Market Overview

Based on a recent historical assessment, the KSA smart textiles for military market recorded spending of approximately USD ~ million, reflecting confirmed allocations under national defense modernization programs focused on soldier protection, situational awareness, and advanced wearable technologies. The market size is driven by sustained investment aligned with Vision 2030, prioritizing localization of defense manufacturing, enhancement of troop survivability, and integration of digital technologies into combat gear. Rising emphasis on force readiness, extreme climate adaptability, and adoption of sensor-enabled uniforms further support steady procurement of smart military textile solutions.

Based on a recent historical assessment, Riyadh, Jeddah, and Dhahran dominate the KSA smart textiles for military market due to concentration of defense command centers, procurement authorities, and military bases. Riyadh leads as the central hub for defense planning, acquisitions, and policy execution. Jeddah supports demand through naval and joint forces operations requiring specialized protective textiles. Dhahran benefits from proximity to key military installations and advanced industrial zones, enabling testing, integration, and deployment of smart textile systems aligned with national defense priorities.

Market Segmentation

By Product Type

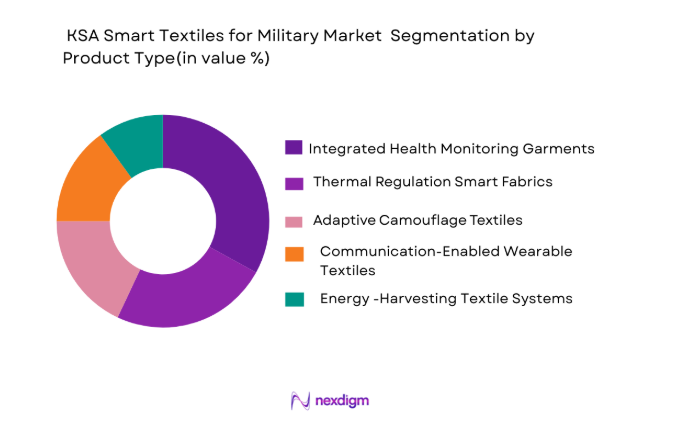

KSA smart textiles for military market are segmented by product type into integrated health monitoring garments, thermal regulation smart fabrics, adaptive camouflage textiles, communication-enabled wearable textiles, and energy-harvesting textile systems. Recently, integrated health monitoring garments held a dominant market share due to the Saudi armed forces’ focus on soldier endurance, heat stress management, and real-time health visibility in extreme operating environments. Continuous monitoring of vital signs supports rapid medical response and command-level awareness. Harsh desert conditions amplify the importance of physiological data. Integration with broader soldier systems enhances operational control. Government-backed modernization programs accelerate adoption. Localization initiatives support customization and sustainment. These combined factors reinforce dominance of health monitoring smart garments.

By Platform Type

KSA smart textiles for military market are segmented by end users into ground combat units, special forces, armored and mechanized units, military medical corps, and defense training and research units. Recently, ground combat units dominated market share due to large force size and direct exposure to high-temperature and high-intensity operational environments. These units require durable, lightweight, and multifunctional textiles to enhance protection and endurance. Continuous deployment cycles drive replacement demand. Infantry modernization initiatives emphasize smart uniforms to improve performance without increasing load. Integration with health monitoring and command systems further strengthens adoption. These factors position ground combat units as the primary demand driver.

Competitive Landscape

The KSA smart textiles for military market is moderately consolidated, led by state-backed defense entities and international defense material suppliers supporting localization goals. High entry barriers arise from defense certification requirements, technology transfer conditions, and capital-intensive manufacturing. Major players shape procurement through joint ventures, offset programs, and long-term supply agreements aligned with Vision 2030 objectives.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Smart Textile Capability |

| Saudi Military Industries | 2017 | Riyadh, KSA | ~ | ~ | ~ | ~ | ~ |

| DuPont | 1802 | Wilmington, US | ~ | ~ | ~ | ~ | ~ |

| TenCate Protective Fabrics | 1704 | Almelo, Netherlands | ~ | ~ | ~ | ~ | ~ |

| Honeywell Advanced Materials | 1906 | Charlotte, US | ~ | ~ | ~ | ~ | ~ |

| Teijin Aramid | 1972 | Arnhem, Netherlands | ~ | ~ | ~ | ~ | ~ |

KSA Smart Textiles for Military Market Analysis

Growth Drivers

Defense Modernization under Vision 2030 and Soldier Protection Priorities

Defense modernization under Vision 2030 and soldier protection priorities is a primary growth driver for the KSA smart textiles for military market, as Saudi Arabia accelerates investment in advanced soldier systems to enhance operational readiness and survivability. Smart textiles support real-time health monitoring, environmental sensing, and adaptive protection, which are critical in desert and high-temperature combat environments. The Saudi armed forces emphasize reducing heat-related injuries and fatigue through smart thermal regulation and monitoring. Embedded sensors provide commanders with actionable health data. Integration with digital command systems enhances situational awareness. Localization mandates encourage domestic production partnerships. Long-term procurement frameworks sustain demand. These factors collectively drive continuous market growth.

Localization of Defense Manufacturing and Technology Transfer

Localization of defense manufacturing and technology transfer significantly drive market expansion by encouraging domestic production of advanced military textiles. Government policies promote joint ventures with global suppliers. Local manufacturing reduces supply chain risk and lead times. Technology transfer builds national capability in smart materials. Domestic R&D benefits from operational feedback. Industrial clusters support scalability. Skilled workforce development strengthens sustainability. These initiatives reinforce long-term demand.

Market Challenges

High Cost of Advanced Materials and Limited Local Expertise

High cost of advanced materials and limited local expertise pose challenges as smart military textiles rely on sophisticated fibers, sensors, and integration techniques. Initial investment requirements are significant. Specialized manufacturing processes limit scalability. Dependence on imported components raises costs. Certification processes extend timelines. Workforce training gaps slow deployment. Maintenance complexity increases lifecycle costs. These factors constrain rapid expansion.

Integration and Data Security Constraints

Integration and data security constraints challenge adoption as smart textiles generate sensitive health and operational data. Secure transmission is critical in combat scenarios. Cybersecurity compliance increases system complexity. Integration with legacy platforms poses technical risks. Data governance requires slow approvals. User trust depends on proven resilience. Continuous upgrades add cost. These constraints require cautious implementation.

Opportunities

Joint Ventures and Export-Oriented Production

Joint ventures and export-oriented production offer strong opportunities as KSA positions itself as a regional defense manufacturing hub. Smart textile solutions developed locally can serve allied markets. Vision 2030 incentives support scaling. Export certification enhances competitiveness. Partnerships expand technology access. Operational validation strengthens credibility. This creates long-term growth potential.

Advanced Thermal and Climate-Adaptive Textile Systems

Advanced thermal and climate-adaptive textile systems present opportunities due to extreme operating environments. Innovations in phase-change materials improve endurance. Adaptive cooling enhances performance. Reduced heat stress improves mission effectiveness. Integration with health monitoring adds value. Local testing environments support rapid validation. These solutions align with national needs.

Future Outlook

Over the next five years, the KSA smart textiles for military market is expected to grow steadily, supported by Vision 2030 defense localization, modernization programs, and regional security requirements. Technological development will focus on thermal adaptation, health monitoring, and integration with soldier systems. Regulatory and procurement support will remain strong. Demand will increasingly favor locally produced, multifunctional smart textile solutions.

Major Players

- Saudi Military Industries

- DuPont

- TenCate Protective Fabrics

- Honeywell Advanced Materials

- Teijin Aramid

- 3M Defense Solutions

- BAE Systems

- Saab Group

- Elbit Systems

- Rafael Advanced Defense Systems

- Schoeller Textil

- Kolon Industries

- ArmorSource

- Point Blank Enterprises

- Polartec

Key Target Audience

- Defense ministries and armed forces

- Government and regulatory bodies

- Investments and venture capitalist firms

- Military procurement agencies

- Defense OEMs and prime contractors

- Advanced material manufacturers

- Local defense manufacturing entities

- Export-focused defense distributors

Research Methodology

Step 1: Identification of Key Variables

Defense spending patterns, modernization initiatives, climate requirements, and material innovation indicators were identified. Demand and supply factors were mapped. Market boundaries were defined.

Step 2: Market Analysis and Construction

Data from defense programs, procurement disclosures, and industry sources were analyzed. Segmentation by product type and end user was constructed. Cross-validation ensured consistency.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through defense and materials experts. Assumptions were refined based on operational insights and compliance requirements.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into structured narratives. Quantitative and qualitative data were aligned. Outputs were reviewed for accuracy and relevance.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Government defense modernization and Vision 2030 initiatives

Rising demand for enhanced soldier survivability systems

Increasing integration of IoT and wearable technologies

Strategic export and foreign military collaboration opportunities

Investment in advanced materials and manufacturing technologies - Market Challenges

High R&D and manufacturing costs for advanced textiles

Integration complexity with legacy military systems

Workforce skill gaps in smart textile technologies

Stringent defense certification and compliance regimes

Supply chain dependencies on imported components - Market Opportunities

Development of multifunctional combat textile systems

Joint ventures with global defense OEMs for co-development

Localized manufacturing and defense textile hubs - Trends

Embedded real-time health and environmental sensing

Focus on lightweight, durable, and multifunctional fabrics

Integration of smart textiles with soldier command systems

Government-funded defense technology accelerators

Export-centric military textile product pipelines - Government Regulations & Defense Policy

Defense procurement and private-sector engagement policies

Export control frameworks for military-grade smart textiles

Vision 2030 defense modernization funding programs - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Flexible wearable health and status monitoring systems

Adaptive camouflage and concealment textiles

Thermal regulation and environmental adaptive fabrics

Communications-integrated wearable textiles

Energy harvesting and smart power textiles - By Platform Type (In Value%)

Soldier wearable textile platforms

Armored vehicle integrated textile systems

Tactical shelter and base camp textile systems

Medical and casualty management textiles

Unmanned system textile integration platforms - By Fitment Type (In Value%)

New military procurement programs

Upgrade and retrofit textile systems

Field support and logistics textile deployments

Training and simulation textile systems

R&D prototype and trial deployments - By End-user Segment (In Value%)

Ground combat units

Special forces and elite units

Armored and mechanized divisions

Military medical corps

Defense research and training establishments - By Procurement Channel (In Value%)

Direct government defense procurement

Defense prime contractor integration contracts

Foreign military sales and export channels

Public-private defense technology partnerships

Technology licensing and service-based procurement - By Material / Technology (in Value%)

Conductive smart fibers and polymers

Nanotechnology-enhanced smart textiles

Embedded sensors and IoT modules

Phase change and thermal adaptive materials

Energy storage and harvesting textile systems

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology maturity, integration capability, defense certification, production scalability, export footprint, partnership ecosystem, cost competitiveness, innovation pipeline, material sourcing strength, lifecycle support)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Saudi Military Industries Co.

Advanced Fiber Technologies

TenCate Protective Fabrics

DuPont Performance Materials

Honeywell Advanced Materials

3M Defense and Commercial Solutions

Schoeller Textil AG

Point Blank Enterprises

Elbit Systems

Rafael Advanced Defense Systems

BAE Systems

Kolon Industries

Teijin Aramid

ArmorSource Inc.

Polartec LLC

- Ground combat units’ demand for endurance and protection

- Special forces requirements for adaptive textile solutions

- Role of armored units in textile system customization

- Medical corps integration of monitoring and protective textiles

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035