Market Overview

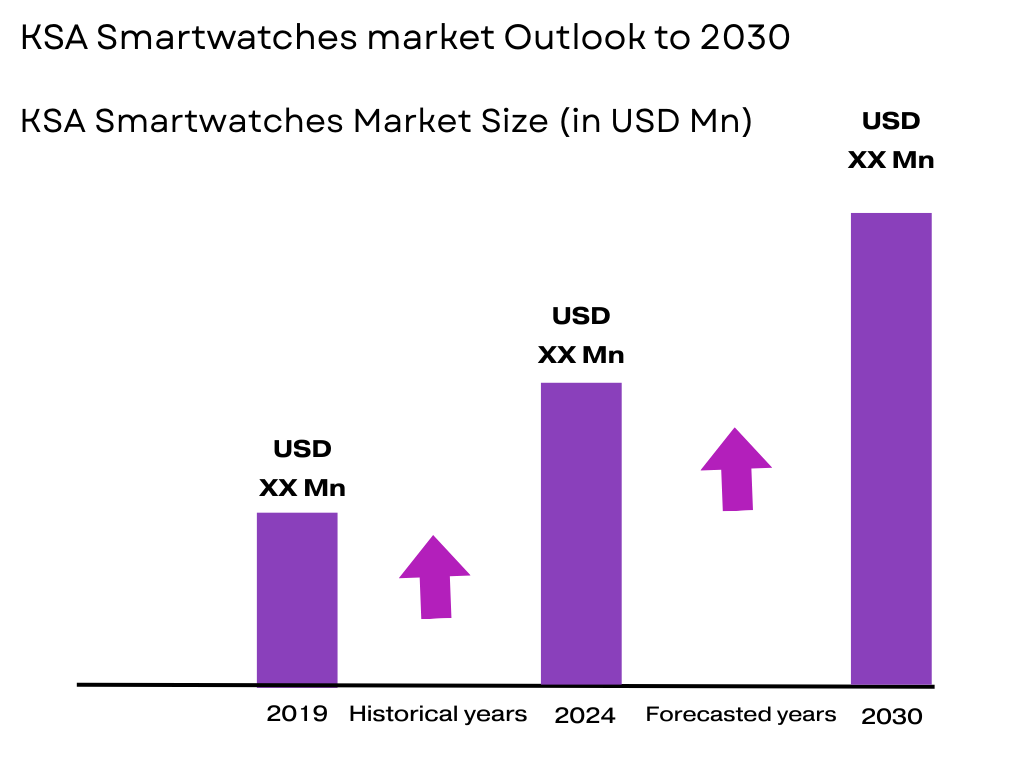

The KSA Smartwatches market has experienced substantial growth over recent years, with the market valued at approximately USD ~ billion in 2024. The market’s expansion is driven by increasing consumer adoption of wearable technology, particularly among health-conscious individuals and fitness enthusiasts. With advancements in technology and the integration of health monitoring features such as ECG, blood pressure tracking, and sleep analysis, smartwatches have become an essential part of everyday life. The surge in smartphone penetration, coupled with growing health and fitness awareness, further accelerates the demand for these devices. As of 2025, the market size is projected to continue growing at a steady pace, with a strong forecast for the period from 2025 to 2030.

Riyadh, Jeddah, and Dammam are the primary cities dominating the smartwatches market in KSA. These cities are characterized by a large concentration of tech-savvy consumers, higher disposable incomes, and strong access to modern retail and e-commerce channels. Riyadh, as the capital, plays a central role in shaping the market due to its position as the economic hub. Jeddah and Dammam, as major metropolitan areas with growing technology adoption, also contribute significantly to the demand. The dominance of these cities is largely due to their larger populations, higher urbanization rates, and the rising interest in wearable technology driven by both health-conscious individuals and tech enthusiasts.

KSA Smartwatches Market Segmentation

By Product Type

The KSA smartwatches market is segmented by product type into fitness-focused smartwatches, hybrid smartwatches, luxury smartwatches, fashion-focused smartwatches, and healthcare-oriented smartwatches. Among these, fitness-focused smartwatches hold a dominant market share. This is due to the increasing popularity of wearable health devices that track physical activities, heart rate, and other health metrics. These devices are particularly favored by individuals interested in monitoring their fitness levels and improving their overall health. The convenience of tracking workouts, calories burned, sleep patterns, and even stress levels has made fitness-focused smartwatches the go-to option for health-conscious consumers in KSA. Brands like Fitbit, Garmin, and Apple have successfully captured this market segment with feature-rich offerings designed to cater to various fitness needs.

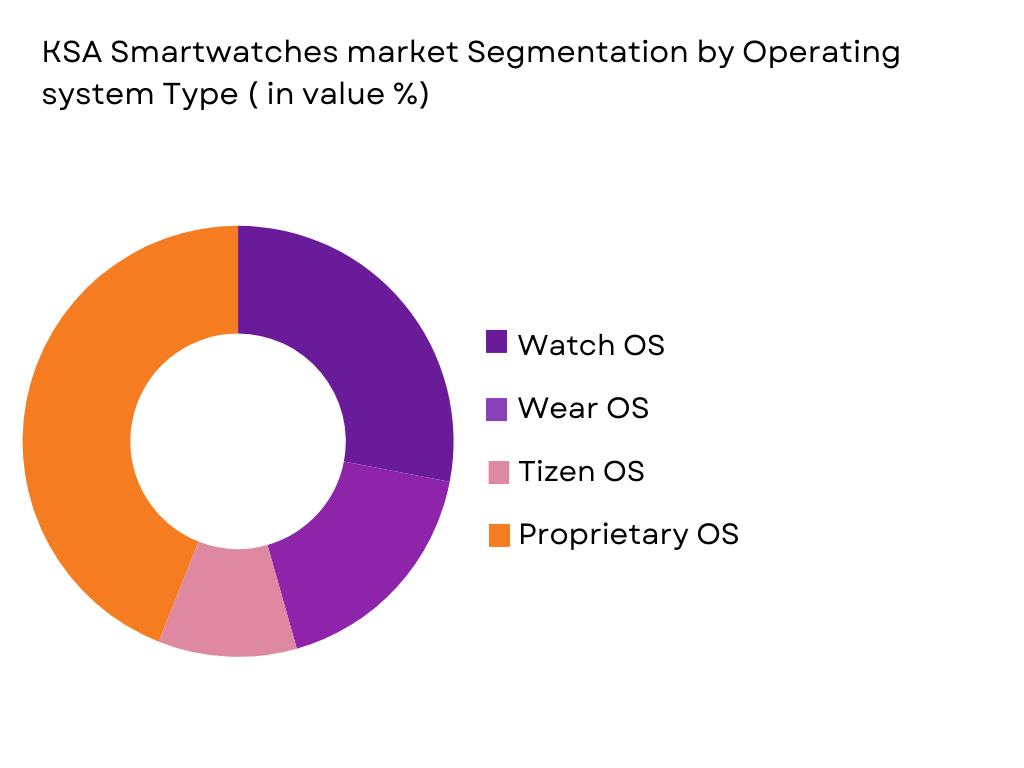

By Operating System Type

The KSA smartwatches market is segmented by operating system into WatchOS, Wear OS, Tizen OS, and proprietary operating systems. Currently, WatchOS dominates the operating system segment due to its strong association with Apple’s ecosystem. Apple’s smartwatches, powered by WatchOS, continue to lead the market, especially in urban areas where consumers are heavily invested in the Apple ecosystem. The integration of WatchOS with other Apple products, such as the iPhone, enhances the appeal of Apple smartwatches. Furthermore, Apple’s brand loyalty and premium offerings make its devices highly desirable in the KSA market. Wear OS, despite gaining traction through offerings from brands like Fossil and Samsung, is still a distant second. Tizen OS is prevalent in Samsung’s smartwatches but is overshadowed by the dominance of Apple in this market.

Competitive Landscape

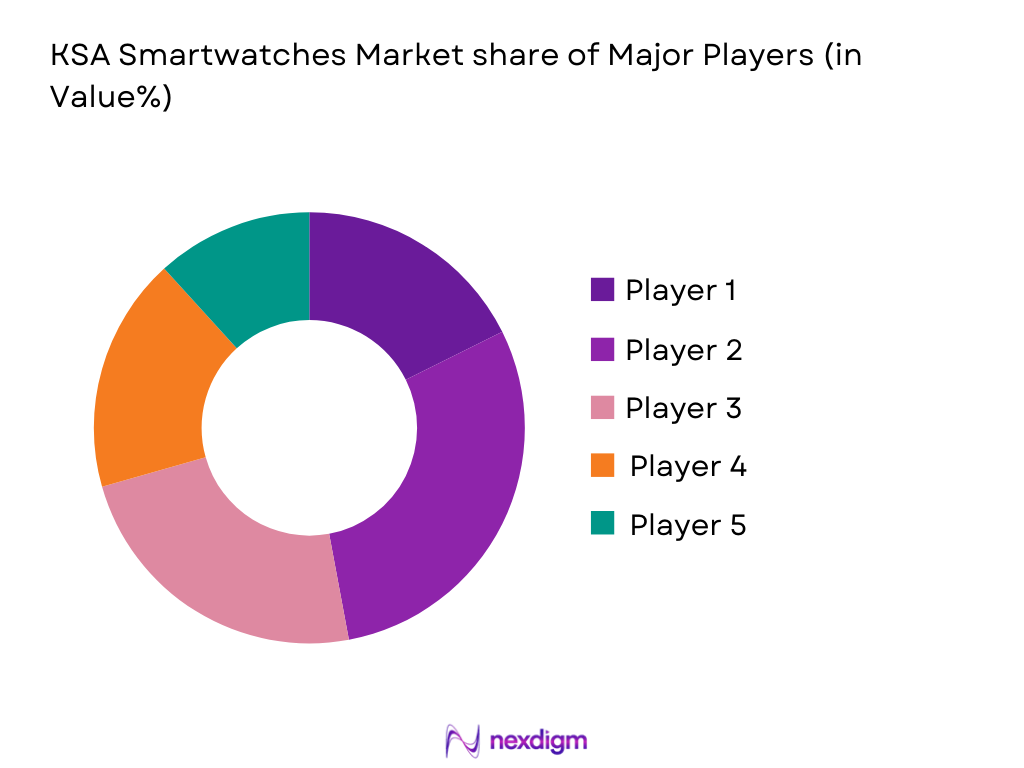

The KSA Smartwatches market is characterized by fierce competition between global technology brands and local companies. Leading players such as Apple, Samsung, Garmin, and Huawei dominate the market, with strong product offerings that cater to different consumer needs. The competition is not only driven by product features but also by brand loyalty, pricing strategies, and after-sales services. In addition to these global players, local companies are gaining traction by offering customized solutions and catering to the unique preferences of the KSA consumer base.

The market is consolidated with Apple, Samsung, and Garmin holding the majority of the market share. The competition is expected to intensify as newer players, including Xiaomi and Huawei, continue to innovate and launch advanced products at competitive prices. The future of this market will likely see the rise of AI-powered health tracking features and further integrations with other IoT devices, keeping the competitive dynamics active.

| Company | Establishment Year | Headquarters | Product Type | Market Position | Revenue | Growth Strategy |

| Apple | 1976 | Cupertino, USA | ~ | ~ | ~ | ~ |

| Samsung | 1938 | Seoul, South Korea | ~ | ~ | ~ | ~ |

| Garmin | 1989 | Olathe, USA | ~ | ~ | ~ | ~ |

| Huawei | 1987 | Shenzhen, China | ~ | ~ | ~ | ~ |

| Fitbit (Google) | 2007 | San Francisco, USA | ~ | ~ | ~ | ~ |

KSA Smartwatches Market Analysis

Growth Drivers

Urbanization

Urbanization in Saudi Arabia continues at a rapid pace, with the urban population projected to account for over ~% of the total population by 2025. This trend directly influences the adoption of smart technologies, including smartwatches, as urban residents tend to have higher disposable incomes and a greater inclination towards adopting new technologies. In major cities like Riyadh, Jeddah, and Dammam, the prevalence of smartwatches has seen a steady rise, driven by the growing demand for personal health and fitness solutions. Urban areas are expected to maintain this trend, as more consumers seek integrated devices that help manage both health and connectivity.

Industrialization

Saudi Arabia’s ongoing industrialization, particularly under Vision 2030, has been a significant growth driver for the KSA Smartwatches market. As industrial sectors expand, the demand for workforce wellness and productivity monitoring tools, such as smartwatches, increases. The government’s focus on diversifying the economy beyond oil, particularly in tech sectors, has also catalyzed the rise of wearables in both industrial and commercial applications. Industries like construction, manufacturing, and oil and gas are increasingly adopting health-monitoring devices to track workers’ fitness levels, reducing downtime and promoting safety. This trend supports the overall demand for smartwatches.

Challenges

High Initial Costs

Despite the growing interest in smartwatches, the high initial cost remains a significant barrier for many potential consumers in Saudi Arabia. Although prices have decreased in recent years, premium models with advanced health tracking features can still cost upwards of SAR 1,500, making them inaccessible to lower-income groups. This high upfront cost is one of the major challenges limiting the broader adoption of smartwatches across all income segments. However, the growing presence of budget-friendly alternatives from brands like Xiaomi and Huawei is expected to address this constraint in the near future.

Technical Challenges

Smartwatches face technical challenges such as battery life limitations, connectivity issues, and device compatibility. Despite advancements in battery technology, many consumers still face the inconvenience of frequent charging, especially with more feature-rich models. Furthermore, issues with seamless integration between smartwatches and smartphones—especially among non-Apple devices—have hindered widespread adoption. Technical problems like these prevent consumers from fully realizing the potential of their smartwatches, thus slowing the market’s growth. As technology advances and manufacturers address these issues, the market is expected to overcome these barriers.

Opportunities

Technological Advancements

Technological advancements in artificial intelligence (AI) and the Internet of Things (IoT) offer significant growth opportunities for the KSA smartwatch market. With the rise of AI-powered health monitoring features, such as real-time ECG readings and predictive analytics for chronic diseases, smartwatches are transforming into critical health management tools. Moreover, advancements in battery technology and faster connectivity are improving the usability and functionality of smartwatches. Companies are increasingly integrating AI for more personalized health recommendations, which will drive further growth in the sector.

International Collaborations

International collaborations between global smartwatch manufacturers and local distributors in Saudi Arabia present a major opportunity for market expansion. Partnerships with local retailers, technology companies, and healthcare providers will allow international brands to gain a stronger foothold in the market. These collaborations facilitate the customization of products for the Saudi market, catering to unique needs such as language preferences, health regulations, and lifestyle demands. Additionally, they help in expanding distribution networks to reach a broader consumer base, especially in emerging markets within the country.

Future Outlook

Over the next five years, the KSA smartwatches market is expected to continue its growth trajectory, driven by factors such as technological advancements in wearable health devices, the growing trend of fitness tracking, and rising consumer interest in integrating smart technologies into everyday life. The market will also benefit from the increasing use of artificial intelligence (AI) and machine learning (ML) in health-related applications, such as real-time health monitoring and predictive analytics. The expansion of e-commerce platforms, along with local partnerships, will further drive market accessibility and penetration. Government initiatives promoting health and fitness awareness will also create opportunities for growth, with a heightened focus on preventive healthcare.

Major Players

- Apple Inc.

- Samsung Electronics

- Garmin Ltd.

- Huawei Technologies

- Fitbit (Google)

- Fossil Group

- Amazfit (Huami)

- Xiaomi Corporation

- Withings (Nokia)

- Suunto

- TCL Communication

- Coros Wearables

- Oppo

- Sony Corporation

- Realme

Key Target Audience

- Consumers (Tech-savvy Individuals)

- Fitness Enthusiasts

- Health-conscious Individuals

- Technology Retailers

- Electronics Distributors

- E-commerce Platforms

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA smartwatches market. This step involves extensive desk research, utilizing both secondary and proprietary databases to gather comprehensive industry-level information. The objective is to identify the key market drivers, barriers, and trends shaping the industry.

Step 2: Market Analysis and Construction

In this phase, historical data from key sources will be analyzed to understand market penetration, the influence of major players, and consumer behavior patterns. This includes evaluating how different smartwatches are adopted across different regions in KSA and their impact on revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be tested through interviews with industry experts and stakeholders, including manufacturers, retailers, and health specialists. These consultations will provide additional operational and financial insights that will help validate the collected data and refine the market analysis.

Step 4: Research Synthesis and Final Output

The final phase will involve gathering feedback from market players to refine the report’s conclusions. Detailed insights into product preferences, sales performance, and technological innovations will be integrated to ensure an accurate reflection of the KSA smartwatches market dynamics.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis & Evolution

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increased Health and Fitness Consciousness

High Smartphone Penetration and Connectivity

Adoption of IoT and AI in Smartwatches - Market Challenges

High Prices for Advanced Features

Limited Battery Life

Consumer Reluctance towards New Technology - Opportunities

Growth in Health Monitoring Features (ECG, Blood Pressure, Sleep Monitoring)

Increased Adoption of Smartwatches among Seniors - Trends

Customization and Design Variations

Expansion of Wearables in Healthcare

Government Regulation - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces Analysis

- Competition Ecosystem

- By Value, 2019-2025

- By Volume, 2019-2025

- By Average Price, 2019-2025

- By Product Type (In Value %)

Fitness Focused Smartwatches

Hybrid Smartwatches

Luxury Smartwatches

Fashion-focused Smartwatches

Healthcare-oriented Smartwatches - By Operating System (In Value %)

WatchOS

Tizen OS

Wear OS

Proprietary OS - By Distribution Channel (In Value %)

Online Retail

Offline Retail

Third-party Retailers - By Price Range (In Value %)

Premium Smartwatches

Mid-range Smartwatches

Budget Smartwatches - By Region (In Value %)

Central Region

Eastern Region

Western Region

Southern Region

- Market Share (Value/Volume)

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Product Type, Number of Touchpoints, Distribution Channels, Margins, Production Capacity, Unique Value Proposition)

- SWOT Analysis of Major Players

- Pricing Analysis

- Detailed Profiles

Apple Inc.

Samsung Electronics

Huawei Technologies

Garmin Ltd.

Fitbit

Fossil Group

Amazfit

Xiaomi Corporation

Withings

Suunto

TCL Communication

Coros Wearables

Oppo

Sony Corporation

Realme

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2026-2030

- By Volume, 20266-2030

- By Average Price, 2026-2030