ~ | ~ | ~ | ~ |

| Omnitec Group | 1985 | Dubai | ~ | ~ | ~ | ~ |

| Parkopedia | 2007 | London | ~ | ~ | ~ | ~ |

| NParking | 2000 | Riyadh | ~ | ~ | ~ | ~ |

| EasyPark | 2001 | Stockholm | ~ | ~ | ~ | ~ |

KSA Smart Parking Solutions Market Analysis

Growth Drivers

Urbanization and Increasing Vehicle Ownership

The rapid urbanization and growing population in Saudi Arabia, particularly in cities like Riyadh and Jeddah, have led to an increasing number of vehicles on the road. This surge in vehicles has put a significant strain on existing parking infrastructures, creating a need for smarter and more efficient parking solutions. As the demand for parking spaces continues to rise, smart parking systems, which optimize space utilization and reduce congestion, become a crucial solution for urban mobility.

Government Initiatives and Vision 2030

Saudi Arabia’s Vision 2030, which focuses on transforming the country into a smart city hub, has fueled the demand for smart infrastructure solutions, including smart parking. The government’s investment in technology, alongside efforts to improve traffic management and urban planning, directly supports the growth of the smart parking sector. The ongoing push to modernize urban infrastructure and the commitment to achieving sustainable cities further enhances market potential.

Market Challenges

High Initial Investment and Installation Costs

The adoption of smart parking systems requires significant upfront investment in terms of infrastructure, technology, and installation. These costs, including sensor technology, IoT systems, and integration with existing urban frameworks, can be prohibitive for municipalities and businesses looking to implement smart solutions. Additionally, ongoing maintenance and system upgrades add to the overall cost, making it a challenge for wide-scale adoption.

Regulatory and Compliance Barriers

Despite the support for smart city initiatives, there are challenges related to local regulations, compliance standards, and data privacy issues. Saudi Arabia’s regulatory landscape for smart parking solutions is still evolving, and parking operators must navigate various municipal rules, data protection laws, and certification processes. The lack of standardized frameworks and the need for approvals from multiple government bodies can delay the rollout of smart parking solutions.

Opportunities

Integration with Electric Vehicles (EV) Charging Stations

As the demand for electric vehicles (EVs) increases in Saudi Arabia, there is a growing opportunity to integrate EV charging stations with smart parking systems. By incorporating charging infrastructure within parking facilities, smart parking solutions can cater to the needs of EV owners, offering convenience and promoting the adoption of green technology. This integration will also help cities address sustainability concerns and provide an enhanced service offering to users.

Data Monetization and Advanced Analytics

Smart parking solutions generate a wealth of data regarding parking patterns, vehicle movement, and space utilization. This data can be monetized through partnerships with local businesses, advertisements, or traffic management services. Additionally, cities can leverage advanced analytics to optimize parking space allocation, reduce congestion, and improve traffic flow. The opportunity to offer data-driven services presents a lucrative avenue for companies to innovate and generate new revenue streams.

Future Outlook

Over the next 5 years, the Saudi Arabian smart parking solutions market is expected to exhibit strong growth, fueled by increased government support, the rising number of vehicles, and the expansion of smart city infrastructure under Vision 2030. Technological advancements, particularly in IoT and AI, will continue to drive innovation, making parking solutions more efficient, sustainable, and user-friendly. The adoption of electric vehicles (EVs) and the integration of EV charging stations into parking systems will also be key growth drivers, as the demand for smart infrastructure increases.

Major Players

- IDEX Services

- Omnitec Group

- Parkopedia

- NParking

- EasyPark

- Desert Services

- Aflak Electronic Industries

- Smart Parking Company

- Makani Parking

- Woqoof

- Flowbird

- Passport Parking

- ParkMobile

- NexPark

- SkyPark

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Saudi Ministry of Transport, Saudi Vision 2030)

- Real Estate Developers

- Municipalities and Urban Planners

- Parking Management Companies

- Large Commercial and Retail Chains

- Hospitality Sector (Hotels and Malls)

- Transportation Hubs (Airports, Bus Stations)

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying critical variables impacting the KSA smart parking solutions market, using secondary research and data sources such as government reports, market surveys, and databases. Key metrics such as parking demand, urban growth trends, and technology adoption rates are gathered to form the baseline for further analysis.

Step 2: Market Analysis and Construction

In this phase, historical data for market performance and key market indicators are compiled. The analysis will include regional insights, technological adoption rates, and segment performances. A bottom-up approach will be used to assess the real-world implications of smart parking implementations in various urban areas.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with key industry experts, including municipal authorities, technology providers, and parking service companies. These consultations, conducted via surveys and expert interviews, provide insights into market trends, customer needs, and technology adoption barriers.

Step 4: Research Synthesis and Final Output

The final output is produced by synthesizing the findings from primary and secondary research, expert consultations, and statistical analysis. This ensures a holistic view of the market, confirming the accuracy of the data and validating the hypotheses. Key reports and forecasts are generated to inform stakeholders of future market developments.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions; Data Sources – Primary & Secondary; Sampling & Weighting; Market Sizing & Forecasting Approach; Statistical Models; Market Validation; Limitations and Bias Controls)

- Definition & Scope of Smart Parking Solutions

- Market Genesis & Evolution

- Saudi Urban Mobility Landscape Overview

- Smart Parking Business Cycle

- Smart Parking Value Chain & Ecosystem

- Integration with Smart Transportation & Smart Cities Initiatives

- Growth Drivers

Increase in Urban Vehicle Ownership

Smart City mandates & Vision 2030 funding

IoT Infrastructure & 5G Connectivity

Demand for Predictive Analytics & AIbased Guidance - Market Challenges

Infrastructure Retrofit Complexity

High Upfront Sensor and Connectivity Costs

Data Privacy & Regulatory Barriers

Cultural Adoption Curve - Market Opportunities

Integration with Autonomous Fleet Parking

EV Charging Enabled Parking Slots

Data Monetization & MaaS Linkages

PublicPrivate Deployment Models - Key Market Trends

AI & Predictive Parking Guidance

Appbased Prebooking & Smart Payment Adoption

Realtime Big Data Traffic Orchestration - Government Regulation & Policy Landscape

Smart Parking Regulations & Standards

Vision 2030 Smart Mobility Initiatives

Local Municipality Policy Trends

Incentives & Investment Frameworks

- Market Size by Value 2019-2025

- Market Volume & Installed Units 2019-2025

- Market Price & ARPU Trends 2019-2025

- Digital Transactions to Total Parking Transactions 2019-2025

- RealTime Parking Utilization Data Metrics 2019-2025

- By System Type (In Value %)

Guided Parking Systems

Autopark Assist Systems

Dynamic Space Allocation Solutions - By Technology Stack (In Value %)

IoT Sensors

Vehicle Recognition Systems

Mobile and Cloud-Based Platforms for Parking Management - By Solution Modules (In Value %)

Parking Guidance Systems

Reservation & Availability Platforms

License Plate Recognition (LPR) Systems

Digital Payments and Contactless Solutions

EV Charging Integrated Parking Solutions - By Deployment Type (In Value %)

On-Street Parking Systems

Off-Street Parking Solutions

Multi-Level Parking Systems

Mixed-Use Parking Solutions - By End-User Vertical (In Value %)

Municipal & Government Infrastructure

Commercial/Retail Businesses

Transport Hubs (Airports, Bus Stations, etc.)

Hospitality (Hotels, Malls)

Residential & Mixed-Use Developments - By Integration Partner Type (In Value %)

System Integrators

OEMs

Smart City Platform Providers - By Payment & Billing Mode (In Value %)

Cashless Payment Solutions

Mobile Wallet Payments

Subscription-Based Models

- Market Share: Smart Parking Solutions

- Cross Comparison Parameters: (Company Overview; Revenue Bands; Regional Footprint; Tech Stack Depth; Deployment Scale; Sensor Portfolio; Mobile App Capabilities; Digital Transaction Volume; Cloud Platform Integration; Customer Retention Metrics; Partner Ecosystems; Support & Maintenance Models; Compliance Certification)

- SWOT Profiles of Key Competitors

- Pricing Strategy & Value Pricing Models

- Detailed Profiles of Major Competitors

IDEX Services

Desert Services

Aflak Electronic Industries Co. Ltd

Omnitec Group

NParking

Nedap FZE

Cisco (Saudi Arabia) Support Limited

Makani Parking

Smart Parking Company

Woqoof

ParkMobile (Digital Interface Provider)

Parkopedia (Realtime Data Services)

EasyPark

Flowbird

Passport Parking

- Procurement Criteria by Municipal Authorities

- Private Sector Investment Patterns

- SME Adoption Patterns

- Price Sensitivity & TCO Preferences

- Customer Satisfaction & Feature Prioritization

- Market Value Forecast 2026-2030

- Tech Adoption & Installed Systems Forecast 2026-2030

- Digital Transaction & Mobile App Usage Forecast 2026-2030